Collision vs. Comprehensive Car Insurance: What’s the Difference?

7 Min Read | May 1, 2025

It’s easy to confuse them. They both start with the letter “C” and they’re both types of car insurance that cover damage to your car only, but that’s where their similarities end. To add to the confusion, car insurance companies usually bundle comprehensive and collision insurance together.

So, what’s the difference between collision vs. comprehensive car insurance? Get ready for one of those explanations that when you hear it, you realize, oh, that makes perfect sense!

Let’s go over the basics and clear up the confusion.

- What Is Comprehensive Insurance?

- What Is Collision Insurance?

- What’s the Difference Between Comprehensive vs. Collision Insurance?

- What Do Comprehensive and Collision Insurance Cover?

- Do I Need Comprehensive and Collision Insurance?

- How Much Does Comprehensive and Collision Insurance Cost?

- Get the Best Coverage for the Best Price

What Is Comprehensive Insurance?

The simplest way to explain comprehensive car insurance is to say that it covers damage—to your car only—that’s caused by something other than a collision with another car.

Home and auto insurance aren’t just about low rates—they’re about the right coverage level. Talk to a trusted pro who can help you get both.

It could be a natural disaster, theft, damage from hitting an animal, vandalism, act of terrorism or a falling object. So, if your car gets damaged in a tornado, is stolen from the airport long-term parking lot, or your new paint job gets “keyed,” you’d be covered by comprehensive insurance. (Extremely unlucky but covered!)

Comprehensive insurance events are sometimes referred to as “acts of God” since you have no control over them. Most likely, you’re not even around when they happen.

The main benefit of comprehensive insurance is to give you peace of mind and financial protection if something really unlucky happens to your car.

What Is Collision Insurance?

Collision insurance covers repair or replacement costs—to your car only—if you cause damage to your car by colliding with another vehicle or an object like a tree, fence or traffic barrier. A good way to remember this type of insurance is that you have control over the collision. (Side note: Hitting a deer or other animal is covered by comprehensive. It might seem like it’d fall under collision but think of it like this: The deer is running into you. You don’t have control over that.)

Let’s say you sideswipe a guardrail at high speed. If you have collision insurance all you’re responsible for is paying your deductible, and your insurance company will cover the cost to repair your car.

The main benefits of carrying collision insurance are peace of mind that you won’t have to pay high repair costs, and typically, that you won’t have to deal with another driver’s insurance company.

What’s the Difference Between Comprehensive vs. Collision Insurance?

The main difference between collision vs. comprehensive insurance is that collision insurance covers damage caused when the driver is in control of the car, while comprehensive coverage generally covers events that are out of the driver’s control.

Let’s use a tornado to illustrate the difference between collision vs. comprehensive insurance. Imagine the following two scenarios:

- A couch from a home that was caught in the funnel of a tornado falls on your car while it was parked in your driveway.

- You swerved to avoid hitting a couch that was caught in the funnel of a tornado and drove into a street pole.

In scenario one, since you did not have control over the falling couch, your insurance company would reimburse you for damages to your car under your comprehensive car insurance.

In scenario two, you did have control over your car in that situation, so your insurance company would reimburse you for damage to your car from the street pole under your collision coverage.

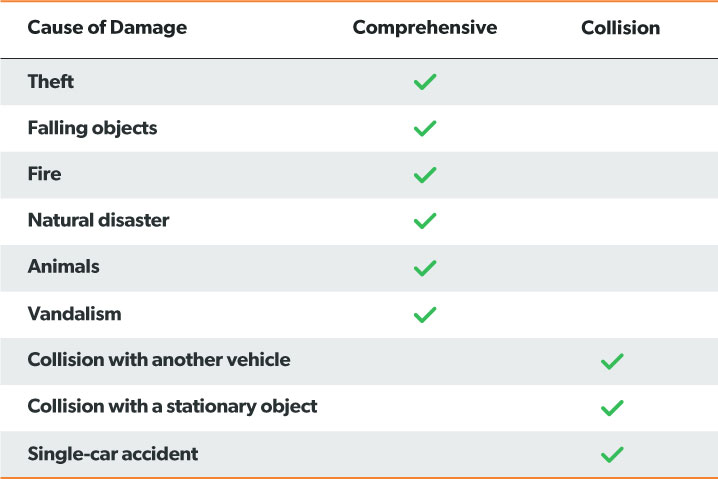

What Do Comprehensive and Collision Insurance Cover?

Together, comprehensive and collision insurance (combined with the required liability insurance) is called full coverage. Here’s a chart that shows what comprehensive and collision insurance cover individually.

We recommend connecting with one of our RamseyTrusted pros to find the best price for comprehensive and collision coverage.

Do I Need Comprehensive and Collision Insurance?

If you’re wondering whether both types of coverage are necessary, the answer is almost always yes. Both types of damage are common, so we do recommend carrying comprehensive and collision insurance in most cases. Here’s why.

