Key Takeaways

- Affording something means having the money in your budget to pay for it outright—no loans, credit cards or payment plans.

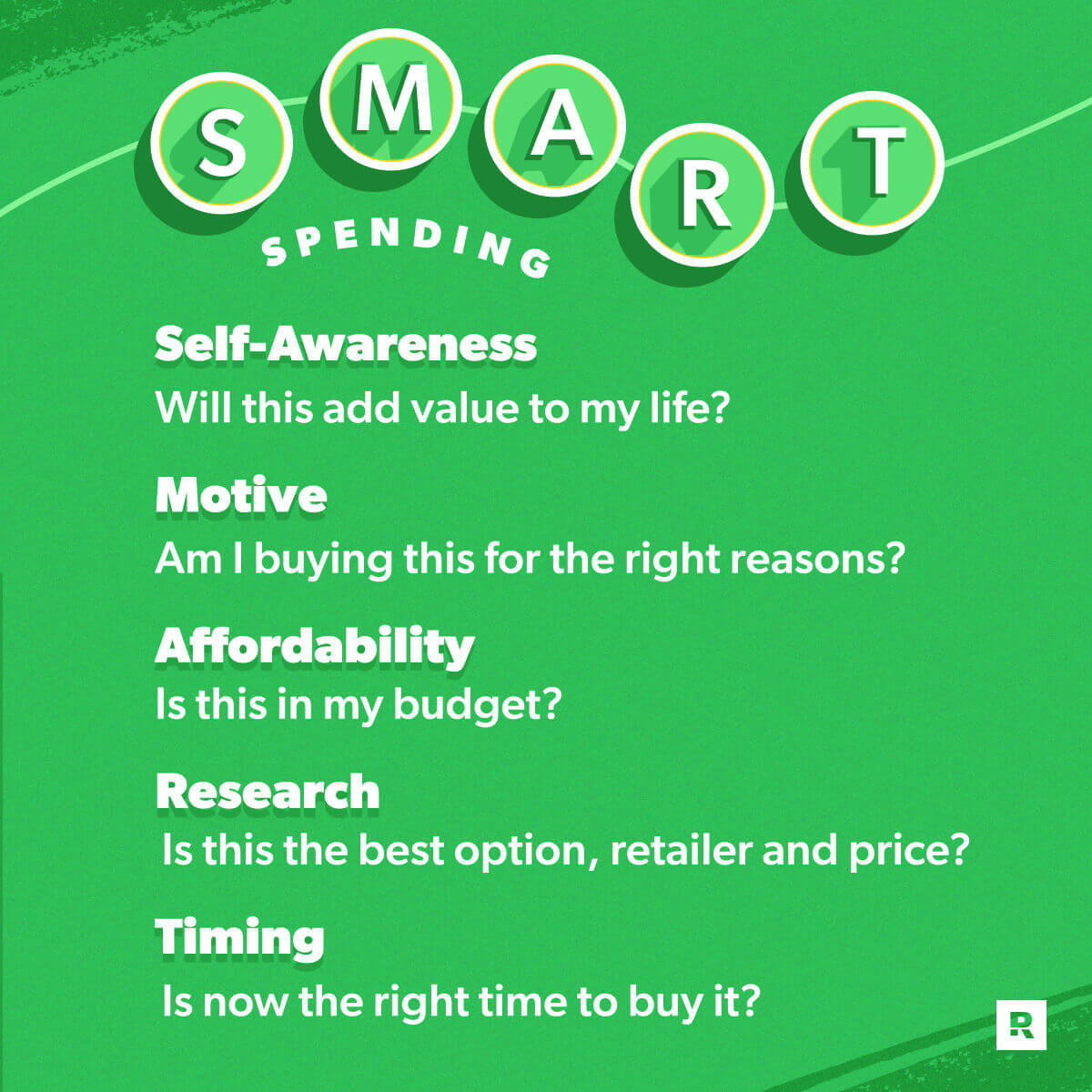

- Use the SMART questions—self-awareness, motive, affordability, research and timing—to guide your spending decisions.

- A budget gives you clarity and confidence in spending decisions and is essential to knowing what you can truly afford.

- If it’s not in the budget, you can’t afford it right now—but you can plan and save for it intentionally.

You’re looking at that graphic tee, latest smartphone, pair of Air Jordans, Cloud sofa, new car or even your dream house—and you’re wondering, Can I afford it? For purchases of all sizes (but especially huge ones), this is a common question! How can you answer it?

