Let’s be real: Keeping your kids entertained on a budget can be hard. (Have you seen the price of movie theater snacks lately?)

That’s why I’ve put together a massive list of free things to do with your kids. Yep, free!

From art projects and outdoor games to online learning and local activities, here are 101 fun things to do with kids that won’t cost you money.

Free Things to Do With Kids Under 5

Free Things to Do With Kids in Kindergarten and Elementary School

Free Things to Do With Kids in Middle and High School

Free Things to Do With Kids Locally

Free Things to Do With Kids Outside

Free Things to Do With Kids Inside

Free Things to Do With Kids Under 5

1. Make this simple ball-ramp game.

2. Play free online games featuring Elmo, Daniel Tiger and more with the PBS KIDS app.

3. Learn the ABCs with Post-It Match—a DIY name-recognition activity.

4. Watch astronauts read children’s books from space.

5. Sign up for Dolly Parton's Imagination Library, and any of your kids 5 years old and under will receive free books in the mail each month (check to see if it’s available in your area).

6. Do an alphabet walk—just look for things that start with each letter.

7. Create a sensory play experience—you can fill plastic bottles with water and glitter, Ziploc bags with paint and shaving cream, or bins with sand, dry pasta or bubbles.

8. Play a sorting game where kids sort their toys by color, size or type.

9. Go on a walk or drive and count things like trees, dogs or cars.

10. Try ice painting.

Free Things to Do With Kids in Kindergarten and Elementary School

11. Create your own spelling tests or choose from dozens at Spelling Training.

12. Plant a snack garden in your backyard. (You can get free seeds from your local library and use old coffee grounds as soil.)

13. Use the Novel Effect app to add music, sound effects and character voices to children’s books for a totally new story-time experience.

14. Use old shoeboxes to create dioramas of scenes from their favorite stories or places.

15. Play free educational games personalized to your child’s learning level with the Khan Academy Kids app.

16. Get moving with YouTube fitness channels for kids like DannyGo!, Cosmic Kids Yoga and Brain Breaks with Coach Corey Martin.

17. Make your own musical instrument—you can create shakers from a jar of rice, drums from pots and pans, or a guitar from a tissue box and rubber bands.

18. Play make-believe by setting up a pretend store, kitchen, stuffed-animal clinic or school.

19. Put on a puppet show with sock puppets or shadow puppets.

20. Host a storyteller hour where kids read aloud to their stuffed animals or dolls.

I'm Glad When I Can Share

Free Things to Do With Kids in Middle School and High School

21. Learn a new language with Duolingo.

22. Use code-breaking and geography skills with these awesome Carmen Sandiego work sheets.

23. Choreograph a dance to a favorite song.

24. Check out these fun science experiments to try.

25. AP students can prep for their courses with fun quizzes and study guides for every subject.

26. Learn how to code with Scratch.

27. Make jewelry or friendship bracelets.

28. Host a video game tournament.

29. Watch an age-appropriate documentary together and discuss.

30. Pick a topic and have them debate a side. (For example: Does pineapple belong on pizza? Are cats or dogs better? Is cereal a soup?)

