It’s impossible to build wealth when you’re in a cycle of never-ending debt. Find out how to manage your money the right way and get started on the life you were meant to live.

It’s impossible to build wealth when you’re in a cycle of never-ending debt. Find out how to manage your money the right way and get started on the life you were meant to live.

General Debt

Your Debt Guide

Find out how to crush your debt fast, just like a snowball rolling downhill.

The Budget Calculator

Enter your monthly take-home pay and boom—the calculator will use your income to fill out all the expense categories automatically.

Credit Card Debt

Your Debt Guide

Discover the truth about credit cards and how you’re better off without them.

The Budget Calculator

Enter your monthly take-home pay and boom—the calculator will use your income to fill out all the expense categories automatically.

Car Loan Debt

Your Debt Guide

Getting rid of a car loan that’s strangling your budget is possible.

The Budget Calculator

Enter your monthly take-home pay and boom—the calculator will use your income to fill out all the expense categories automatically.

Car Loan Debt

Your Debt Guide

Getting rid of a car loan that’s strangling your budget is possible.

The Budget Calculator

Enter your monthly take-home pay and boom—the calculator will use your income to fill out all the expense categories automatically.

Student Loan Debt

Your Debt Guide

Paying off your student loan may feel impossible. But you can do it—and fast!

The Budget Calculator

Enter your monthly take-home pay and boom—the calculator will use your income to fill out all the expense categories automatically.

Medical Debt

Your Debt Guide

Receiving your medical bill can be as painful as the hospital stay. See what options will help ease your worry.

The Budget Calculator

Enter your monthly take-home pay and boom—the calculator will use your income to fill out all the expense categories automatically.

Budgeting Helps You Kick Debt to the Curb

No matter what type of debt you have, the journey to paying it off starts with a budget. Here are three steps that’ll put you in the driver’s seat of your finances and future.

Step 1: Learn Why Budgeting Is Key to Getting Out of Debt

Like a gas pedal to a car, a budget helps you get moving toward a debt-free life. And once you start budgeting, you’ll find more money you can use to pay off debt faster while keeping you on track with your other expenses. You’ll shift from wondering where your money went to having full control of your finances!

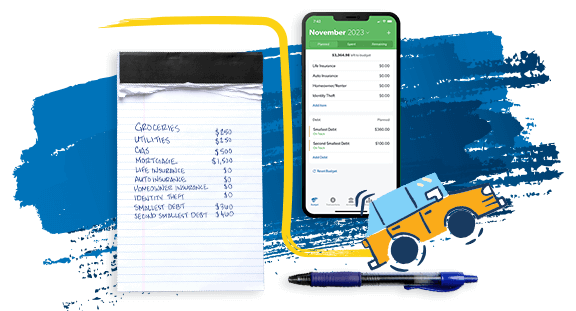

Step 2: See How Easy It Is to Build a Budget

Common myths about budgeting are that it’s hard and it’s time-consuming. Not here! Check out how easy it is to build your budget. You really can do this!

Budget Calculator

Enter your income and the calculator will show the national averages for most budget categories as a starting point. A few of these are recommendations (like giving). Most just reflect average spending (like debt). Don't have debt? Yay! Move that money to your current money goal.

Income

Expenses

Difference

Total Expenses

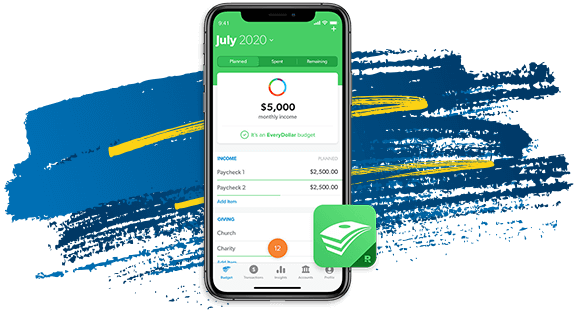

$0.00Step 3: Create Your First EveryDollar Budget

Budgeting might feel a little out of your comfort zone. But don’t worry—the EveryDollar budget app makes it easy to build your budget and edit anytime, anywhere. And the best part? The app does all the math for you while you keep crushing your debt!

