Best budgeting tool out there

This has been a huge money-saver for me. I’m controlling every aspect of my finances by budgeting. It’s the foundation for everything I’m doing with my money.

DC_Dave

The easy-to-use zero-based budgeting app that helps you keep tabs on your money at a glance—anytime, anywhere.

The easy-to-use zero-based budgeting app that helps you keep tabs on your money at a glance—anytime, anywhere.

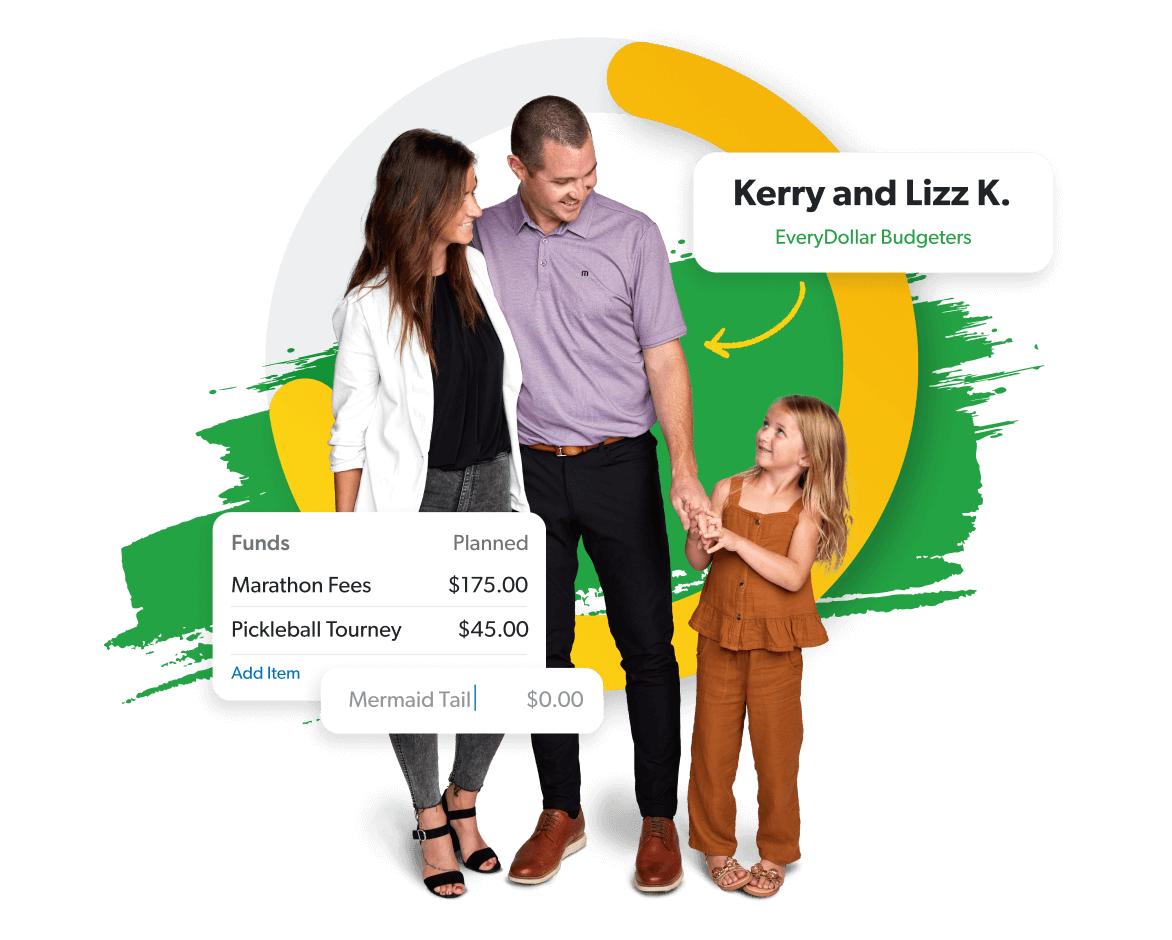

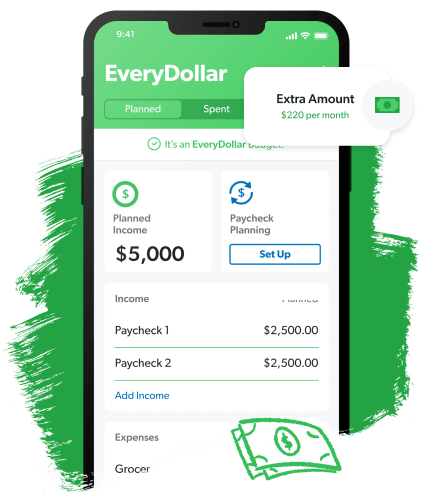

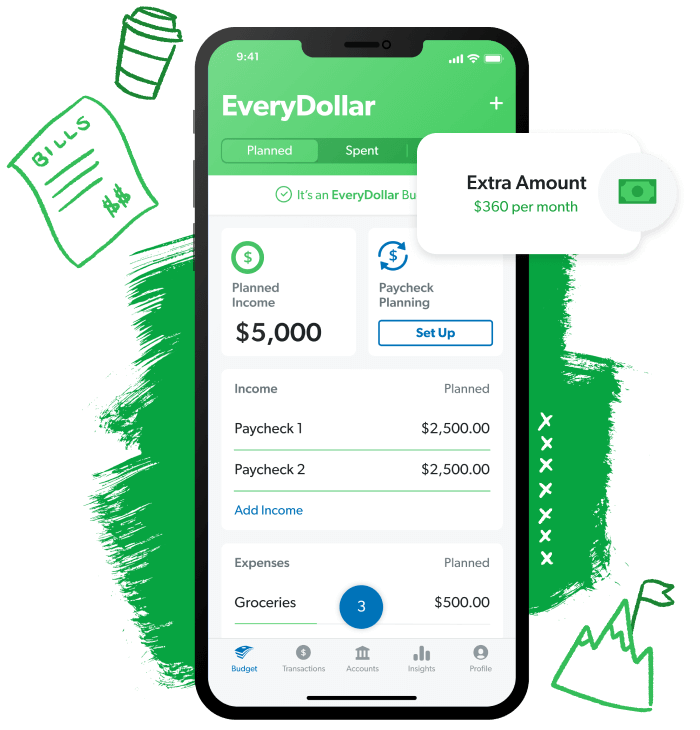

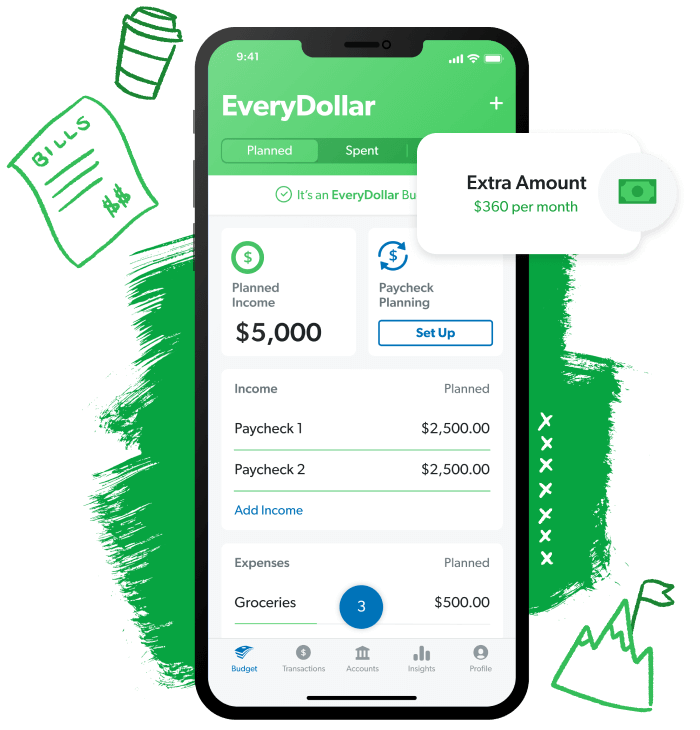

Whether you’re saving for a high-tech mermaid costume or stocking up on staycation snacks, EveryDollar makes it so easy to plan for it all. Customize your budget with unlimited categories!

