Okay, I know thinking about taxes can make you want to take a nap and not wake up till April’s over (believe me . . . I’d rather do anything else, including go to the dentist). But like it or not, taxes are unavoidable, and you’ve got to arm yourself with knowledge so you don’t end up in trouble with Uncle Sam.

Getting your tax filing off to a good start all comes down to getting your federal tax withholding set up just right on the front end. That way, you don’t risk overpaying the government throughout the year, or underpaying and getting hit with a hefty bill later!

So, what’s the deal with federal tax withholding? Glad you asked! Let’s dive into what you need to know.

What Is Federal Tax Withholding?

Basically, federal tax withholding is where your employer takes a certain amount of money out of each paycheck for taxes and sends it to the federal government on your behalf. The amount withheld from your paycheck depends on how much money you make and how you fill out your W-4.

Get expert money advice to reach your money goals faster!

Why does this matter? Well, when tax season comes around and you finish filing, you’ll either get a refund or owe additional taxes. A lot of people think getting a nice big refund check is like getting free money.

Nope! All a big tax refund means is you’ve been loaning the government your hard-earned cash interest-free. All. Year. Long. Um, yeah . . . that’s a hard pass for me.

You want to go for the Goldilocks approach. Follow me here: Too much withheld and you’re giving Uncle Sam money without earning any interest. Too little withheld and you’ll end up owing the government money. You want your withholding to be just right so you break even when tax time rolls around. If you haven’t recently, check with your employer to make sure you’re withholding just enough to cover your tax obligations (I’ll show you how to do that below).

How Does Tax Withholding Work?

Here in America, everyone who earns an income is supposed to pay income tax to the federal government (and your state if you live in one with a separate income tax)—whether we like it or not.

When you start a new job or have a major life change, like getting married or having kids, you’ll need to fill out a W-4 form. This form tells your new employer how much money to take out of your paycheck for taxes.

How to Fill Out a W-4

Filling out a W-4 is nothing to stress about. There are basically five steps, or sections, you’ll need to complete. Some of these steps might not apply to you right now, but it’s still good to know what each section means in case you need to make changes later.

Here’s what you’ll fill out:

- Step 1: Write down your personal information. Fill in your name, address, Social Security number, and expected filing status (single, married filing jointly, married filing separately or head of household).

- Step 2: Note if you have multiple jobs or a working spouse. Additional income from a working spouse, second job or side hustle can affect how much you should withhold. Follow the directions on this step to make sure you’re not withholding more or less than you need.

- Step 3: Claim dependents and other credits. This is where you’ll claim your dependent tax credits to lower your withholding and keep more money in your paycheck (thank you, child tax credit!).

- Step 4: Make other adjustments. Here’s where you can adjust your withholding for income not from jobs (like investment income), deductions other than the standard deduction, or extra money you’d like withheld for taxes.

- Step 5: Add your signature. Sign it, date it, and you’re done!

Remember, you don’t want too much taken out of your paycheck—just enough to let Uncle Sam know you’re doing your due diligence.

How to Determine Your Federal Tax Withholding

Getting your W-4 just right is easier than you might think. You can figure out the right amount of tax withholding a couple of ways.

Divide up last year’s taxes.

If your tax situation hasn’t changed much since last year’s filing, you can always take a look at what you owed last year and divide that by 12 to determine how much you should be withholding from your check every month.

Do a mock tax return.

If you want to be super thorough (or if you’ve had a significant change in your finances in the last year) make a mock tax return. You can do that for free with any online tax software, and it’ll tell you exactly what you’ll owe. Once you’ve got that amount, divide it by 26 (if you get paid every two weeks) or by 24 (if you get paid twice a month).

For example, if your federal tax bill will be $4,000, divide that by 24 ($4,000/24 = $167). You’ll need $167 to come out of each paycheck to break even on your taxes—assuming your income stays the same all year.

When to Update Your W-4

You should update your W-4 when something major has happened in your life that affects your finances. We all know life changes all the time, and sometimes overnight!

Did you buy a home, get married, or have a baby? Life events like these affect your tax bill. You should update your W-4 right away so your withholding is as spot-on as possible. Take a look at the last year and see if there’ve been any major changes in your life.

If you’ve got one, take a look at your tax refund (or tax bill).

Okay, let’s say you didn’t have any major life changes last year and for the last few years you’ve gotten a $3,000 refund. You’d want to adjust your W-4 so you don’t get a refund. Why? Because getting a $3,000 refund means an extra $250 is coming out of your pocket each month throughout the year. Think that could make a big difference in your monthly budget or your debt snowball? Heck yes!

Check and change your W-4.

Alright, guys—so you figured out you need to make some adjustments to get your withholding set up just right (remember, Goldilocks style). The next step is to get a copy of your current W-4.

Luckily, it’s pretty easy to get ahold of your W-4. Reach out to your payroll department (or whoever handles payroll at your job)—they should have it on file. If your job uses an online payroll service, you might be able to log in and take a peek at your W-4 that way.

After looking it over and deciding what to adjust, you can download and fill out a revised W-4 form from the IRS website to give to your employer.1 You can change your W-4 whenever you want, so there’s really no reason to put off any adjustments after a major life change.

Do Taxes the Right Way

Okay, I know. All this is a lot to keep in mind—and yes, there’s some math involved. But you don’t have to dig through the numbers alone! If you got a big refund or tax bill last year and can’t figure out why, ask a RamseyTrusted tax pro for help. They can make sense of your personal tax situation and guide you toward getting your W-4 right on the money (literally) so you can win with taxes.

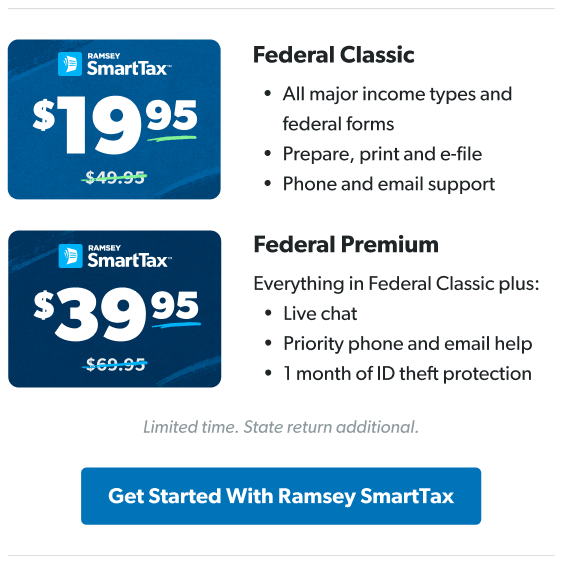

But let’s say you got your withholding right and have a simple tax return. You should check out Ramsey SmartTax. It’s easy-to-navigate tax software that’s affordable, so you can file your return with confidence. No hidden fees, no advertisements, no games. That’s how it should be.