Free Things to Do With Kids Locally

31. Have a picnic in the park.

32. Go to the library (find out when story times are).

33. Head to a local playground.

34. Visit a museum (many offer free admission for kids on certain days).

35. Go to the zoo (ask your library for free tickets).

36. Cool off at a splash pad.

37. Feed ducks at a pond. (FYI: Oats, frozen peas and cracked corn are better for the ducks than bread.)

38. Go geocaching (there’s a free app).

39. Tour local historic sites.

40. Attend vacation Bible school at a local church.

41. Check out free building workshops for kids at Home Depot and Lowe’s.

42. Volunteer—help a neighbor, clean up a park, organize a toy drive, serve meals at a food bank.

43. Look for free events happening in your area.

Free Things to Do With Kids Outside

44. Go on a nature walk or hike.

45. Go camping in your backyard.

46. Bird-watch.

47. Do a scavenger hunt.

48. Play a sport (soccer, basketball, kickball, frisbee).

49. Ride bikes.

50. Skateboard or roller-skate.

51. Set up a hammock.

52. Create an obstacle course or relay race.

53. Blow bubbles.

54. Collect flowers or leaves to press.

55. Wash the car (fun for them and one less thing for you to do).

56. Draw with chalk on the sidewalk or driveway.

57. Start a backyard campfire.

58. Play nature bingo.

59. Lie on a blanket and find shapes in the clouds.

60. Fly a kite.

61. Take the dog on a walk.

62. Paint a rock and leave it for someone to find.

Free Things to Do With Kids Inside

63. Have a dance party.

64. Host a movie marathon (complete with costumes, trivia and fun snacks).

65. Watch live video feeds of pandas, giraffes, elephants and more from the San Diego Zoo.

66. Have a reading challenge (you could even create a cozy reading corner).

67. Build a fort out of cardboard boxes.

68. Play a board game (or find a printable board game online).

69. Bake cookies.

70. Learn to play an instrument.

71. Play Kahoot! with the whole family.

72. Make a collage from old magazines.

73. Print out these educational work sheets for every grade level.

74. Play “don’t let it touch the ground” with balloons.

75. Declutter and choose items to sell or donate.

76. Rearrange a bedroom.

77. Write and perform a play.

78. Do a trivia competition.

79. Play hide-and-seek or freeze tag.

80. Put together a talent show.

81. Create your own comic book.

82. Build things with Legos.

83. Do a puzzle (or create your own).

84. Put on a fashion show.

85. Have a joke-off.

86. Write letters to a friend or family member.

87. Have a paper airplane competition.

88. Call a grandparent or relative.

89. Learn a magic trick.

90. Draw or paint.

91. Decorate an old T-shirt.

92. Turn helping around the house into a game.

93. Listen to audiobooks.

94. Do a poetry reading.

95. Have a “fancy” candlelight dinner and practice table manners.

96. Make your own playdough or slime.

97. Get creative with the hilarious Combination Man drawing game.

98. Help cook a meal.

99. Print out coloring pages or word searches.

100. Fill a bowl or jar with other fun activity ideas and pick one at random.

101. Host your own podcast-style interview. If you need some ideas of what to ask, get the Questions for Humans: Parents and Kids cards! This deck includes 55 fun, silly and thought-provoking questions for kids ages 5–12 (and their parents). You’ll laugh, learn something new about each other, and—most importantly—spend some quality time together.

Don’t Forget Your Budget!

As you can see, there are plenty of fun children’s activities that won’t break the bank. But for all the things that actually cost you money (childcare, school lunches, karate class), having a monthly budget is key!

A budget is simply a plan you make for your money.

It helps you cover the essentials and add in the fun extras. And when you know exactly where your money is going, you can spend less time stressing and more time having fun with your family.

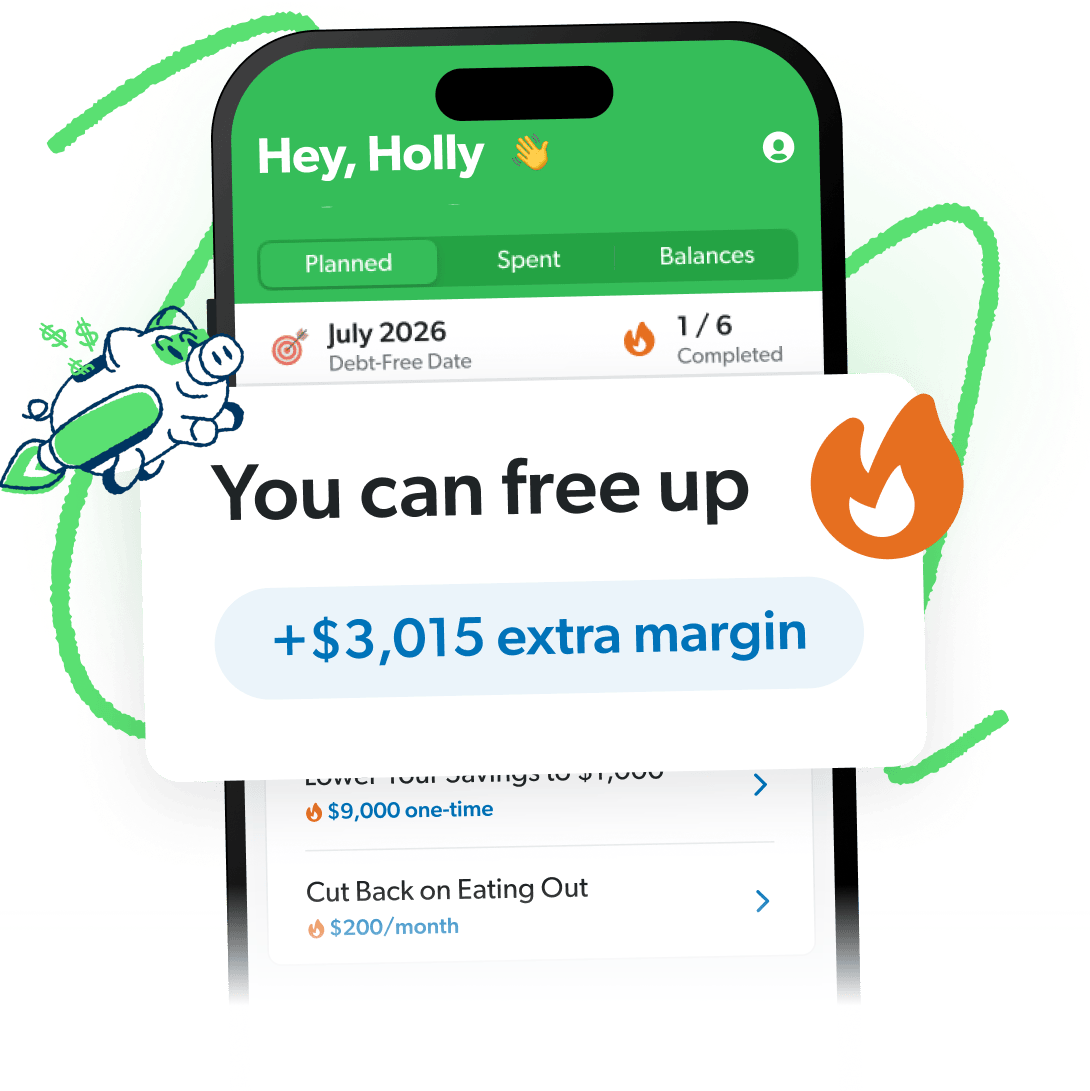

Put More Breathing Room in Your Budget

Money feeling tight? Not anymore. The EveryDollar budgeting app helps you free up thousands of dollars you didn’t know you had—in minutes.