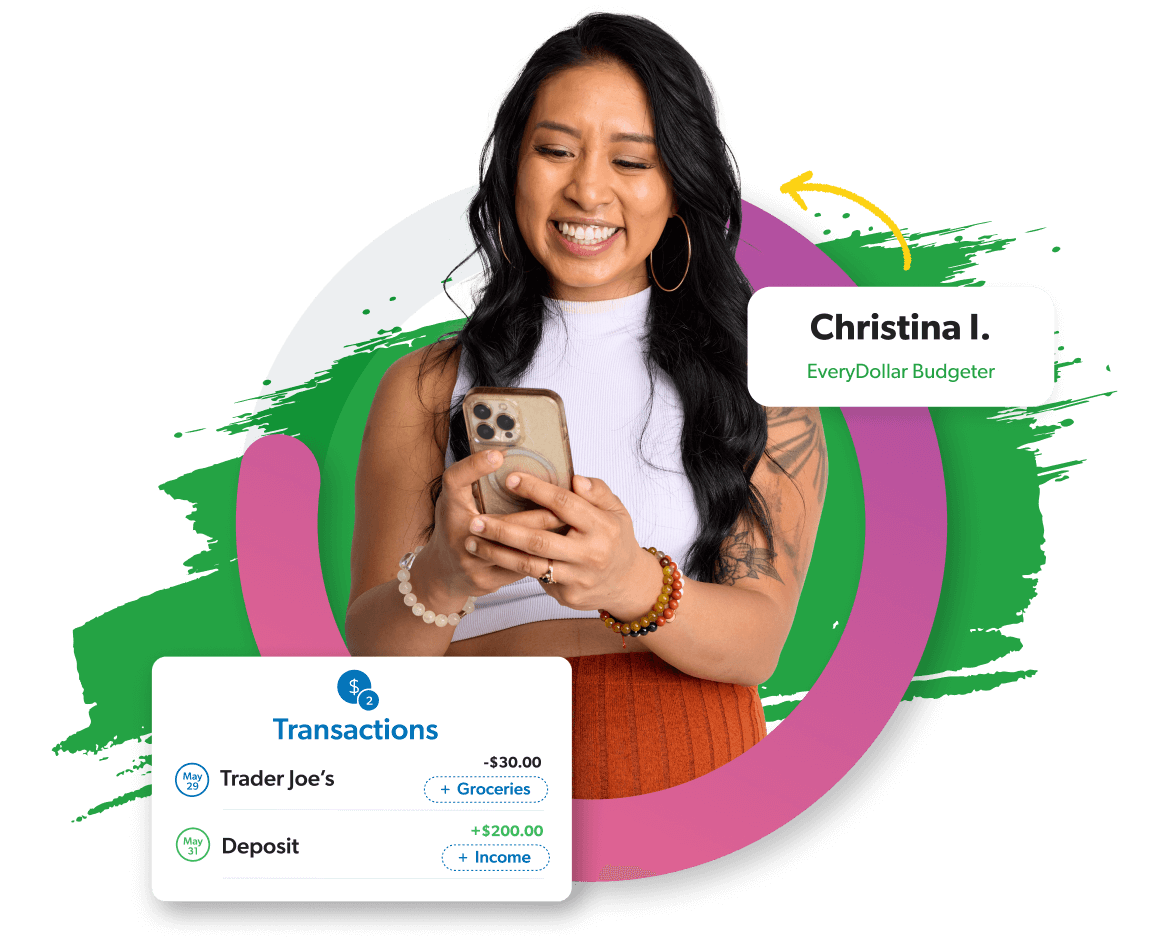

Stream transaction updates from your bank to your budget. Check balances on the go and see upcoming expenses at a glance. EveryDollar keeps up so you can keep moving!

Streamline the way you manage your money by seeing all of your financial accounts conveniently in one place. No need to switch between different apps to stay on top of your finances.

Uncover up to $395

to use toward debt

Cut monthly

expenses by 9%

Build better

budgeting habits

Whether you’re saving for a high-tech mermaid costume or stocking up on staycation snacks, EveryDollar makes it so easy to plan for it all. Customize your budget with unlimited categories!

Stream transaction updates from your bank to your budget. Check balances on the go and see upcoming expenses at a glance. EveryDollar keeps up so you can keep moving!

Streamline the way you manage your money by seeing all of your financial accounts conveniently in one place. No need to switch between different apps to stay on top of your finances.

Uncover up to $395

to use toward debt

Cut monthly

expenses by 9%

Build better

budgeting habits

Best budgeting tool out there

This has been a huge money-saver for me. I’m controlling every aspect of my finances by budgeting. It’s the foundation for everything I’m doing with my money.

DC_Dave

I use this app all the time

I have been using EveryDollar since it launched. It replaced the other two or three budgeting apps that I had previously used, and there has been no going back.

big_dan_

Simple to use yet so helpful

It has really helped us visualize our spending which in return helps us manage it better. It’s a quick and convenient way to see a snapshot of what to expect for the month, especially with bills and income that fluctuate each month like utilities, etc.

Holly B.

Easy to use

Connect it with your bank, and all your transactions drop right in. Makes budgeting easy (and actually kind of fun!) :) Highly recommend!

Kim

Lifesaver

This budgeting app was life-changing! It helped me get out of debt, save money, and truly understand where my money goes. If you aren’t budgeting, this will be your lifesaver!

Amber B.

Giving back is something that’s important to you. So why not plan for it the same way you’ll be budgeting for everything else? Using the app’s built-in Giving line item, you can quickly and easily set aside money for charity or donations every month.

Even when nothing’s on fire (unless we’re talking about your rap skills), being proactive about saving gives you the relief of knowing you’ll be okay if something pops up. Because surprise expenses shouldn’t set you back on your goals.

