In the first episode of The Fine Print podcast, titled “How TurboTax Is Screwing You,” host and Ramsey Personality George Kamel investigates tax-software behemoth TurboTax. Hey George, tell us how you really feel about TurboTax!

TurboTax has a 70% market share among folks who choose to self-file their income taxes, and it’s owned by a $100 billion company called Intuit. Its daughter companies include QuickBooks (accounting software), Mint (personal financial management), and Credit Karma (credit monitoring).1

So how does a billion-dollar company make money by offering free or low-cost tax software? The answer lies in the data they collect on their users.

George digs into Intuit’s 2020 Investor Day presentation—a 13-page document that details Intuit’s plans to “help” its customers who are having trouble making ends meet.

“TurboTax and its parent company Intuit have a new long-term game plan to get you and keep you in a cycle of debt long after you’ve filed your taxes,” George explained.

Get expert money advice to reach your money goals faster!

The Investor Day presentation shared an example of an ideal TurboTax customer—a retail employee named Tracy. Tracy used the free version of TurboTax’s federal tax filing services for three years. Then, once TurboTax had a history of her financial data, they used what they knew about her to start offering her a credit card. Just in time to finance her wedding.

TurboTax actually received a bounty for getting Tracy, and thousands of other TurboTax users like her, to sign up for a credit card!

George talks with Dave Ramsey, who says TurboTax is a good company that lost its way when it began using the data it gleans from its tax software customers to generate leads and peddle debt products.

“Banks and their partners make bazillions of dollars off of credit cards, off of debt, off of you,” Dave said. “It’s unbelievably lucrative.”

Intuit bought Credit Karma for $8.1 billion in 2020.2 Why would Intuit spend billions of dollars to buy a company that provides free credit score tracking?

The answer is disturbing.

“Credit Karma has all your data, and based on that data . . . they know how to write the script to get you to sign up for credit cards,” Dave said.

TurboTax and Credit Karma make lots of cash by using your financial data.

Intuit’s documentation actually refers to receiving bounties on people who sign up for loans and credit cards! And in case you didn’t know, a bounty is defined as money paid for capturing or killing a person or an animal.

TurboTax has us in their crosshairs. We’re all potential bounties.

“They’re using their tax software or this free credit score as the bait. This is the trap,” George said. “They’re trying to get you near, so they can say, ‘Boom! Gotcha. Let’s sell them a loan.’”

Intuit’s stated vision is: “Financial freedom for all consumers.” And some people believe lowering your interest rate on your credit card or consolidating loans is the way to financial freedom. But being debt-free is the only way to be truly free.

“You can’t borrow your way out of debt,” Dave said.

Taxes Done Right?

Using customers’ data is messed up. But sometimes TurboTax messes up with the service it provides.

TurboTax sent a Tweet in December 2020 that said: “Get your taxes done right. Pay zero dollars to file fed and state taxes with TurboTax. Simple tax returns only.”

But during George’s investigation into TurboTax, he talked to an unsatisfied customer named Christopher whose tax refund was held up for several months because TurboTax did not prompt him to submit a 1095-A (a form related to the Affordable Care Act). The error not only delayed a refund worth several thousand dollars, it also kept Christopher from qualifying for a stimulus check.

The IRS notified Christopher of the error, but TurboTax could do nothing to fix it. He had to submit an amended return on his own.

“I’m absolutely appalled . . . about the whole process. It’s so convoluted,” Christopher said.

“It’s sad when the IRS is more helpful than TurboTax,” George said. “They get a lot of heat. But in this case, the IRS is looking like a champ.”

A Better Way

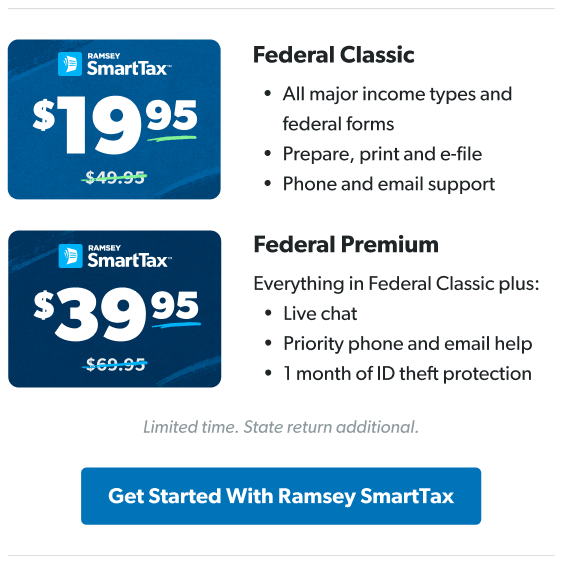

The truth is, no one should profit on their access to the info you provide on your income taxes, so Ramsey Solutions launched Ramsey SmartTax, an inexpensive tax software that’s simple, accurate and safe.

“We partnered with the folks at TaxSlayer, and your data won’t be sold or used to sell you credit cards or anything else,” Dave said.

SmartTax has no hidden fees and no hidden agenda. It’s simple software to get your taxes done right the first time!

“Even though death and taxes may be a part of life, debt doesn’t have to be,” George said.

Learn how you can file your taxes with SmartTax!

Listen to the Podcast

The Fine Print podcast is the place to learn about the latest money traps and trends that you need to know about so that you can be confident with the decisions you make with your life and money.