Your home should be your refuge—a safe place to unwind at the end of the day. But if you’re struggling to pay your mortgage, relaxation is probably the last thing on your mind.

Feeling panic every time you pay a bill or check your bank account is not a good way to live. If you’re struggling to pay your mortgage, you’ve got to do something—and you need to do something now.

What Are You Sacrificing to Pay Your Mortgage?

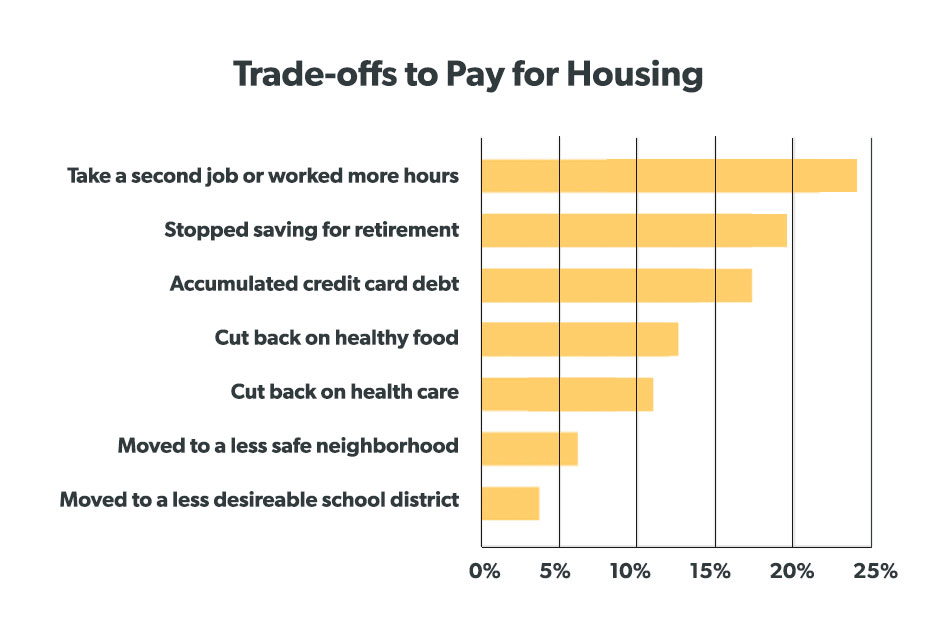

If this sounds like you, take heart. According to the MacArthur Foundation, you’re not alone. Their latest Housing Matters survey found that 45% of homeowners and 71% of renters have made at least one sacrifice to cover the cost of housing in the past three years.(1)

With any trade-off, you’re giving up something important. It might be time and energy or even your physical health.

Find a Mortgage Lender You Can Trust!

But often, it’s your financial future you sacrifice—and that can cost a lot in the long run. Racking up credit card debt to make ends meet only makes it harder to pay the bills. And slashing retirement savings from your budget? Well, that’s a cut that runs deep.

Consider this: Dialing back your 401(k) contribution by just $300 a month could put a $650,000–970,000 dent in your nest egg after 30 years. Ouch! No home is worth that kind of loss. You don’t have to sacrifice peace of mind—today or tomorrow—for a comfortable place to live. Options do exist.

Let’s see how a family stuck between a rock and a hard place can still come out on top. In this example, we’ll follow Tom and Kate Fisher through their decision process.

How Close Are You to a Financial Crisis?

Tom and Kate are both 38 years old and live in a four-bedroom home they bought 10 years ago with having a family in mind. They paid $225,000 for their home and put 3% down on a 30-year mortgage at 6.5% interest.

With taxes and insurance, their mortgage costs them $1,850 a month. They knew it would take up a big chunk of their income, but they figured they could swing it since they didn’t have kids or any debt at the time. Despite income growth, their mortgage payment still takes up nearly a third of their $6,000 monthly take-home pay.

And a lot of life has happened over the past decade.

- Tom went back to graduate school a few years ago. Now they pay $250 toward his student loan each month.

