Key Takeaways

- Inflation happens when prices rise over time, and your money’s purchasing power decreases as a result.

- Inflation is driven by factors like higher demand, rising production costs, and expectations of future price increases.

- The Federal Reserve works to manage inflation by adjusting interest rates and measuring key price indexes like the Consumer Price Index (CPI).

- You can protect yourself from inflation by budgeting your income every month, saving wisely, and investing for long-term goals.

We’ve all probably heard a grandparent or parent reminisce about “the good old days”:

Get expert money advice to reach your money goals faster!

“I remember when gas was a quarter and hamburgers were 15 cents.”

“I made 50 bucks a week at my first job.”

Well, we’re a long way from yesteryear, and inflation is the reason prices and wages are about 10 times more than they were in the 1950s.

So, what is inflation? If you snoozed through high school economics class, don’t worry—we’ll get you caught up on what inflation is, why people are talking about it more now, and what you can do to guard your money from inflation.

What Is Inflation?

Inflation is an increase in the price of goods and services over time. And when prices go up, the value of your money (aka purchasing power) goes down. Hey, five bucks could fill up your gas tank 50 years ago, but you’d be lucky to move the needle above E with $5 now.

The inflation rate you hear about in the news is a percentage based on the increase or decrease in prices from one year to the next. So if the inflation rate is 10%, that means prices have gone up 10% from the year before. In the real world, that means a grocery order that was $100 last year would be about $110 this year.

Inflation is nothing new. You’ve probably just heard more about it lately because it’s higher than it’s been in decades, and it’s causing a lot more pain with higher prices at the gas pump and grocery store.

What Is the Inflation Rate Right Now?

As of September 2025, the inflation rate in the U.S. over the previous 12 months was 3%.1 That’s a third of what it was in June 2022 when inflation hit 9.1%—a 40-year high!2 So, we’ve gotten a little relief from inflation as it’s gradually come down over the last year, but it’s still above the 2% rate that many economists think is healthy for the economy.

What Causes Inflation?

Inflation happens when prices go up and the purchasing power (the value of the currency) goes down as time goes on. It all goes back to supply and demand. When people want to buy things but there isn’t enough stuff for them to buy, prices go up.

Now, there are three different types of inflation, and each one impacts the way prices go up. Let’s walk through them:

Demand-Pull Inflation

Demand-pull inflation happens when demand for goods or services goes up more than the supply of goods and services. Consumer demand then pulls up prices.

So, what causes consumer demand to increase? Well, it really boils down to people having more money to spend than stuff to buy. Economists describe this situation as “too many dollars chasing too few goods.”

That extra cash could come from a strong job market (reflected in a low unemployment rate) that allows people to earn more money. Or it could come from easy access to credit due to low interest rates—or from the government (ahem, stimulus checks). A strong economy also gives consumers the confidence to spend (or borrow) more money—rather than save it for emergencies.

Government spending (because the U.S. government is a giant consumer) can bump up prices as well.

Cost-Push Inflation

Cost-push inflation happens when the cost of the stuff manufacturers use to make goods goes up. When this happens, the prices are pushed up (usually by some kind of event cutting off the supply of resources). We saw this happen when the global supply chain took a hit and factories shut down during the COVID-19 pandemic back in 2020. Now, some price increases were caused by people panic-buying, but shutdowns really pushed prices up. Oil also often plays a role in cost-push inflation. Oil is a big part of the global economy—from transportation to plastics—and when the price of oil goes up, it causes the price of other goods to increase.

Built-In Inflation

Built-in inflation is kind of odd because it’s inflation caused by inflation.

Say what?

Well, when demand-pull inflation or cost-push inflation drive prices up, people start to expect inflation in the future. So they begin asking for raises or looking for jobs that pay better. Or companies give their employees higher cost of living increases to keep up with inflation. This increase in wages can cause prices to rise. This is sometimes called the wage-price spiral.

How Inflation Affects You and the Economy

If you’re still wondering, What is inflation? (like a lot of us are these days), just remember that most inflation goes back to the basic supply and demand problem. If items people need or want are hard to find, it drives the cost up and creates a scarcity mindset (where you think there won’t be enough of something left for you to have any). If factories and other producers make more stuff than what consumers demand, then prices go down.

