Key Takeaways

- Side hustles can help you reach your money goals faster by increasing your income.

- There are so many ways you can earn extra money—from driving for Uber to mowing lawns and tutoring online.

- Find a side hustle that matches your skills, your money goals, the resources you have available (don’t go into debt over it), and how much you’re willing to hustle.

- Make sure you’re on a budget to keep that side hustle money working for you instead of the other way around.

Side hustles are one of the best ways to bring in extra cash. Whether you’re saving up money, knocking out debt, or just need more wiggle room in your budget, a side job can help. My husband and I hustled hard when we were paying off debt—and it made a big difference!

I’ve pulled together this list to help you find the side hustle (or two) that works best for you. Some are quick wins. Some take more time. But they all can help you get closer to your money goals.

Quick Side Hustles

Need money fast? Check out these ideas that require little time and setup to get started—though you will need a reliable car for several of them.

Drive people around.

If you like driving, meeting people, and working when you want (and if you have a dependable car)—check out Lyft or Uber. Both offer flexible scheduling, extra pay during peak hours, bonuses and insurance protection while you’re out on the job. How much money you actually make depends on your location and demand. On average, Uber drivers make about $15–25 per hour, but drivers in busier areas like LA and New York make more—around $30.1

Deliver food.

For a driving side gig with less face-to-face time, check out delivering through Grubhub, DoorDash or Uber Eats. Hey, everyone’s got to eat, right? And a lot of people would rather pay to have the food come to them. Like ride-share services, it’s a work-when-you-want thing, and how much you get paid depends on location and demand.

Deliver groceries.

If you don’t mind driving and shopping, check out Instacart or Shipt. You’ll get paid to shop and deliver groceries to clients through these on-demand services. And Shipt claims you can make between $16–27 an hour working for them.2 Not bad!

