Key Takeaways

- If it costs more to repair your car than the car’s worth, that’s usually a sign you should replace it. But depending on the kind of car and your budget, fixing your car might be the better choice.

- Whether or not you should repair or replace your car comes down to car value, repair cost, repair frequency, safety and the current car market.

- If you decide to repair your car, you should shop around, fix what you can yourself, and decide what can wait.

- If you decide to replace your car, be sure to choose used over new, pay in cash, and save up for the car you want.

Has your car been in the shop more than in your driveway lately? Are you tired of sinking money into your ride, only for it to keep breaking down?

Get expert money advice to reach your money goals faster!

It can be hard to know if you should fix your car or buy a new one. But when is it not worth repairing a car? While it mostly comes down to your car’s value vs. repair costs, you still need to consider your budget and the current car market.

When Is It Not Worth Repairing a Car?

As a general rule, if the repair costs are more than the value of the car, you should probably replace your car. But that’s not always the case. Depending on the kind of car you have and your budget, you might be better off fixing your car instead of buying a new one. Clear as motor oil, right?

The truth is, there are multiple factors to consider when deciding if your car is worth fixing or if you should sell it—including:

- Car value

- Repair costs

- Repair frequency

- Safety

- Current car market

Car Value

First things first: Find out how much your car is worth—both if you did make repairs and if you didn’t make repairs. Sites like Kelley Blue Book or Edmunds are good places to start. You’ll plug in the year of your car, the make and model, the mileage, and what condition it’s in to get an estimate of what it could sell for.

So, let’s say you’ve got a 2014 Honda Civic with about 100,000 miles on it. In good condition, your car would be worth about $7,000. But you won’t get that much out of the same car with the same miles if it needs a new transmission.

Knowing your car’s value before you put the money into it, as well as how much the repairs could increase the value, helps you see if you should shape it up or ship it off.

Note: If you currently owe more on your car than it’s worth, you’ve got an upside-down car on your hands. In that case, you’ll want to sell your car before you get even further underwater.

