The Total Money Makeover

Learn the proven plan to break free from debt and take control of your money for good.

Guide Contents

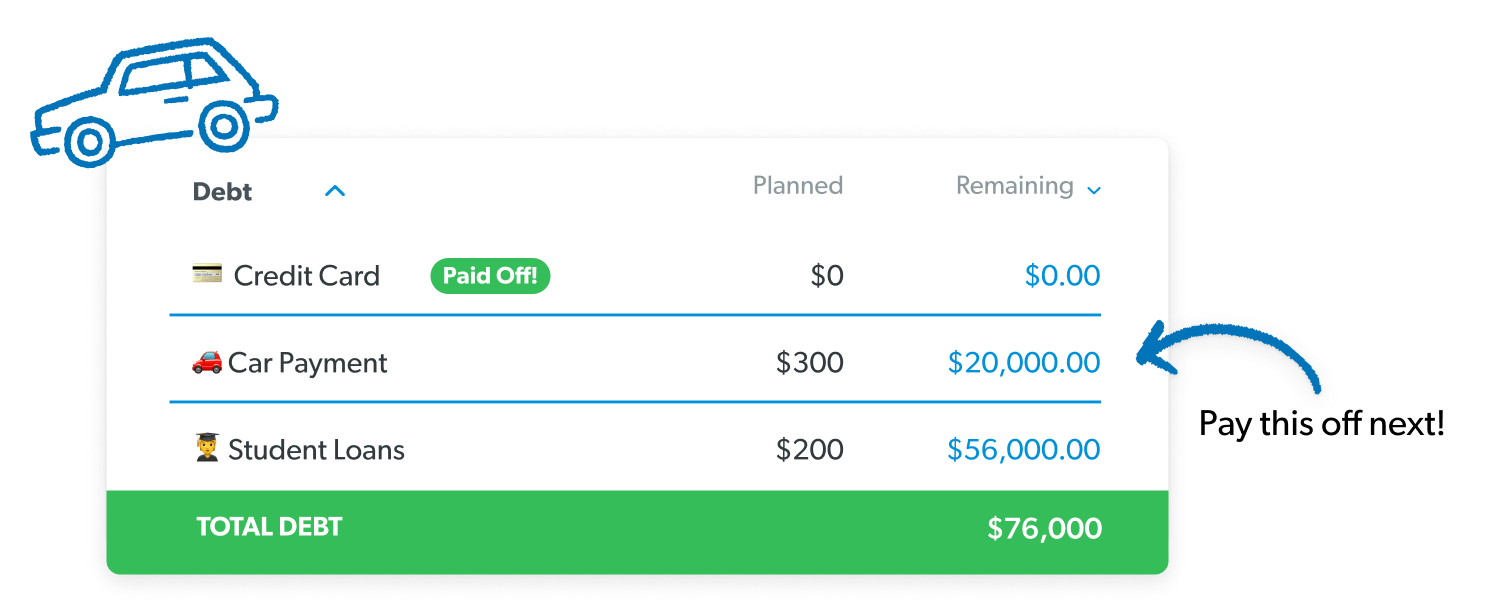

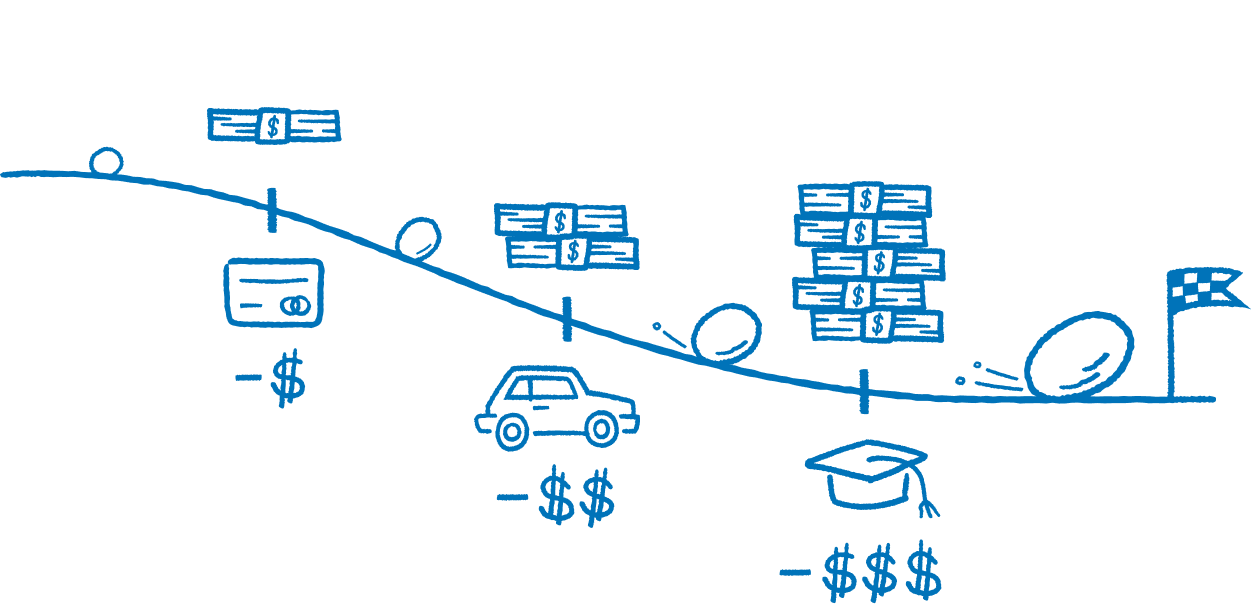

The debt snowball method helps you pay off debt faster than you ever thought possible. Whether you’ve got student loans, credit card debt, car payments, or all of the above, you can get rid of your debt—one step at a time!

