Key Takeaways

- Rocket Money (formerly Truebill) is a financial app that focuses on helping you manage bills and cancel subscriptions.

- Rocket Money’s subscription cancellation service costs money and doesn’t work for all subscriptions.

- You have to pay to access most of Rocket Money’s features.

- Rocket Money’s free budgeting experience doesn’t offer enough customization to make it worth using.

From giving you a breakdown of your finances to slashing your subscriptions in half, Rocket Money claims to be the “money app that works for you.”1

Get expert money advice to reach your money goals faster!

But when it comes to actually helping you take control of your spending, Rocket Money doesn’t have enough fuel to get you off the ground.

Let’s talk about what Rocket Money is, what features they offer, and if it’s worth paying for.

What Is Rocket Money?

Rocket Money is a bill management and budgeting app started in 2015 by Rocket Companies—the same people who run Rocket Mortgage, Rocket Homes, Rocket Loans (basically everything Rocket . . . except NASA).

If you’re looking for an app that will cancel your unwanted subscriptions and negotiate bills for you, Rocket Money will do that (for a fee, of course). But if you want a budgeting tool that will help you take control of your money and actually reach your money goals, Rocket Money is not the app for you.

Rocket Money offers tools and services that are supposed to make managing your money more convenient and “effortless.” But really, you’re just paying them to do things you can easily do yourself for free.

Even though Rocket Money says they “[empower] you to save more, spend less, see everything, and take back control of your financial life,” they actually encourage you to be as hands-off with your money as possible.2 And we hate to break it to you, but being hands-off with your money is not how you hit your financial goals. It’s how you end up broke.

What Happened to Truebill?

A company who cancels subscriptions—does that remind you of anyone? Truebill, maybe? (Those Instagram ads were everywhere!) Well, that’s because Rocket Money bought Truebill in 2021, and then Truebill officially became Rocket Money in August 2022.

While Rocket Money has more to offer than Truebill did, the subscription cancellation service is still one of their biggest selling points.