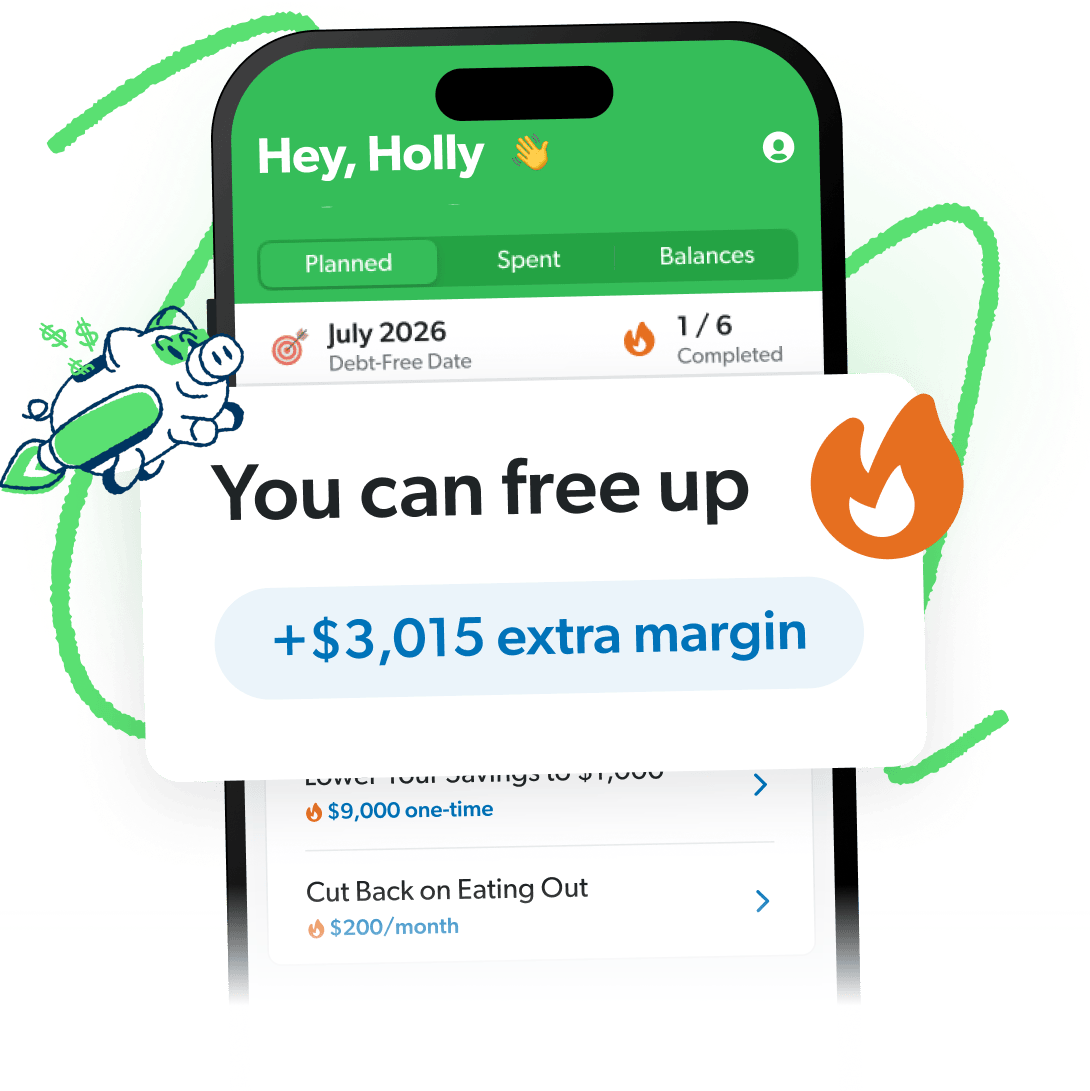

Put More Breathing Room in Your Budget

Money feeling tight? Not anymore. The EveryDollar budgeting app helps you free up thousands of dollars you didn’t know you had—in minutes.

Repair Costs

Once you know the value of the car, you need to know the cost of repairs. Call around and get an estimate of how much it would cost to fix your current car—including parts and labor. If the total cost of repairs ends up being more than the value of the car (even with the fix), that’s usually a sign to hold off on repairs and put that money toward another car.

Otherwise, find out from the mechanic how long the repairs will last you. Would it be a temporary fix or a more permanent repair? You don’t want to shell out a couple grand if you’ll only get another month out of the thing, but you may be able to extend the life of your car for a lot longer than you think.

Let’s go back to our Honda example: It costs about $4,000 to replace a transmission, and that repair would keep the car going for quite a while longer.1 So, in this case, it makes sense to make a $4,000 repair for a car that will be worth at least $7,000. You could choose to sell it or drive it, but either way, you aren’t losing money.

And keep in mind, if you drive an expensive car with pricey parts or one that’s harder to work on (we’re looking at you, fancy foreign cars), your repair costs will probably be higher than average. So, do the math and decide if it’s worth keeping your ride or if you can trade it in for something that’s less high-maintenance.

Repair Frequency

Another thing to consider is how often you’re taking your car into the shop. All cars need routine maintenance every now and then, but nobody wants to be nickel-and-dimed to death. If you’re spending $500–700 every couple of months on a car that’s only worth $7,000, getting another car is probably the smartest choice.

So, do your research to know what repairs are normal for your vehicle and when to expect them. You can also check car forums online to see how long your make and model usually lasts and if other owners think certain repairs are worth paying for (they’ll definitely tell you). Brands like Toyota, Honda and Lexus are known to last a long time with regular upkeep (even over 200,000 miles)—so it might be best to hold onto one if you have it.

But if you’re at the mechanic’s so often that they stock the Keurig with your favorite coffee brand—or you’re on the side of the road more often than a dead armadillo—you should consider what these repairs are really costing you in time, money and headaches.

Safety

Obviously, safety is a huge priority. But is your car actually unsafe to drive or are you using safety as an excuse to get a new car? Faulty transmissions, busted taillights, bad brakes or steering problems definitely need to be fixed. But just because your car is older or has more miles on it, doesn’t mean it’s necessarily unsafe.

Ultimately, if you’re really worried about safety, a good mechanic will let you know of any serious concerns and whether or not they can be repaired.

