The premium version of the app that’s helped 10M+ budgeters

A proven step-by-step plan, world-class tools and commonsense education that gives your team hope and helps them build healthy money habits that last.

Exclusive access to a network of vetted pros—CPAs, CFPs, realtors, insurance providers and more

AI-powered search that serves personalized answers from our financial experts on your money questions

A legally binding will and powers of attorney with this online will-maker, for FREE—no hourly fees, no legal jargon

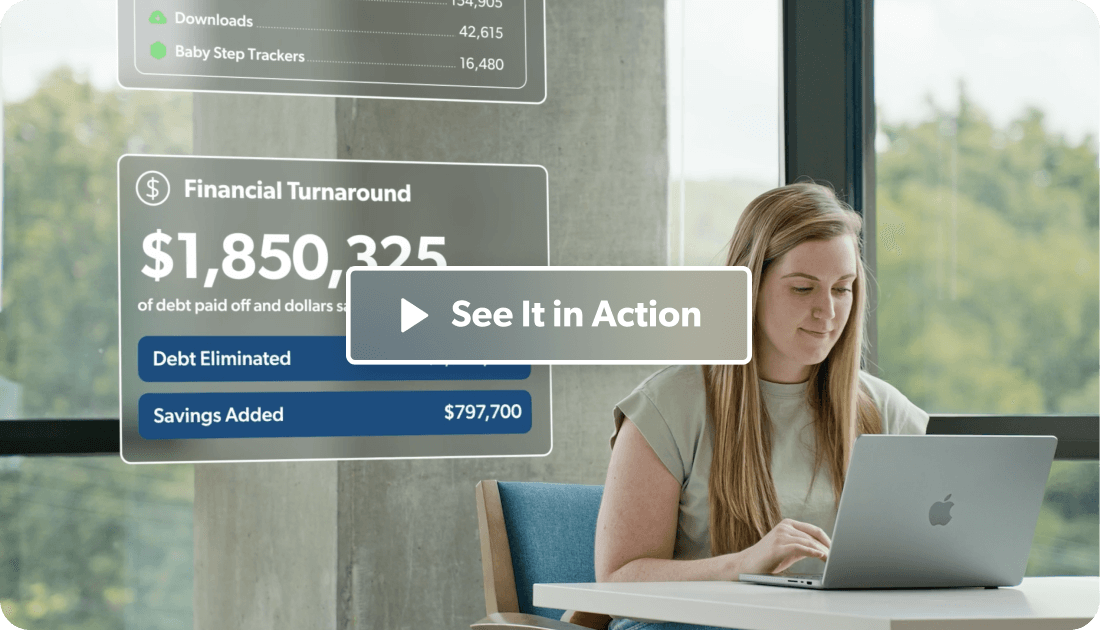

