Key Takeaways

- Ramsey SmartTax is an e-file alternative to other popular tax software programs like Jackson Hewitt, H&R Block, TaxAct, and TurboTax.

- Both Ramsey SmartTax and TurboTax simplify the process of e-filing your taxes and provide a reliable tax filing experience.

- In most cases, Ramsey SmartTax is a more affordable tax filing software and offers more transparency up front about its pricing than TurboTax.

- TurboTax’s parent company, Intuit, uses the data it collects from its financial services products to promote other financial products, like loans and credit cards. When you e-file with Ramsey SmartTax, your info will never be used to sell debt-based products or services to you.

- When you e-file with Ramsey SmartTax, you’re getting the best and clearest price, a reliable tax filing experience, and—most importantly—a product that keeps your well-being and financial future in mind.

If you remember getting a thick tax booklet in the mail from the IRS every year, carefully tearing out the perforated forms, and then filling them out line by line (in pencil if you were smart)—man, you’re old!

We’re just kidding. But if you do remember those days, you know how great it is to be able to file your taxes electronically. You also probably know how great it was to get a mixtape from a friend—but that’s another story.

In 2025, 95% of people filed their taxes electronically through either self-filing software or a tax pro.1 And why wouldn’t they? Filing electronically requires very little math, no erasing so many times you wear a hole in the form (it happens), and no chance of your return getting lost in the mail.

If you’re a do-it-yourselfer when it comes to taxes, you need software that moves you from start to finish quickly, accurately and affordably.

You’ll want to get the most out of your tax software, but with several e-filing providers available, which one should you choose?

Let’s take a look at Ramsey SmartTax versus TurboTax so you can make the best decision for your tax situation.

How to Choose an E-File Service

If you’ve got multiple income sources, own your own business, or just generally have a more complicated tax return, it’s best to skip the DIY e-file route and head straight to a trusted tax professional.

If you have a simpler tax situation, look for a service that’ll give you easy-to-use software, a budget-friendly price, and peace of mind that your tax return has been completed correctly. Plus, keep an eye out for service providers that have hidden fees and ridiculous add-ons—not to mention the ones that try to sell you stuff you don’t need (we’re looking at you, credit cards).

What Is Ramsey SmartTax?

Ramsey SmartTax is an e-file alternative to other popular tax software programs like Jackson Hewitt, H&R Block, TaxAct, and TurboTax—which, let’s face it, is less interested in helping you along your entire financial journey and more focused on additional fees, add-ons and debt-based product partnerships (we’re still looking at you, credit cards). With Ramsey SmartTax, every part of the e-filing process is designed to be easy to use, accurate and reliable. It’s the only e-file tax return service Dave Ramsey recommends. But that’s not where the differences end. So here we go: Ramsey SmartTax versus TurboTax.

5 Differences Between Ramsey SmartTax and TurboTax

Before you choose an e-file service for self-filing or go with ol’ faithful one more year, make sure you understand what to look for.

Ease of Use

Both Ramsey SmartTax and TurboTax simplify the process of e-filing your taxes. Each one guides you through a step-by-step process to complete your tax return. When it’s time to enter W-2s, dependents, health insurance and mortgage information, each software service shows you how to find that information and helps you put it into the IRS’ giant math equation.

Both show you where you are in the filing process at all times so you can keep the momentum going. And with Ramsey SmartTax, there are only three steps—prep, save and e-file—that stand between you and having your taxes done! Plus, you can file from anywhere, anytime—including in your pajamas from the couch at midnight on a Saturday night.

Have questions along the way? Ramsey SmartTax Federal Classic has built-in support—just pick up the phone or send an email. If you’d like to skip the line for phone and email support or use live chat, you can upgrade to Ramsey SmartTax Federal Premium.

Reliability

When it comes to taxes, you need an e-filing system that won’t leave you scratching your head or the IRS questioning your return. Both Ramsey SmartTax and TurboTax deliver basic reliability, but one goes the extra mile.

Ramsey SmartTax is powered by TaxSlayer, one of the most trusted names in the tax return game for more than 50 years. Besides, this isn’t just SmartTax—this is Ramsey SmartTax. That means you’re in the hands of people who care about you and your money goals. We want you to be confident when dealing with Uncle Sam and your financial information.

TurboTax has also been around for several decades, making them reliable (depending on your definition of reliable) in the tax return space as well. They’ll file your taxes for you, but you’re basically just a tax ID number who they can market additional debt products to for their gain.