Oversupply equals prices going down. Undersupply equals prices going up.

Here’s a quick example to show how supply and demand affects price. If a car company makes 10,000 of a certain model of car but only 9,000 people want those cars at the current price, at some point, they’ll have to lower their prices to sell the remaining 1,000 cars. On the other hand, if 11,000 people want cars (which means demand is higher than supply), then the company can raise prices to the point where only 10,000 people are willing to buy a car.

Now, this is a super simple example. Pricing decisions are much more complex because companies are kind of guessing when it comes to consumer demand. And this situation plays out thousands (or maybe millions) of times in the whole economy over time. One company raising prices doesn’t cause inflation. Inflation happens when many companies across many different industries raise their prices.

When inflation happens, you see the effects of it hit stores—and your wallet—pretty fast. We’re watching this kind of thing play out now, with the price of groceries up 3% in the last year.3 And when prices go up, that’s where that nasty word inflation actually starts to impact you. All of a sudden, regular products you used to be able to buy for a decent amount jump in price. I don’t remember cereal costing that much! Yeah, you’re not making it all up in your head.

Whether we want to admit it or not, inflation is here, and it’s sticking around, folks. Despite what the folks at the Federal Reserve told us back in 2021, this inflation is anything but transitory.

What Is Transitory Inflation?

Transitory inflation happens when prices go up but the rising prices are short-lived and don’t leave a permanent mark. It’s an economic term used to talk about inflation when it’s quick and painless. Basically, prices might be inflated, but they won’t last long. They’re temporary. They’ll peak and then come back down again.

Does any of that sound like what we’ve seen in the last couple of years?

Nope, we didn’t think so.

We have gotten some relief from inflation in the last year, but we still have a way to go before inflation gets back to normal levels. But don’t worry—there are lots of things you can do to protect yourself against inflation (we’ll cover that a little later).

Types of Price Indexes

Here in the U.S., we measure inflation by three things—the Consumer Price Index (CPI), Producer Price Index (PPI) and Personal Consumption Expenditures Price Index (PCE). It’s a mouthful, but it goes a long way to track the changes in prices of goods and production. While PPI and PCE are useful inflation measures, the CPI is most watched by economists.

Here’s how it all breaks down:

Consumer Price Index (CPI)

The Consumer Price Index measures the change in the prices of goods and services that consumers pay over time. In other words, CPI is tracking how much your toothpaste (and lots of other stuff) costs today compared to last month and last year.

Producer Price Index (PPI)

The Producer Price Index is similar to the Consumer Price Index, but PPI measures the change in prices producers receive for their goods and services. So, it reports inflation from the side of sellers (producers) rather than buyers (consumers). The PPI used to be called the Wholesale Price Index, and it includes pricing for about 500 industries. It might seem like the CPI and PPI should be identical numbers, but the PPI doesn’t include things like government subsidies, taxes and distribution costs that affect consumer prices.4

Personal Consumption Expenditures Price Index (PCE)

And the last one here, the PCE Price Index, shows the actual month-to-month changes in the prices of services that consumers actually bought. Think of this one as the way to figure out if people are really laying down their hard-earned cash and buying the stuff or not.

Looking at all this data sounds like one big headache (probably because it is), but the data gives you a pretty good idea of what’s happening in the world of inflation and with our money’s purchasing power.

What Is Purchasing Power?

Purchasing power all comes down to the value of currency. In the U.S. when people say “purchasing power,” they’re usually talking about how far your dollar bills go to cover the price of items you want to buy. Like, when you go to the store, could your $1 buy one or two packs of gum?

And it’s no secret that a dollar bill has way less purchasing power than it did 50, 20 or even just 10 years ago. In fact, according to our State of Personal Finance report, just over 49% of Americans say they have trouble paying their bills. Thanks, inflation!

Types of Inflation

If you Google “what is inflation,” these confusing economic terms are sure to pop up in your search results, so let’s go ahead and tackle them one by one.

Deflation

Deflation happens when prices for goods and services go down over time and the rate of inflation drops under 0%. In plain words, deflation just means you can get more bang for your buck (aka purchasing power) when you head out to the store or shop online.

Even though deflation makes your dollar go further, though, that’s not really a good thing here. See, deflation causes a whole lot of other problems—like zero economic growth, stale income and lots of job losses. But these days, we’re more concerned with inflation than we are deflation.

