Key Takeaways

- Inflation is raising costs across the board, so focus on covering your Four Walls—food, utilities, shelter and transportation—first.

- Save on groceries by shopping at discount stores, choosing affordable staples, using coupons, and cutting out nonessentials.

- Simple adjustments like using less energy, negotiating a lower rent, or finding a roommate can make utilities and housing more affordable.

- Lower your transportation expenses by using gas rewards and price-tracking apps, carpooling, and combining errands.

- Cut spending where you can, pick up extra income through side hustles, and rework your budget to stay in control as prices rise.

Inflation. It’s the headline in every news story, the butt of the joke in every meme, and the word we curse under our breath.

Right now, the inflation rate is 2.7%, which means the typical good or service costs 2.7% more than it did one year ago.1 Not too bad! But keep in mind, that number only considers the last year—and we all know that pretty much everything has been getting way more expensive for the past few years.

There’s good news, though. Because even though you can’t control how much inflation swings up from year to year, you can stay on top of your money to handle inflation.

Money-Saving Tips to Beat Inflation

If money is tight and getting tighter by the second, you need to make sure the most important things in your budget are covered. No, we’re not talking about your Amazon Prime membership or your Disney+ streaming subscription. You need to make sure your Four Walls (food, utilities, housing and transportation) are paid for each month.

Here’s how to beat inflation and keep your Four Walls guarded!

Saving Money on Groceries

Grocery prices have increased by a whopping 25% over the past four years, so it’s no surprise that our 2025 State of Personal Finance study revealed that the price of food is the top money issue for U.S. adults, above the price of gas and the cost of housing.2

If you’ve found yourself in that same boat, or if you just want to make your food bill a little easier to stomach, here’s how to save money at the grocery store.

- Shop at the cheapest grocery stores. Shocker—Whole Foods (aka Whole Paycheck) won’t have the cheapest prices on food. And that means if you really want to cut back on your grocery bill, you have to rethink where you shop. In the U.S., some of the cheapest grocery stores are ALDI, Market Basket, WinCo Foods, Food 4 Less, Costco, Walmart and Trader Joe’s.

- Look for foods that give you more bang for your buck. Rethink dinner if you need to, and look for foods like rice and beans that will go a long way in your cooking. Not every meal needs to have a big slab of meat to go with it either. Meat can be super expensive these days, so only buy it when it’s on sale.

- Cut out the wants, and only buy the items you need. You need food for breakfast, lunch and dinner—you don’t need chocolate chip cookies, kombucha and $15 pre-cut organic watermelon. If your grocery budget is being blindsided, it’s time to have a serious conversation with yourself about which groceries you need and which ones you don’t.

- Use coupons. Grocery stores and brands offer lots of coupons for a ton of items. Just make sure the coupon is for an item you already buy—aka don’t buy something random just because there’s a coupon for it. Some grocery stores will double your coupon on specific days of the week or give you $5 off a purchase of $50 or more (which isn’t hard to hit these days).

