Everything You Need to Know About Investment Fees

10 Min Read | Apr 28, 2025

Key Takeaways

- Investment fees are charges investors pay to use certain financial products and services.

- Investment fees cover important costs to ensure your investments are managed well, but they can also have a big impact on your investment performance over the long run.

- Most kinds of investment fees are structured as either one-time charges (flat fees) or recurring fees that are charged as a percentage of the funds in your investing account.

- When deciding which investment fees are worth paying, look for the long-term value of the investment and the overall cost of the fees, and what your expected return will be.

If you’ve bought just about anything lately, you’re probably very familiar (and fed up) with fees . . . you know, those sneaky little charges that lurk just below the surface of your purchase.

Market chaos, inflation, your future—work with a pro to navigate this stuff.

Take airline tickets, for example. You might think you got the deal of the century on that flight to the Caribbean (pristine beaches and two inches of extra leg room? Sweet!).

But then the fees start piling up. Want to check in an extra bag? There’s a fee for that. Oh, you want more pretzels? Whack. That’s another fee right there. Sometimes you even have to cough up a few extra dollars to borrow a blanket (if they still have those onboard)!

When it comes to investing, you’re going to run into investment fees too. It’s just a fact. Many folks are confused or blindsided by how these investment fees work, and sometimes that confusion keeps them from investing at all. It doesn’t have to be this way!

Let’s discuss everything you need to know about investment fees so you can invest with more confidence.

What Are Investment Fees?

Investment fees are charges investors pay to use certain financial products and services. Some common investment fees include loads (which are basically sales commissions on the stocks you buy), management fees, advisory fees, broker fees, and trading fees.

As a general rule, investment fees are structured in one of two different ways:

- Ongoing fees: These recurring fees are charges you incur on a regular basis, like a quarterly or annual account maintenance fee. Ongoing fees are usually charged as a percentage of the funds in your account.

- Trading fees/transaction fees: These are one-time transaction charges that work like a flat fee (for example, some investment platforms will charge you $2 for every trade).

Paying a small investment fee here and there might not seem like a big deal, but over time they can have a big impact on your investment performance. That’s why it’s so important to understand how your fees are helping or hurting the long-term value of your investment.

Types of Investment Fees

There are a lot of investment fees to look out for, and many of them are just flat-out confusing. You’re not the only one wondering, What in the world is a 12b-1 fee?

We’re going to cut through some of the confusion right here. Let’s take a closer look at a few of the most common fees you’ll come across when you start investing for retirement in your IRAs and 401(k)s.

Loads (Sales Commissions)

When you put money into your Roth IRA, you’re actually buying shares in a mutual fund. The investing pro you’re buying those shares from will get a percentage of the money you invest, otherwise known as a load. In exchange, you get to work with a pro who can help you pick investments for your portfolio.

So whenever you see the word load, just think of a sales charge or a commission. That’s the load. And there are three types.

- Front-end load: When you invest in a mutual fund with a front-end load, you are charged when you put money into your retirement fund. So if you invest $1,000 in a mutual fund that has a 5.75% front-end load, you’ll pay an up-front fee of $57.50 and your initial investment will be reduced to $942.50.

Many investors hate the idea of paying around 5% of their investment for up-front commission. But there are a couple of reasons front-end load funds might be a good idea, especially for retirement planning. First, it’s a one-time expense, so the value of your investment grows without being bogged down by expensive fees. And second, as your investment increases in value over time, the commission has less impact on the overall cost of owning the fund.

- Back-end load: Back-end loads are charged when you take money out of your retirement account. The catch is that these loads often have higher fees that you have to pay regularly.

Here's A Tip

Pro tip: If you see contingent deferred sales charge (CDSC) in your statement or the fund’s prospectus, that’s just a really fancy term for a back-end sales load.

- No-load: With a no-load fund, you aren’t hiring an investing pro, so you don’t have to pay commission . . . and that might seem more attractive at first. No commission means more money saved, right? Only in the short-term. But no-load funds can cost you big time in the long run:

- No investing pro means no one to help you select funds with good track records and no one to navigate the market with your financial goals in mind.

- Some no-load funds’ yearly maintenance fees will make you wish you’d paid commission instead. They’re based on the value of your fund, so as the value of your fund increases, so can your fees. And isn’t increasing the value of your funds kind of the whole point of investing?

- No investing pro means no one to help you select funds with good track records and no one to navigate the market with your financial goals in mind.

