Key Takeaways

- Starting early with investing gives compound interest more time to work its magic, turning even small contributions into long-term wealth.

- You can set yourself up for millionaire status by avoiding student loan and credit card debt, living on less than you make, not taking big risks with your money, and sticking to the 7 Baby Steps.

- Most millionaires today got there through consistent, long-term investing in their workplace 401(k)—not high-income careers, inheritance, or “hitting it big” on risky investments like single stocks or crypto.

If you’re a teenager trying to stay on top of your grades and figure out who you’re going to ask to prom, just the thought of becoming a millionaire sounds like a far-off dream, right? It might even seem impossible—like trying to convince your parents that a brand-new sports car is a perfect first car for a high school sophomore (good luck with that!).

Market chaos, inflation, your future—work with a pro to navigate this stuff.

But guess what? Reaching millionaire status is actually more realistic than you might think. That’s right, you (yes, you) can become a millionaire someday. And if you’re already asking questions about what you need to do to get there before you even have a high school diploma, congrats—you’re way ahead of the game!

You might not realize it, but the choices you make today will have a huge impact on where you’ll end up years from now. It’s going to take some hard work, but reaching the million-dollar mark is possible. Here’s how!

A Millionaire’s Best Friend: Compound Growth

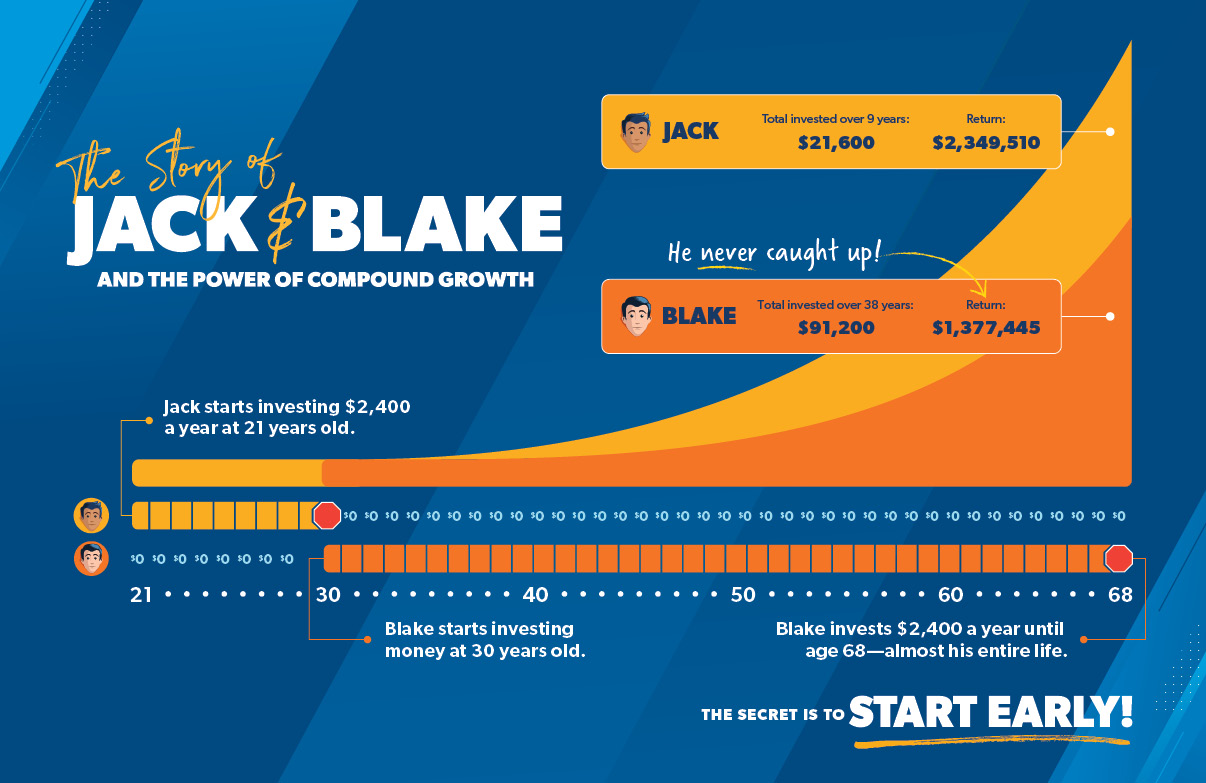

Here’s a little secret: Compound growth, also called compound interest, is a millionaire’s best friend. It’s the money your money makes. Seriously. But don’t take our word for it—let us introduce you to our friends Jack and Blake and tell you about their adventures with compound growth.