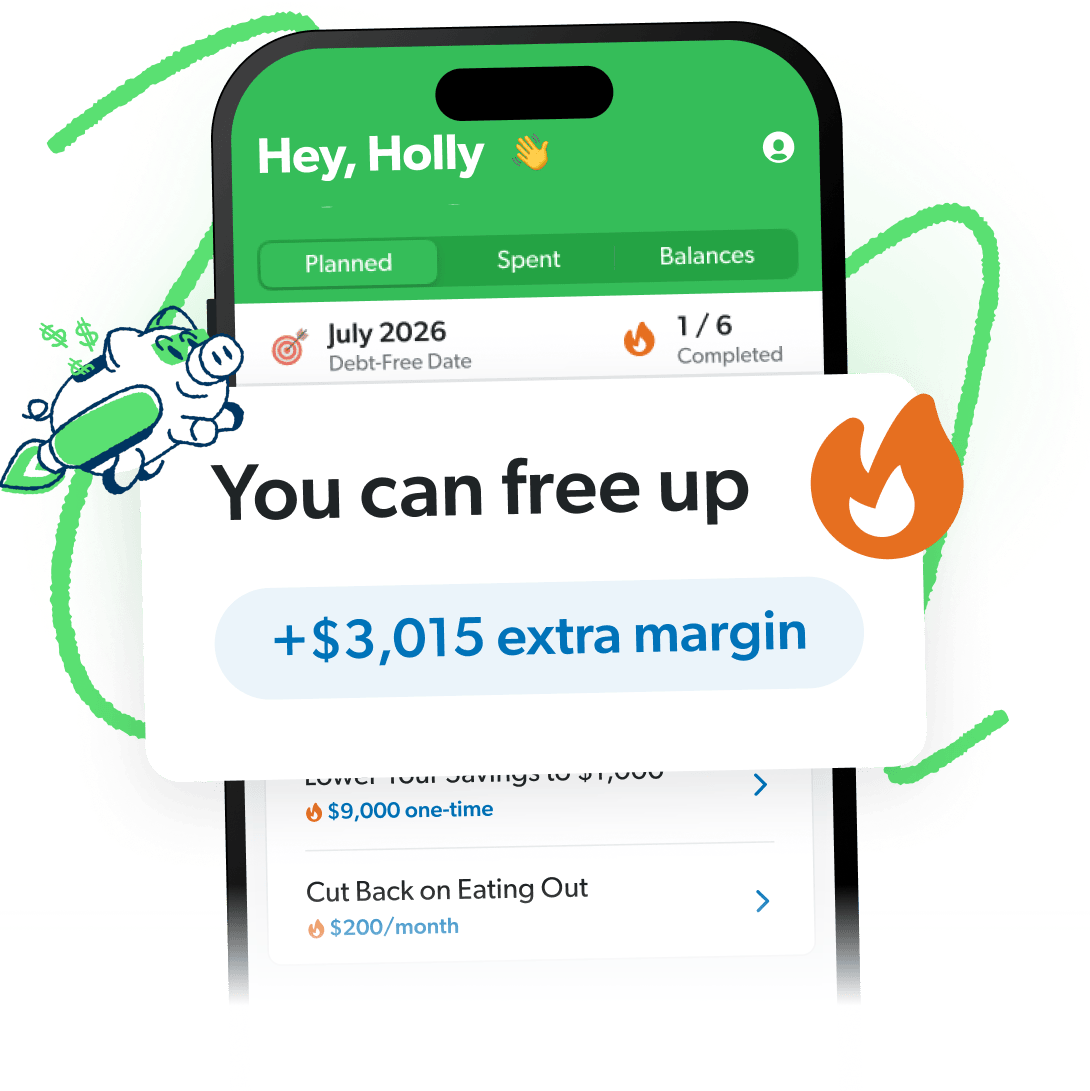

Find Margin You Didn’t Know You Had With EveryDollar

The EveryDollar budgeting app helps you find extra money every month so you can beat debt, build wealth, and make progress. Every. Day.

Saving Money on Utilities

Has your electric bill gone way up over the last few years? Welcome to the world of higher energy prices thanks to inflation.

Here are some tips you can use to cut back on your electric bill or heating bill.

- Don’t run appliances unless they’re full. The kids got chalk stains all over their pants (again). But instead of washing those pants alone, wait until you have enough clothes to run a full load of laundry. Fewer loads mean less energy—and a lower bill. And when it comes to the dishwasher, the same thing is true. Don’t run it until you have a full load to wash.

- Program your thermostat. Spoiler alert: If you’re not going to be home all day, the heat doesn’t have to be pumping through the house. You can save as much as 10% a year if you drop your thermostat down 7–10 degrees for eight hours a day.3 So turn down the thermostat before you head out the door.

- Use less. This one seems like a no-brainer, doesn’t it? But if energy costs are busting up your budget, one of the best things you can do is try to use less of it. Even the little things like turning off the lights and putting on an extra layer of clothing can do a lot to keep you from using more.

Saving Money on Housing

Like everything else over the last few years, the price just to have a roof over your head has gotten insane—no matter if you’re a renter or a homeowner. Since the start of 2020, the median home listing price in the U.S. has increased by 42%, and the typical apartment is 22% more expensive.4 Those are massive jumps.

