So, you’ve picked out the home of your dreams, made an offer, and are now wondering what mortgage to get when buying your new house. After you weed out all the junky options, it usually comes down to deciding between a 15-year versus a 30-year mortgage. But which one is better?

Here’s the truth—the 15-year mortgage is the better option for one simple reason: A 30-year mortgage will cost you way more in the long run.

Skeptical? Let’s look at the numbers!

15-Year vs. 30-Year Mortgage: How Are They Different?

Okay, let’s get the most obvious difference out of the way first. You’ll pay off a 30-year mortgage in 30 years, while you’ll pay off a 15-year in 15 years. No surprises there, right? Here are a few more key differences.

Find a Mortgage Lender You Can Trust!

30-year mortgage: Because a 30-year mortgage has a longer term, your monthly payments will be lower and your interest rate on the loan will be higher. So, over a 30-year term, you’ll pay less money each month, but you’ll also make payments for twice as long and give the bank thousands more in interest.

15-year mortgage: A 15-year mortgage has higher monthly payments, but because the interest rate on a 15-year mortgage is lower and you’re paying off the principal faster, you’ll pay a lot less in interest over the life of the loan. Plus, you’ll pay off your house twice as fast.

15- vs. 30-Year Mortgage Comparison

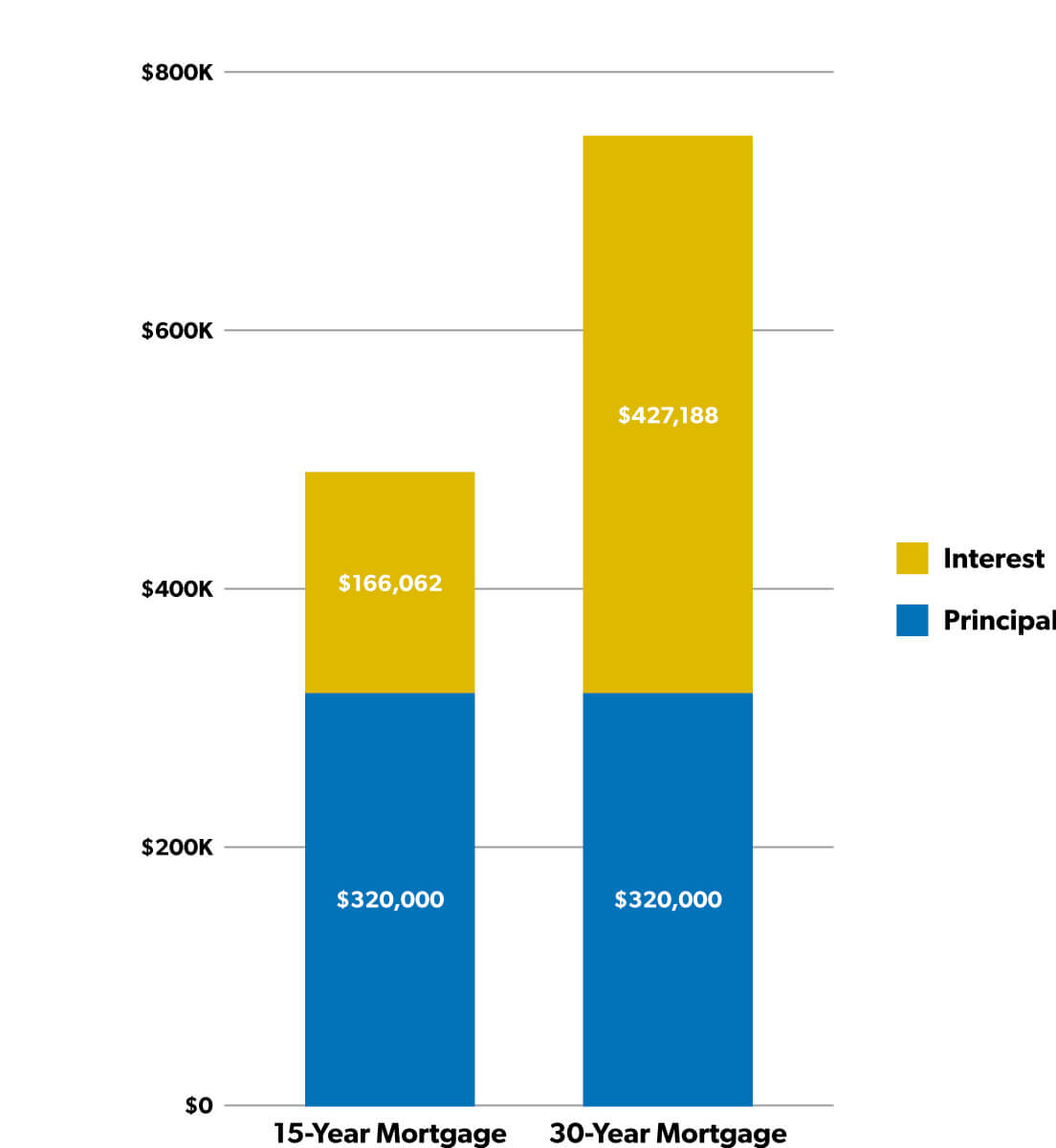

Let’s look at an example. Suppose you want to buy a $400,000 house and have a healthy 20% down payment ($80,000). That means you need a mortgage for $320,000.

Here’s what your expenses would look like on a $320,000 home loan—whether you chose a 15-year mortgage or a 30-year mortgage:

|

Mortgage Term |

15 years |

30 years |

|

Interest Rate |

6% |

6.75% |

|

Monthly Payment |

$2,700 |

$2,076 |

|

Total Interest |

$166,062 |

$427,188 |

|

Total Payments |

$486,062 |

$747,188 |

FYI: We calculated the numbers for both monthly payments on our Mortgage Calculator using principal and interest only. Then, we calculated the total interest and total mortgage amounts on our Mortgage Payoff Calculator.

As you can see, the 30-year mortgage would have you paying over $260,000 (that’s about 55%) more than you’d pay with a 15-year mortgage!

