Sometimes managing money is tough simply because you’re busy. But don’t let your busyness get in the way of making your money work as hard as you do.

You need a budgeting tool that makes it easy to budget on the go. Life is hectic, but budgeting shouldn’t be.

Ways to Manage Your Money on the Go

1. Get a budgeting app.

You’ll literally have everything in the palm of your hand. You can budget wherever, whenever, because your budget is always with you—not buried in a spreadsheet on your computer or in a notebook on your desk.

We suggest the EveryDollar app, of course. You’ll see why as you keep reading.

2. Set up each month’s budget from your phone.

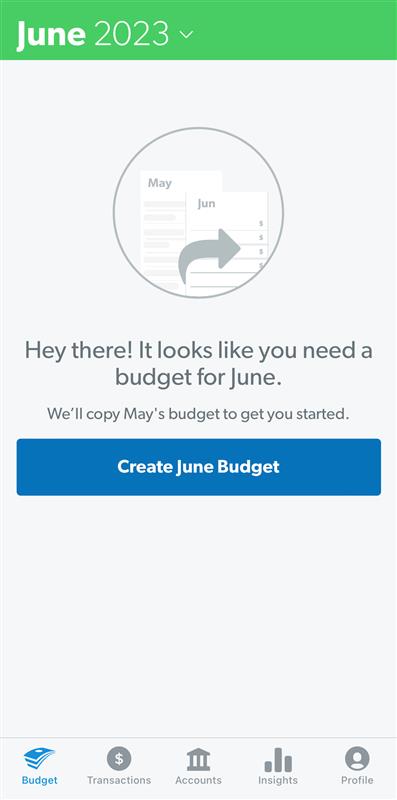

Once you get that budgeting app, create your first budget. But it doesn’t stop there! You should budget every month before the month starts. Why? Because thinking ahead is how you get ahead in life and with your money.

Get expert money advice to reach your money goals faster!

With the EveryDollar app, it’s easy. Every month, you just copy the previous month over, right from your phone. Then make sure you add in your month-specific expenses (such as birthday celebrations, school field trips or holidays).

Boom. You’re ready for everything coming your way, and you didn’t even have to haul out the laptop or sit by the desktop.

3. Enter transactions on the go.

If you want to manage your money well, you need to keep up with your spending. That means typing your transactions into your budgeting app every day.

Set a time to enter all your receipts from the day. Or even better—pull out your phone and track that transaction in your car before you even leave the parking lot!

It takes a couple seconds in the moment, but it’ll keep you from worrying over lost receipts in your wallet, grocery bag or wherever else those things run off to when you really need them. (We’d say that’s worth it!)

4. Create accountability.

With the EveryDollar app, you and your spouse share one budget account. Why? Because this creates accountability and financial fidelity. (Yes, it’s a thing!)

You and your spouse need to talk to each other about your money. That means monthly budget meetings, for one. It also means talking through big purchases and being on the same page with your money.

But what about the routine, day-to-day spending? When you share the same budgeting app, and you keep up with your transactions, those purchases can’t hide. You’re being accountable to your budget, your spouse and yourself!

Now, this sharing isn’t so you can become the budget police for your spouse and blow the whistle every time they make a purchase.

It’s about avoiding those money fights and increasing that money communication.

5. Check your budget from anywhere.

When you’re tracking your spending on the regular, you can open up your EveryDollar app and see your remaining amounts anytime, anywhere, so you’ll know what’s left to spend in every category and every budget line.

If you want a new cardigan, do a quick peek in the app before you walk to the checkout line. Got enough left in that budget line? Go for it!

6. Adjust your budget from anywhere.

Your rearview mirror, your attitude and your budget. What do these things have in common? They all need adjusting from time to time.

Yes, your budget is not a “set it and forget it” thing. You track. Things change. You adjust. When you have to spend more than you planned on your water bill, take money from another line. When your drive less and spend less on gasoline this month, move that extra money somewhere else.

And it’s so easy with the EveryDollar app. You can just change the amount you planned to spend to what you actually spent, and you’ll see the difference pop up automatically. Bada-bing, bada-boom.

How the Premium Version of EveryDollar Brings On-the-Go Upgrades

1. Connect to your bank.

Imagine all your accounts are in one place—right inside your budget. What a wonderful world.

How do you make that happen? Upgrade your budget and get the premium version of EveryDollar. Then you'll see how much simpler it is to manage money on the go when all your bank accounts and your budget are together.

2. Track your spending with ease.

Since the premium version of EveryDollar connects your bank to your app, transactions automatically stream into your budget. All you have to do is drag and drop them into their correct budget line.

That’s right. You don’t have to remember the receipt when you pay for pizza or type in the total when you fill the gas tank in your truck.

When there are transactions to track, you’ll see a lovely blue circle at the bottom of the app. Click that, and you’ll see all the incomes and expenses you need to put in their place.

3. Set due dates with reminders.

Did you know your EveryDollar account can help you pay your bills on time? Yep, it’s true!

You can easily add due dates and reminders to your expenses. Just click a line item in your budget, select Due Date, and follow the simple directions! Once you set the due date, you’ll get a reminder alert three days before the actual day.

Your brain is a precious resource. It’s already chock-full of gluten-free taco recipes, soccer schedules, the names of your favorite podcasts, and so much more. Keep all that stuff fresh in your mind—and let EveryDollar remember your bills’ due dates.

4. Plan your budget based on your paychecks.

Ready for another EveryDollar app advantage?

EveryDollar’s popular paycheck planning tool helps you set up your budget based on when bills and expenses hit, so you can be confident you have enough money to cover the transaction. No more panicking over alert dings from your bank saying you don't have enough funds. No more overdraft fees. What a relief!

This is perfect for anyone who has an irregular income (aka commission-based or hourly job). But no matter how you get paid, this feature helps you space out your spending. (You know, so you aren’t blowing all your entertainment money in week one and then missing out on all the fun the rest of the month!)

You can try out that premium version of EveryDollar in a free trial and test-drive all these features to see what we’re raving about.

Remember, life can get chaotic, but don’t let that be an excuse to let budgeting slip through the cracks. Get a budgeting app and get your money working for you. Every. Single. Dollar.