Key Takeaways

- Zombie debt is old debt that collectors are trying to get you to pay.

- If you pay anything toward zombie debt, it can revive the debt.

- You can request a debt validation letter and dispute the debt if it isn’t yours.

Is there anything worse than debt? Yeah, in fact, there actually is. It’s a little something called zombie debt. And it’s back from the debt graveyard to haunt you with nightmares from the great beyond.

Pay off debt fast and save more money with Financial Peace University.

Think that sounds scary enough? Sometimes that zombie debt isn’t even your debt! (Insert scary screams here.) But you don’t have to live in fear. There are steps you can take to bury zombie debt for good.

What Is Zombie Debt?

Tactics Zombie Debt Collectors Use

What to Do if You’re Contacted About Zombie Debt

How to Protect Yourself From Zombie Debt

What Is Zombie Debt?

Zombie debt (sometimes called phantom debt) is old debt that’s come back to haunt you. This could be either debt you’ve already paid off, debt that’s too old to be collected, or debt that belongs to someone else entirely. Basically, debt collectors are trying to get money they have no legal right to go after. But that won’t stop them from trying.

Beware: If you fall for the trick and pay even one penny toward zombie debt, you revive the debt—giving the debt collectors permission to collect!

You’re probably thinking, there’s no way I would pay a debt that isn’t mine. But you’d be surprised at how often this tactic works. In fact, 56% of consumer complaints to the Consumer Finance Protection Bureau (CFPB) are about collectors trying to collect debt not owed by the consumer.1

You see, these debt collectors are really good at their jobs, and if they see an old debt to resurrect (no matter how old it is or who owes it), they want that money. And they’ll do their best to get it from you.

Types of Zombie Debt

- Settled debts: These are debts that have already been discharged—whether through a bankruptcy or another avenue. With settled debts, you should have written proof from your lender that you’re no longer responsible for the debt.

- Time-barred debts: If you borrowed money and didn’t repay it, collectors aren’t allowed to sue you after a period of time (this is called the statute of limitations). But if you make a payment, it will reset the clock!

- Debts that have fallen off your credit report: After seven years, unpaid debts fall off your credit report. But debt collectors can still try to scare you with them.

- Debts that aren’t even yours: The debt collector might think you’re someone else or it could mean you’ve been the victim of identity theft. Either way, you’re not responsible for paying a debt that isn’t yours.

Collectors contact the wrong people all the time, so don't listen to their bluffs. You aren’t responsible for any debt you personally didn’t sign for (which is also why you should never cosign for someone’s debt). So if you don't owe, don't let collectors bully you into paying.

Tactics Zombie Debt Collectors Use

It shouldn’t surprise you that zombie debt collectors don’t play fair. Think about it this way: They have one job—to chase down people with debt and get money from them. That’s it. And they’ll go to great lengths (including lies and threats) to make sure they get the job done. Here are a few of the tactics debt collectors use:

Lying to you: Yeah—they’re not afraid to bend the truth. When it comes to chasing down your money, they’ll lie about anything. Some of their favorites include telling you that you owe more than you actually do, pretending to be someone they’re not, and telling you that you’re going to jail (which is not true).

Threatening or harassing you: Zombie debt collectors may threaten to sue you, use abusive language, and even threaten you with violence. But you have the right to hang up and file a complaint with the CFPB if collectors are harassing you.

Squeezing information out of you: You don’t have to tell collectors anything—no matter how many times they ask. If someone calls asking for your Social Security number, current address or your mother’s maiden name, keep your lips sealed! If you really do owe on a debt, your lender should already have the information they need.

Debt collectors can get really nasty. And they might even cross legal boundaries to get you to pay up. It’s important to know what they can and cannot do—so you can stand up for yourself and not get taken advantage of.