Your Financial Situation

If your car is totaled, can you afford to replace it without going into debt? It’s an unpleasant thought, but car accidents happen all the time. If your answer is no, then that’s a risk you don’t need to take. Get comprehensive and collision coverage so the insurance company can help with your car’s replacement cost and you can keep your emergency fund for another time. The only exception to this is if your car is paid for and not worth very much, and you could easily afford to replace it. In that case, you could skip comprehensive and collision.”

Your Driving Habits

Do you have a long commute to work or a relationship with someone in a different city? If so, keep in mind (as you’re stuck in freeway traffic, yet again) that the more you drive, the higher the risk of damage to your car, and the more likely you need to buy comprehensive and collision insurance.

Where You Live

Your location has a lot to do with buying car insurance coverage. Even if you don’t drive that often, if you live in an area that has a high crime rate or is prone to natural disasters, you should at least buy comprehensive insurance.

How Your Car Is Financed

If you lease or finance your car, the lender will most likely require that you carry comprehensive and collision insurance. Lenders want to make sure they’re not at risk if your car is totaled or stolen, and you walk away from your loan or lease.

If you own your car (the better financial choice!), you’re not required by law to carry comprehensive or collision insurance, but again—if you can’t afford to pay to repair or replace your car on your own, it’s too risky to go without the right coverage.

Insurance Can Be Confusing. We Have Someone Who Can Help.

RamseyTrusted® insurance pros are independent and vetted—and they help you fill the gaps in your policies. They make getting insurance (like home, auto and umbrella) one less thing to stress about. Plug in your zip code to connect with an agent who understands the coverage needs in your area.

How Much Does Comprehensive and Collision Insurance Cost?

In general, collision insurance is more expensive than comprehensive insurance because collision claims are more frequent than comprehensive claims. Let’s look at the average rates in each state.

|

State |

Average Annual Collision Premium |

Average Annual Comprehensive Premium |

|

Alabama |

$380.51 |

$175.28 |

|

Alaska |

$387.12 |

$147.87 |

|

Arizona |

$326.28 |

$208.25 |

|

Arkansas |

$375.25 |

$235.36 |

|

California |

$483.60 |

$94.72 |

|

Colorado |

$330.50 |

$272.44 |

|

Connecticut |

$407.54 |

$133.86 |

|

Delaware |

$352.86 |

$140.52 |

|

District of Columbia |

$535.96 |

$228.71 |

|

Florida |

$361.79 |

$149.26 |

|

Georgia |

$408.41 |

$176.31 |

|

Hawaii |

$357.78 |

$107.66 |

|

Idaho |

$262.67 |

$139.75 |

|

Illinois |

$339.04 |

$140.57 |

|

Indiana |

$286.49 |

$135.63 |

|

Iowa |

$252.65 |

$214.65 |

|

Kansas |

$287.24 |

$276.33 |

|

Kentucky |

$312.51 |

$164.68 |

|

Louisiana |

$487.44 |

$248.57 |

|

Maine |

$294.80 |

$113.33 |

|

Maryland |

$422.06 |

$167.61 |

|

Massachusetts |

$440.55 |

$147.06 |

|

Michigan |

$479.11 |

$159.08 |

|

Minnesota |

$265.74 |

$206.45 |

|

Mississippi |

$372.17 |

$239.34 |

|

Missouri |

$315.49 |

$216.92 |

|

Montana |

$283.65 |

$306.00 |

|

Nebraska |

$272.48 |

$260.97 |

|

Nevada |

$366.54 |

$119.28 |

|

New Hampshire |

$327.30 |

$118.58 |

|

New Jersey |

$414.39 |

$130.26 |

|

New Mexico |

$311.24 |

$214.10 |

|

New York |

$457.77 |

$180.64 |

|

North Carolina |

$342.13 |

$137.45 |

|

North Dakota |

$279.45 |

$256.76 |

|

Ohio |

$302.57 |

$130.74 |

|

Oklahoma |

$346.73 |

$267.99 |

|

Oregon |

$280.61 |

$106.87 |

|

Pennsylvania |

$376.21 |

$169.21 |

|

Rhode Island |

$474.58 |

$140.40 |

|

South Carolina |

$318.08 |

$207.09 |

|

South Dakota |

$244.47 |

$327.11 |

|

Tennessee |

$355.01 |

$163.83 |

|

Texas |

$442.88 |

$269.90 |

|

Utah |

$309.20 |

$127.53 |

|

Vermont |

$329.47 |

$147.81 |

|

Virginia |

$316.05 |

$148.25 |

|

Washington |

$312.65 |

$118.19 |

|

West Virginia |

$350.20 |

$224.86 |

|

Wisconsin |

$247.95 |

$159.82 |

|

Wyoming |

$297.61 |

$317.22 |

* Statistics are from the National Association of Insurance Commissioners

Get the Best Coverage for the Best Price

We recommend carrying both comprehensive and collision insurance. Yes, the two types of coverage are different, but they’ll both protect your emergency fund in the event of significant damage to your car.

Connect with one of our RamseyTrusted pros who can find the best rates for comprehensive and collision insurance in your state. Most of our pros are independent agents, meaning they can work for you, not the insurance company.