Key Takeaways

· A money order is a secure, prepaid form of payment that acts like a check—but instead of the money coming out of your account when the recipient cashes it, it comes out of your account as soon as you buy the money order.

· It’s often used for transactions where cash or personal checks are not accepted.

· To fill out a money order, you need to include the recipient’s name, your information, a memo (if needed) and your signature.

When you’ve got bills to pay or you want to make a big purchase, a money order can be a great option to use as a form of payment. Like a check, a money order is a piece of paper that tells your bank how much to pay someone. But instead of the bank taking the money out of your account after you write the check, the funds for a money order are prepaid. That means the money comes out of your account as soon as you buy the money order.

Get expert money advice to reach your money goals faster!

That’s the biggest reason people like to get paid by money order—there’s no chance it will bounce. The person you’re paying knows you’re “good for the money.” It’s also more secure for you since you’re not carrying around big wads of cash or handing over your debit card info to buy something off Craigslist!

How to Fill Out a Money Order

Buying and filling out a money order is pretty simple. You can buy one for a small fee at banks, post offices or grocery store customer service counters. Ever heard of a little neighborhood market called Walmart? Yep, they sell money orders too . . . and they’re cheap! Wherever you go, you‘ll simply ask the cashier for a money order. Then tell them how much money you’d like to add to it. Money orders have a funding limit of $1,000—and some places cap it at $500—so if you’re buying something that costs more than that, you’ll need multiple money orders to cover the cost (or you can get a cashier’s check from your bank).

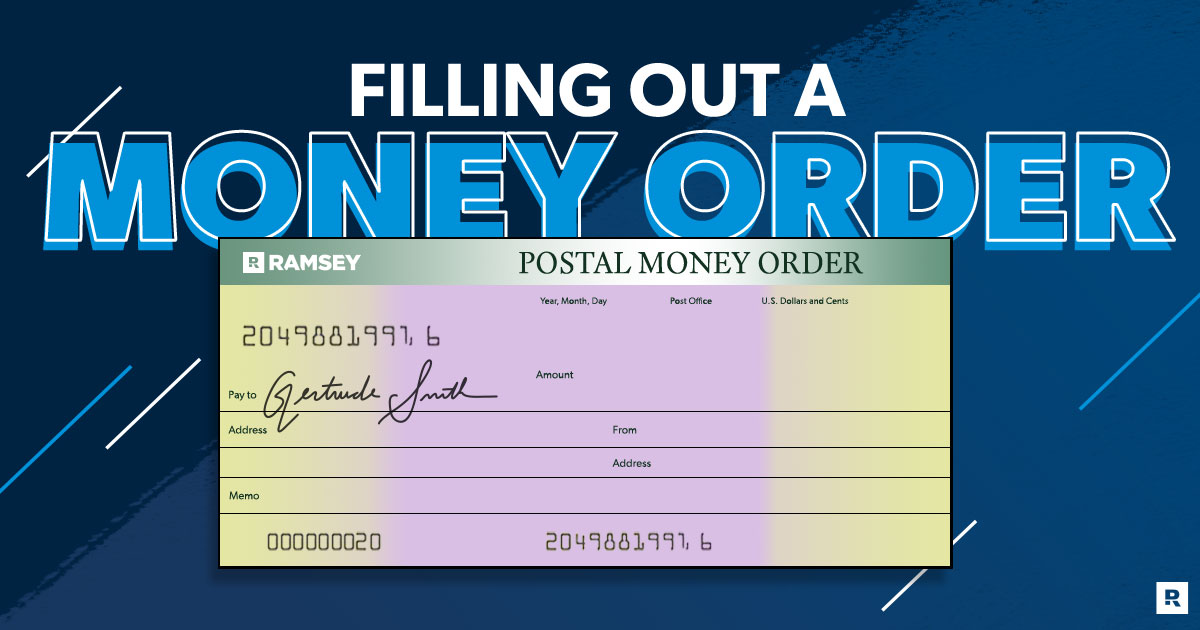

Now comes the important part—how to fill out a money order once you purchase it.

1. Address the money order in the pay to line.

Make sure the name of the person or business you’re paying is spelled correctly so they can cash or deposit the money order right away. There’s no autocorrect or spell-check here, so take your time to get it right.

2. Fill out the purchaser or from section.

Write your full name and current mailing address in this spot. Your money order will note the exact information you need to add.

3. Include extra details.

If your money order has a memo or notes section, list the purpose for the money order—like “dining table” or “rent.”

4. Sign the bottom of the front of the money order.

This certifies that the money order is ready to be cashed out. Don’t sign the back of the money order, though. That’s where the person you’re paying signs so they can cash or deposit the payment.