Here are some of the best ways to make housing more affordable.

- Get a roommate. Okay, we get it—you don’t want to live with other people. People are complicated. People don’t want to wash their dishes after cooking spaghetti. But you know what? Those same people can cut your housing costs in half. For savings like that, you can put up with a few extra dishes in the sink.

- Sign a longer lease. This one only applies to renters, but it can make a difference. If you sign a 16- or 18-month lease, your landlord might drop the monthly price for you or let you lock in your rate to help protect you from that rent going up. Bottom line? It never hurts to ask and brush up on those negotiating skills.

- Move to a more affordable area. Yep, moving is the worst. Packing up all your belongings and physically moving them to a different place is a big ol’ pain. Nobody likes moving. But some cities have higher inflation than others, so if you can find cheaper rent 15 miles outside of town—suck it up and make the move.

Saving Money on Transportation

Getting from point A to point B has also gotten more expensive over the last few years, mostly thanks to rising gas prices. The average price of gas is now $3.25 per gallon—compared to $1.94 back in 2020.5

Luckily, there are plenty of ways to save money on gas that don’t include having to pedal your car around like Fred Flintstone. Here are some of our favorites.

- Join gas rewards and cash-back programs. Sign up for gas rewards programs at places like Kroger and Costco (just make sure they’re free rewards you’re signing up for and not credit cards). Or check out cash-back apps like Upside to score some extra cash in your pocket every time you head to the pump.

- Use apps to track the cheapest gas prices. You don’t have to waste gas driving around town looking for a good deal. Just use an app like GasBuddy or Waze to find the cheapest gas prices in your area.

- Make fewer trips. Have a bunch of errands to run this week? Knock them all out in one trip instead of making eight different trips to the store during the week.

- Carpool. When all else fails when it comes to saving money on gas, there’s always carpooling. Hear us out—carpooling to the office, to school or to the kids’ soccer game is a great way to build some human connection while saving money too.

More Tips to Combat Inflation

Believe it or not, we’ve got a few more ways to combat inflation up our sleeve. Give these a try too:

Buy Less Stuff

Captain Obvious, right? But a lot of people can’t handle the idea of tweaking their lifestyle and making sacrifices to spend less money. They hate the idea of buying a generic brand and saying no to impulse purchases. Even though it’s an obvious answer, people still don’t want to do it.

Here’s the deal though: If your cost of living is going way up, then you’ve got to focus on something you can control (like your spending) to help free up more cash.

So, where can you cut back and make a few sacrifices? Try a spending freeze where you don’t spend anything all weekend long. Switch to the generic brands at the grocery store. Try whatever you can to cut back wherever you can.

Increase your income.

With the gig economy gaining speed and side hustles everywhere you look, it’s pretty easy to make extra money and increase your income these days. Have a slow weekend? Get started with DoorDash, Taskrabbit, Uber or Lyft. You could even pick up a part-time job in the evenings or weekends too.

Bonus: You’ll probably get a store discount on top of the extra income. If you work Saturdays at Target, you’ll not only make some extra cash, but you’ll get a markdown on groceries there too. Win-win!

Budget Your Money

Look, if your budget has been derailed by inflation lately, you’re not alone. But just because things cost more now, don’t throw your budget out the window. Heck no! You need a budget now more than ever.

Don’t let it all overwhelm you—you’ve got this! Prices going up just means you have to rework your budget. If you need to bump up the grocery budget these days, just be sure you’re taking money from somewhere else. Like, oh, let’s say the restaurants category. That’s right, you’ve got to cut back somewhere. And if you’ve got all those groceries in the fridge, then stay home and eat those instead of dropping $50 going out to eat.

We know—budgeting might feel like more of a headache right now. But make it easier on yourself and download our EveryDollar budgeting app.

EveryDollar does more than just help you track your spending and manage your money—it actually helps you find more margin every month! Just download the app, answer a few questions, and we’ll build you a plan to free up thousands in margin to put toward your goals.