Just like anything else in life, managing your money when you’re single has its pros and cons. Pros? No money fights (unless you fight the voice inside your head). Cons? A single income with less accountability. But no matter what your pros and cons list looks like, getting ahead with your money is a big job. So, I’m here with eight money tips for singles to get your confidence up and your financial stress down!

1. Get on a budget.

A budget is just a plan for your money. Plain and simple. And guess what: No matter what you’re hoping to accomplish with that money, budgeting is the first step to get you there. Want to save up for a house? Budget. Want to pay off your credit card debt? Budget. Want to make sure you can afford tickets to see your favorite emo band’s reunion tour? Budget.

From the big to small to in-between money goals, a budget is how you’ll make it all happen. And it’s not as complicated as you think! You just:

- List your income (all the money coming in).

- List your expenses (all the money going out).

- Subtract your expenses from your income (and this should be zero).

- Track your expenses (all month long).

- Make a new budget each month (before the month begins).

What’s this “zero” business? No, it doesn’t mean you walk around with zero dollars in your bank account. That’s dangerous. Leave a buffer in there of a few hundred bucks so you don’t accidentally overdraft.

Get expert money advice to reach your money goals faster!

This “zero” I’m talking about is zero-based budgeting (income – expenses = zero). That means if you make $4,000 a month, everything you give, save or spend equals $4,000. This gives every single dollar you make a job to do.

Nothing is hidden or mindlessly spent in the drive thru, checkout line, or merch table at that once-in-a-lifetime reunion tour. (Pro tip: Budget ahead of time for a band T-shirt. Then it isn’t a problem—it’s part of the plan!)

