Key Takeaways

- Grocery prices increased 2.7% from August 2024 to August 2025.

- Groceries are more expensive due to several factors, including inflation, weather, labor costs and global supply chain issues.

- Specific food prices that have increased the most include coffee, beef, eggs, apples and bacon.

As the grocery cashier drags canned goods across the scanner, you notice the total on the little screen getting much higher than you thought it’d be. You think, Did something ring up wrong? Am I going to have to put something back to afford all this food? Ever been there?

Trips to the grocery have been difficult for most of us these last few years. In fact, from August 2024 to August 2025, grocery prices increased 2.7%.1 And they’re up 29% from 2020!2

It’s enough to make you throw a mini tantrum in the checkout line—right next to the 5-year-old begging for a Kit Kat bar.

Grocery prices have gone up due to several factors, including inflation, weather, labor costs, global supply chain issues, and higher production costs. All these things and more affect how much you spend on groceries each month.

Let’s break down some of the main reasons a trip to the grocery store has become a pain in the wallet. Plus, we’ve got some tips to help you save money when grocery shopping!

Inflation

It’s been a couple of years since inflation was the big news story. Back in 2022, everyone was feeling the pain of rising prices on everything from cars to candy bars. Grocery prices actually increased by more than the average inflation rate for other goods, topping out at 11.4%.3 That means your $100 grocery order in 2022 was $111 a year later. Yikes!

While we haven’t had as many big jumps in prices as we did in 2022, higher prices have stuck around. And to add insult to injury, your paycheck probably hasn’t increased as much as prices have. Ask yourself: Are you making 29% more than you did five years ago? Probably not. So you have less buying power, and the feeling that grocery prices are too high is very real! Your hard-earned dollars just don’t go as far as they used to.

Weather

Food prices—especially for fruits and vegetables—can swing up and down based on weather. Droughts, fires, floods, hurricanes and other natural factors can ruin crops and make food prices rise—even years down the road. On the other hand, a perfect growing season with plenty of rain and sunshine can bring prices down for certain crops.

For instance, the price of coffee jumped about 30% in the last year due to droughts in coffee-producing countries Brazil and Vietnam.4 If you’re a coffee drinker, you might even be thinking about switching to tea at this point. Well, probably not.

Weather also affects the price of beef and other livestock. A lack of rainfall in the U.S. the last few years hurt the production of feed crops—so ranchers decided to reduce their herds. And that’s why beef prices are high right now. Fewer cows mean higher prices for steaks and hamburgers.

Labor Costs

Whether you’re eating a fresh apple or something packaged, like Frosted Flakes, it took a lot of work to get that product to the grocery store shelf. And there’s currently a labor shortage in the food industry. Farmers, truck drivers, food processors, and grocery store workers are in shorter supply, leading to higher wages—and higher prices for shoppers.

But even though there are fewer people helping to produce our country’s food supply, America’s appetite isn’t getting any smaller. And when people buy food faster than it can be produced—you guessed it—your grocery bill gets bigger.

Global Supply Chain Issues

The U.S. imports about 15% of all its food.5 And the entire process has gotten a lot more expensive lately. Wars have disrupted food production and transportation in certain parts of the world.

International shipping costs, as well as tariffs and trade wars, also directly increase the cost of certain foods we get from other countries. And unfortunately, that extra cost gets passed on to us. All of these factors make imported food like bananas and seafood pricier.

Higher Production Costs

When the prices of farm supplies go up, farmers have to pay more for seeds, fertilizer, animal feed and equipment they need to produce all the delicious foods we eat. And extra cost for farmers means extra cost for you, the consumer.

And let’s not forget about gas to run tractors, other farm machinery and delivery trucks. When gas prices go up, food prices usually go up because farmers and delivery drivers have to spend more money on fuel.