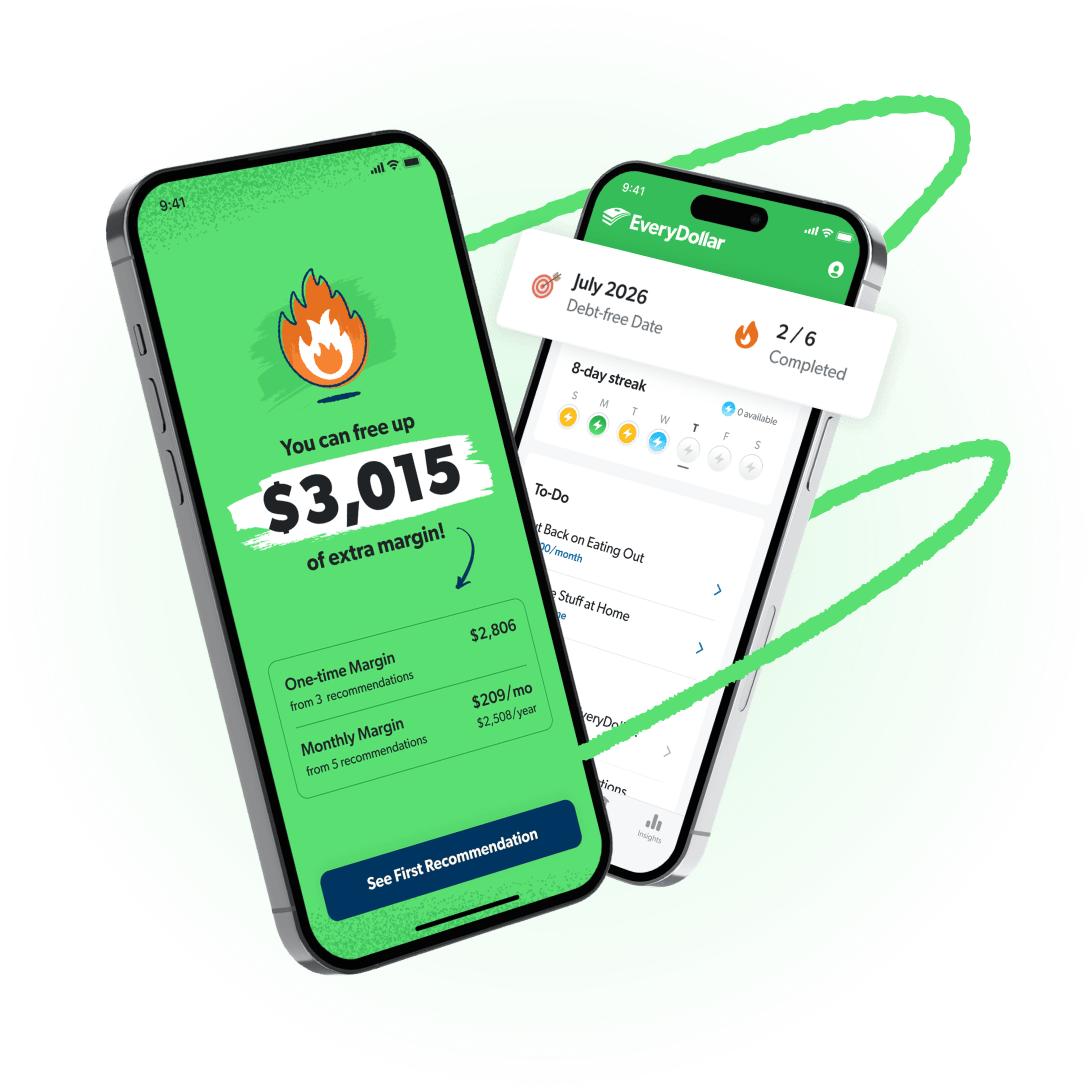

Free Up Margin. Make Real Progress.

The EveryDollar budget app helps you find hidden margin and put it to work so you can stack savings, crush debt, and build wealth that lasts.

Deliver packages.

Your Amazon Prime account can quickly derail your spending. But what if you used Amazon as a quick way to make money instead? Sign up to deliver packages with Amazon Flex and set your schedule to work as much or as little as you want. Amazon says most drivers make $18–25 an hour!3

Dog walk or pet sit.

If you’re an animal person, raise your hand. Wow. That’s a lot of you. What if you turned your love of animals into income? You can pet sit while the owners are away or find a couple clients whose dogs you can walk during the week. And if you’re really good with dogs, you can do what I did and offer to train them as well!

You can advertise your own pet-sitting business on social media, put up signs in your neighborhood, post at work, or use a website like Wag! or Rover. They let you set your schedule and adjust your fees—but they do take a cut of your pay. If that seems like too much, try drumming up your own business with friends and family, and ask them to help you get the word out.

Be a professional pooper-scooper.

Okay, hear me out: Being a pooper-scooper is a legit side hustle. And yes, you can make some good money doing it. People love their pets, but let’s be honest—nobody loves cleaning up after them. That’s where you come in! You get paid to scoop poop and help people keep their outdoor spaces fresh.

It’s flexible, doesn’t cost much to start, and has constant demand. You just have to get past the “ew” factor and remember: You’re doing a service that people genuinely need!

Do odd jobs for people.

Are you good at quick fix-it jobs or running errands? People will pay you to complete their honey-do lists through sites like TaskRabbit. You can do all kinds of things, from hanging shelves to putting together furniture. And if you’re a certified plumber or electrician looking for extra jobs, Handy offers those too.

Mow lawns or do yard work.

People are busy, and they don’t want their lawns to look like a scene from The Jungle Book. That means they’ll gladly pay you to do yard work for them—like mowing, raking, pressure washing, hedge trimming and leaf blowing (rich people are afraid of leaves). You can grab seasonal hours with a local landscaping company, check out TaskEasy, or work on your own.

And when the temps drop, people still need outdoor help. If you’re in a town that gets a lot of snow, you can make bank through the winter by shoveling driveways and sidewalks. It’s a cold job, but somebody’s got to do it. You might as well be that somebody and earn the warm reward of extra income as you do.

Clean houses.

Cleaning houses is hard work, but if you don’t mind getting your hands dirty, this could be the perfect fit for you. We all need our houses cleaned, and lots of people would rather pay someone else to do it. Don’t sleep on this opportunity!

