Your bank is driving you nuts.

You’re fed up. You’ve hit your limit and you can’t stand it anymore.

The fees and surcharges. The inconvenient ATMs. The pitiful interest rates. You’ve wanted to switch banks for a while, but you’ve been putting it off because you’re not sure how to do it.

Switching banks isn’t as easy as switching on a light, but it’s not rocket science either. The biggest hurdle is taking time to complete all the tasks. We’ll walk you through it step by step.

1. Pick the bank you want to switch to.

Choosing a bank may feel a bit like going to an ice cream shop with 50 different flavors—except you can’t sample banks. But you can do research to find one that’s right for you. Your first decision will be whether to go with a bank or a credit union. Not everyone can join a credit union, so that decision may be made for you.

Get expert money advice to reach your money goals faster!

Before you choose your new bank, make a list of the features you need. Here are a few essentials:

- Top-notch security

- Good interest rates for savings accounts

- Debit card

- Online and mobile banking

- Automatic bill pay

- Mobile deposit

You may have other non-negotiables on your list, but make sure of one thing: don’t choose a bank that will gouge you with fees and needless charges. You have too many choices in banks to work with one that will pick your pocket every time you sneeze. It’s your money so it should stay in your wallet, not theirs.

2. Make a list of all your automatic bill payments and direct deposits from your current bank.

You don’t want any of your bill payments to get lost in the shuffle. And you definitely don’t want a paycheck going to your old bank. To prevent this, create a list of digital transactions you make every month or quarter. If you use a budgeting tool like EveryDollar, your job just got a whole lot easier since you have every bill listed out already. If that’s not an option, pull up a year’s worth of transactions online or use the old-fashioned paper monthly statements. Look out for the following:

- Direct deposits. Don’t forget about child support, freelance work or other irregular income.

- Automatic bill payments

- Subscriptions (monthly or annual)

- Recurring transfers (like quarterly insurance payments)

- Linked accounts (such as online shopping sites linked to your debit card)

Is this your favorite way to spend the evening? Honestly, no. But when you get to ditch a bank you hate because its service stinks or its fees are yanking your chain, you’ll be glad you took the time to do it.

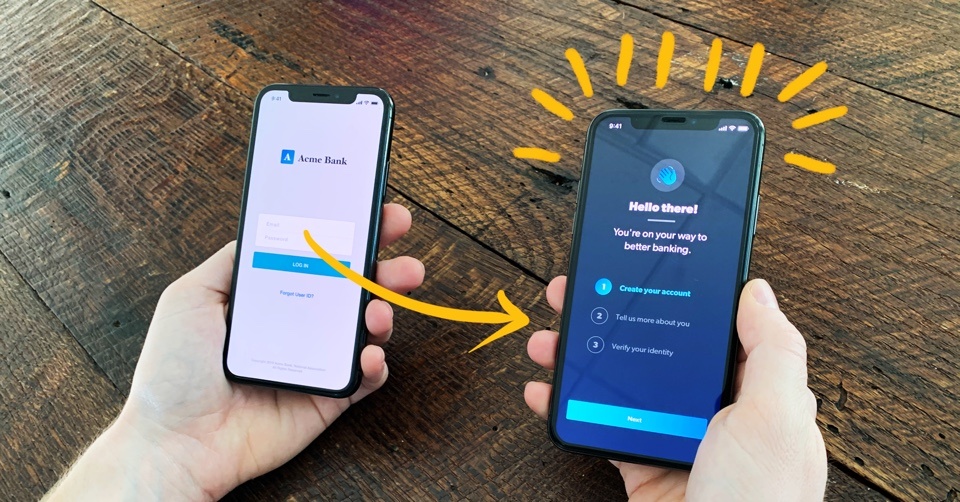

3. Open your new bank account.

Now you’re ready to open your new bank account. Some banks will allow you to do everything online, but others require a trip to an actual, physical bank. Either way, the process isn’t hard, but you will need to provide a few documents and details:

- ID (like a driver’s license)

- Birthdate

- Proof of your mailing address and physical address (think utility bill)

- Social Security Number

- Employer name and contact information (if setting up automatic deposits)

There’s one more thing you’ll need to give the bank: money. You’ll need a deposit. Some require a minimum amount to open or maintain an account, and some require larger balances for extra features like waiving fees for a safety deposit box. Skip the fancy options and keep the money.

Pro tip: Make sure you leave some cash in your old account for a month or two. This will cover any automatic payments you might have missed, which will help you avoid late penalties. When your new account has been running smoothly for a couple of months, you can close the old account.

4. Update your automatic payments.

We get it. This is the worst part of switching banks. Paying bills was swift and easy with the old bank, and now you have to set up your automatic payments all over again. But there is a huge upside of updating your automatic payments. You can use this process to weed out the subscriptions and services you don’t use, like the magazines you don’t read or gym membership you’ve neglected. Or that bacon of the month club (yes, that’s a real thing) you need to ditch because you want to eat healthier. Once you’ve decided which payments you need to update, here’s the process to do that:

- Go to the payment center for each specific bill.

- Look for a tab or option that reads “change payment method” or something similar.

- Remove the old bank account information and enter new account numbers.

- Accept or confirm changes (the wording will vary, but you get the idea).

- Go back to the payment method to make sure the new bank information shows on the account.

- If you encounter any problems, contact each company’s customer service department.

Updating your payments could mean more cash in your shiny new bank account, so it’s definitely worth reviewing what you’re actually spending your money on every month.

5. Close your old bank account.

Once you’ve updated all the online transactions and your new account is running smoothly, you can say adios to the old bank. Every bank is different, so you may need to visit a physical branch. Or you may be able to call a customer service number or email them instead.

Even if you can do all the heavy lifting at home, you need to request a letter stating that your accounts have officially been closed. Keep this letter in case the bank accidentally resurrects your account or a company tries to access the old account for bill payment.

Once your account is closed, destroy the debit cards and checks connected to that account. But keep your bank statements for your records! You might need them later for taxes. Or if you paid a bill, but the not-so-helpful customer service rep keeps saying you never paid it. You have that old bank statement to prove your case. Problem solved!

Switching banks takes time and energy, and it’s not your favorite way to spend an evening, especially when you have a gazillion other things you’d rather do. But once it’s all over, the payoff will be worth it. And you won’t have to worry about that old bank anymore!

Bank on Your Budget

The best way to control your money is with a budget. Sign up for EveryDollar and start today--for free!

Sign Up