Have you ever wanted to retire early after a rough week at work? We’ve been there.

From couples approaching retirement age wondering if they can afford to kick back a few years ahead of schedule to young professionals joining the rapidly growing F.I.R.E. movement, the idea of an early retirement is more popular than ever before..

So, can you retire early? And is an early retirement a worthwhile goal to begin with? Let’s talk about what it could take for you to ride off into the sunset a little sooner than everybody else!

Before We Talk About Early Retirement . . .

We know the thought of traveling the world or sipping margaritas on a tropical beach somewhere sooner rather than later is really exciting. But let’s slow down just a little bit and make sure we’re on the same page about a few things!

Market chaos, inflation, your future—work with a pro to navigate this stuff.

Most importantly, you need to follow the Baby Steps before you start daydreaming about an early retirement. In other words, any early retirement planning should happen on top of all the effort you’re putting into the tried-and-true Baby Steps.

That means you shouldn’t be doing any investing of any kind if you’re trying to get out of debt or don’t have enough money in your emergency fund. If that’s where you’re at, pause contributions (temporarily) to your retirement accounts and any saving you were doing for early retirement. No exceptions, people. Get out of debt, save 3-6 months of expenses for emergencies, then (and only then) start investing.

Otherwise, you could end up with an empty 401(k), no college savings for your kids, and mortgage payments still hanging around as retirement draws near.

Here’s why: If you don’t have an emergency fund, you might be forced to tap into your retirement accounts for—you guessed it—emergencies, like replacing your roof or losing your job. Then you’ll get hit with huge taxes and penalties. Or you might borrow (boo!) money in those situations—then you’ll be stuck in a cycle of debt instead of investing your cash. That’s no good!

And once you’re ready to start investing for retirement, your first goal is to invest 15% of your income in tax-advantaged retirement accounts (aka your 401(k) and Roth IRA). Any money you set aside to prepare for early retirement is on top of that.

If you take away nothing else, let it be this: There are no shortcuts to an early retirement. Got it? Good! Now let’s talk through some of your early retirement options.

Can I Retire Early? Three Early Retirement Options

These days, retirement can look different for everyone. For some, their long-awaited life of leisure kicks in right after they walk out of the office for the last time. Others see retirement as a chance to abandon the corporate treadmill for a purpose-driven pursuit.

Let’s take a look at three different ways early retirement could work for you.

Option 1: Semi-Retire at Age 55

If you work hard and plan right, you can have the freedom to do work you really love without feeling the financial pinch! Think of it as semi-retirement—a chance to retire early and live life on your terms. Here’s what that might look like:

- You work part time at a bookstore, surrounded by the smell of paper and ink and chatting with your fellow bookworms every day.

- You open that coffee shop you always wanted but never had time to put into action.

- You take a job at your favorite nonprofit, even though it means less pay, because you’re passionate about its mission.

The goal is to earn enough to cover living expenses without dipping into your retirement fund. You may not be contributing to your retirement accounts anymore, but you continue to build wealth and avoid early withdrawal penalties.