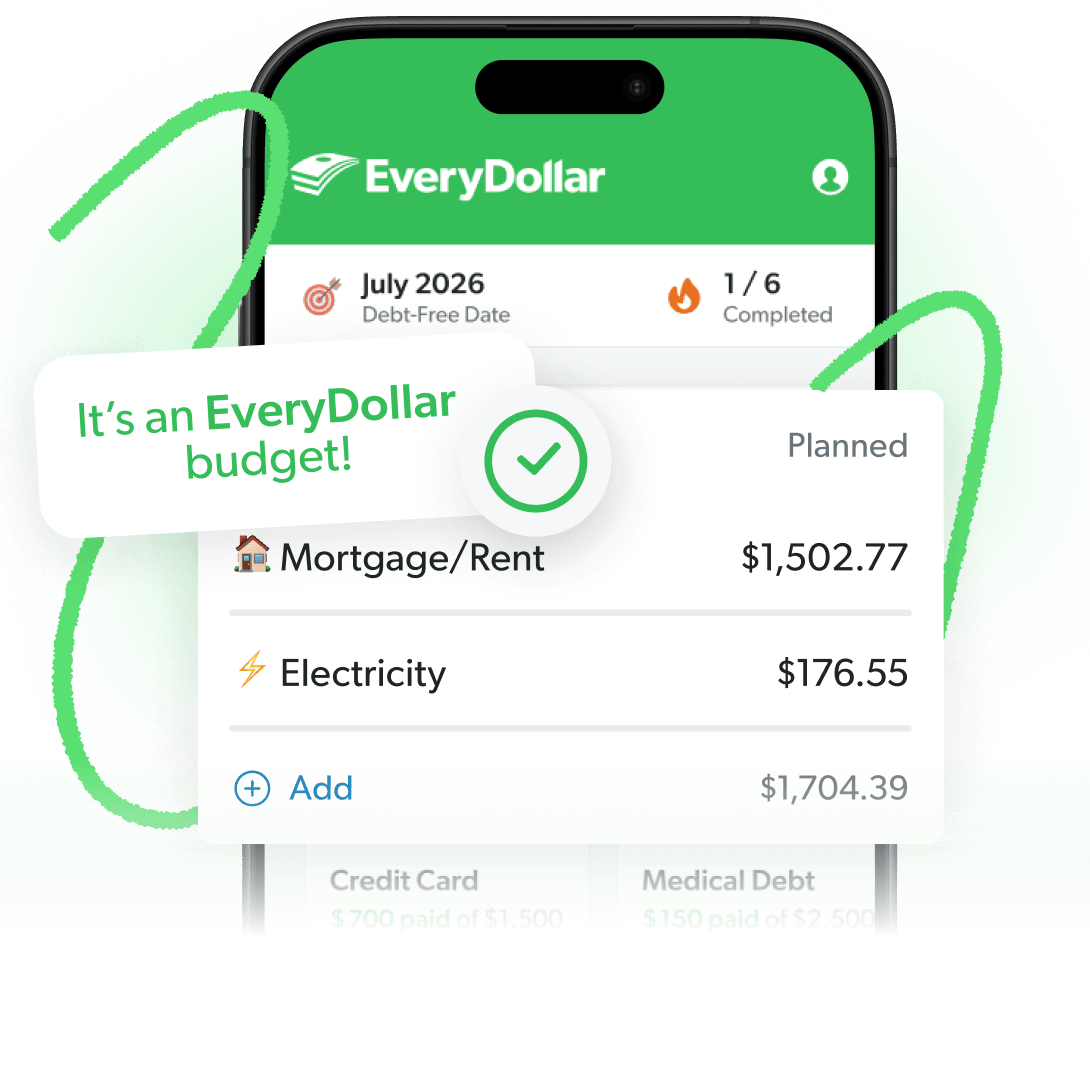

Find Margin You Didn’t Know You Had With EveryDollar

The EveryDollar budgeting app helps you find extra money every month so you can beat debt, build wealth, and make progress. Every. Day.

2. Find an accountability partner.

Raise your hand if you think accountability partners are just for people who don’t have their lives together. Put that hand down. That’s categorically false.

Don’t get me wrong. If you’re struggling with your finances, getting a good accountability partner is a brilliant plan. But if you’re knocking it out of the park, getting a good accountability partner is still a brilliant plan!

But what makes a “good” accountability partner anyway? Find yourself someone who will encourage you along the way—but also get real and call you out when necessary. You know, someone who won’t hesitate to say, “George, you do not need another custom oil painting of your Frenchies. You know this will set you back from your bigger goals this year.”

There is no shame in asking someone to help you keep your eye on your goals. Don’t skip this tip.

3. Set goals and make them happen.

We’ve all got dreams of what we’d like to do with our money. But guess what? The only way to turn those dreams into reality is to make actionable goals. That means you:

- Write down the goals.

- Make them specific.

- Make them measurable.

- Give yourself a deadline.

- Make sure they’re your own goals.

It isn’t magic, but it can feel pretty magical. Because when you put pen to paper, get real, and get some serious buy-in—from yourself—that’s when you make the magic happen.

4. Follow the Baby Steps.

But wait. Where do you start when it comes to picking your goals? I mean, there are a lot of awesome money goals you can set in life. Save for this, pay off that, travel here, invest there—how do you narrow it all down? Wouldn’t it be awesome if there was a step-by-step plan for the major money goals in life?

Good news, my friends—there is. And it’s called the 7 Baby Steps! Walk these steps, in order, as your proven plan to pay off debt, save money, and build wealth. They’ve worked for me and millions of others. And they’ll work for you too!

5. Pay off your debt.

It keeps coming up, so for this money tip, let’s go ahead and talk about it. I want you to pay off your debt. All of it. And here’s why: Debt is a thief. It steals from your future paychecks to pay for your past.

Like those sueded leather boots you decided to buy with four “easy payments” on a stupid buy now, pay later plan. Or the new car that comes with monthly payments that rival your grocery bill. Or that cart of groceries you “paid” for with a quick tap, insert or swipe of your credit card. All of these create a cycle of debt—of paying for the stuff you got a while back, way into the future. You can’t get ahead like that. And I know you want to get ahead! We just talked about those big money goals you’re going after.