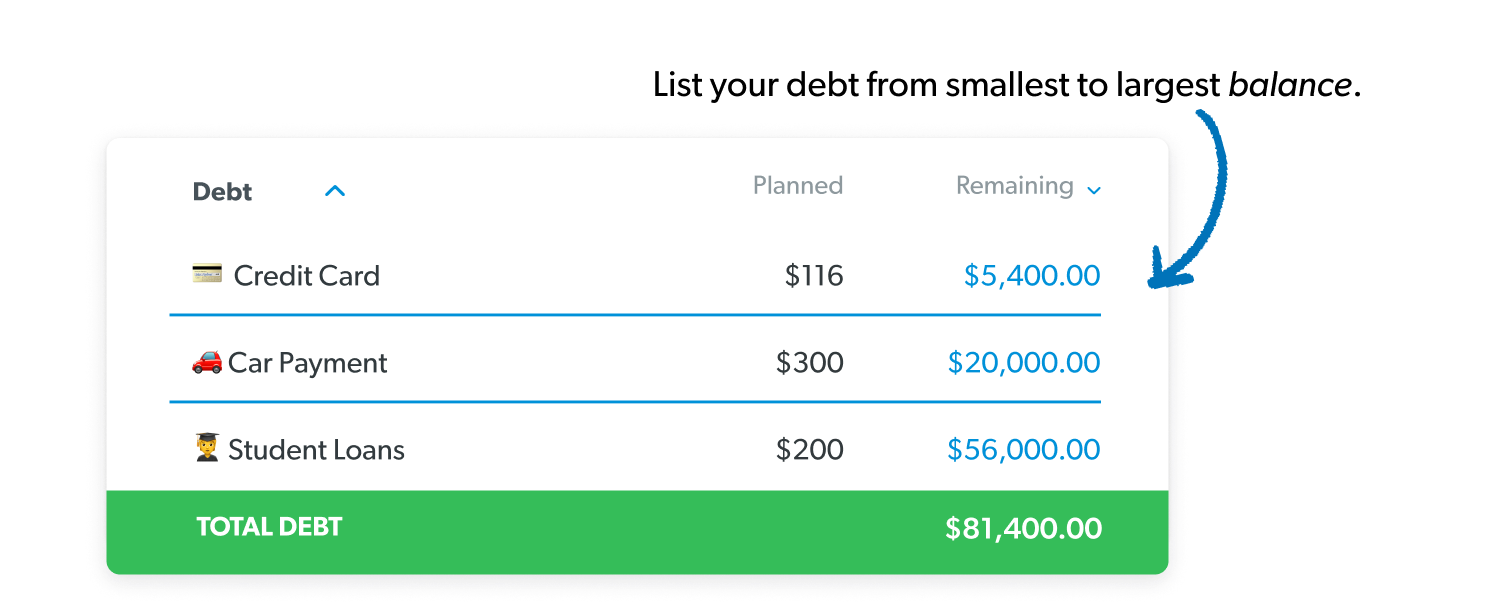

List your debts from smallest to largest (regardless of interest rate).

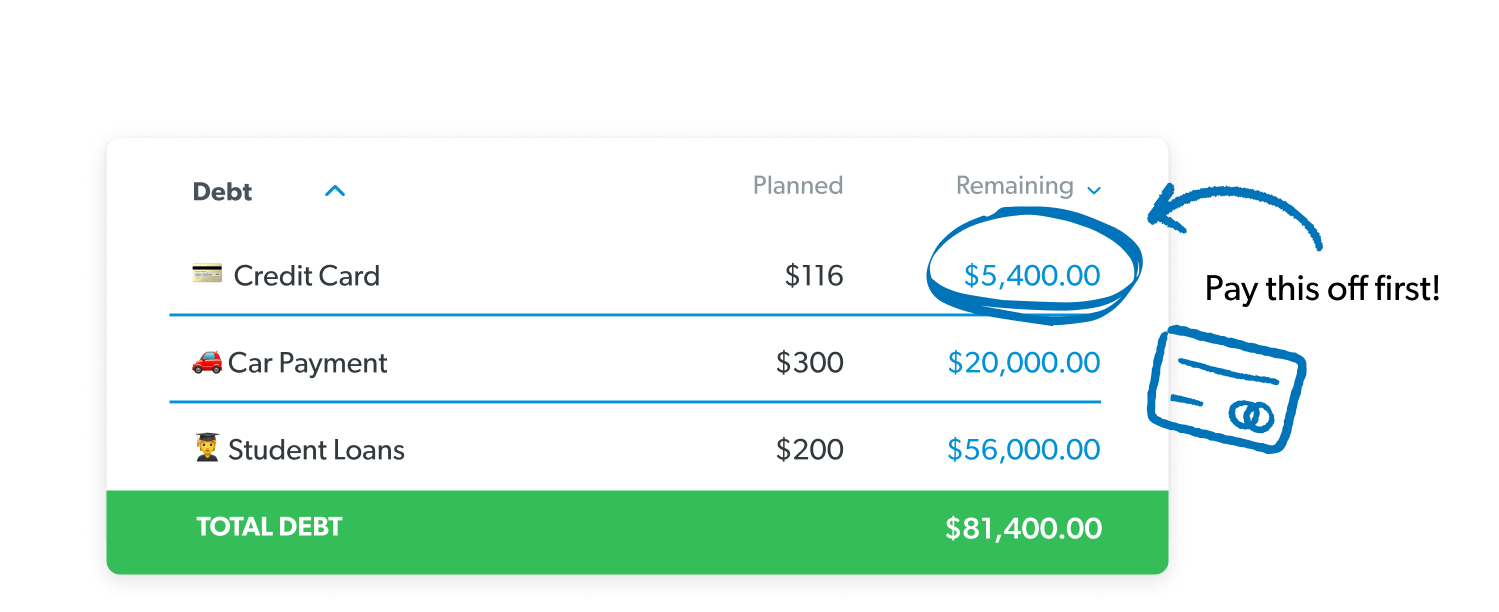

Make minimum payments on all your debts except the smallest debt.

Throw as much extra money as you can on your smallest debt until it’s gone.

Take what you were paying on your smallest debt and add that to your payment on the next-smallest debt until it’s gone too.

Repeat until each debt is paid in full and you’re completely debt-free!