Advisor Fees

We mentioned it above, but when you invest in mutual funds, you’ll either pay your investing pro through a load (commission-only advisors), advisor fee (fee-only advisors), or some combination of both (fee-based advisors).

If your pro charges an advisor fee as part of their payment structure, it might show up as an assets under management fee. Under this arrangement, fees are charged each year as a percentage of how much money your pro manages for you.

For example, if you have a balance of $500,000 in your Roth IRA, and your investing pro charges a 1% assets under management fee, then you’ll pay $5,000 in fees. The good news is, most of the time the fee rate goes down as the balance of your account goes up.

Just a heads up: The industry is gradually shifting away from funds with front-end loads to funds with advisor fees, so it might be easier to find funds structured this way.1

Expense Ratios (Annual Fund Operating Expenses)

Now that you’ve paid your investing pro, you need to help cover the costs of running the mutual fund. That’s where the expense ratio comes in. It will show up on your statements as a percentage of your investment account balance.

So, if your fund has an expense ratio of 1% and you have $1,000 in your account at the end of the year, you’ll pay $10. Simple, right?

When you look at the prospectus for your mutual fund, you’ll see several fees that make up the expense ratio:

- Management fees: The stocks that make up your mutual fund didn’t end up there by accident. There are a bunch of professional nerds—led by a portfolio manager—who make sure that only the best investments make the cut. These fees help them manage the fund well.

- Distribution and service (12b-1) fees: These fees pay for the fund’s marketing costs—how much it takes to promote the fund.

- Administrative fees and operating costs: These cover things like salaries for the fund’s managers, record keeping and research.

Some funds are more expensive to run than others, which will impact how high or low the expense ratio is.

Transaction Fees/Trading Fees

Every time you buy, sell or exchange shares of a stock or ETF, you’ll be charged transaction fees (also called trading fees). Depending on the platform and services used by your broker, you could pay anywhere from less than $5 to more than $20 as a transaction fee. Yikes!

If you’re day trading or stock trading, these transaction fees can pile up quickly and take a big bite out of your investment performance over the long run. They’re just one more reason we recommend sticking with good growth stock mutual funds.

Make an Investment Plan With a Pro

SmartVestor shows you up to five investing professionals in your area for free. No commitments, no hidden fees.

Ramsey Solutions is a paid, non-client promoter of participating pros.

How Fees Impact Your Investment

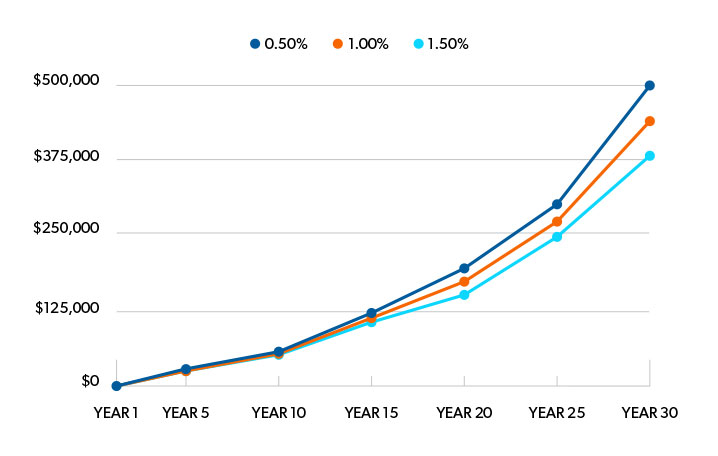

So, exactly how big of a deal are fees when it comes to investing? While a 1% difference in fees might not look like much, it could make a difference down the line. Here’s how.

Let’s say you have $25,000 saved in a retirement account with an 11% average annual rate of return and you don’t put in another penny for the next 30 years.

If you paid a 0.5% fee on your account balance each year, your retirement savings would grow to $500,000. Bump those fees up to 1% and you would end up with $436,000. That’s still pretty good!

But what would happen if you paid 1.5% in fees each year? In that case, you would finish with $380,000 after 30 years.

Fess do matter to an extent, but they're not the only thing that matters. Don't get so fixated on finding the funds with the lowest fees that you end up stepping over dimes to pick up pennies. You want to find funds with a strong track record over a long period of time. That's why you need an investment pro to help you stay focused on the big picture!

How Do I Decide Which Investment Fees Are Worth Paying?