The truth is this: You and debt have a toxic relationship. Debt’s holding you back, and it’s time for you to break up. For good. Then let your accountability partner know. That way, you’ve got someone who’ll help keep your eyes on the prize when a “once in a lifetime deal” pops up that you can’t afford right now. Because if it isn’t great for your financial future, that’s actually called a bad deal. Budget for your purchases and buy the shoes, the car and the groceries with money you have right now.

Pay off the debt. Don’t rack up new debt. You got this.

6. Make sure you have the right insurances.

Insurance probably isn’t on your top 10 favorite things to talk about, I guess unless you’re an insurance agent. But otherwise, nobody talks about it until you need it—and often times by then it’s too late.

So, this not-so-glamorous part of adulting is super important. And having the right insurances (and the right coverage) is also super important.

Here’s a quick rundown of the eight types of insurance you need:

- Term Life

- Auto

- Renters or Homeowners

- Health

- Long-Term Disability

- Long-Term Care (if you’re 60+)

- Identity Theft Protection

- Umbrella Policy (if your net worth is over $500,000)

If you aren’t sure if you’ve got what you need, take the free insurance Coverage Checkup. Your personalized action plan tells you what coverages you’re missing. It’ll even put things in priority order so you can knock them out one by one.

More Money. Less Stress. Yes, Please.

In his new book, George Kamel does the research for you and exposes all the worst money traps out there so you can build real wealth!

7. Watch out for marketing tactics.

Listen, the last thing you need is to fall for scammy marketing tactics. But they’re literally all over the place. So, what can you do? Learn some of their go-to tricks, like:

- Personal Selling: Yeah, it’s hard to say no to someone’s actual face (especially those tiny humans in uniform selling cookies outside the grocery store), but news flash—you can say no (politely).

- Product Placement: There’s a reason the pricier cereals are right at eye level— stores know plenty of us won’t scan the shelves for a better deal. Be wise. Use those eyes! Grab the BOGO generic brand coco-mallow-crunch-oh’s on that bottom shelf. (And don’t forget to grab the milk!)

- Brand Association: I’ve got nothing against brand loyalty. I mean, I’m a die-hard Apple-phoning, Costco-clubbing, Southwest-flying, Starbucks-drinking kind of guy. However, you should know plenty of brands are banking on your belief that you can be cooler, smarter, hotter and happier—if you’d just buy what they’re selling. But don’t believe it. You don’t have to be loyal to a certain brand to be who you want to be. (Also, you’re already cool, in case no one told you that today.)

Those are just three of the six tactics I cover in our lesson on Wise Spending in Financial Peace University. Check it out if you want to diver deeper into all this. But here’s the main thing I want you to take away from this money tip: Get to know what you’re up against so you aren’t hoodwinked by these companies! And remember, you are the one in control of your spending. Not a fancy marketing trick.

8. Quit the comparison game.

It wouldn’t be a good list of money tips for singles if we didn’t get deep. So, I have a question for you. Do you know who wins when you play the comparison game? No one. Only losers. There are no gold medals—just frustration and lots of wasted time.

First of all, you have no idea if someone’s just faking having it all together. Underneath the flawless Instagram posts and flashy exterior could be a pile of debt, money stress and sleepless nights.

Second of all, you’ve got a lot going for you. Right now. But you’ll never realize how much you have if you’re always looking at what you don’t.

Now, you’ll still set and work on those money goals. But not to show someone up or keep up with the Joneses. You’ll do it for you. So you can have real security with your money and get to where you can help others along the way.

So don’t compare your budget, your home, your car, your purchases, your job, your relationships or your life to anyone else.

No matter where you’re at with money, you can get better. That’s why we made the EveryDollar budgeting app!

EveryDollar helps you find extra margin every month so you can start making real money progress, really fast. Just download the app, answer a few questions, and we’ll build you a personalized plan, based on your situation, to free up margin and make the most of every dollar. Every day. (See where we got the name?)