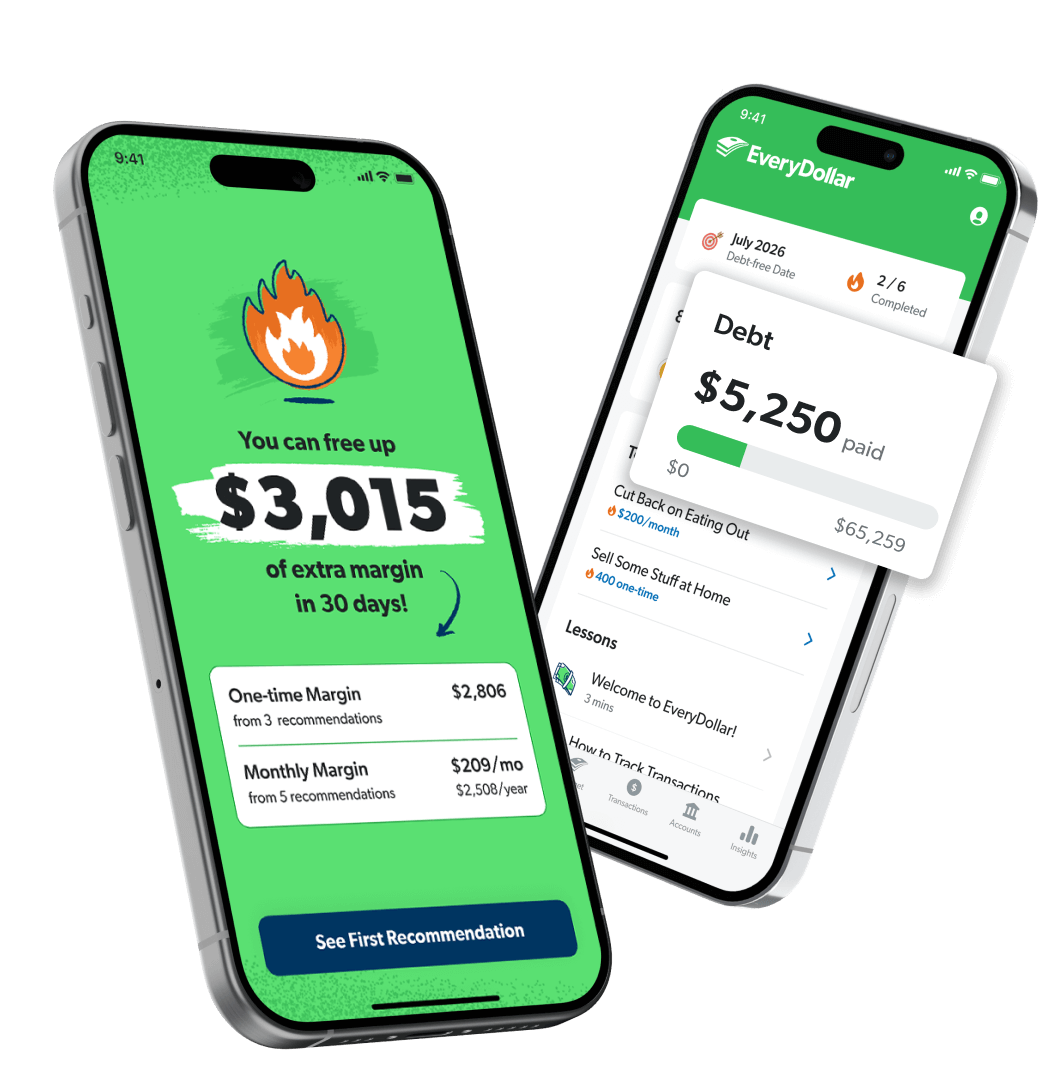

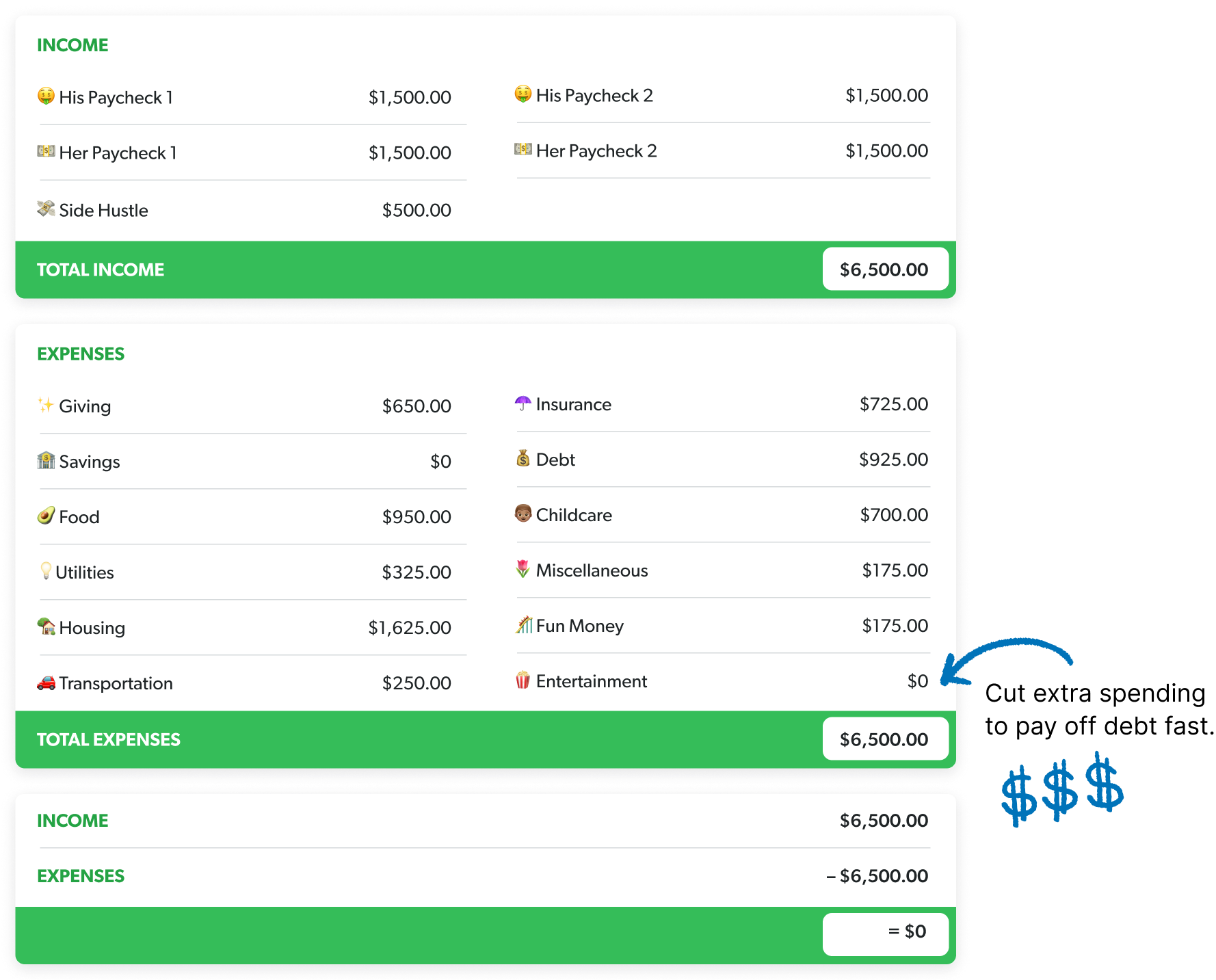

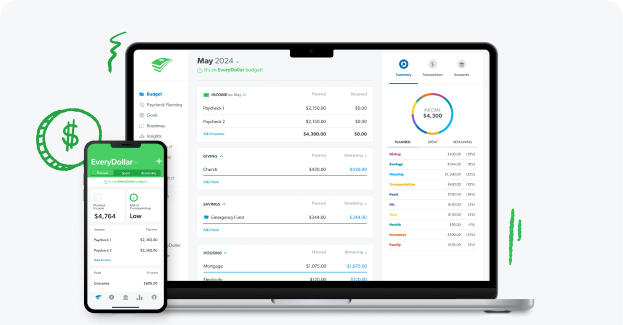

Our EveryDollar budget app helps you stay on top of your spending and free up more money to throw at your debt. The average person finds $3,015 of margin in just the first 15 minutes (now that will get things rolling)!