You’re giving every single dollar a job to do, telling it where to go, so you can give yourself permission to spend—guilt-free. But that doesn’t mean fun-free! So, make room for some shenanigans in your budget. You work too hard to not enjoy the money you make.

We know you’ve got a lot to juggle—weekly grocery runs, date nights, that surprise flat tire 50 miles into your road trip . . . (Those are the worst, right?) EveryDollar helps you prepare for it all.

We know you’ve got a lot to juggle—weekly grocery runs, date nights, that surprise flat tire 50 miles into your road trip . . . (Those are the worst, right?) EveryDollar helps you prepare for it all.

We know you’ve got a lot to juggle—weekly grocery runs, date nights, that surprise flat tire 50 miles into your road trip . . . (Those are the worst, right?) EveryDollar helps you prepare for it all.

Listen—you don’t have to cross your fingers every time you swipe your card. When you have a budget (aka a plan for your money), you can spend and save with confidence. Say goodbye to that overwhelmed feeling—because you’re about to start taking control of your money.

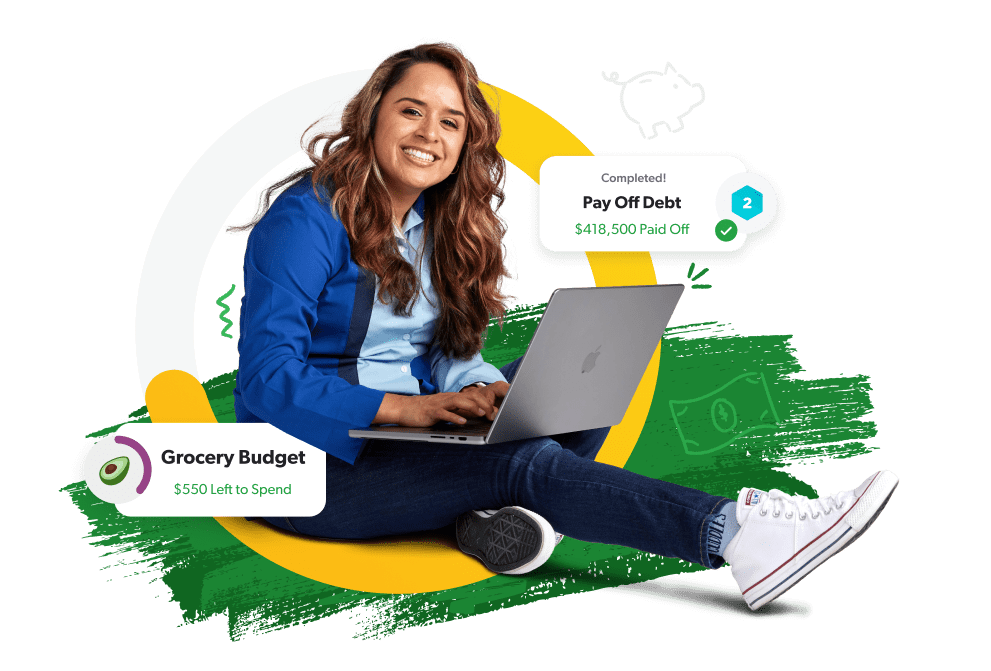

In the first month of budgeting with EveryDollar, you can expect to:

Find an extra $395 hiding in plain sight

Cut your monthly expenses by 9%

Sleep 17 times better (okay, we can’t exactly prove this one—but the other two are true)

Set up your account.

Create your budget.

Say goodbye to money stress.

Listen—you don’t have to cross your fingers every time you swipe your card. When you have a budget (aka a plan for your money), you can spend and save with confidence. Say goodbye to that overwhelmed feeling—because you’re about to start taking control of your money.

In the first month of budgeting with EveryDollar, you can expect to:

Find an extra $395

hiding in plain sight

Cut your monthly

expenses by 9%

Sleep 17 times better

(okay, we can’t exactly

prove this one—but

the other two are true)

Set up your account.

Create your budget.

Say goodbye to money stress.

Listen—you don’t have to cross your fingers every time you swipe your card. When you have a budget (aka a plan for your money), you can spend and save with confidence. Say goodbye to that overwhelmed feeling—because you’re about to start taking control of your money.

In the first month of budgeting with EveryDollar, you can expect to:

Find an extra $395

hiding in plain sight

Cut your monthly

expenses by 9%

Sleep 17 times better

(okay, we can’t exactly

prove this one—but

the other two are true)

Set up your account.

Create your budget.

Say goodbye to money stress.

Pay $0.00 today with your 14-day free trial. Cancel anytime. No hassle.

Pay $0.00 today with your 14-day free trial. Cancel anytime. No hassle.