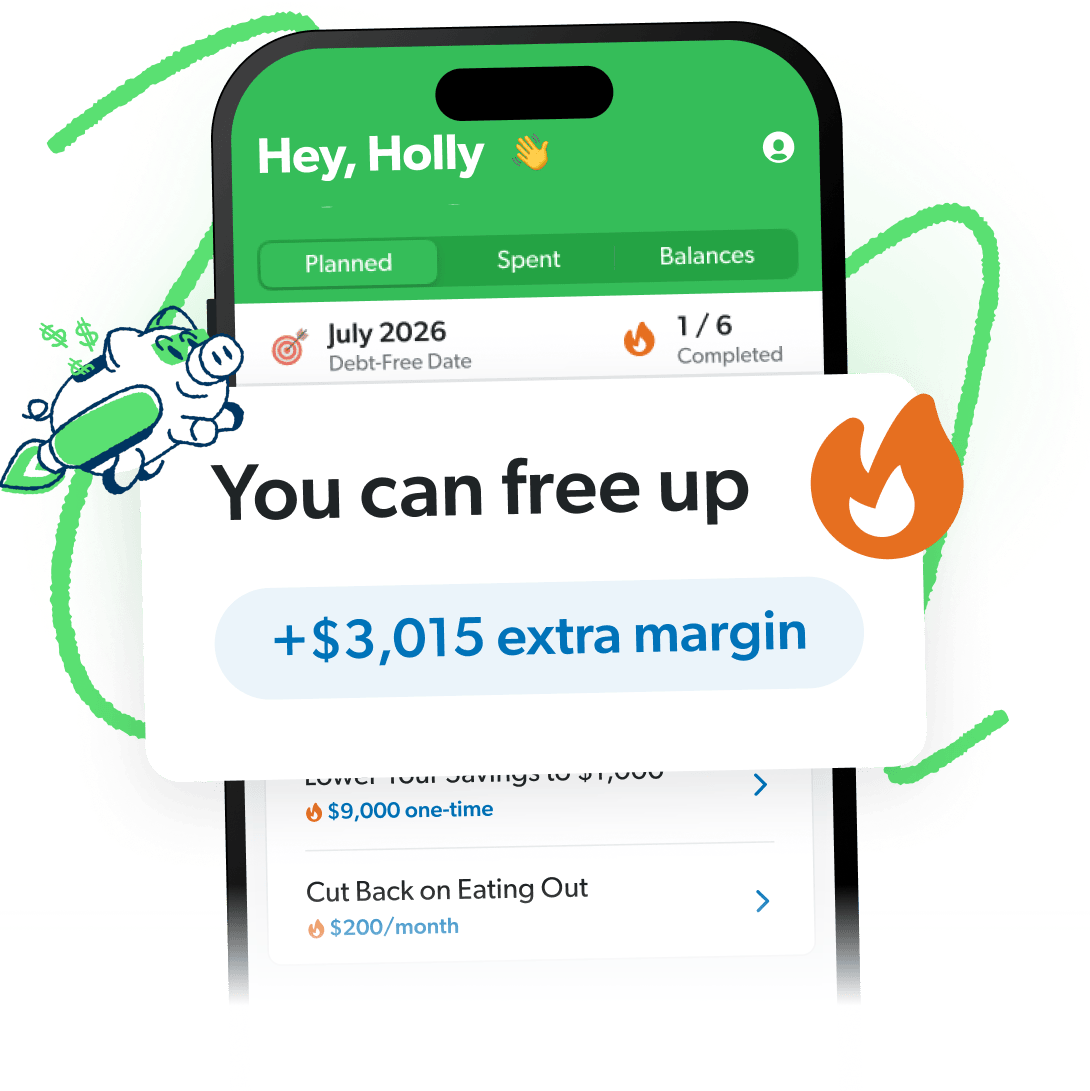

Put More Breathing Room in Your Budget

Money feeling tight? Not anymore. The EveryDollar budgeting app helps you free up thousands of dollars you didn’t know you had—in minutes.