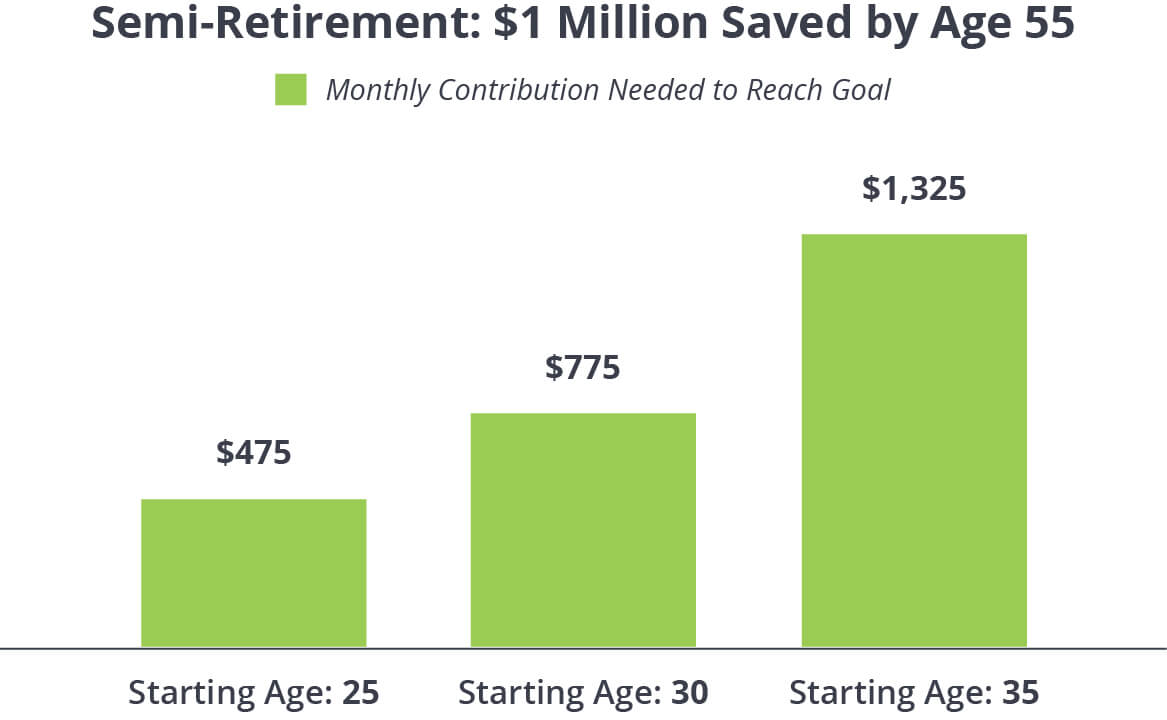

Let’s look at how much you’d need to invest each month, starting at different ages, so you could afford to shift gears, ditch the grind, and follow your passion 10 years early.

We chose $1 million as your retirement goal because it’s a great milestone to set your sights on. But get this: That cool million could grow to almost $3 million by the time you hit 65 if you keep your hands off your nest egg until then. And that’s if you don’t add a penny more to your retirement fund after age 55. Imagine the growth you’d see if you keep on investing!

Option 2: Retire Fully at Age 60

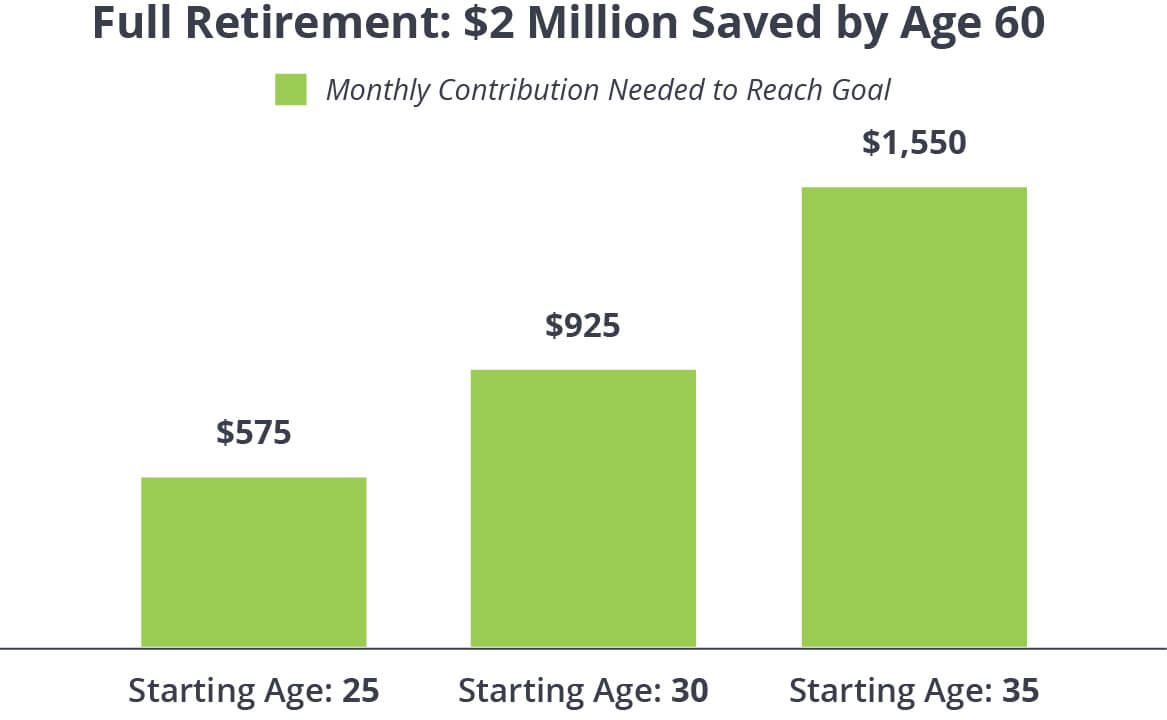

You work hard for your money and love the idea of getting to enjoy your retirement savings while you still have energy to chase your big life dreams. So, what would it take for you to step out of the workforce and into the good life at age 60?

Since you’ll be dipping into your retirement fund five years early, we’ve upped the saving ante to $2 million. In this scenario, you have five extra years to save for retirement at full speed. So it doesn’t take that much more a month to go from $1 million to $2 million.