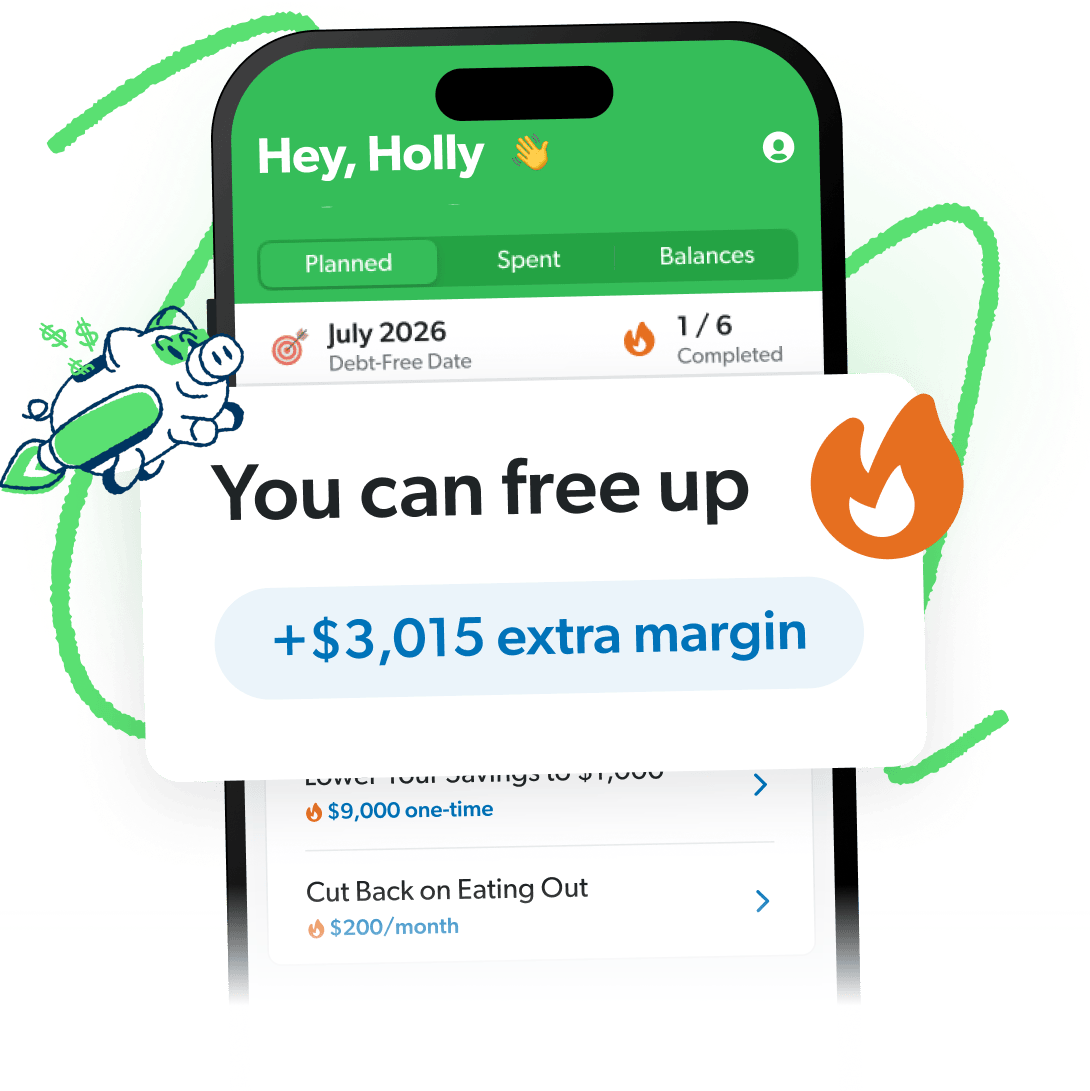

The Budgeting App That Finds Hidden Margin

You’ve got more margin than you think. EveryDollar helps you find it in minutes so you can start making real money progress, really fast.

How Does Rocket Money Work?

Okay, so what can you do with Rocket Money? Well, you can see a lot of things, that’s for sure. Do? Not so much. But here are the main tools and services Rocket Money offers:

Subscription Management

Rocket Money will identify recurring payments from your spending and list your subscriptions in one place—as well as when each is due—so you can avoid late fees and overdrafts.

But their main feature is that they’ll assign you a “concierge” to cancel any duplicate or unwanted subscriptions for you. (Because apparently there are a ton of people who don’t know they’re paying for two Netflix memberships every month?)

Yeah, having a digital butler who cancels your subscriptions is convenient. But you only get this service if you pay for the premium membership. And in the time it takes you to upload a copy of your most recent bill to the app, you could’ve already hit that cancel button or called the customer service rep yourself.

Also, Rocket Money isn’t Liam Neeson. They don’t have a special set of skills that allow them to cancel the things you’ve already tried to cancel. Sorry, but there are some things you’re just going to have to get out of yourself: gym memberships, cults . . . gym cults. Rocket Money only tackles the subscriptions that are easy to cancel—which, again, are also the ones you can cancel yourself for free.

Bill Negotiation

If Rocket Money thinks a certain bill is too expensive, they may offer to negotiate that bill on your behalf. But they’ll also take a cut of the savings—which kind of defeats the purpose.

Rocket Money charges 35–60% of the amount they help you save for the year. So, let’s say they negotiate your phone bill to a lower price and save you a total of $175 for the next year. That means you’d have to pay them an upfront fee of anywhere from $61–105 . . . to do something you could’ve done yourself!3

Also, some of these savings may only apply to the first year. And you could end up stuck with a plan that doesn’t have all the features you wanted in the first place. Even if you hate going back and forth with customer service on the phone, you can still negotiate your own bills and keep 100% of the savings.

Budgeting

The Rocket Money app technically has a budgeting experience—it’s just not a very good one.

You can set up a budget to keep track of your expenses throughout the month. But you can’t create unlimited budgets and customize your budget categories unless you pay for the premium version.

And since Rocket Money categorizes your transactions for you, it's super easy for purchases to get put in the wrong category and throw your whole budget out of whack.

Bottom line: You should be the one controlling your budget—not Rocket Money!

Spending Insights

The Rocket Money app also tracks your spending. It shows you how much you’ve spent versus earned, what your top spending categories are, and how much you have left to spend for the month.