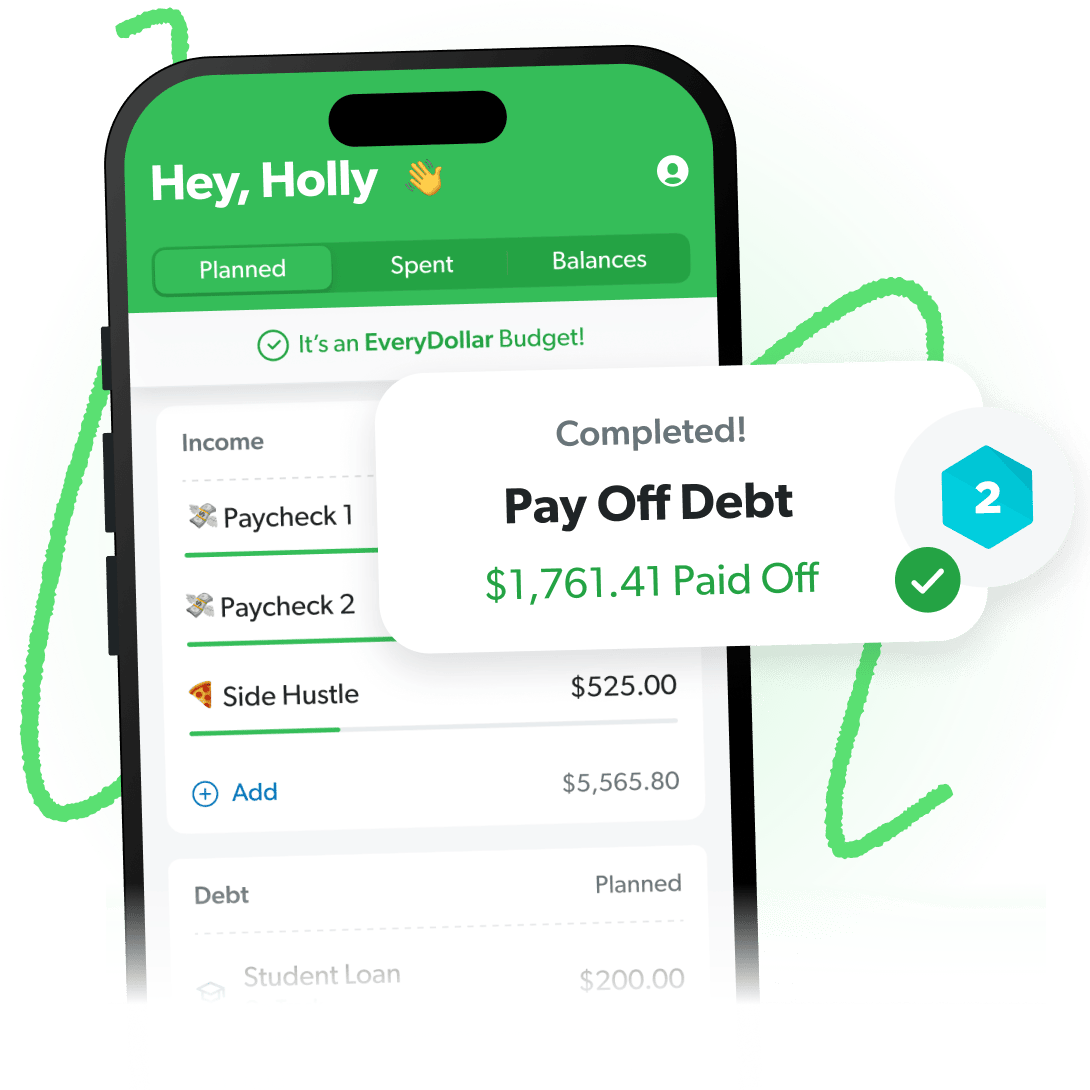

Find More Margin. Beat Debt Faster

Paying off debt doesn’t have to take forever. With the EveryDollar budgeting app, you’ll find extra margin every month so you can pay off debt faster.

What to Do if You’re Contacted About Zombie Debt

1. Request a debt validation letter.

The ball is in the collector’s court to prove the debt is actually yours. So, ask them for a debt validation letter that includes how much the debt is, who the original creditor is, and when you signed for the debt. If they refuse to give you that in writing, it’s a sure sign of a scam.

If collectors are trying to resurrect old debt that actually belongs to you (even if it’s so old you don’t legally have to pay), you should still pay it. After all, that’s money you borrowed and said you’d pay back. So, if you can, pay off your debt. Just be sure you get everything in writing and don’t give collectors access to your bank account.

But if you’re being harassed over zombie debt that you believe isn’t yours, here’s how to deal with it.

2. Dispute the debt.

If you’ve searched your personal records and know you don’t owe what they say you owe, send the collector a certified letter (return receipt requested) stating that the debt isn't yours and asking them to stop calling you. You can use one of the sample letters from the CFPB.

3. Report the debt collector.

If you’ve disputed the debt and the collector keeps at it, you can file a complaint with the Federal Trade Commission (FTC) or your state attorney general’s office.

4. Freeze your credit.

If you think you might be the victim of identity theft, it’s time to freeze your credit, close any accounts that were opened in your name, place a fraud alert, and report it to the FTC.

How to Protect Yourself From Zombie Debt

1. Check your credit report once a year.

It's important to check your credit report for a few reasons. Obviously, you want it to be accurate, but if people are calling you and telling you to pay up, some stranger might be running up debt in your name! Make sure to pull your credit report once a year and check it for inaccuracies.

2. Know what you owe.

We can’t stress this enough. Knowing exactly how much debt you owe (and who you owe it to) is the best defense against zombie debt collectors. That way, if they come calling, you’ll know if they’re trying to make you pay for a debt you’ve already settled—or worse, a debt that was never yours in the first place. Keep all payoff statements, contracts and records of payment on file in case you need them.

3. Don’t share any information.

If a lender is calling, they should already have your information. If a zombie debt collector is calling, they’ll try to go fishing for more information. Don’t take the bait and share anything with them, or they will use it against you!

4. Know your rights.

Believe it or not, debt collectors have rules they’re supposed to abide by. Still, they don’t always follow them. The Fair Debt Collection Practices Act protects you from nasty collectors when it comes to communication, harassment or threats, lying and validation of your debt. If you think a collector is stepping outside their bounds, let them know and then file a complaint with the CFPB.

5. Get identity theft protection.

You can’t see the future and know when identity theft will hit. But you can be prepared and protect yourself before it happens. Zander Insurance is the only company we recommend for identity theft protection. And it’s totally affordable (starting at just $6.75 per month). Protect your identity and get peace of mind.

6. Run from debt.

The best way to protect yourself from zombie debt (and debt collectors) is to run from debt—as fast as you possibly can. That might feel impossible if you and debt have been best buds for years. But believe us: That relationship is toxic and one-sided. Debt keeps you focused on the past instead of being excited for your future.

You Can Be Debt-Free

We get it. Maybe the idea of paying off all your debt sounds overwhelming . . . or like it’ll take forever!

But you can do it! And our EveryDollar budgeting app can help.

EveryDollar shows you how to find thousands of dollars of hidden margin (no, really) and builds you a personalized, step-by-step plan to beat debt way faster. Plus, you’ll track your progress right in the app until every dollar of debt is history!

So, what are you waiting for? Start EveryDollar for free today!