Let’s find out exactly how to know if you can afford something (or not).

How Can You Tell If You Can Afford Something?

Here’s the simple answer: Being able to “afford” something means there’s money in the budget to pay for it. Outright. Right now.

It means you can pay for that swimsuit without a buy now, pay later installment plan you’ll be dealing with long after summer’s gone. You can pay for that new-to-you SUV today without car payments that linger years after that new car smell fades.

Being able to afford something means you are able to own it—not owe on it.

But, even with that definition, sometimes a purchase feels like it falls in a gray area. So let’s get even more clarity here.

5 Questions to Ask Before Buying Something

One of the best ways to tell if you can afford something is by asking yourself a series of questions.

1. Self-Awareness: Will this add value to my life?

Will you use this? Like, seriously? Telling yourself it’s just a little retail therapy doesn’t make it a wise buy. Instead of swiping your card to boost your mood, go for a walk, call a friend, or dive into a hobby you enjoy. No need to add more junk to the back corner of that closet, after all.

2. Motive: Am I buying this for the right reasons?

Really check your motivation here. Are you buying this because you need it—or because you’re trying to keep up with someone else? Don’t fall for comparison traps, sneaky sales tricks, or so-called “loyalty” perks. Make spending decisions based on what’s right for you, your life, and your budget.

3. Affordability: Is this in my budget?

And we’re back to our main definition here. Do you have the money in your budget to cover this purchase? In full? If not, then it’s simple: You can’t afford it . . . at least not right now. No, layaway doesn’t count. And putting it on a credit card definitely doesn’t count.

But hang on—we’re not just here to shut the door. We’ll walk through how to plan and save for a big purchase in just a minute.