Get More Information

Need more guidance? We’ve got you covered. Choose how you like to learn, and we’ll point you to the right tools that’ll help you with budgeting and paying off debt. Or take our free money quiz to find out where you are with your finances and how to get where you want to be.

Take the 3-Minute Money Quiz

Want to pay off debt but don’t know where to start? Answer a few questions to get a customized financial plan, along with free tools and resources.

Frequently Asked Questions

-

What is debt?

-

In simple terms, debt is owing any money to anybody for any reason. Types of debt include credit card debt, personal loans, car loans, student loans, mortgages and HELOCs.

-

What is the debt snowball?

-

The debt snowball method is a debt-reduction strategy where you pay off debt in order of the smallest to largest balance, gaining momentum as you knock out each debt. When the smallest debt is paid in full, you roll the minimum payment you were making on that debt into the payment for the next-smallest debt. It’s the best and fastest way to knock out all your debt!

-

Which debt should I pay off first?

-

If you’ve got multiple debts, pay off the smallest debt first (regardless of interest rate). But if you owe the IRS any money (aka tax debt), you need to take care of that before anything else—even if it isn't your smallest debt.

-

When should I pause my debt snowball?

-

You may need to pause your debt snowball for a short time to deal with an unexpected (or expensive) situation—like if you’re having a baby, you’ve lost your job, you're dealing with a health crisis, or you’re going through a major life-change (like a divorce). Just be sure to get that debt snowball rolling again once you’re past the emergency or crisis period.

-

How long does it take to pay off debt?

-

The average person who works the debt snowball with focused intensity pays off all their consumer debt (everything but their house) in about 18–24 months. But it’s really up to you—the more work you put in, the sooner you’ll be debt-free!

-

Should I pay off debt before I save for retirement?

-

Around here, we teach the 7 Baby Steps. If you’ve got any debt (other than your mortgage), your goal is to pay it all off before you start saving for your future—and that includes investing for retirement. Trust us, the best thing you can do for your financial future is ditch your debt so you can free up your income and start building wealth faster.

-

How does debt affect my credit score?

-

A credit score is really just a number that measures your relationship with debt (how much and what types you’ve had and whether you’ve paid it off). That’s why we call it an “I love debt” score. Taking on more debt and paying it off continuously will boost your score, while taking on more debt and not paying it off will lower your score. But a credit score only lets you do one thing: go into more debt. If you don’t borrow money (aka take on debt), you don’t need a credit score. Period.

-

How do I get out of credit card debt?

-

The debt snowball method is the best way to get rid of credit card debt (or any other debt you have). But you also need to stop using credit cards (cut those suckers up!), get on a budget, control your spending, and do whatever you can to pay off your credit cards ASAP. Also, avoid things like balance transfers, personal loans and more credit cards—those will only make your problem way worse.

-

Should I pay off my student loans?

-

Yes, you should! The truth is, student loan forgiveness is not guaranteed. And you may not believe it now, but you can pay off your student loans—even if you’re staring down a big number. The sooner you take responsibility for your debt and get serious about paying it off, the sooner you can experience the peace of being debt-free (and use that student loan payment to build lasting wealth!).

-

What happens if I don’t pay my debt?

-

If you don’t make your debt payments, you’ll get hit with late fees and interest. After a certain period of time, your debt will usually get moved to collections. This is when debt collectors call and demand you pay up. Your credit score will also take a hit. And depending on the type of debt, you may have your wages garnished (money taken straight out of your paycheck) or get sued for what you owe.

-

How do I handle debt collectors?

-

Debt collectors have one mission and one mission only—to get your money. And they’re not above stooping to some pretty low levels to make you pay (like lying, harassing and manipulating you). But you have rights, and you can defend yourself against these bullies!