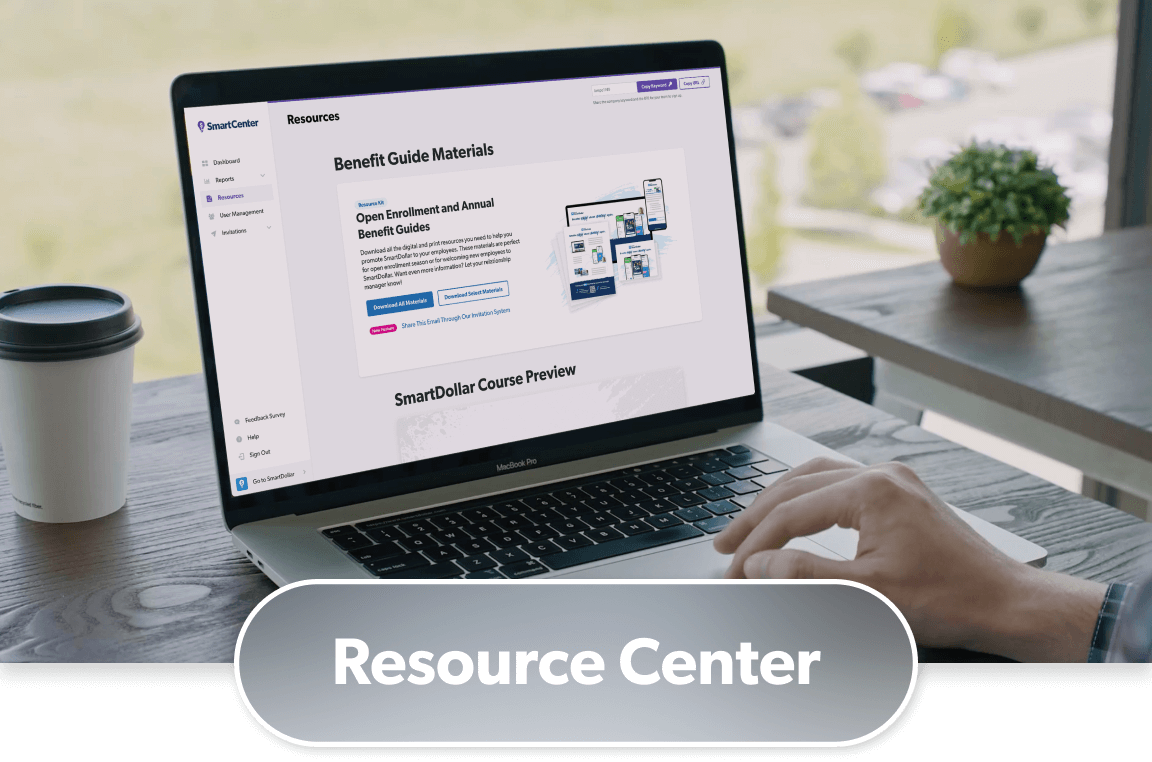

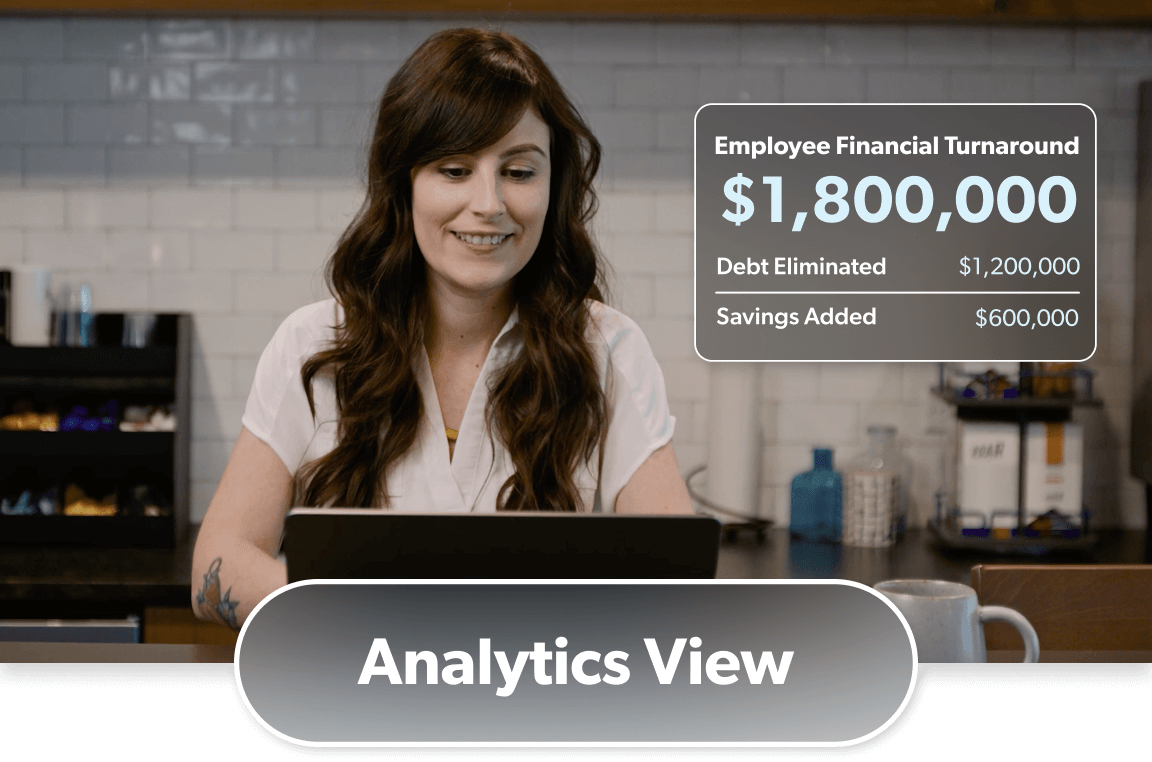

An admin portal that includes everything you need to promote SmartDollar, track the numbers, and witness your employees finally taking control of their money.

A dedicated Relationship Manager to work with you every step of the way to help you reach your goals

A library of ready-made assets to launch and promote SmartDollar and keep your team engaged long-term

Track employee engagement and overall financial progress while keeping their information private and secure