Sure, it feels nice on the front end to save over $600 a month by choosing the 30-year mortgage—but your interest rate will be higher, and you’ll spend twice as much time in debt!

Is a slightly cheaper mortgage payment on the front-end worth $260,000 more on the back end? No way!

Do You Pay More Interest on a 15- or 30-Year Mortgage?

The average interest rate for a 30-year mortgage has been around 0.5–1% higher than a 15-year mortgage for the past several years.1,2

One percentage point may not seem like a huge difference—but keep in mind, a 30-year mortgage has you paying that difference for twice the amount of time compared to a 15-year mortgage. That’s why the 30-year mortgage ends up being so much more expensive.

What’s a Disadvantage of Getting a 15-Year Mortgage Instead of a 30-Year Mortgage?

The only downside to a 15-year mortgage compared to a 30-year mortgage is that it comes with a higher monthly payment. But really, that’s a good thing! With the higher monthly payment on a 15-year mortgage, more of your money goes toward paying off the principal amount of your loan—instead of getting thrown away on interest.

That’s how the 15-year mortgage allows you to pay off your loan in half the time compared to a 30-year mortgage—and avoid a mountain of interest payments.

Keep in mind, you never want a mortgage with a monthly payment that’s more than 25% of your monthly take-home pay—otherwise, you’d be house poor! That 25% limit includes principal, interest, property taxes, home insurance, private mortgage insurance (PMI), and homeowners association (HOA) fees.

If a 15-year mortgage has you going over that 25% limit, you might be tempted to choose a 30-year mortgage to lower the monthly payment. But you’re really just trying to buy a house you can’t truly afford. A 30-year mortgage isn’t worth it!

Instead, try one of these ideas to keep the monthly payment on your 15-year mortgage within the 25% limit:

- Work with a real estate agent who’s skilled at finding houses for sale that actually do fit your 25% limit. Fair warning: You may have to adjust your expectations on what you want in a house.

- Save a bigger down payment so the monthly mortgage payment on your ideal house does fit your 25% limit.

Is It Cheaper to Pay Off a 30-Year Mortgage in 15 Years?

Some people get a 30-year mortgage, thinking they’ll pay it off in 15 years. If you did that, you’d save yourself 15 years of interest payments.

