To really win with money, you’ve got to show it who’s boss like an expert fighter—with strategic moves and maneuvers that take it to the mat and tell it where to go.

If you’d like to have more to show for your money and get a few other perks in the process, you might want to look into the world of MMAs. No, not mixed martial arts. We’re talking about money market accounts—special savings accounts that offer more bang for your buck at the bank by giving you a better interest rate than a normal savings account.

Shopping for a money market account that puts more cash in your pocket is one small way you can win more (and more often) with money. We’ll give you the rundown about how these accounts work before you step into the money market arena!

What Is a Money Market Account?

A money market account (MMA), also known as a money market deposit account or money market savings account, is a type of savings account that usually pays a better interest rate than you’d get with a regular savings account.

Get expert money advice to reach your money goals faster!

How can that be? Well, your bank (or credit union) uses your MMA deposits to invest in short-term debt securities.

Huh? Basically, that means your bank loans your money out to governments, corporations and other banks for a short amount of time, and when they repay your bank, they pay interest. And in exchange for using your money, your bank pays you interest (by the way, those debt securities are also known as the “money market” because your money is instantly accessible like cash). Clear as mud?

Just like in a normal bank account, deposits in MMAs are also insured for up to $250,000 in your bank (by the Federal Deposit Insurance Corporation) or credit union (by the National Credit Union Shared Insurance Fund).