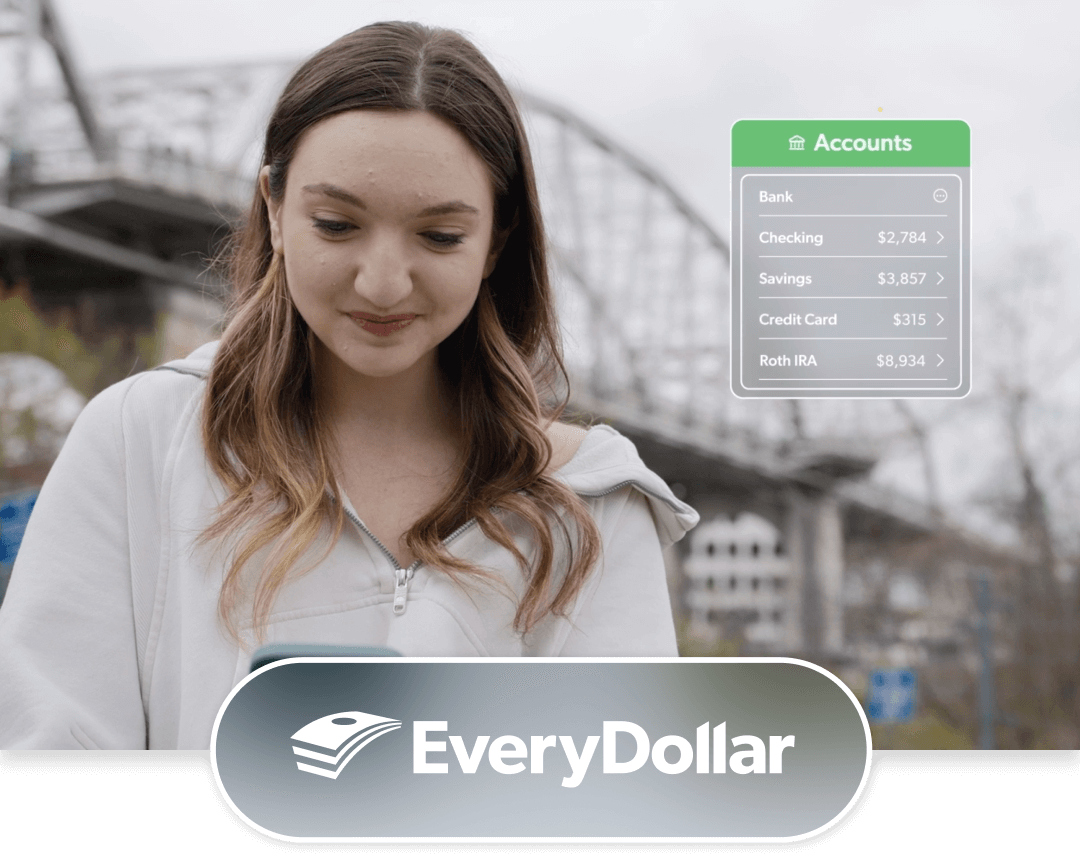

EveryDollar Budgeting App ($80.00 value)

Financial Curriculum ($100.00 value)

Financial Coaching ($250.00 value)

Ramsey SmartTax ($100.00 value)

Online Will-Maker ($249.00 value)

And much more!

We’re excited to show you how SmartDollar helps your employees beat their money stress and build wealth—and it helps you make a measurable impact on your business.

SmartDollar clients see the highest participation results with their employees when leaders get involved.

That means leaders working the Baby Steps alongside their team, offering incentives, celebrating small (and big) wins, and sending out the prewritten email invitations.

And you don’t have to do it alone. Your dedicated relationship manager will help you encourage your employees to use SmartDollar—whether they’re in the office, in the field or in front of a classroom.

We can’t promise your whole team will sign up—but the ones who work the Baby Steps can change their lives!

Ready to change your employees’ lives? We are too! Let’s go.

With SmartDollar, your employees will have 24/7 access to easy-to-consume content, including the premium version of our budgeting app, EveryDollar, to track their money.

They can pay off debt (we’re looking at you, student loans!), save for life’s big emergencies, and finally get excited about their future.

You’re not alone! You'll have a relationship manager dedicated to your company who’ll guide you through the implementation process, suggesting the best way to launch SmartDollar to your team. You’ll also have access to promotional materials inside your admin portal.

Plus, group and individual invitations will help you to quickly (and easily) get new employees signed up.

You can absolutely use it too! Companies have higher success rates with SmartDollar when leaders work the plan.

This could be as easy as showing a SmartDollar video during your current meeting rhythms or more in depth like scheduling an hour once a month to watch a video, discuss progress, and celebrate together.

But SmartDollar isn’t a class, so even if watching content together isn’t an option, you and your employees can work the plan and access the tools anywhere, anytime.

Learn more about how SmartDollar serves you and your employees!

A lot of SmartDollar users are on the road, in the front of a classroom, on-site or somewhere other than sitting at a desk. That’s okay!

Your employees can access SmartDollar on a desktop or a mobile device so wherever they are, SmartDollar is too. Your dedicated relationship manager can also give you ideas to keep your employees encouraged and on track toward their money goals.

Yes! Our product is designed to serve Spanish-speaking employees through subtitles and accurate webpage translation. We also have Spanish-speaking coaches available, so they don’t have to miss out on valuable coaching sessions!

We serve teams of all sizes with different needs and preferences. To best serve you, we need to learn about your team and put together custom pricing options that make the most sense for your business.

Schedule a meeting here with a SmartDollar team member to get started.

SmartDollar is an employer-sponsored financial wellness benefit. That means it’s completely free for your employees—a great reason to encourage them to get started.