Set the Right Price

After you choose your agent, you need to work together to price your home. Don’t worry: Your agent will walk you through the pricing strategy they recommend. But ultimately, the final number is up to you.

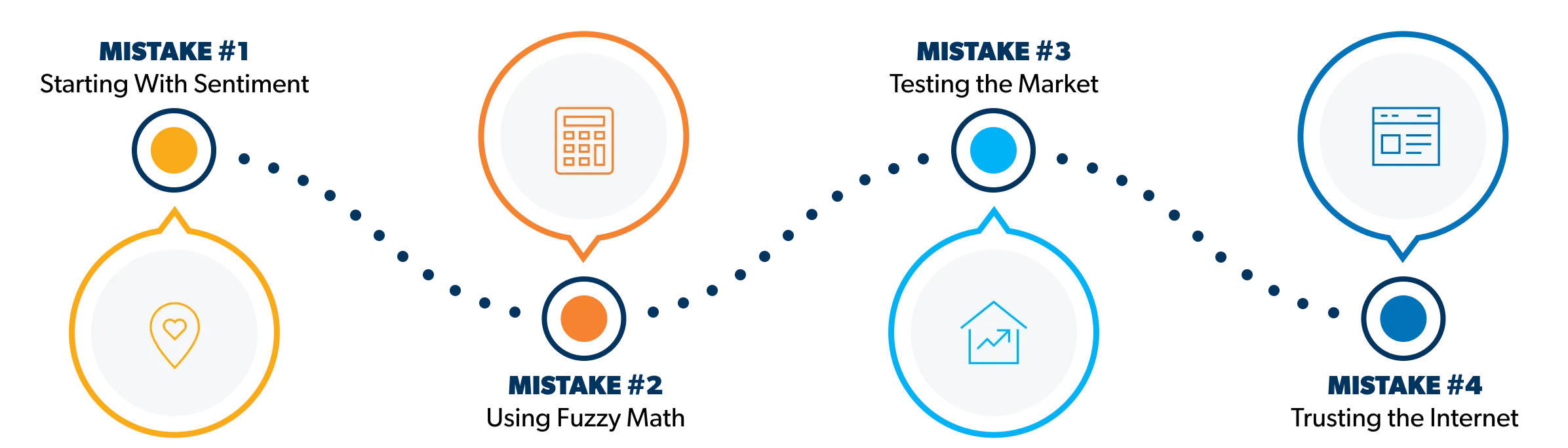

Pricing Mistakes to Avoid

So, how do you make sure you don’t get it wrong? Here are some common pricing mistakes to watch out for—and how to price to win.

Mistake #1: Starting With Sentiment

Nothing tugs at the heartstrings quite like selling a home. How do you put a price on all those years of warm, fuzzy memories? The answer is easy: You don’t. We hate to burst your bubble, but buyers are no more attached to your place than any other home on the market. Price it too high and you can count on sending buyers running the other direction.

Mistake #2: Using Fuzzy Math

Be careful not to base your sale price solely on how much money you need to buy your next home—that gets sketchy real fast. Leave your bottom line out of it and you’ll have a better chance of landing on a price that makes sense with the market.

Mistake #3: Testing the Market

When the market’s hot, it’s tempting to shoot for the stars to see just how much money you can get. After all, you can always negotiate it down or drop the price if buyers don’t bite. But that’s a bad approach. Here’s why: Buyers don’t waste time on overpriced homes, much less make offers on them. And the longer your listing stays on the market, the more money it costs you in the end.

Mistake #4: Trusting the Internet

These days, you can find oodles of home values online. Sounds great—until you actually dig into the data. Three different sites show three different values. How do you know which one is right? The truth is, you don’t—and neither does a computer programmed to pull numbers from the shelf. This job calls for a real, live expert with personal experience in your market.

Get a Comparative Market Analysis (CMA)

Let’s face it, your home is worth what someone is willing to pay for it. The best way to get an idea about that number is to compare recent sales of homes like yours in your area. Your real estate agent has access to all of this information and can provide a CMA to help you get every dollar your home is worth in the least amount of time.

What’s a Comparative Market Analysis?

A comparative market analysis is a detailed report that compares your home to nearby homes that are on the market or were recently sold. The goal is to find homes that are most like yours. This helps your agent to better predict what buyers will pay for your home.

A comparative market analysis is a detailed report that compares your home to nearby homes that are on the market or were recently sold.

For example, if you live in a 2,000-square-foot home with three bedrooms, your agent won’t pull a list of 3,000-square-foot homes with four bedrooms. Why? Because that wouldn’t be a fair comparison. In the same way, homes that are just like yours but located across town in a highly desirable school district also won’t get you any closer to your home’s market value.

Your CMA will offer pages and pages of information and will usually feature photos and a location map of all the properties. A true pro will take time to walk you through the results so you understand exactly how your home stacks up to the competition. With this information in hand, you can work with your agent to set a competitive price based on facts, not emotions.