- Tom and Kate welcomed two children into their home. Kate’s mom offered to babysit the kids while they worked, saving them tons of money in daycare costs. (Whew!)

- The Fishers bought a minivan for their growing family, adding a $450 car payment to their monthly debt load.

Somehow, in the midst of all this change, Tom and Kate never realized just how close they were getting to the financial edge.

Until . . . Kate’s mom started experiencing major health issues and could no longer provide childcare. Between daycare for their son and after-school care for their first-grade daughter, they added another $1,000 to their financial plate overnight, leaving them with a $650 deficit each month.

They’ve given up what little they were saving for retirement and have been dipping into their emergency savings for the past three months just to get by. But they both know something’s got to change.

Let’s take a look at their options.

Option #1: Refinance Their Home

Tom and Kate know you should only refinance your mortgage to reduce your interest rate—not your payment. Thankfully, mortgage interest rates have dropped about 2.5% since they bought their home in 2006. Of course, they hope that means a smaller payment.

The Fishers also know a refi is no good if it means adding another decade of debt onto their mortgage, so they choose a 15-year term instead of 30.

The good news is a 15-year mortgage could trim five years and nearly $80,000 in interest fees off their long-term mortgage costs. They’ve also built up enough equity to ditch private mortgage insurance (PMI) on their refinanced payment each month.

The bad news is it would take them the life of the loan to break even on their refinancing costs. While they could save $160 on their mortgage payment each month, it’s not enough to get their family budget back in the black.

Option #2: Sell Their Home

Since refinancing won’t solve their problem, the Fishers partner with a real estate agent they trust to sell their home. Their agent runs a comparative market analysis (CMA) to see how their home stacks up against similar sales in their area.

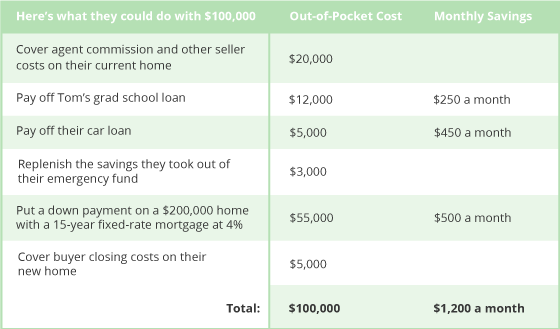

Thanks to a few cosmetic updates over the years and a recent neighborhood revitalization, the Fishers’ home could fetch about $285,000 in today’s market. With just $185,000 outstanding on their mortgage balance, that gives them $100,000 in equity!

With that kind of extra cash, there’s no point in renting their next home. They plan to buy a less expensive home in a new neighborhood with a hefty down payment.

What’s the Right Move?

Selling their home clearly offers a big opportunity to turn things around. Tom and Kate decide to downsize to a three-bedroom home with a longer commute. They never used their guest room anyway, and moving farther out gives them access to better schools for the kids.

Between a big down payment and an affordable price point, the Fishers keep their mortgage costs to less than 25% of their take-home pay, and they can easily afford daycare costs. Plus, they have $550 to invest for retirement. When their son starts kindergarten in two years, they plan to increase their contribution to $900 a month. That would put them on track to retire with $1.3–1.9 million at age 65.

Of course, that’s all well and good for the Fishers. But what about you?

Want More Expert Real Estate Advice?

Sign up for our newsletter! It’s packed with practical tips to help you tackle the housing market and buy or sell your home with confidence—delivered straight to your inbox twice a month!

Work With a Lender Who Cares

If you’re struggling to pay off your mortgage, sit down with your spouse and have an honest conversation about your situation. Selling your home may be the right choice, or the answer could be simpler: You may just need to start working with a different mortgage lender. Some lenders don’t care if you stay in debt for the rest of your life. While others, like Churchill Mortgage, believe in the mission to eliminate debt, including your mortgage.

If you’re thinking about refinancing, start by calling Churchill Mortgage. You can trust Churchill will help you not only get back on track, but also kill that mortgage once and for all.

Did you find this article helpful? Share it!

We Hear You!

We’re considering adding the ability to save articles to your Ramsey account.