Start-up costs are low. You’ll need some tools and supplies—though some homeowners might even provide the products they want you to use. You can make good money while burning some calories and listening to music, audiobooks or podcasts. Win-win!

Wash and detail cars.

Pump the brakes. You mean you can make money cleaning other people’s cars? Yes. You can. Like home cleaning, you’ll need to invest in some products (car wax, a shop vacuum, leather cleaner, etc.). But they’ll go a long way, so you’re mostly investing time and energy, which are two of your best resources.

Babysit.

Babysitting’s not just for teenagers! You can still get in on some of that babysitting cash as an adult. Parents need sitters all the time for date nights or busy days. Just get the word out and let people know you’re up for watching their kids (for pay, of course).

And hey, do you have kids of your own and worry this means too much time away from them? Some families would be totally cool with you bringing your kids along (just make sure you ask first). That way, it’s a playdate you’ll get paid for. Score!

Online Side Hustles

Here are some things you can do from the comfort of your home—in your pj’s if you want!

Tutor online.

Didn’t graduate at the top of your class? No problem! You don’t have to know everything to teach others. If you’ve got a good understanding of a particular subject and strong communication skills, look into online tutoring with Tutor.com or Studypool.

Teach English.

If you have a desire to help others learn and the time to lead a class online, you can teach English for a company like VIPKid. They do require a four-year degree (in any field) and at least two years of teaching, tutoring or coaching experience. But if you qualify, they handle all the lesson plans and grading for you. It’s a great way to get paid to help others!

Join a focus group or take paid surveys.

Want to get paid for sharing your opinion? It’s not a bad way to make some extra cash online. You can join a focus group or look into survey sites like Survey Junkie.

Just remember, these sites are looking for really specific types of people for each survey, so you might not qualify for each one you see. You also usually have to complete a lot of surveys before you can cash out.

Become a user tester.

When a business realizes something isn’t working, they need to know why. Sometimes they turn to their customers or random people to be user experience testers. Companies like UserTesting and Trymata will pay you to test out websites, apps and products—and give them feedback.

Do freelance work.

If you have design or writing skills, people need you. Sites like Fiverr, Upwork and 99designs connect freelancers with clients who need those creative minds. All you have to do to get started is create a profile (kind of like an online resumé) so potential clients can check out your experience, rates and specialties.

Create and sell digital downloads.

One of the smartest, low-cost side jobs you can start today is creating and selling digital downloads. I’m talking about things like printable planners, habit trackers, chore charts, coloring pages, wedding invitations—you name it. You make the product once, post it on Etsy or Shopify, and every time someone buys it, you get paid without lifting another finger!

Help write resumés and cover letters.

Helping people write strong, clean resumés and cover letters is a killer way to bring in extra cash from home. Folks out there are applying for jobs left and right, but most of their resumés are a hot mess. That’s where you come in! You take their skills, polish them up, and make them look like a rock-star candidate. Charge per project on sites like Fiverr or LinkedIn, offer quick turnaround, and you’ve got yourself a legit side hustle that can be done right from your laptop.

Be an IT consultant.

You might know your way around computers, networks or software, but not everyone does. Being an IT consultant means you step in when small businesses or individuals are drowning in tech issues—whether it’s setting up their systems, troubleshooting, securing their data, or just teaching them how to actually use the tools they’re paying for.

Most small businesses can’t afford a full-time IT person, but they will pay for someone to fix their headaches as needed. Plus, you can set your own rates.

Skill-Based Side Hustles

Got some mad skills? You could make someone’s life easier and get paid for it!

Become a transcriptionist.

If you’re good at typing and listening and you have good attention to detail, then this could be the job for you! A transcriptionist is a professional typist who listens to recorded or live audio and types up written versions of it. They’re super important in the medical and legal industries, but other areas of the corporate world need them as well.

You have to be trained and certified to be a transcriptionist, but you can make around $20–45 an hour depending on your skill level and speed.4 Once you’ve got your certification, you can snag some jobs on Rev.