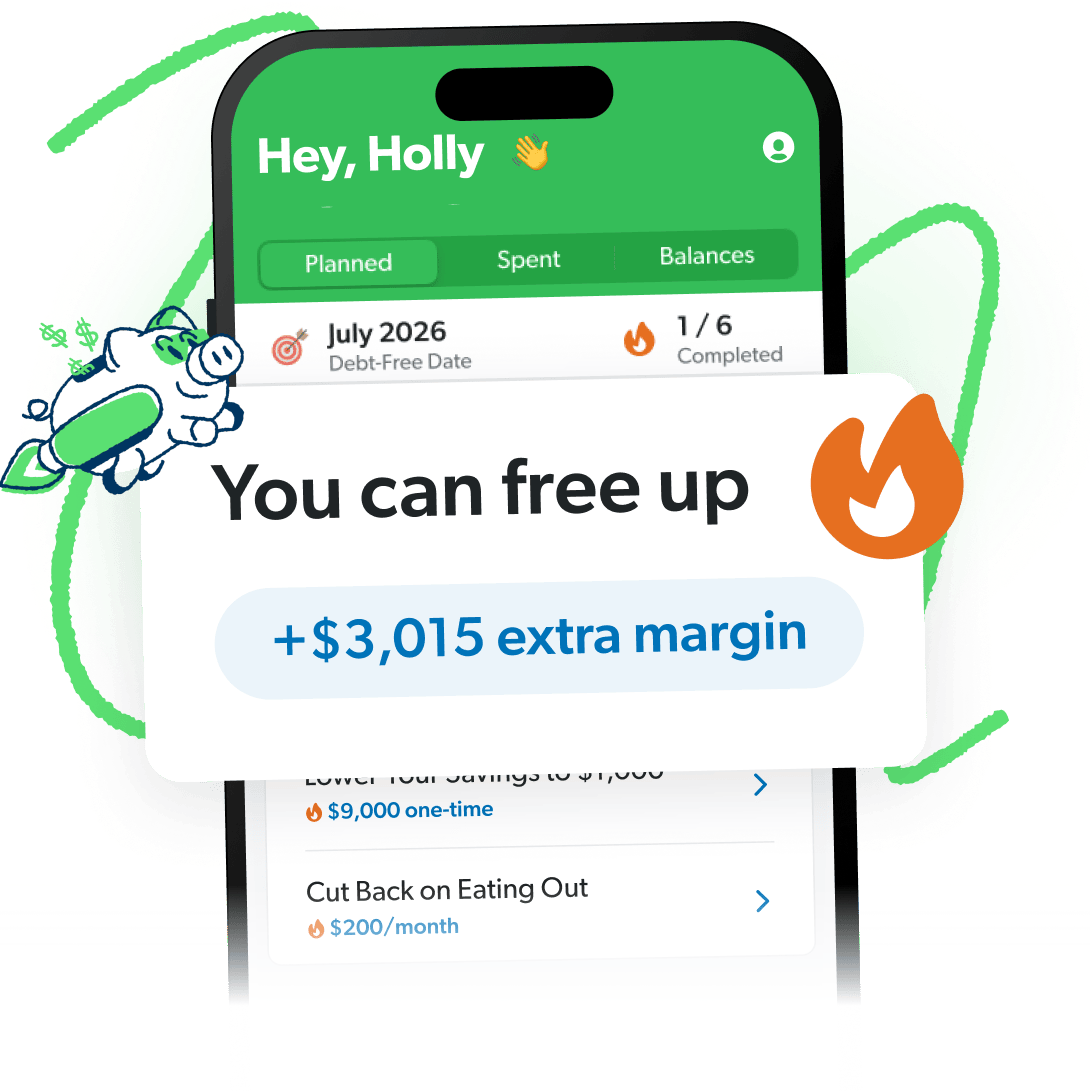

More Margin Means More Money in the Bank

In just minutes, the EveryDollar budgeting app helps you find margin you didn’t know you had—you’ll feel like you got an instant raise!

There are way more great perks to a money market account than just the higher interest rate. Because of its liquidity (that’s banker speak for easy access to your money), you can use the money in an MMA to pay for things with checks or a debit card. Some money market accounts even offer tiers that give you a better interest rate for higher balances.

That’s the good news.

Here’s the not-so-good news: The bank limits the number of times you can withdraw your MMA money in a month (usually only six times). Plus, there’s a higher minimum balance compared to typical accounts, and you’ll get slapped with a wonderful account maintenance fee if you don’t maintain that balance.

Back in 2020, as part of an effort to provide relief during the COVID-19 pandemic, the Federal Reserve relaxed the old rule that limits MMA withdrawals to six times monthly—and it doesn’t look like they’re going to bring it back anytime soon.1 But the removal isn’t mandatory. So your bank might still have its own monthly limits.

Here’s the good news about the not-so-good news: The details of what you can and can’t do with your money market account really depend on where you’re banking. Minimum balances for MMAs are different with every financial institution—and some don’t have any. Other banks don’t even have debit cards for MMAs (it’s usually just an ATM card if it’s not a debit card). So be sure to shop around and see which banks have the best rates and perks when it comes to MMAs.

Another thing to keep in mind is that interest rates change literally every day, so there’s no guarantee you’ll actually make money with a money market account. So if you find the interest rates for regular savings versus an MMA are the same or close at your bank, you might be better off just using a normal savings account and avoiding the higher minimum balance requirement (and possible fees).

How Does a Money Market Account Work?

While it’s treated like a savings account, a money market account works a lot like a checking account. You can:

- Write checks

- Use a debit card

- Make withdrawals

Here’s our favorite thing about MMA life (no, not the jab and double-leg takedown combo): Money market accounts are safe! Aside from the usual FDIC insurance protection up to $250,000, because your bank’s money market investments are usually set on a short term, MMAs are super low risk for you. At the same time, that little bit of risk pays off in the form of a better-than-average interest rate.

Earning more on your cash is always a smart move, but MMAs are not meant to be long-term investments like retirement accounts. They’re essentially short-term savings accounts for money you’re not going to touch for a little while—which is why MMAs are a popular place to park things like sinking funds for big purchases and rainy-day emergency funds rather than for grocery trips and UFC gym dues.

Bottom line: Investment isn’t the main goal with an MMA—safety is. You just need a nice, safe place to put some dollars. Making a little money on your money at the same time is just a nice bonus.

How Do Money Market Accounts Compare With Other Accounts?

Don’t let all those bank account options scare you! Each one has its own advantages, and the differences are worth understanding.

Money Market Accounts Compared to Savings Accounts

We’ve said it a few times now: Money market accounts sometimes pay you a better interest rate than their garden-variety cousins known as savings accounts. But that isn’t always true. It’s really up to you to find out what rates are available (we know you can do it!). From there, you’ll want to know the minimum balance requirement for any MMA before opening it.

