Saving for a Down Payment

Now you’re ready to hit the ground running toward saving for a down payment. If you’re getting a mortgage, we’ll share some savings guidelines that’ll set you up for success when buying your dream home.

How Much Should You Save?

As with any goal, it takes planning and preparation to buy a home the smart way—especially if you’re taking out a mortgage. The most time-consuming task is saving enough cash for the down payment, closing costs and moving expenses—but hang in there. You can do this! Just take it one step at a time.

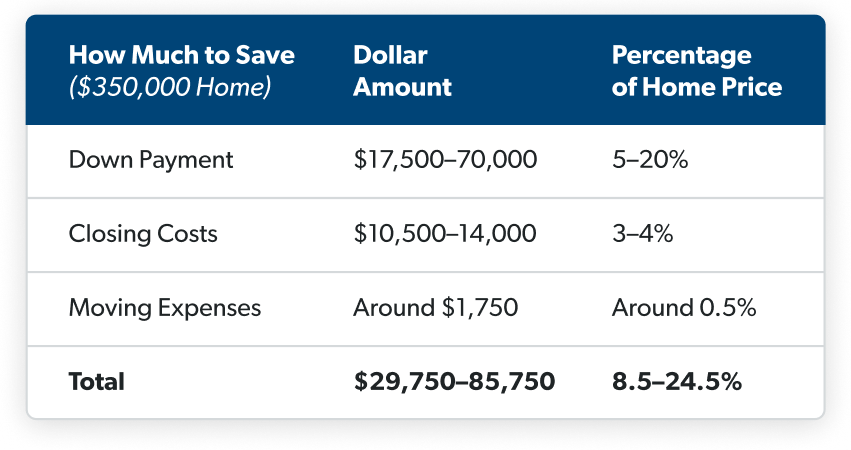

To give you a clear picture of what this step looks like, here’s an example of how much money you’d probably need to save up if you were to purchase a $350,000 house or condo:

For this example, let’s pretend you’re getting a 15-year fixed-rate mortgage with a 6% interest rate. Keep in mind, in the real world, your interest rate would change based on multiple factors—but for simplicity, let’s stick with an imaginary example of one set interest rate.

If these numbers feel too steep, we get it. Things like student loans, credit card debt and car loans might be slowing you down from being able to save up something as big as a home down payment. Remember, that’s why you need to get out of debt ASAP and have an emergency fund of 3–6 months of expenses before buying a home. The good news is, we’ve shown millions of people how to do this through Financial Peace University—where you can learn a proven plan to pay off debt fast and save more money for your future.

Down Payment

Once you’re in good financial shape, set a down payment savings goal. Ideally, you want a down payment of at least 20% of the home’s purchase price. Putting down 20% allows you to avoid paying for private mortgage insurance (PMI). Remember, PMI doesn’t benefit you at all.

If you’re a first-time home buyer, saving 5–10% is okay too. But then you’ll have to pay for that PMI (boo!). No matter what, make sure your monthly payment is no more than 25% of your monthly take-home pay on a 15-year fixed-rate mortgage. And stay away from expensive VA and FHA loans! (Don’t worry, we’ll cover more details on mortgage types in the next section.)

Sure, 5–20% of a home might feel like a crazy amount of money to save. But it is possible! Suppose you’re buying a $350,000 house or condo and want to save a $17,500–70,000 down payment. If you tighten up unnecessary expenses and stash away $1,800 of your monthly budget, you could have that down payment saved in around nine months to three years—not bad!

Moving Expenses

You can always save money on moving costs by asking friends for help. Or you could rent a moving container or truck. Otherwise, hiring movers can cost hundreds to thousands of dollars depending on how much stuff you’re moving and how far away you are from your new home. If you go that route, be sure to get quotes from local moving companies ahead of time to help with budgeting.

You’ll also want to prepare your budget for other moving costs, like utility transfer fees and any immediate updates to your home (like painting or installing blinds).

If you don’t have enough money saved for these up-front costs, you’ll either need to hold off on your home purchase for now (you’ll thank yourself later) or shoot a little lower with your home price range. Whatever you do, don’t let the closing costs keep you from making the biggest down payment possible. The larger the down payment, the less you’ll owe on your mortgage!

Unlock Access to Our In-Depth Home-Buyers Course

Connect with a RamseyTrusted® agent for instant access to our home buyers video course. You’ll get clear, step-by-step help finding a home you love that fits your budget.

Closing Costs

On average, buyers might pay 3–4% of a home’s purchase price for closing costs.1 But yours could be more or less than that depending on where you live—so do your own research to get a better idea of what average closing costs are like near you. When you close on a house—which is basically just signing all the paperwork that officially makes your new home yours—you have to pay for expenses like:

- Loan origination fees

- Credit reports

- Underwriting fees

- Appraisal fees

- Title fees

Remember, you’ll also need to cover property taxes and home insurance—lenders call these prepaid items. Your real estate agent and lender will give you a detailed list of these costs before your closing day.