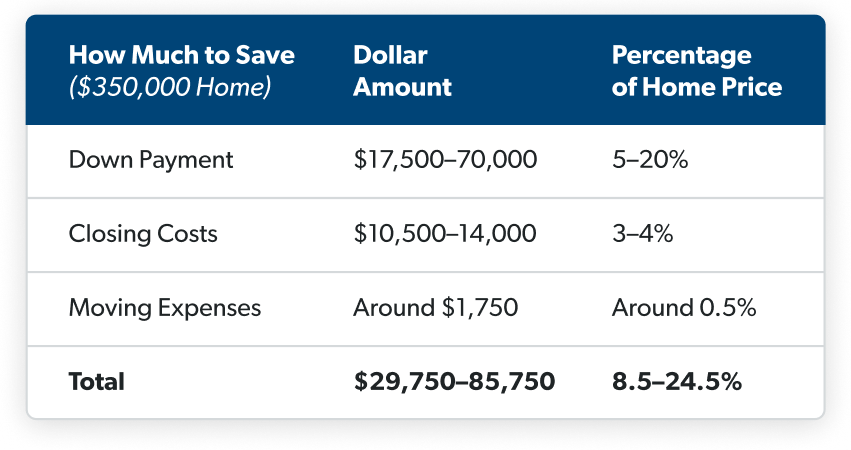

Total Cost Breakdown

We’ve covered a ton of ground! That’s why we want to help you make sure nothing slips through the cracks—like unexpected housing costs. So, let’s walk through a simplified budget of everything that goes into buying and owning a home so you can step into homeownership with confidence.

Again, for simplicity, these examples assume a 15-year fixed-rate mortgage with a 6% interest rate and other set costs for taxes and insurances that—in the real world—would change based on factors like your down payment amount.

When you break down each home-buying cost, it’s easier to see why you need more than just a down payment saved up to purchase a house. Never steal from your hard-earned down payment amount to pay for closing costs and moving expenses—that’ll only eat into your equity and add more interest.

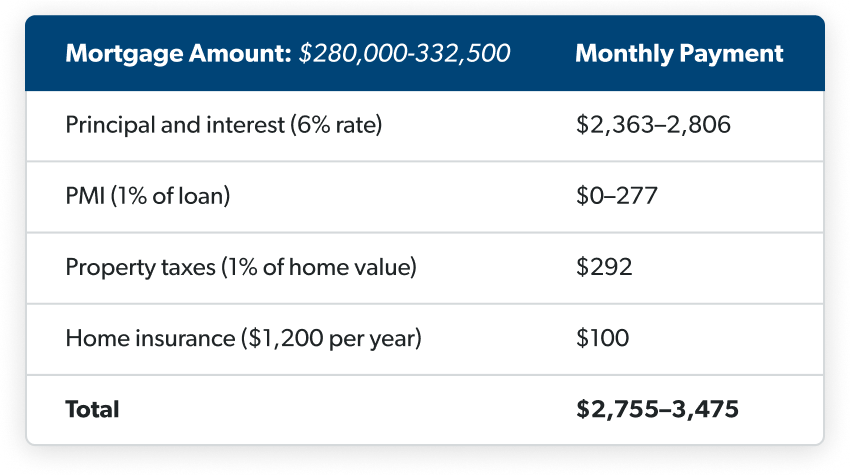

Now let’s see what monthly house payments might look like after you purchase a $350,000 home with a 15-year fixed-rate conventional mortgage. If you had a 5–20% down payment, your total mortgage amount could be around $280,000–332,500. Here’s how the monthly payments would break down.

The biggest thing to remember here is that your monthly house payment isn’t just made up of principal and interest—it also includes property taxes and home insurance. And don’t forget that it could also include private mortgage insurance (PMI) if you put down any less than a 20% down payment.

Keep in mind, you never want your monthly payment to be more than 25% of your monthly take-home pay. If it looks like you’ll be going over that 25% mark after doing the math, save up a bigger down payment or look for a lower-priced house. That way, you won’t end up house poor.

HOA and Home Maintenance

Aside from your mortgage, if you happen to buy a home that’s part of a homeowners association (HOA), membership fees could be another several hundred dollars per month!

And remember, homeownership means you’re on your own when it comes to things like home maintenance. No more calling up the landlord to fix the air conditioning. It’s up to you to either fix it yourself or budget for a pro to fix it for you. Home maintenance can cost upward of a $2,0001 per year. So make sure you have room for it in your budget.

The End

That’s right, folks! You did it. You’re done. You now have what it takes to buy an affordable home you love. If you follow this guide on your home-buying journey, you’ll avoid common money mistakes and start building wealth that’ll help you leave a legacy.