The debt snowball method is the best way to get out of debt—especially if you’re juggling multiple debt payments. It helps you prioritize your debts and gives you the motivation to actually make progress. Here’s how the debt snowball works:

You might be wondering if you should pay off the debt with the highest interest rate first (aka the debt avalanche method). While the math makes sense on the surface, paying off debt is about more than just the math—it’s about experiencing the motivation you need to keep going.

By paying off your smallest debt first (instead of focusing on the interest rate), you get a quick win! Plus, you immediately free up money to tackle the rest of your debt. The debt snowball gives you the motivation and momentum you need to become debt-free once and for all!

Be sure to list all your debts in your budget to keep track of your monthly payments. Adding your debts in your budget also helps you with the next step . . .

Where exactly are you supposed to find extra money to pay off debt? Great question! This is where your budget becomes your best tool. By creating more margin—cutting unnecessary expenses, adjusting spending habits, and increasing your income—you can free up cash to make real progress.

Like a snowball rolling down a hill, the amount you’re paying on your debt grows in size and gains momentum with every debt you pay off.

People who use the debt snowball method have a greater likelihood of paying off all their debt because they experience small wins early and often, which keeps them going till the end!

It usually only takes people between 18–24 months to pay off all their debt with the debt snowball. Two years? That’s a drop in the bucket! A couple years of intensity for decades of freedom? Worth it!

Plug your numbers into our Debt Snowball Calculator below to find out when you'll be debt-free. (And don’t get discouraged—this is just the first step. We’ll show you how to pay off your debt faster!)

Keep track of your progress! 💰

Learn the proven plan to break free from debt and take control of your money for good.

Get the support you need to finally make progress. Join the class that’s helped millions of people become debt-free.

Find more margin and get a personalized plan to take down your debt—in just 15 minutes.

Let’s be real: There are times when you may need to pause your debt snowball to deal with an unexpected—or expensive—situation. Saving money for an emergency before you start the debt snowball can keep you from having to pause your progress. But here are the most common reasons to (temporarily) pause your debt snowball:

Continue to make minimum payments on your debt so you can pay for those expenses as they pop up and start stockpiling cash until the baby comes. Once everyone comes home from the hospital healthy and happy, restart your debt snowball.

A job loss can turn your world upside down. If this happens, take a deep breath, remind yourself it will be okay, and then go into spending survival mode. Focus on paying for the Four Walls (aka the basics): food, utilities, shelter and transportation. If you can, make minimum payments on your debt, but nothing extra.

A serious medical diagnosis can throw your family into a whirlwind of emotions. During this season, it’s more important to get the care your family needs than to pay off debt. If a major surgery, hospital stay or expensive treatment is on the horizon, pause your debt snowball and cash flow your medical bills instead.

If you’re about to go through a divorce (or you’re in the middle of one), you’re probably just trying to keep your head above water both emotionally and financially. During this major life transition, you don’t have to go heavy on crushing your debt. Take care of you. Take care of your family. Keep budgeting through the changes, and you can jump right back into your debt snowball once you settle into your new normal.

Pausing your debt snowball to pay the IRS is a smart idea for two reasons: First, their interest rates and penalties are really high. Second, they almost have unlimited power to collect your debt. Yeah, don’t ignore them. It’s wise to get the IRS out of the way and then restart your debt snowball.

And hey, it’s okay if you do need to hit pause on your debt payoff to get through a hard season. Just be sure to get right back at it once you’re back on track with money and life.

When you’re drowning in debt, it's easy to fall for scams that promise quick fixes but only make things worse. Watch out for these common debt relief scams that can derail your progress:

Debt Consolidation

Debt consolidation is a type of loan that rolls several unsecured debts into one single bill, usually to get a lower interest rate. The intent is to help you slash mounds of debt. But really, you end up staying in debt longer because the term of your loan is extended. The longer it takes you to pay off your loan, the more money you pay in interest. That’s why we call it debt CON-solidation. (The only version of this we might suggest is student loan consolidation.)

