Get Out of Debt

Managing your finances is 80% behavior and 20% head knowledge. Learn the right way to handle money—and get the tools to put it into practice.

We don’t believe in managing debt—we get rid of it. Debt might seem normal, but normal is broke. We’ll help you break free from debt and build lasting wealth.

If you don’t intentionally manage your money, it will manage you. It’s not complicated, but you have to put in the work. We’ll help you get there using the 7 Baby Steps.

We know your financial situation is unique, and so is your path forward. From books to courses to coaching, we’ll help you find what works for you.

Our money advice is based on biblical financial principles and grandma’s commonsense wisdom, and it’s proven to change your behavior with money.

Money wisdom isn’t new—the Bible talks about it over 2,300 times. It tells us to live on less than we make, save money, and build a legacy. But today’s culture embraces debt and paycheck-to-paycheck living instead. Get back to the basics using our 7 Baby Steps and build wealth the right way.

Dave Ramsey and his team of financial experts will help you crush your money goals and stay on track with the 7 Baby Steps.

Dave Ramsey

Personal Finance and Retirement Expert

Rachel Cruze

Personal Finance and Budgeting Expert

George Kamel

Personal Finance Expert

Jade Warshaw

Personal Finance and Debt Elimination Expert

This easy-to-use budgeting app is key to helping you stay on track and crush your money goals.

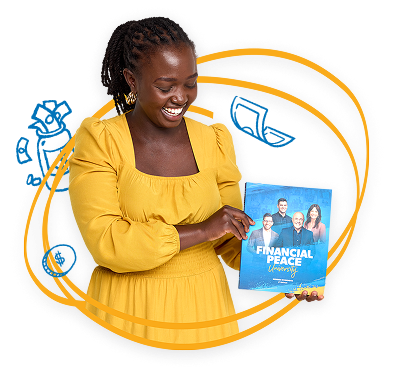

Take the course that’s helped millions beat debt, build wealth, and speed through the 7 Baby Steps.

File smarter, not harder. Choose our easy-to-use software or let a RamseyTrusted® pro to handle it for you.

Get in-depth articles full of practical steps to help you budget, pay off debt for good, and build lasting wealth.

Let's break down what shopping addiction is and talk about how to fix it so you can have a truly healthy relationship with money.

Retail therapy is spending money to make yourself feel better. Here's how you can take back control of your spending habits.

Caveat emptor (let the buyer beware)! Find out the top tactics companies use to get you to spend more and how you can outsmart them.

Buyer’s remorse happens when you spend money on something and regret it later—and it’s not fun. Learn more about what it is, why it happens, and how you can avoid it.

Here are some last-minute Valentine’s Day gift ideas for under $30! Surprise someone you love without breaking the bank.

It’s been a long time since economics class. But with prices and inflation rates going up, it’s time we revisit this question: What is the Consumer Price Index?

Every week, receive expert guidance and practical steps to help you stay on track with your goals and create a strong financial future.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

The Bible has 2,350 verses on money, offering a clear blueprint for managing your money the right way. By following God’s financial principles—budgeting, saving, avoiding debt, and building wealth—you can experience financial peace and be free to give generously. Ramsey’s proven, commonsense Baby Steps plan isn’t just about money—it’s about creating a secure future and living with purpose. Learn more about God’s ways of managing money.

Where does grandma come into this? Well, these commonsense money principles—just like your grandma or great-grandmother used to follow—have helped generations manage their money well. Dave has been teaching these principles for 30 years because they still work today.

We believe having debt is the opposite of healthy personal finances. Your income is your greatest wealth-building tool. And you can’t build wealth when all your income goes toward debt payments every month. That’s why a life without credit cards and loans is a life of financial peace—no more worrying about missed payments or using your paychecks to cover the past. Learn how to pay off debt fast.

When you follow the 7 Baby Steps, you’ll start investing 15% of your household income in retirement after you’ve completed Baby Steps 1–3. Once you’ve paid off all your consumer debt and saved 3–6 months of expenses in a fully funded emergency fund, then you’re ready. Find out more about how to invest in your future with a trustworthy pro.

If you have personal or self-employed income and feel confident using tax software, you can easily file online with Ramsey SmartTax. If you have more complicated taxes, don’t want to take the time to do your own taxes, or want expert advice, then a RamseyTrusted® tax advisor is for you.