Be a handyman.

Being a handyman (or woman) is one of those side hustles that might not sound glamorous, but trust me, it’s a moneymaker. People always have things around the house that need fixing—whether it’s a leaky faucet, a broken door, hanging a TV or some shelves that need putting up. If you've got the skills to handle these types of tasks, you can make some solid cash.

You don’t need to be a pro—just someone who knows their way around tools and isn’t afraid to get their hands dirty. Plus, you set your own rates, and you get to decide how many jobs you take on. It’s a great way to bring in extra income, and before you know it, you could turn it into a full-blown business.

Give music lessons.

This is one of my personal favorite side hustles! If you haven’t played your alto saxophone in 20 years, you probably shouldn’t dust it off and try teaching kids how to become the next Kenny G. But if you’re a musician with the heart of a teacher, giving music lessons is an excellent side gig.

Set your own prices and hours. You can offer lessons in your home, rent a studio space, or charge extra to travel to the client’s home. Start-up fees can be practically nothing when you have your own space and instrument. You’re really just offering your time, talent and teaching.

Become a coach.

You can coach sports for rec leagues (some are just volunteer gigs, but others pay!). There’s also the kind of coaching that doesn’t require a whistle—like life coaching, career coaching and even Enneagram coaching (it’s a real thing).

Just like teaching, it all comes down to having a heart for helping others get better at something you’ve got a natural knack or passion for. You might need special certifications, but if you feel the call, coaching is a solid side hustle.

Sell baked goods.

People love sourdough bread, cakes, cookies, pies and other treats. So if you’re good at baking, this is a great side hustle for you.

Start by baking for a friend or relative. Make a gorgeous cake, post it online, and get people talking. Use social media and the wonderful power of word of mouth. Because when you delight people’s eyes and tummies, you’ll have repeat customers who can’t stop singing your praises. Just don’t forget to look up local laws for baking and selling food out of your home before you get started.

Do makeup for special events.

Are you naturally good at doing makeup? Do you love helping women feel their best? Consider doing makeup for special events like weddings, photo shoots, proms and performances! Most states don’t require a license to be a freelance makeup artist, and you can take on as many clients as you like.

You’ll have to invest in some good tools and a variety of makeup options, but it can be a fun way to do something you love and get paid for it.

Become an event planner.

Do you enjoy a good party? Are you detail-oriented? Then you might have what it takes to be an event planner.

You could help plan or coordinate birthday parties, weddings or business events. You’d work with a client (and their budget) to help their vision come to life—and get a small commission (maybe even some free cake!).

You’d probably want to start on a smaller scale, like your nephew’s birthday party or a coworker’s bridal shower. But you get to decide how many events you do each month.

Offer bookkeeping services.

Small-business owners are busy, and most of them don’t have time (or the know-how) to keep their finances in order. So if you’re organized, good with numbers, and know your way around a spreadsheet, this is an opportunity to make some extra cash.

You can help handle the business owners’ invoices, manage expenses, and balance the books so they can focus on growing their business. Plus, it’s flexible and can be done remotely!

Be a fitness instructor.

If you enjoy working out and motivating others, why not get paid to do both? Being a fitness instructor means you can lead classes at a local gym, outdoors or even online. And you can teach anything from yoga and spin to strength training and dance.

You’re not just helping people hit their fitness goals—you’re building a community and stacking extra income while doing something you already love. Plus, you control your schedule, your rates and how many clients you take on.

Creative Side Hustles

Side hustles can not only make you extra money, but they can also help you stretch your creativity. Check out how your creative work can make you some cash.

Become a photographer.

It seems like everyone with a smartphone thinks they’re a pro photographer. But if you’ve got legit photography talent, use those skills to make extra money!

People need photos all year long, but you should think about marketing seasonally: senior photos in summer or early fall, family portraits for people to put on their Christmas cards, Easter pictures in the spring—you get the idea. Just keep in mind that professional photo equipment can get pretty expensive, so make sure you have the budget to get yourself set up.

Resell thrifted items.