Current Car Market

While paying for car repairs can be frustrating and expensive, finding a replacement car in your price range can be even more of a hassle. Depending on current car availability and cost, you could end up spending way more to buy a car right now than if you’d made repairs to your ride and waited.

No one wants to pay a $700 repair bill, but that one-time cost looks way better than the $738 a month (the average new car payment) if you financed a replacement vehicle!2

The last thing you want to do is rush in to buying a car you can’t afford. So, keep an eye on the market and do what makes sense for you and your budget right now. That could mean fixing your current car to last a little longer while you save up, or upgrading your car now if you have the money to spend.

If You Decide to Repair Your Car

Shop around.

Like momma told you, you better shop around—especially when it comes to car repairs. Don’t accept the first quote you’re handed. Get the initial diagnosis from a trusted dealership or a larger mechanic shop, but don’t assume their price is the price. The majority of your cost is probably not parts but labor. And it’s almost always higher at larger, more established shops.

To find a reliable mechanic for a lower price, ask a few friends where they go for trustworthy work. Then call around to find the best price. While you’re on the phone, ask about any current discounts and specials they might offer too.

Fix what you can yourself.

Maybe you need new brakes, but you also need to replace a door handle that came off. Why not get the brakes fixed at the shop and find a replacement for your door handle online? Then watch a YouTube video on how to install it. Obviously, know your own skills and limits here, but the more you can do yourself, the more you’ll save.

Decide what can wait.

If the estimated repair is still out of your price zone, ask the mechanic what needs to be fixed now and what can wait a few months. Don’t skip important safety features like brakes, tires and timing belts. But you can live without automatic windows or a working sound system while you save up the money.

If You Decide to Replace Your Car

Choose used over new.

We know it’s tempting to want a shiny new ride with a warranty, but the last thing you want is to chain yourself to that monthly $738 new car payment.

Because here’s the deal: It’s better to choose a used car over a new one. New cars depreciate (or drop in value) much faster than used cars—60% in the first five years!3 And just because a car is new, it doesn’t mean it won’t need its own share of repairs. In fact, according to J.D. Power, newer cars are “becoming more problematic” because the quality is declining (especially for cars with higher tech).4 So, your fancy new ride might have you in the shop more often than you’d like.

Plus, a used car doesn’t automatically mean crappy quality. You can still find a reliable used car—even in today’s market—that won’t have you at the mechanic every week. You just need to do your research and know where to look.

Pay in cash.

You may think car loans are the only way you can afford a car. But the truth is, car loans cost you way more in the long run than if you’d pay for a car outright.

For example, if you financed a $25,000 car at 11.93% (the average interest rate for a used car), you’ll pay over $33,000 when all is said and done—not to mention, you’ll be chained to a car payment for five years.5

And remember, all cars need repairs and maintenance. But with a car loan, you’ll have a monthly car payment and repair bills on top of that. Ouch! Your best bet is to buy your car with cash (the money you already have, plus whatever you get from the sale of your current car). That way, you own the car, rather than it owning you.

Save up for the car you want.

If you don’t have enough money right now to buy the car you want, you just need to be strategic in how you save up. Start by buying a car you can afford with the cash you have on hand—let’s say it’s $5,000. That can get you around for at least 10 months or so. Then take $738 (again, the average new car payment) and save it every month.

After 10 months of doing that, you’ll have built your car-buying budget back up to over $7,000. Add that to the cash you get from the sale of your current car (let’s say you get $4,000 for it), and you have over $11,000 for a new ride. That’s a major upgrade in car in just 10 months—without owing the bank a dime! See, it can be done.

Repair or Replace: You Still Need a Budget

Listen, no matter what kind of car you’ve got, you’ll have to spend money on it. Gas, routine maintenance, savings to replace it one day . . . and it’s all easier when you plan that spending (and any other spending) with a budget.

A budget helps you cover all your regular monthly expenses. And if an unexpected expense pops up during the month (like a flat tire), you can adjust your budget to cover the cost.

That’s why we made the EveryDollar budgeting app! EveryDollar helps you find extra margin every month so you can start making real money progress, really fast.

Just download the app, answer a few questions, and we’ll build you a personalized plan, based on your situation, to free up margin and make the most of every dollar. Every day. (See where we got the name?)