Debt Settlement

Debt settlement means you hire a company to negotiate a lump-sum payment with your creditors for less than what you owe. Debt settlement companies also charge a fee for their “service.” Most of the time, settlement fees cost between $1,500 to $3,500, which is way more than you would pay if you cut out the middleman and settled the debts yourself.

Withdrawing or Borrowing From Retirement Savings

You might be tempted to withdraw money from your retirement to pay off your debt, especially if you’re having trouble making payments. But that’s a bad idea for several reasons—not only will you get hit with outrageous early withdrawal penalties and have to pay taxes on anything you take out, but you’re also stealing from your future self! And 401(k) loans are even worse!

The only time you should even consider taking money out of your retirement accounts early is to avoid a bankruptcy or foreclosure. Otherwise, hands off the 401(k)! That said, cashing out non-retirement investments can be a good way to pay off debt.

Credit Repair and Debt Elimination Scams

In a world that revolves around the almighty FICO score, it’s easy to come across companies that are ready to “fix” your credit report—for a fee, of course. But the truth is, most of these repair companies are scams. They offer to remove the negative information from your report, even if it’s accurate. (Psst. That’s illegal.)

And debt elimination scams are similar. They offer to eliminate or drastically lower your debt for a large up-front cost. But all you’re paying for is falsified loan documents that aren’t tricking anybody. Yikes.

You’ve got the game plan. Now, it’s time to kick your debt payoff into high gear! Use these tips to boost your debt snowball payments and speed up your journey to becoming debt-free:

You have to draw a line in the sand and decide that you’re done with debt. No more swiping that credit card or taking out personal loans for things you can’t pay cash for. Those habits have gotten you where you are now, and they won’t help you get out. If you want something different, you have to do something different.

The cash envelope system (aka cash stuffing) is a great way to help you get your spending under control and stick to your debt payoff goal. You take the amount you’ve budgeted for certain categories (like groceries or clothing) and stick it in labeled envelopes. Your goal is to only spend the cash you’ve got in each envelope for the month. This is the kind of habit that will hold you accountable and keep you on track.

Food is usually our biggest budget buster. But meal planning can help you save more each month. And listen, it doesn’t have to be this overwhelming chore that takes up your whole weekend. Just choose a couple budget-friendly meals, try to use ingredients you already have, and decide which nights you’re cooking and which nights you’ll have leftovers. Easy peasy.

One person’s trash is another person’s treasure. Dig through your kids’ rooms and search through the black hole of your closet to find things you can part with. Then sell your stuff online to make some quick cash. Or if you'd prefer to sell your stuff the old-fashioned way, host a garage sale.

Stop contributing to your retirement investments—and that includes your 401(k). Why? Because right now, you want to throw everything you can at your debt so you can pay it off faster. Don’t worry, it’s only temporary. You can start investing again once you’ve paid off your debt and saved up a fully funded emergency fund. By then, you’ll have enough money freed up that you can put even more of your income toward retirement.

Think about how much faster you could pay off debt if you traded in your expensive ride for a used car you can actually afford. Then every month, you could throw that car payment at your debt snowball—instead of out the window. And later, when you’re debt-free, you can save up to buy your dream car in cash!

Or if you’re a two-car family, could you downsize to one car while you pay off debt? Sure, it takes some extra coordination, but you’d be surprised how this can really help you kiss that debt goodbye.

Getting out of debt won’t be easy, but it doesn’t have to be miserable. And once you’re debt-free, it feels great! Here are seven ways to stay motivated as you pay off your debt:

Does debt make you mad? It should! Think about what debt is keeping you from doing and how those monthly payments make you feel. If you’re going to fully commit to paying off your debt, you’ve got to see debt for what it is—the enemy. You need to say, “I’ve had it!”