But doing that is really no different than choosing a 15-year mortgage in the first place. Besides that, choosing to make those extra payments would be up to you. Not to mention that, as we talked about earlier, the interest rate for a 30-year mortgage is higher than a 15-year mortgage.

Good intentions aside, this rarely happens. Why? Because life happens instead. You might decide to keep that extra payment and take a vacation. Or maybe it’s time to upgrade your kitchen. What about a new wardrobe? Whatever it is, there’s always a reason to spend that money somewhere else.

When you have a 15-year mortgage from the beginning, you won’t be tempted to use that money for something else. You’ve got built-in accountability to get your house paid off fast!

Why Choose a 15-Year Mortgage Over a 30-Year Mortgage?

Here are the main reasons we teach home buyers to choose a 15-year mortgage instead of a 30-year mortgage:

You’ll save tens of thousands of dollars.

Remember our example from earlier? That 30-year mortgage would cost over $260,000 (55%) more than a 15-year mortgage. Imagine what you could do with hundreds of thousands of extra dollars in your pocket by choosing a 15-year mortgage!

You’ll build equity in your home faster.

One way to build equity (the value of your home minus what you owe on it) is to pay back the principal balance of your loan, rather than just the interest.

Since you’re making bigger monthly payments on a 15-year mortgage, you’ll pay down the interest a lot faster, which means more of your payment will go to the principal every month.

On the flip side, the smaller monthly payments of a 30-year mortgage will have you paying down the interest a lot slower. So less of your monthly payment will go to the principal.

You’ll pay off your house in half the time.

Guess what? If you get a 15-year mortgage, it’ll be paid off in 15 years. Why would you choose to be in debt for 30 years if you could knock it out in only 15 years?

Just imagine what you could do with that extra money every month when your mortgage is paid off. That’s when the real fun begins! With no debt standing in your way, you can live and give like no one else.

Your Guide to Finding an Affordable Home You Love

Learn our simple, step-by-step process to make closing on the right home for you easier and less stressful.

Does Ramsey Recommend a 15-Year Mortgage?

For decades, we’ve been telling the millions of listeners who tune in to The Ramsey Show the best way to buy a house is with cash. But for those who are going to take out a loan, the only one we ever recommend is a 15-year conventional mortgage with a fixed interest rate and payments that are no more than 25% of their take-home pay.

The shortest path to wealth is to avoid debt. And the best way to do that is to either buy a house with cash or go with a 15-year mortgage, which has the overall lowest total cost—and keeps borrowers on track to pay off their house fast.

How to Pay Off Your Mortgage Fast

Remember, the goal with any mortgage is to pay it off fast. You don’t want that thing weighing down your budget for the rest of your life. Knock it out in 15 years or less so you can move on to building extraordinary wealth and living and giving like nobody else.

Here are some tips on how to pay off your mortgage early:

- Make extra house payments: When you find extra money in your budget at the end of the month, it’s too easy to spend it on something you don’t really need. Instead, what if you committed that surplus to paying off more of your mortgage each month?

- Trim your budget: Imagine how much more money you could throw at your mortgage (and how much faster you’d pay it off) if you eat out less and trim down other unnecessary spending.

- Refinance: If you already made the mistake of getting a 30-year mortgage, you could refinance to a 15-year term (at a lower rate) and pay off your mortgage in half the time!

- Downsize: If you bought a house you feel like you’ll never pay off, an extreme way to crush that mortgage is to sell the house and downsize to something more affordable.

Get Help Choosing the Right Mortgage

It’s simple: Don’t settle for a 30-year mortgage. You can make the right mortgage decision by choosing a 15-year fixed-rate mortgage from the beginning. It’s a smart financial decision that will bless your family for years to come.

Talk to the RamseyTrusted® home loan specialists at Churchill Mortgage about getting a 15-year mortgage that fits your budget so you can pay off your home fast.

Next Steps

- Talk to a mortgage lender you can trust.

- Steer clear of 50-year loans—they’re way too expensive in the long run.

- Get a 15-year fixed rate conventional loan.

Did you find this article helpful? Share it!

We Hear You!

We’re considering adding the ability to save articles to your Ramsey account.