Head to your local thrift stores, garage sales or flea markets and look for deals. You can even sell your own stuff you don’t use and clear out your closet in the process. Research what’s trending and how much things are selling for online. You might come across a valuable vintage piece hiding in plain sight—or something you can fix up and sell for more.

Your easiest route is to resell through sites like Facebook Marketplace, Amazon, eBay, Poshmark, ThredUp and GameStop—to name a few. This one requires some cash up front, but it’s another option if you love shopping and understand the market value of things. The idea is simple: You buy low and sell higher. Just don’t go into debt for this!

Sell your products online.

Are you crafty? I’m definitely not. But if you are, then maybe you should sell your crafty products on Etsy. Jewelry, scarves, paintings, hand-lettered inspirational prints and more—Etsy’s a great place to sell anything you’re good at making.

Setting up a profile is simple, and listing a product is easy. Etsy charges 20 cents per listing and takes a percentage of the sale.5 But it’s worth it because people trust Etsy. Plus, you can buy your shipping labels right on the site—which means you can send everything from your own mailbox (aka no last-minute runs to the post office). So simple.

Become a freelance writer or proofreader.

Some companies have their own in-house writers and editors. Others hire out project by project. If you’re good at wordsmithing, pick up some freelance writing gigs. Emails, blog articles, print pieces—somebody’s got to write them!

If you’re more into correcting the words than writing them, take on freelance editing or proofreading. Search for jobs online or get the word out to your community that you’re open for freelance work. You can use Fiverr and Upwork for this as well.

Paint pet portraits.

Got painting skills and a soft spot for furry friends? Painting custom pet portraits is an easy way to turn your talent into serious income. Pet owners won’t blink at paying good money to get a one-of-a-kind portrait of their pup or cat—whether it’s watercolor, acrylic or even digital art.

You can set your price and knock these out from home on your own schedule. Post a few examples on social media, Etsy or even local Facebook groups, and trust me—the orders will roll in!

Create print-on-demand designs.

Whether it’s funny quotes, cool graphics or trendy patterns—you can start making money fast with print-on-demand designs. Here’s the beauty of it: You create the design once, upload it to platforms like Redbubble, Society6 or Teespring, and they handle the printing, shipping and inventory for you. No up-front costs, no boxes of T-shirts stacked in your garage—just passive income rolling in every time someone clicks Buy.

Be a wedding DJ or entertainer.

This is a great side job if you’ve got musical talent, a solid playlist or a knack for hyping people up. Couples are paying top dollar to make sure their wedding is unforgettable. You could offer your services as a DJ—which is more than just pressing play. You’re setting the vibe, keeping the energy up, and making sure the night flows smoothly. You will need to invest in some audio equipment, though.

Or offer the full package by spinning tracks and performing music live. It’s flexible and high paying, and once you get a few gigs under your belt, the referrals will come. My husband, Sam, and I ran our own entertainment company for years while getting out of debt—performing on cruise ships and other places. It was a lot of work, but a lot of fun!

Here's A Tip

Okay, you’ve seen a lot of side hustle options. How do you know if any of them will work for you? Take this free Side Hustle Quiz to get a list of side hustles that are connected to your talents and actually fit into your schedule, then make a plan to earn extra income ASAP.

Other Side Hustle Ideas

Here are a few more outside-the-box ideas for side hustles.

Rent your home or spare room.

If you have an extra bedroom or garage apartment, consider renting it out on Airbnb or Vrbo. For example, if you keep a guest room and bathroom rented out all month, you could earn over $2,400 a month in the Nashville area (other areas vary).6

Now you might think an Airbnb property will be nothing but passive income, but it’s anything but passive. There’s maintenance, cleanup, supplies—not to mention compliance with any local regulations your city or state may have. Just be sure your time and budget can handle it.

Wait tables or bartend.

Picking up shifts as a server or bartender is one of the fastest ways to boost your income. Is it always the most enjoyable? Nope. (You’ll have your share of grumpy customers.) But you’ll walk out with tips in your pocket after every shift, and that cash adds up fast! You can choose to work nights, weekends or special events—and you can stack extra hours when you need the cash or scale back when you don’t.