Wasn’t that simple? There’s just one more thing you need to do: Save your money order receipt. Your money order has a detachable section you keep for your records. It’s your proof of purchase, and it includes tracking information you can use to confirm when the money gets deposited.

More Margin Means More Money in the Bank

In just minutes, the EveryDollar budgeting app helps you find margin you didn’t know you had—you’ll feel like you got an instant raise!

When to Use a Money Order

If they work almost the same way as a check, when does it make sense to use a money order? Money orders are handy when you want to pay a bill (like rent) or make a significant purchase—like a piece of furniture or new appliance—in a safe and secure way. Housing and utility companies or people who sell things or provide services might request a money order instead of cash, debit cards or personal checks. That’s because money orders are prepaid—they’re guaranteed to clear when they’re deposited.

Money orders are also super secure once they’re filled out because they don’t show any of your private banking information. When they’re addressed to a specific person or business, it’s hard for thieves to tamper with the document. (Money orders aren’t entirely immune to fraud, though. If you lose a money order that hasn’t been filled out yet, a sneaky thief can fill in the information and cash it for themselves. But in general, there’s smaller risk of tampering because of the built-in document privacy.)

Let’s say you’re buying an authentic mid-century modern dining table for $300 from a little old lady on Craigslist. (First, I applaud you for your excellent taste. Second, that dining table is a steal.) Sweet Mrs. Gertrude hasn’t discovered the supersonic speed of Venmo’s digital bank transfer yet, so she requests a money order. That’s okay—it’s no trouble on your end to pay her with a slip of paper that’s equal to cash and is guaranteed to deposit without technical difficulties. In total, this purchase will cost you about $301.65 and five minutes at the post office or grocery store to get that money order. That includes the fee for the money order itself, plus the money to pay for your dining table. This method might be a little old school, but it’s trustworthy, and it works!

Frequently Asked Questions (FAQs) About Money Orders

Money orders are easy to use, but you might still have some questions. So, here are some answers to common money order questions.

How much do money orders cost and how do I buy one?

Money orders will run you anywhere from $0.70 at a drugstore or convenience store to $5 at your bank. It just depends on where you buy it and how much money you’re wanting. You can use cash, coins, debit cards and traveler’s checks to buy your money order, but not a personal check or credit card.1

Where can I cash a money order?

Money orders purchased in the U.S. can be cashed at any post office location and just about any bank. If you have a question about where your money order can be cashed, it’s best to call your bank or the money order issuer.

Can I send money orders to other countries?

You sure can! You can send a money order to some international countries with the MP1 Direct Exchange Money Order. It’s the only international money order offered by the United States Postal Service.2

What’s the money order limit?

The limit for a single domestic money order is typically $1,000.3 International money order limits depend on the country—but cap out at $700.4

What money order should I use?

See what your neighborhood convenience store, grocery store or post office offers—you might be able to knock out an errand and pick up your money order at the same time. If you’re looking for a speedier money order option, MoneyGram orders are filled out the same way as a traditional money order, but transfers can be deposited by the recipient within 10 minutes. This service has a higher fee for each transfer, but it could be worth the extra cost if you need to send money quickly. You also can’t go wrong the standard money order brands like Western Union.

How do I cancel a money order?

If a money order gets lost or stolen or you want to cancel the payment before it gets cashed, there are a few steps to take. First, always save your receipt! It has steps for canceling the money order. If you don’t have the receipt, you’ll need to contact the original issuer. You may need to visit the location where you bought the money order to show your I.D. and fill out cancellation paperwork. They’ll need details like who the money order is addressed to and the date when it was purchased. Unfortunately, there will be a cancellation fee. The amount depends on where you bought the money order.

What’s the difference between a money order and a cashier’s check?

Money orders and cashier’s checks are both prepaid forms of payment. The biggest difference between the two is cashier’s checks can be used for higher payment amounts than money orders, but they also cost a little more to buy.

Pros and Cons of Money Orders

If you’ve still got some questions about the pros and cons of using money orders, check out this handy-dandy chart for a quick rundown.

|

Pros |

Cons |

|

Money order deposits can be tracked. |

They can only be bought in person. |

|

You can buy a money order with cash. |

Money orders have a small purchasing fee. |

|

Money orders can be used in other countries. |

You’ll need multiple money orders for large payments. |

|

Payment is guaranteed when money orders are deposited. |

If you lose a money order, you also lose your money. |

|

They’re easy to find and purchase at the post office, banks and other financial institutions. |

An empty money order can be addressed to the wrong person if it gets into the wrong hands. |

No matter where you’re at with money, you can get better. That’s why we made the EveryDollar budgeting app!

EveryDollar helps you find extra margin every month so you can start making real money progress, really fast. Just download the app, answer a few questions, and we’ll build you a personalized plan, based on your situation, to free up margin and make the most of every dollar. Every day. (See where we got the name?)