Affordability

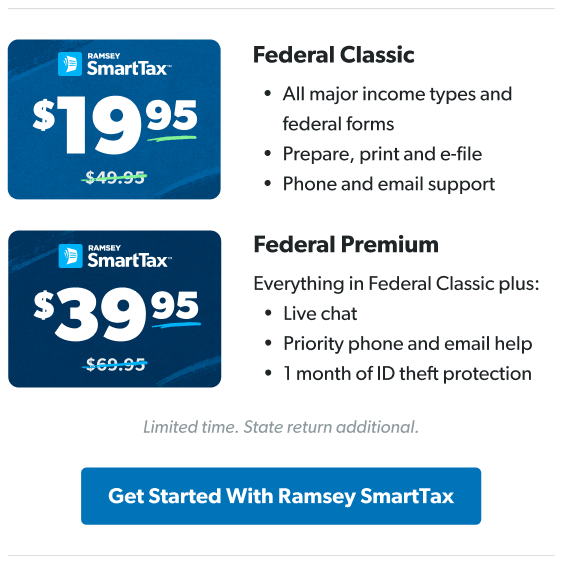

Ramsey SmartTax’s Federal Classic version is $49.95 for federal filing. The Federal Premium version? That’s $69.95 for federal filing. (If you need to file a state tax return, that will cost an additional $49.95.)

But that’s it. No other fees or add-ons. Period.

Bottom line: No matter your situation, you can file your federal taxes with Ramsey SmartTax for $49.95. And moving from Federal Classic to Federal Premium, where you get extra support, is just $20 more. How’s that for affordable?

TurboTax offers a free entry-level product, but it’s geared toward a pretty limited set of folks. For example, you can file for $0 if you have a W-2 or dependents, plan to take the standard deduction, don’t own a home, and don’t make more than $100,000 a year. While that might be a lot of people, it’s probably not most people.

If you have to file more than a simple 1040 tax form, you won’t qualify for the freebie filing. This includes homeowners, folks who plan to itemize deductions, the self-employed, people with 1099 income, and more. From there, the minimum you’ll spend with TurboTax is $79 plus a $64 state filing fee. But it’s not actually as clean and simple as adding a couple of numbers for a federal and state return. Let’s take a look at price transparency.

Price Transparency

When you’ve got a straightforward return, you need a straightforward price. Fortunately, Ramsey SmartTax doesn’t do “confusing.” You don’t have to worry about fees or add-ons that stack up along the way. Even the most straightforward taxes often need a few extra tax forms outside of the basics. With Ramsey SmartTax, that’s not a problem. We don’t do fees or add-ons. Period.

TurboTax, on the other hand, makes it kind of hard to nail down a price. Is it $0? $79? $139? Most of the time you won’t know until you get started. That’s because additional forms to meet your specific tax situation are added on as you go along. You might start with the $79 plan and get bumped up to the $139 plan after a few questions and clicks.

And it’s not just getting bumped up into another plan that’s concerning. When you look closely at the fine print, TurboTax sometimes tacks hidden fees onto your charge.

For example, if you’re using the online or mobile version of TurboTax and want to pay for TurboTax out of your federal refund, that sounds easy enough, right? Think again. That’ll be an extra $40 refund processing fee. And that price is subject to change without notice.2 Yikes!

That’s just one way you could rack up fees from filing with TurboTax. Because Ramsey SmartTax believes in price transparency, you can make Ramsey SmartTax a line item in your EveryDollar budget and trust that you won’t be hit with any surprise fees!

Protecting Your Personal Information

This one’s important. When you do your taxes electronically, you’re putting your whole financial life in the hands of a software system. And that’s no joking matter. Not only do you want your personal information to be protected from fraudsters, scammers and hackers, but you also want the e-filing service provider you go with to protect your money goals. Sounds pretty noble, huh? Well, that’s because for a tax filing service, it is. But it’s what you can expect with Ramsey SmartTax. Normal is for everybody else, and you’re not everybody else.

When you e-file with Ramsey SmartTax, unlike with TurboTax, your info will never be used to sell debt-based products or services to you. One of TurboTax’s not-so-secret moneymakers includes using its customers’ data—the same people trusting them with their most sensitive and private financial information—to market credit card companies, private lenders and more. Your debt is their gain. Yuck.

TurboTax makes money on your data. TurboTax’s parent company, Intuit, actually refers to receiving bounties on customers they entice to sign up for loans and credit cards. Getting people into debt is part of their business model!

And if you owe money to the IRS, they’ll conveniently offer you a loan to help pay your bill. That’s definitely a turbo approach to lining their pockets with your money. The last thing you want to do when you’re filing your taxes is to create more debt for yourself.

And like we pointed out earlier, if you’re getting a refund, TurboTax will graciously let you pay for their services with a portion of your refund—for an additional $40 refund processing service fee!

Ramsey SmartTax vs. TurboTax: Which Is Right for You?

Bottom line: We want you to win with money 24/7—not just at tax time. That's the main difference between Ramsey SmartTax and TurboTax. Ramsey SmartTax is designed to keep you winning. When you e-file with Ramsey SmartTax, you know you’re getting the best and clearest price, a reliable filing partner, and—most importantly—a product that keeps your well-being and financial future in mind.

Don’t just do your taxes this year. Have a plan to get them done the right way. For a smarter way to do your taxes, check out Ramsey SmartTax.