Option 3: Build a Bridge Account

But what if you’re just tired of the grind and want to get out of the workforce as soon as possible? Maybe you’ve set a goal of calling it quits once you turn age 55. Before you quit your job for good, keep in mind that money you withdraw from your retirement accounts before you turn 59 1/2 could get hit with a 10% early withdrawal penalty. And that’s on top of any income taxes that you might owe.

So if you want to retire fully when you turn age 55, you’ve got a four-and-a-half year bridge period to think about—that’s the amount of time between when you want to retire and when you can withdraw money from your retirement accounts without penalty!

You can solve that problem by saving enough money outside of your retirement accounts to bridge the gap between whatever age you want to retire and age 59 1/2. That’s why we call it a bridge account!

Just like with your 401(k) or Roth IRA, we recommend investing in good growth stock mutual funds within a taxable investment account (like a brokerage account) to cover those bridge years. While taxable investment accounts don’t offer any of the tax benefits of a 401(k) or a Roth IRA, they let you withdraw your money anytime and for any reason without having to pay any early withdrawal penalties to Uncle Sam. But be warned, you’ll probably still have to pay capital gains taxes on the money you earn in a taxable account when you withdraw it.

If you’re considering early withdrawals or opening up a bridge account to help you retire early, talk to your tax professional to see how taxes and penalties apply to you. A pro can also show you how dipping into your retirement accounts sooner than planned could affect your overall growth potential.

Keep Boosting Your Investing Know-How

Every two weeks, the Ramsey Investing Newsletter will send you practical insights, easy-to-use resources, and the latest investing news. All explained in plain English.

How to Retire Early

If these examples don’t work for your budget—or you can afford to save more—that’s okay. Remember, investing 15% of your household income for retirement is always a good place to start. Just be sure you’re out of debt with 3–6 months of expenses in your emergency fund first.

Of course, that’s not all you can do to get you to your goal. Here’s how to boost your savings so you can retire early.

- Take advantage of tax-advantaged retirement plans as soon as you start your career. That gives compound growth more time to work its magic so you can put less effort into building a big nest egg.

- Pay off your mortgage early. Let’s assume your mortgage takes up 25% of your budget. Knocking that sucker out slashes your household expenses by a quarter! Better yet, your home becomes a big asset you carry right into retirement.

- Visualize your retirement dreams. Retiring early means you’ll have a lot of free time on your hands. What are you going to do with that time? Whether you want to travel the world or spend your days volunteering in the community, having a clear picture of what your retirement is going to look like will light a fire under you to get there faster!

- Work with a pro. Everyone’s financial situation is different. The numbers we’ve crunched here might not work for you. An investment professional can help you determine how much you need to save based on when you plan to retire and the lifestyle you envision for yourself.

Is Early Retirement Worth It?

Most folks would agree retiring early brings a lot of perks. Who wouldn’t love a little more rest and relaxation in their lives? But before you order party favors for your big celebration, you have to ask yourself: Is it worth it?

According to research from the Federal Reserve Bank of St. Louis, the coronavirus outbreak drove millions of Americans into early retirement.1 But now we’re seeing a bunch of those early retirees start to boomerang right back into the workforce.2 So, why is that? There are lots of reasons, but there are a couple that might impact your decision to retire early (or not).

First, a lot of early retirees realize that they weren’t really financially prepared to call it quits a few years early.

Maybe they get so fed up with their jobs that they decided to retire without thinking things all the way through. But after a couple years, they look at their retirement account balance and it hits them—they’re burning through their nest egg faster than they realized. So they go back to work to keep from running out of money.

And second, a lot of folks who retire early realize pretty quickly that an early retirement might not be everything it’s cracked up to be.

Some start to get bored twiddling their thumbs at home. Others feel isolated and miss getting to spend time with coworkers or clients. So what do they do? They go back to their old job or even start their own business so they have something to do!

So before you pop those champagne bottles at your early retirement party, make sure you have your finances in order and a good idea of how you’ll be spending your time—because you’ll have lots of it!

Work With an Investment Pro

Is early retirement in your future? Are you doing all you can to reach your retirement goals? Whether you’re a seasoned investor or just starting out, you don’t have to figure it all out on your own. Connect with a SmartVestor Pro today, and get on a path to early retirement that’s right for you.

Make an Investment Plan With a Pro

SmartVestor shows you up to five investing professionals in your area for free. No commitments, no hidden fees.

This article provides general guidelines about investing topics. Your situation may be unique. To discuss a plan for your situation, connect with a SmartVestor Pro. Ramsey Solutions is a paid, non-client promoter of participating Pros.