When Jack turned 21, he decided to start investing $200 a month every year for nine years. At age 30, he decided to stop investing altogether. But his friend Blake started when Jack stopped, investing $200 a month every month starting at age 30, all the way until the ripe old age of 68.

So at age 68, who do you think had more money in their account? Let’s do the math. At the end of nine years, Jack invested $21,600, didn’t invest another dime, and ended up with close to $2.35 million at age 68. Let’s say that again—$2.35 million! That’s the power of compound growth, friends.

And Jack’s friend Blake invested a whopping $91,200 over the course of 38 years. At age 68, he had built up $1.3 million, but he never caught up with Jack.

So, how did Jack do it? That’s right: compound growth. He didn’t invest nearly as much as Blake did, but still ended up with about $1 million more in his nest egg. Compound growth can turn a little more than $20,000 invested in nine short years into almost $2.35 million over 38 years! Try our Compound Interest Calculator that will do the calculations for you.

What You Can Do Now to Set Yourself Up for a Millionaire Future

As you can see, on top of compound growth, you have another advantage your parents and teachers don’t have: more time. You see, time and compound growth go together like Taylor Swift and catchy song lyrics. Together, they can make you a millionaire!

But the decisions you make now while you’re still in high school and once you’re in college will either set you up to build wealth quickly or set you back years financially. Here are some things you can do right now to set yourself up for success.

1. Say No! to Student Loan Debt

You can choose to not go into any debt—not even for college. That decision alone will put you light-years ahead of your peers by the time you graduate.

Think you might want to go to that fancy private school? Think again. Sure, you might look good when you’re wearing the sweatshirt, but is it really worth it? (Trust us—it doesn’t matter as much as you think it does.) The worst thing you can do to your future is get buried in payments before you’re even out of your parents’ house!

Here are just a few ways you can get ready to pursue a debt-free degree right now:

- Apply for as many scholarships and grants as you can.

- Choose an affordable state university that offers you the most financial aid.

- Commit to working a part-time job when you’re not in class.

- Live off campus or continue living at home with your parents while you go to school.

We believe in you (and your future). Don’t get caught up in the lie that the only way to go to college is with debt. You can chase after your dreams while leaving student loan debt in the dumpster.

Our documentary Borrowed Future uncovers the dark side of the student loan industry and shows you how you can forge a better path for your future—one that doesn’t include graduating with a mountain of student debt. Watch it today!

2. Stay Away From Credit Cards

Once you step onto a college campus, get ready. You’ll be bombarded by grinning credit card representatives trying to convince you to fill out credit card applications in exchange for a free t-shirt or a slice of pizza. This is a trap, people! Run (don’t walk) in the other direction!

The sad part is that many teens fall for this schtick and end up creating a financial mess for themselves. More than half of college students say they have a credit card and 46% admit to using credit for non-essential, impulse-driven spending (their words, not ours). Even worse, 28% carry a balance greater than $2,000!1 That’s just dumb (definitely our words).

Don’t jeopardize your financial future by buying stuff you can’t afford to impress people you barely know. It’s not worth it.

3. Live on Less Than You Make

The struggle of the broke college student is real. We get it. But you don’t get a pass on being financially responsible just because you’re in college. You can still have fun in college—just be smart about it!

Now is the time to learn how to make a budget and stick to it. Making a budget might sound boring and restrictive, but a budget doesn’t take away your freedom—it gives you freedom to save, spend and give how you want to.