For example, let’s say your bank is offering a 0.75% annual percentage yield (APY)— the interest you’ll earn on an account in a year—in both kinds of accounts. But the bank requires a $2,500 minimum deposit to open a money market account (those are pretty typical numbers you might find). So basically, if both the MMA and savings account have the same APY, there’s no compelling reason to go with an MMA. And with a regular savings account, you don’t have to deal with the restrictions and requirements on an MMA.

But if you had the cash on hand to open an MMA and the bank was offering 1.75% APY, it would be worth it. Why? Because the bank is offering a higher interest rate on the MMA than the 0.75% on the savings account. Think about it . . . if you saved $250 a month over the course of a year ($3,000 total), you’d earn an extra $30 compared to a regular savings account. That’s three extra months of ESPN+ for you (the UFC fights cost extra, though)!

Money Market Accounts Compared to High-Yield Savings Accounts

Meet the MMA’s richer cousin: high-yield savings accounts. These accounts are pretty similar to money market accounts. They have a much higher APY than conventional savings accounts, and they’re great for short-term savings like sinking and emergency funds.

But comparing these account types is a lot like comparing mixed martial arts to boxing. Both get the job done and are awesome in their own way, but MMAs just have more tools at their disposal.

High-yield savings accounts act a lot like regular savings accounts but don’t have features like check writing and debit card use like money market accounts do. And most of the banks offering high-yield savings accounts are completely online with no physical locations that give beatdowns to their bottom lines. That means they can pass the savings on to you in the form of a better APY (out of the kindness of their hearts). So, if your bank has a bunch of physical branches, it may not even offer a high-yield savings account.

Money Market Accounts Compared to CDs

What about CDs? No, not compact discs. Something even more useless: certificates of deposit. There’s really no good reason you should use them. They don’t usually offer much of an interest advantage over MMAs. On top of that, you have to agree to leave your money alone for a set time period. And if you need to get at your money early, you’ll be paying a penalty to the bank (oh, those dreaded fees!).

Getting a CD makes about as much sense as going into a cage match with both hands tied behind your back. Not fun.

What’s the Difference Between Money Market Accounts and Money Market Funds?

Let’s learn about a similar-sounding but totally different kind of investment: a money market fund. Money market funds (MMFs) are just mutual funds you can buy through a bank or mutual fund company that invests your money in the money market. While both MMAs and MMFs are invested in the same place, there are a few key differences:

- The investment (or principal) in an MMF is totally uninsured—even if you bought the shares through a bank. Although dips in the money market are rare, losing some of your savings isn’t fun.

- Banks are allowed to set their own limits on your monthly transactions from an MMF, and there may be fees for those. Be sure you learn your bank’s rules before getting one.

That said, just say “no” to MMFs. Just think of them as a silly, fake version of the real deal . . . like pro wrestling.

Instead, use an MMA. And remember, only use MMAs for short-term savings like emergency or sinking funds. If you’re looking to invest (after you’re debt-free and have three to six months’ of living expenses in your emergency fund, of course), you’re better off investing in long-term tax-advantaged retirement accounts. These include accounts like your 401(k) or a Roth IRA.

How Do I Choose a Money Market Account?

Money market accounts work well as a flexible safekeeper for emergency and sinking funds. And there’s never a penalty for withdrawing your money (but there may be limits).

Still, not all MMAs are created equal. So what sets a true MMA champ apart? Obviously, it’s the one that gives you the best interest rate to give your money more gas in the tank.

An MMA will be right for some people or situations. For others, it wouldn’t make any sense. The point is to do what’s best for you and makes your money work harder for you.

Just remember that there are both pros and cons to MMAs:

- Pros: Higher interest rate, safe and insured, account debit cards and checks

- Cons: Small interest earnings, high minimum balance requirements, and limits on monthly transactions

Bottom line: Those dollars won’t save themselves. So if you want to stop cringing when you check your bank account, you need a budget.

You need EveryDollar. Our budgeting app does more than just help you track your spending and manage your money—it actually helps you find more margin every month! Just download the app, answer a few questions, and we’ll build you a plan to free up thousands in margin to put toward your goals.