But Rocket Money’s version of budgeting is more about monitoring than managing. You can see how much you’ve already spent, but they don’t make it easy for you to tell your money where to go in the first place.

This kind of basic budgeting isn’t going to help you change your spending behavior and save money. Basic budgeting gets you basic results.

Account Linking

You can link multiple accounts to the Rocket Money app and see all your financial information in one place. This includes your checking, savings, investment and debt accounts. While this is useful, there are lot of money apps that do the same thing.

Net Worth Tracker

By having all your assets and debts in one place, Rocket Money can determine your total net worth and how it changes month to month. That's good to know, but calculating your net worth yourself is much easier than you think!

Just add up all your assets (bank accounts, retirement, real estate, etc.) and subtract your liabilities (credit card debt, student loans, car loans, etc.). Then (ta-da!) you have your net worth. You don’t need Rocket Money to do that.

Automatic Savings

If you opt into Rocket Money's Financial Goals feature, they'll automatically transfer a certain amount of your money into a savings account—a Rocket Money savings account (should’ve seen that coming). While having a monthly habit of saving money is important, you can easily do this through your own bank.

Credit Score Monitoring

Rocket Money will give you your current credit score, as well as your credit report and history. But just like Credit Karma, Rocket Money wants you to be obsessed with trying to improve your credit score. And of course, Rocket Money’s got a whole suite of debt products to help you do just that. If you’re not careful, you’ll fall right into their trap—and straight into debt.

How Much Does Rocket Money Cost?

The Rocket Money app is free to download, but you have to pay if you want the premium features—which can cost anywhere from $6–12 a month (with a 7-day free trial).4

Why the range? Well, they’ve got one of those “pay what you think is fair” scales (which, let’s be honest, are confusing). And the strange thing is, someone who pays $72 a year is getting the same features as someone who pays $144 a year. Make it make sense!

The free version of Rocket Money includes:

- Account linking

- Balance alerts

- Subscription management

- Spend tracking

The premium Rocket Money subscription includes:

- Subscription cancellation assistant

- Bill negotiation (but you still have to pay an extra 35–60% of what they save you—on top of your subscription)

- Premium budgeting features (including custom categories and unlimited budgets)

- Net worth tracking

- Credit score monitoring

- Financial goals saving

- Shared accounts

- Chat support

You can also get the premium version of Rocket Money if you (surprise, surprise) apply for their Rocket Visa Signature Card. Because if they can’t make money from you using their app, Rocket is going to make money off you with their other debt products.

Is Rocket Money Safe?

Rocket Money doesn’t store your log-in info. Instead, they link your financial accounts using Plaid, which is a trusted company in the financial tech space. And your smart savings account is held in an FDIC-insured U.S. bank account.

So, your money might be safe in the bank. But what you really need to worry about is Rocket Money stealing from you in plain sight. Because charging you 60% to save you some money on your next bill, when all they really do is call up a company and read off a script? That’s highway robbery!

Is Rocket Money Worth It?

No, the free version of Rocket Money doesn’t have enough features to make it worth using. And like we’ve already said, anything you can do with the premium version, you could do yourself for free or do better somewhere else.

Rocket Money currently has an Apple App Store rating of 4.3 stars. But you don’t have to do much digging to find all the complaints from former Rocket Money users.

The most common problem with Rocket Money has to do with their bill negotiation service. Users say they’ve gotten randomly charged for bills they didn’t even know were being negotiated and continued to get charged even after trying to cancel their Rocket Money account!

Yeah, best to steer clear of that.

Get a Budgeting App That Puts You in Charge

Don’t put your finances on autopilot! When you use an app that automatically manages your money for you, you lose touch with what’s actually happening with your money.

You need a budgeting app that puts you in control.

The EveryDollar budgeting app helps you create a zero-based budget that fits your lifestyle and your goals. You can customize your budget categories and decide how much to spend in each.

EveryDollar does more than just help you track your spending and manage your money—it actually helps you find more margin every month! Just download the app, answer a few questions, and we’ll build you a plan to free up thousands in margin to put toward your goals.

You deserve to be the one in charge of your money. Start EveryDollar for free right now!