What are the reasons you want to ditch your debt? Maybe your dream is to build a legacy—to create a home where your children will never watch their parents stress out about the grocery bill or the minimum payment on their credit card. Maybe you want to pursue a passion or start a business. Or maybe you want to build wealth, live and give like no one else . . . but you have to get out of debt first. Get specific with whatever your why is.

When you’re feeling discouraged, you need something that will remind you of how you’ll feel once you’re debt-free. Every sacrifice you make today gets you closer to the kind of future you want to live.

The debt snowball method works by tackling your smallest debts first, but even that can feel overwhelming. So, instead of focusing on a $15,000 balance, divide it into smaller, manageable chunks—whether it's $5,000 or $500. Setting smaller goals makes progress feel achievable, keeps you motivated, and reinforces that you can do this!

Because so many of us are visual learners, it can help to actually see your progress toward your money goals. You can place a sticky note on your bathroom mirror to remind yourself of your reason for getting out of debt. Maybe you want to draw a piggy bank on poster board and color it in as you pay off your debts. Having visual reminders will keep your goal on your mind and help you reach it faster.

It’s okay to give yourself small rewards to stay motivated along your debt-free journey. You could treat yourself to something as small as a latte from your favorite coffee shop or maybe some shoes that are on sale. Better yet, add those rewards to your visual tracker to have something to look forward to when you reach a goal! You choose your rewards—just make sure they aren’t so extravagant that they slow down your progress.

It’s great to get inspired by other people’s stories, but avoid comparing your story to theirs. Everyone’s debt journey is different—some have less to pay off or more income to work with. So don’t let comparison keep you stuck. Stay focused on your own path. And don’t believe the lie that debt is normal!

Reaching your goals is much easier when you have people walking alongside you. Everyone needs a cheerleader! So, find someone to encourage you and hold you accountable on your debt-free journey—whether it’s a family member, friend, church group, financial coach or Financial Peace University class.

Weighed down by credit card debt? Find out the best way to ditch that debt for good!

Here’s how to chip away at medical debt, one unwanted hospital bill at a time.

Money’s tight right now. We're all feeling it. But listen, you can get rid of debt, no matter your income. These seven steps will help.

The debt snowball is all about motivation. By paying off your smallest debt first, you get a quick win! Plus, you immediately free up money to tackle the rest of your debt. The debt snowball creates unstoppable momentum to knock out the rest of your debts—like a snowball rolling down a hill! Learn more about how to pay off debt.

If you’ve got multiple debts, pay off the smallest debt first (regardless of interest rate). But if you owe the IRS any money (aka tax debt), you need to take care of that before anything else—even if it isn't your smallest debt. Get your top debt snowball questions answered.

Around here, we teach the 7 Baby Steps. If you’ve got any debt (other than your mortgage), your goal is to pay it all off before you start saving for your future—and that includes investing for retirement. Trust us, the best thing you can do for your financial future is ditch your debt so you can free up your income and start building wealth faster. Find out how to start.

The debt snowball method is the best way to get rid of credit card debt. But you also need to stop using credit cards (cut those suckers up!), get on a budget, control your spending, and do whatever you can to pay off your credit cards ASAP. Also, avoid things like balance transfers, personal loans and more credit cards—those will only make your problem way worse.

Debt collectors have one mission and one mission only—to get your money. And they’re not above stooping to some pretty low levels to make you pay (like lying, harassing and manipulating you). But you have rights, and you can defend yourself against these bullies! Find out how to deal with debt collectors.

Bankruptcy is a gut-wrenching experience that lays out your money problems for all to see and drags you through the legal mud. It also stays on your credit report for years and doesn’t even erase all your debts in most cases. You should do everything in your power to avoid filing for bankruptcy. Get the truth about bankruptcy.

Every day on The Ramsey Show, we invite people just like you to share their financial journey and do a Debt-Free Scream. And yes, it’s exactly what it sounds like! After all the hard work, sacrifice and determination, you get to stand up and proudly shout, “I’M DEBT-FREE!”

Once you’ve officially kicked debt to the curb, you can call in or come to our headquarters in Franklin, Tennessee, to do your Debt-Free Scream live on The Ramsey Show!