Stagflation

Stagflation happens when economic growth slows down (or totally comes to a screeching stop), unemployment numbers are high, and the cost of goods and services keeps on going up. Oh, and all of this happens at the same time.

The last time the U.S. saw stagflation hit was back in the 1970s, but some economists worry that it could happen again if things don’t shape up soon.

Hyperinflation

Hyperinflation is just like it sounds—it’s inflation on steroids. Hyperinflation happens when the prices of goods shoot up fast and go insanely out of control. Most economists agree that inflation can only be called hyperinflation when prices increase at a rate of 50% each month. That’s like a gallon of milk going from $3.50 in May to $5.25 in June to $7.88 in July. Sheesh.

Yeah, it sounds insane, like something that couldn’t ever happen, but it did happen in Germany after World War I. Germans loaded wheelbarrows with cash just to buy food! Still, hyperinflation is a pretty rare thing.

Shrinkflation

If you’ve walked around the grocery store lately and thought items looked smaller than they used to, you’re not going crazy. Say hello to a little thing called shrinkflation. Shrinkflation happens when the items you buy shrink in size but you still pay the same price for them (so companies can give their profit margins a buffer against things like inflation).

It all boils down to paying the same price for an item as you used to but getting less of it. Like paying $3.99 for a 10-ounce bag of candy—when a few months back you could get 12 ounces for that same price. It should really be called sneakflation, because that’s exactly what this is—sneaky.

How to Calculate Inflation Rates

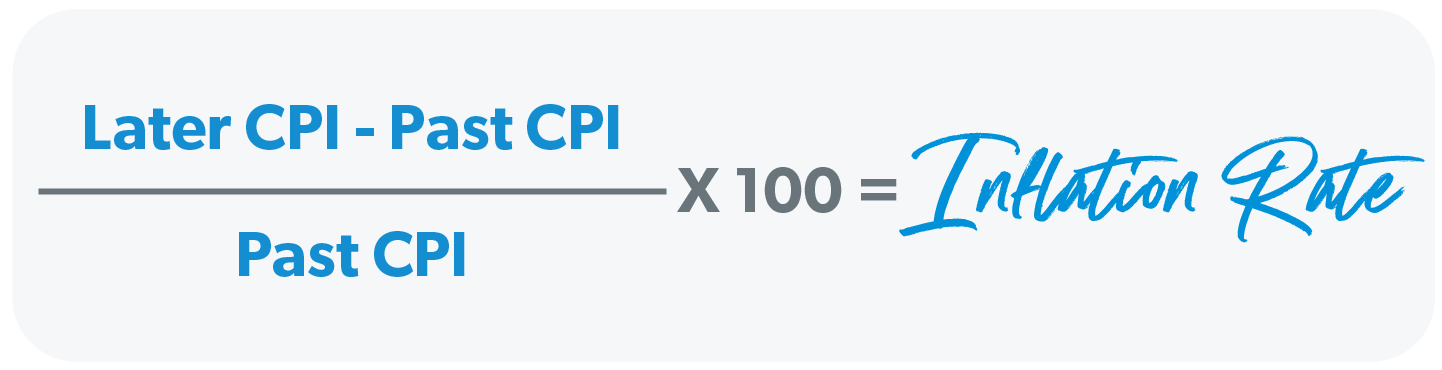

Now that we’ve covered economics, it’s time for the second class of the day—math. For this one, we’ve got to go back to the Consumer Price Index and use a formula (ugh). But don’t let that scare you. It’ll all make sense in a second. Ready? Let’s do some math:

Uh . . . say what now?

All right, it’s time to put that crazy-looking formula into a real-world example. Let’s say a gallon of gas cost you $1.55 in 2000 and cost you $2.25 in 2020. How can you know how much the inflation rate was over those 20 years? Buckle up, we’re going to do some math.

Here’s how you can know what the inflation rate was: $2.25 - $1.55 = $0.70. Now divide $0.70 by $1.55. You get about $0.45. Now multiply that by 100 and you get 45. That means the inflation rate on a gallon of gas between 2000 and 2020 was 45%.