Referee sporting events.

Being a referee or game official is a side job worth checking out—especially if you love sports and don’t mind making tough calls. It’s not always the easiest gig (you’ll deal with parents, coaches and players who might not always agree with you), but it’s a great way to stay active and get paid per game.

Local leagues, schools and rec centers are always looking for reliable refs, and you can choose how many games you want to take. Plus, you get to call the shots—literally!

Be a part-time nanny.

If you’re great with kids, working as a part-time nanny can be a solid way to bring in extra income. Sure, it’s not always sunshine and finger painting—there are diaper changes and sibling squabbles. But parents will gladly pay for someone dependable who can step in and handle it all. Whether it’s after-school care, weekends or date nights, you get to set your schedule and build lasting relationships with families who trust you.

Sell your own produce at farmers markets.

Turn your green thumb into a small-scale side hustle by selling homegrown produce at farmers markets. People are willing to pay top dollar for fresh, local fruits, veggies, herbs and even homemade jams. You control what you grow, set your prices, and get to connect directly with customers who love supporting local growers. It’s simple, seasonal and a great way to turn your garden into extra cash.

Become a tour guide in your town.

Do you know your town like the back of your hand? Love sharing fun facts or hidden spots? If so, becoming a local tour guide could be a great side hustle for you! Whether it’s history tours, food walks, ghost tours or art crawls, you could be the friendly face that gives tourists a memorable experience. You set your schedule, choose your route, and get paid to talk about a place you already love.How to Find a Side Hustle That Works for You

Okay, that was a lot of side hustle options. You might be feeling a little overwhelmed with all the possibilities. And the truth is, some side hustles will work for you and others won’t.

But there are three things to consider when trying to figure out what side hustle to choose: your time, your talent and your target.

Consider your time.

How much time do you want to put into this? As you look into what it takes to make your side gig work, don’t forget to be realistic about how much time it will require—not just when you’re doing the work but also when you’re prepping beforehand. What are you actually making per hour when you consider all the time involved?

Consider your talent.

Guess what? You don’t have to hate your side hustle. It can be something that you’re actually really good at—something you already love doing. If you can go this route, do it! Then it’ll feel way less like work and more like getting paid to live in your sweet spot.

Consider your target.

I’m not talking about the store (though working there part time could be a good side hustle). As you’re looking through options, think about what your main target, or goal, is in getting a side hustle.

Do you want something simple to help you pay off debt or get breathing room in the budget? Do you want to help others along the way? Do you want to use your skills for profit? Are you hoping to turn your side hustle into a legit small business?

Whatever your reason, be sure it makes sense for you, your lifestyle and your goals (both now and in the long run). When you know your why, you’re more likely to stick with your side hustle through the ups and downs.

You can get started by choosing three side gig ideas and researching each one. Talk to companies and people with experience to understand the pros and cons. Then, make a list of what you need to get started—like supplies, certifications, skills or clients.

And be sure to factor any up-front costs into your budget—you don’t want to go into debt here. If it’s too costly, consider a different option. Then, it’s time to get hustling!

Narrow Down Your Side Hustle Search

In just five minutes, you'll find the best side hustles for your skills and your schedule that will help you reach your money goals even faster.

Put Your Side Hustle Dollars to Work

When the money starts rolling in, put that extra income in your budget with your specific goal in mind (saving, paying off debt, investing). Otherwise, you’ll end up mindlessly spending it. Which means you’d be doing a lot of extra work without gaining any extra ground.

The EveryDollar budget app can help you free up thousands in margin—money you didn’t even know you had—and give you a custom plan to put it to work on crushing debt, stacking savings, and building wealth that actually lasts.

Download EveryDollar today and finally make the progress you’ve wanted all along.

Next Steps

- Research three side hustle ideas that fit your skills and schedule, then choose one to start this week.

- Make a simple list of the tools and supplies you need so you can begin earning faster.

- Block off a few hours on your calendar to dedicate to your new side hustle.

- Add your side hustle income to your EveryDollar budget so you can put that money to work on your goals.