Food Prices That Have Increased the Most

You’ve probably noticed that ground beef prices are high right now, but the U.S. government actually tracks prices of all kinds of goods and services with a measure called the Consumer Price Index (CPI). According to August 2025 CPI numbers, here are the foods that have gone up the most in the last year:

- Coffee: 20.9%

- Beef and veal: 13.9%

- Eggs: 10.9%

- Apples: 9.6%

- Condiments (not including relishes and sauces): 9.3%

- Candy and chewing gum: 8.1%

- Bacon: 7.2%

- Frozen, noncarbonated juices and drinks: 7.1%

- Frozen fish and seafood: 6.7%

- Bananas: 6.6%6

And these changes don’t just affect grocery prices. The bill at your favorite restaurant or fast-food joint also is higher. The cost of food away from home (aka eating out) increased 3.9% from August 2024 to August 2025.7 So much for those dollar-menu chicken nuggets!

Will Food Prices Go Down in 2026?

Grocery prices are expected to keep rising in 2026 (womp womp)—just not as much as previous years (yay?). The U.S. Department of Agriculture predicts that food prices will increase around 2.3% in 2026.8 So, not terrible news but also not great news. But really, a 2–3% increase in prices each year is kind of normal and something you should expect.

Hopefully, we won’t have a drought, a major storm or something that messes up the supply chain in 2026! But as always, farmers can’t control the weather.

6 Tips to Save on Groceries (Despite Food Prices Rising)

Okay, enough with all the depressing stuff. Yes, food prices are going up. But you’ve still got to eat, right?

Here are some things you can do to fight inflation and save money on groceries this month.

1. Do your research.

Meal planning is a great way to make sure you’re keeping costs low and only buying what you need. And now more than ever, it’s a good idea to do a little research before you make your shopping list.

See what's in season and check out specials at your local supermarket. Are diced tomatoes buy three, get three free? Looks like you’re making salsa! You can save a ton of money just by planning your meals.

2. Use what you have.

Nobody likes wasting food—especially when throwing away one avocado is like throwing $3 in the trash. So before you head out to the store, take a long, hard look inside your fridge and pantry. See if you can use what you already have to make a meal.

Got some rice? Add beans to your list. A little bit of milk in the fridge? Use it to make pancakes. Leftover chicken tenders? Grab some tortillas and make tacos. Taking inventory each week will help you save money and keep you from throwing out perfectly good food. It’s a win-win!

3. Choose generic brands.

Even though prices are going up, you can still shave a couple dollars off the total cost by choosing generic brands. You might not be willing to give up your name-brand cereal or cookies right now, but most staples (like milk, canned vegetables, spices and flour) are practically the same.

In fact, most store brands are similar enough to the name brands in overall taste and quality—and they’re usually 20% to 25% lower in price.9 Just be sure to compare prices while you’re in the aisle so you know you’re actually saving money.

4. Cut back on the meat.

Listen, we’re not telling you to suddenly become a vegetarian. But meat is expensive! You may not be ready to give up your morning bacon ritual just yet, but try replacing a couple of meals throughout the week with a nice salad, pasta or veggie dish. There are lots of great meatless recipes out there, and you might just find a new favorite.

5. Freeze your meals.

If you’re worried about food prices continuing to rise, you can stock up on ingredients now and freeze some meals for later. All you need is a day to cook up a couple casseroles and some room in your freezer. Just be sure to make things you won’t mind eating on repeat for a while.

6. Adjust your food budget.

Listen, food prices may be going up, but you will get through this. All it takes is intentional planning, some focus, a little bit of creativity, and of course, your trusty budget.

Having a budget is the best way to combat rising prices. When you make a plan for your money before the month begins, you can shop those grocery store aisles with confidence. Plus, the great thing about a budget is that you can adjust it as things change!

Ready to start telling your money where to go (instead of always wondering where it went)?

Make it easier on yourself and download our EveryDollar budgeting app. EveryDollar does more than just help you track your spending and manage your money—it actually helps you find more margin every month!

Just download the app, answer a few questions, and we’ll build you a plan to free up thousands in margin to put toward your goals.