-

What if I have old debt?

-

All consumer debts have a statute of limitations—the maximum amount of time a creditor has to take legal action against you for defaulted (late) debt payments. Creditors can’t legally take you to court over time-barred debt (debt that has passed the statute of limitations), but they can continue to call and ask you to pay that money back because, yes, it’s still your debt. Heads up though: If you make even one payment on time-barred debt, it becomes zombie debt, and collectors can then legally come after you for it.

-

Should I file for bankruptcy?

-

Bankruptcy is a gut-wrenching experience that lays out your money problems for all to see and drags you through the legal mud. It also stays on your credit report for years and doesn’t even erase all your debts in most cases. You should do everything in your power to avoid filing for bankruptcy.

Listening Recommendation

The Ramsey Show serves up expert advice for life’s tough questions. Its caller-driven format inspires real-time discussions about managing money, work and relationships for people in all walks of life. You can tune in to The Ramsey Show daily to listen or watch.

Viewing Recommendation

Break the Cycle is a free livestream that uncovers what’s really keeping you stuck in the same place financially. It has nothing to do with math and everything to do with your money habits. Learn how to break the cycle of never-ending debt and start building wealth.

Reading Recommendation

The Total Money Makeover is Dave Ramsey’s all-time bestselling book. It has helped millions of families pay off debt and change their lives forever. With its simple, practical step-by-step plan, it helps you change unhealthy money behaviors and win with money.

Ask a Ramsey Preferred Coach

While it’s great to have digital resources, sometimes you want to connect with an expert face-to-face. And after talking with a financial coach, you won’t just be dreaming about financial peace—you’ll take the first step to start living it. Schedule your free consultation.

How to Get Out of Debt With the Debt Snowball Method

The debt snowball method is a debt reduction strategy where you pay off your debts in order of smallest to largest, regardless of the interest rates.

Once the smallest debt is gone, take its payment and apply it to the next-smallest debt (while continuing to make minimum payments on your other debts).

The more you pay off, the more money you can throw at your next payment—like a snowball rolling downhill.

How to Pay Off Credit Card Debt

First things first. Just like any toxic relationship in your life, you’ve got to break up with your credit cards—aka cut them up! Your next step after that is to pay off one debt at a time using the debt snowball method.

Once the smallest debt is gone, take its payment and apply it to the next-smallest debt (while continuing to make minimum payments on your other debts).

Remember, with each balance you pay off, you'll have more money to throw at the next debt—like a snowball rolling downhill.

How to Get Out of a Car Loan

Cars are the most expensive thing we buy that goes down in value. It’s like lighting a pile of money on fire every time you drive down the road!

So, how do you get rid of a giant car payment? One option is to pay off your loan faster. Start by getting on a budget, cutting back your spending, and picking up a side hustle.

Throw as much money as you can toward your car loan. It’ll take some discipline and determination, but you can do it.

How to Pay Off Student Loans Fast

Get on a budget and stick to it every month. It’s a total game changer.

Unfortunately, there isn’t a special magic trick or life hack to help you get rid of your student loans in 30 days flat. But if you follow the proven method of budgeting, you can and will ditch your student loans for good.

A zero-based monthly budget will show you exactly where your money is going and where you can cut back. And you might find “extra” money you didn’t know you had. Throwing a little bit (or a whole lot) extra at your loans each month makes a huge difference. Keep fighting the good fight (and the bad debt!).

How to Get Help With Medical Bills

We know how it feels to get that pit in your stomach when you see a bill and have no clue how you’re going to pay. But there are things you can do to get rid of your medical bills.

Most medical providers are willing to work with you on a payment plan. Rather than having to pay your bill in one lump sum, this allows you to break it down into manageable, bite-sized chunks.

Whether you’re trying to pay down a medical bill or save up for health expenses, a budget is your best tool. It helps you take something that feels way out of your control and turn it into a plan that you can control.