Learning to make a budget and live within your means will serve you well in the long run. Most millionaires still spend less than $200 dining out each month and almost all of them still use coupons when they shop.2 When you’re able to keep your spending under control, that frees you up to save and invest for the future.

4. Don’t Take Big Risks With Your Money

Some of your classmates might post about buying cryptocurrency on social media or try to convince you to get in on the ground floor of some exciting “investment opportunity.” Don’t take the bait!

Millionaires see investing as the primary tool for building wealth and securing financial peace. They keep things simple, save consistently, and stay away from big risks.

Here are the facts: 80% of millionaires say that investing in an employer-sponsored retirement plan like a 401(k) was the main way they reached millionaire status.3 Meanwhile, 3 out of 4 also mentioned investing outside the company plan, but not on risky single-stock “opportunities.” Nope! In fact, single stocks didn’t even make the top three list of factors.4

For now, focus on graduating college debt-free—no student loans, credit card debt or car payments. Once you’ve started your career and are ready to get going with investing, make sure you connect with a financial advisor—someone who can teach you all about investing and help you pick and choose the right investments for your portfolio. Our SmartVestor program makes it easy to find qualified investment professionals who can serve you.

5. Follow the Baby Steps

If you want to win with money, you need a plan. And the plan that has helped folks all over the country build wealth and become millionaires over time is Dave Ramsey’s 7 Baby Steps. This is a plan that works!

What exactly are those Baby Steps? We’re glad you asked! Here they are in order:

- Save $1,000 for your starter emergency fund.

- Pay off all debt (except the house) using the debt snowball.

- Save 3–6 months of expenses in a fully funded emergency fund.

- Invest 15% of your household income in retirement.

- Save for your children’s college fund.

- Pay off your home early.

- Build wealth and give.

As you probably noticed, there are some steps on there you might not be ready for yet. And some you can skip completely—like debt! Like we said before, your goal right now is to make sure college is paid for.

And since you’re still living under your parents’ roof, a $500 emergency fund will be enough for now. If you’ll spend the next few years focused on those goals, nothing will hold you back from building wealth like a millionaire!

Make an Investment Plan With a Pro

SmartVestor shows you up to five investing professionals in your area for free. No commitments, no hidden fees.

Yes, You Can Be a Millionaire

But before we send you off on your million-dollar journey, let’s talk about lifestyle. When you think of the word millionaire, what comes to mind? An older couple zipping their way up the coast to their summer beach home? Superstars like Jay-Z and Beyoncé with their cool clothes and private jet?

We get why you might think that at first. But guess what? There are 24.5 million millionaires all over the country, and most of them probably look more like that nice couple next door than the “Queen B” herself!5

Here are some more fun millionaire stats from The National Study of Millionaires that will bust the image you might have of what a millionaire is:

- 79% did not inherit a dime of money on their way to a million dollars. That means they worked and saved their way to wealth.

- 62% graduated from public state universities and another 8% attended community colleges. In other words, you don’t need an Ivy League education to be successful and become wealthy.

- Only 31% had an average annual salary of $100,000 or more over the course of their careers. And about one-third of all millionaires never had a six-figure salary in their life! Mind. Blown.

- 94% of millionaires live on less than they make, compared to 55% of the general population.

The big takeaway is this: Anyone in America can become a millionaire. And the earlier you start, the better. In fact, the study found that if members of younger generations are diligent over time, they can become millionaires in their own right. It’s time to get started!

Next Steps

- Grab a copy of Dave Ramsey’s book Baby Steps Millionaires and learn how to bust through barriers preventing you from becoming a millionaire.

- Watch Borrowed Future to uncover the dark side of the student loan industry and see how the system works against you.

- Check out our Investment Calculator and see how starting small today can grow into lasting wealth over time.

- Talk with a financial advisor who will help you choose your investments, keep an eye on their performance, and keep you focused on your plan.

This article provides general guidelines about investing topics. Your situation may be unique. To discuss a plan for your situation, connect with a SmartVestor Pro. Ramsey Solutions is a paid, non-client promoter of participating Pros.