And if you’re just itching to crunch some more inflation numbers or take a walk down memory lane, the U.S. Bureau of Labor Statistics has just the calculator for you. You can punch in the date of your choice and see how much money then would be worth now. Fun fact: $1 in 1951 had the same buying power as $12.39 has now. That means that whatever $12.39 will buy you at a store nowadays would’ve only cost you $1 back then. Crazy!

How Do Interest Rates Affect Inflation?

Mortgage interest rates were crazy low back in 2020—but how does something like that affect other things long term? It might sound kind of strange, but the Federal Reserve’s lowering of these interest rates actually plays a part in inflation.

When interest rates are low, the economy usually grows, but that can also cause prices to go up. That means people are usually okay with borrowing money (bad idea), and they feel more comfortable with spending too. Because of that, more money flows through the economy when interest rates hang out at a lower rate.

The opposite happens when interest rates rise. When interest rates are higher, people buy less, the economy slows down, and inflation drops (in theory). Think about it: When interest rates on homes are higher—there aren’t as many people lined up to buy them, right? And with higher interest rates, people tend to save and invest more because their rates of return go up too. With fewer people spending their money, the economy slows down and inflation chills out.

So, whose job is it to handle this delicate little balancing act? The Fed. They have to have a close watch on the Consumer Price Index and Producer Price Indexes to try to keep the economy steady around the ideal inflation rate of 2%.5

Now, the Fed doesn’t set interest rates for consumer loans. Instead, it sets the federal funds rate—that’s the rate that banks charge each other for short-term loans. And the federal funds rate influences the interest rates for government bonds and all kinds of loans, like mortgages, credit cards and student loans.

How to Protect Yourself Against Inflation

If you’re sitting there thinking, Well, great, this sounds all doom and gloom, think again. What can you do to shield yourself from inflation? Plenty.

1. Stay calm.

When people start talking about inflation, it seems like everyone wants to fill up every container they own with gasoline, start collecting gold, panic-buy yeast for baking, and stick their cash under their mattress. Whoa there, pal. Slow down, breathe and take it easy. We can’t stress this enough: You can prepare without panicking. And the first step here is just keeping your cool.

2. Budget.

Inflation or not, you’re still in control of your money. Armed with a budget, you’ll be able to make sure your money is going toward the right things while being able to find places where you can cut back your spending.

On the not-so-fun side of things, if you’re noticing the prices of things like food and gas rising in your area, then you’re going to need to adjust your budget too. (Did that loaf of bread go from $2 to $3? Yep, been there.) That way, you’ll know exactly how much you’re working with and won’t be in for any surprises.

Let the budget be your guide as you look for places to cut back so you can beef up your grocery cash to cover that dadgum expensive milk. Maybe you’re not traveling right now or not having to pay for your kid’s ballet class for the next few months. Whatever it is—be on the lookout for it.

3. Save.

If you’re feeling that pinch and want to save even more, look for ways to lower your grocery bill or save money on gas. Doing something as easy as having a simple meal at home a couple nights a week can save you big money on groceries. Maybe it’s finally time you switch over to generic brands or carpool into work. And if you find great deals on canned food and things you can stock your pantry with (that you’ll actually use), then go ahead and stock up on food. Just make sure you’ve budgeted for that before you head into the grocery store. That way, you already know exactly what you’ll spend and won’t get swept up into the panic-buying (toilet paper circa 2020, anyone?).

4. Invest.

Like it or not, inflation is a thing. If you retire in 20 or 30 years, it’s pretty much a guarantee that the cost of a loaf of bread, tank of gas and cup of coffee will have gone up by then. The best way to protect yourself against inflation (that’s bound to happen) is to invest your money—the sooner the better. But remember, if you still have debt (other than your mortgage) and don’t have an emergency fund sitting pretty, you need to take care of both of those things first. The sooner you take care of all of that, the sooner you can invest and get to work on your long-term goals.

Get a Pro in Your Corner

So, what is inflation? Well, it’s definitely something you can combat—you just need the right tools.

Ready to go to battle against inflation? Start by having a solid investment plan. And no—that doesn’t mean stuffing cash under your mattress. Make sure you connect with a SmartVestor Pro to talk through all your investing options. They’ll give you the right kind of advice and insight you need to protect yourself against inflation in the future. Make sure you get the most bang for your buck when it comes to investing.