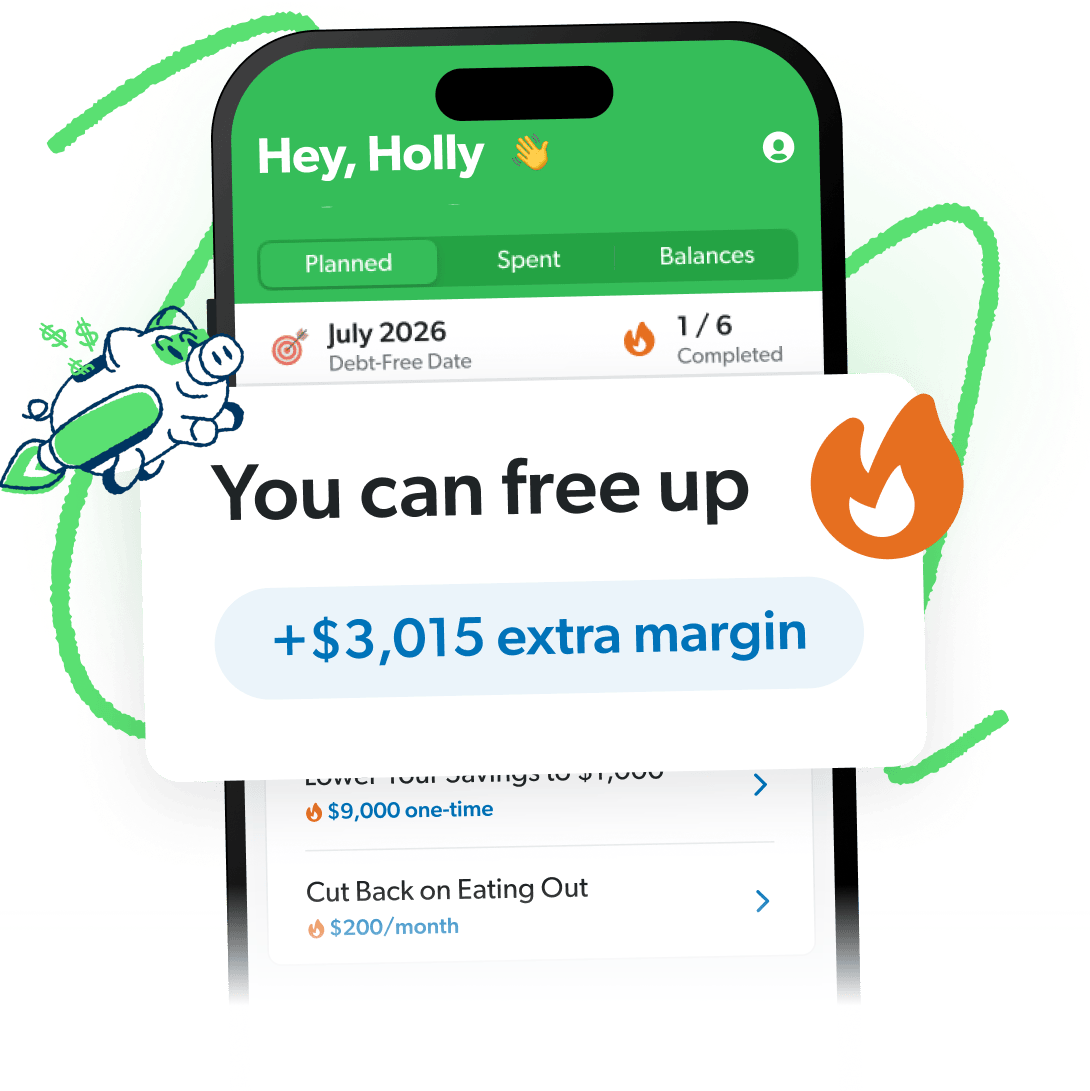

Put More Breathing Room in Your Budget

Money feeling tight? Not anymore. The EveryDollar budgeting app helps you free up thousands of dollars you didn’t know you had—in minutes.

4. Research: Is this the best option, retailer and price?

You’ll avoid impulse buys that can lead to buyer’s remorse by asking yourself this question. And even if impulse shopping isn’t a temptation for you, shopping around and comparing prices helps you know you’re getting the best deal possible.

You can often score gently used items on sites like Facebook Marketplace, eBay or Poshmark for way less than retail. Outlet stores can be a win too—just go in with a plan, stick to your budget, and double-check prices to make sure it’s a real deal.

5. Timing: Is now the right time to buy it?

Truth bomb: Just because you want something (or even need it eventually) doesn’t mean you need it right now. Can you wait for an in-store promotion or online sale? Should you save up more money? You might have legit reasons to make the purchase, but you just need to wait awhile.

Did you notice the topics of those questions spell out SMART? Self-Awareness, Motive, Affordability, Research, Timing. Now you’ll never forget how to make a SMART purchase!

How Can I Afford a Big Purchase?

There’s a toxic money system out there trying to dupe us all into believing we have zero willpower to save up and actually pay for something. That’s a false, toxic money system. And we want no part in their schemes. But if we’re going to buck the norm, we’ll have to take action.

Here are ways you can afford a big purchase—debt-free and dupe-free.

- Set up a sinking fund and stash cash away every month until you have enough to make the purchase.

- Cut spending from other budget lines to free up money you already have.

- Increase your income for awhile to make more money.

- Normalize patience over instant gratification.

That last one isn’t so easy in a society of one-click wonders being delivered to your doorstep in thirty minutes or less. But it’s definitely part of the process of truly affording something.

The Key to Affording What You Want

We keep talking about the budget as one of the biggest tools for knowing if you can afford something. That’s because a budget is a plan for your money. Plain and simple. When you make a budget, you tell every single dollar where to go (so you don’t wonder where it went).

If you aren’t planning your money like this, you’ll never know what you can (and can’t) afford. So if you’re wondering how to know if you can afford something—start with a budget.

Get all your income in there and every monthly expense. You’ll know what’s left so you’ll clearly see if you have the money to make a purchase. And if you don’t have the money yet, you can start intentionally saving up so you will be able to afford the purchase.

A budget gives you all the confidence you need to answer the question “Can I afford it?” It helps you make those SMART spending decisions. And when you use our free budgeting app, EveryDollar, you can have that confidence to spend wisely—right in your back pocket!

So download EveryDollar, remember those SMART questions, practice some patience (when necessary), and you’ll know when you can (and can’t . . . yet) afford something.

Additional Resources for Knowing How to Afford Big Purchases

If you want to look even further into home and auto purchases (two of the bigger expenses out there), check out these resources:

- How Much Car Can I Afford?

- The Best Time to Buy a Car

- How Much House Can I Afford?

- How Much Rent Can I Afford?

And check out some of our calculators too:

Plus, don’t forget EveryDollar. It’s the first, middle and final step to knowing if you can or can’t afford something.