Just because a mutual fund has low fees doesn’t mean it’s a good fund. That’s just one piece of the puzzle, and you need to look at the big picture.

1. Look for the value.

Does the thought of paying around 5% commission up front make you a little uncomfortable? We get it.

But that up-front commission pays for an investing pro’s in-depth knowledge of the thousands of mutual funds out there. It’s a small price to have someone who’s got your back—someone who can teach you about your investment options and get you closer to your retirement dream.

So don’t get tunnel vision trying to find the cheapest fees. Look for a fund that has a reasonable expense ratio with a long-term track record of excellent returns and good management in place. That’s a winning combination!

2. Focus on the long term.

As an investor, you might be better off paying a higher commission up front and having lower ongoing fees. It may cost you a lot to get started, but the ongoing fees are usually lower than no-load or back-end load funds. That’s perfect for long-term investments.

Plus, you’re paying your advisor up front—for their time and expertise—to help you choose your funds and maintain your retirement plan over the next several decades. That in itself is a great investment!

Are some good no-load funds out there? Sure, and you can mix a few of them with your other mutual funds. But without the advice of a pro, owners of no-load funds are likely to jump in and out of those investments, and that will bring down their rate of return. If you invest in a no-load, you'll have to discipline yourself to stay invested long term.

3. Understand your overall cost.

To understand the value of what you’re purchasing, you need to look at what your fees cost and what you’re gaining in return. That means you need to have a conversation with your investing pro. Ask them to break down your fees into a percentage and dollar figure so you can see where your money is going and how it’s getting there.

Work With an Investing Pro

Okay, are you still with us? We know that was a lot to take in. If you need help figuring out which fees are part of your investment portfolio, our SmartVestor program can connect you with an investment pro.

They’ll be able to show you how investment fees are impacting your retirement savings and help you work toward your retirement goals. Don’t try to navigate this alone. Even we get help from the pros.

Next Steps

- Want to get a better understanding of where you are with your investments today and how much money to save each month for the retirement you want? Check out our free R:IQ retirement assessment.

- If you’re not taking advantage of your 401(k) employer match, set up a meeting with your HR representative and discuss your options. A match is free money you don’t want to miss out on!

- Got questions about a specific fee on your statement? Connect with a SmartVestor Pro. They can look at all your fees and help you decide if the ones you’re paying are helping or hurting your investment in the long run.

Frequently Asked Questions

-

Who Charges Investment Fees?

-

Financial advisors, investment professionals and brokers all charge fees for the services they provide.

Some advisors charge a recurring commission (or load) for their services—they get a percentage of the funds you invest. And some are fee-only advisors, meaning they could charge you per hour or have a flat fee structure based on the services you’re getting.

Other advisors do a combination of both commission and fees as their payment structure. They might charge an hourly rate to sit down with you and create a tailored investing plan and a commission based on the funds they recommend.

Just keep in mind that fees can vary from one financial advisor or investing pro to another. It’s important to get a clear picture on what their fees are and how they’ll stack up over time before you agree to work with them, so don’t be afraid to ask for more information about their fees up front!

-

Why Am I Being Charged Investment Fees?

-

There’s a cost to doing business and investing in the stock market is no different. Whether you’re just starting out with your workplace’s retirement plan or you’ve been working with a financial advisor for years and have multiple IRAs and brokerage accounts, you’re using services and products that aren’t free.

That means when you put your hard-earned money into your IRA or 401(k), investment fees could take a big chunk out of those retirement savings if you’re not paying attention.

Don’t get us wrong. Investment fees aren’t all bad. They cover some important costs to help ensure that your investments are managed well. You just want to make sure you’re getting good value from your investments without letting excessive fees cut into your returns.

You should never invest in anything until you understand how it works. And that includes investment fees. Take some time to figure out what you’re paying for and how much it costs—no exceptions!

-

What fees come with a mutual fund?

-

Though you should never decide on a mutual fund based on fees alone, it’s important to understand the long-term impact of a fund’s fees and expenses. A small difference in fees can make a huge difference in your returns down the road.

There are two types of fees associated with mutual funds: ongoing fees and transaction fees. Under the "shareholder fees" section of the fund’s prospectus, you’ll find both the ongoing fees—which are included in the fund’s expense ratio (cost to operate the fund)—and the transaction fees.

Here’s a breakdown of what’s included in each:

- Management fee: This fee is what you pay to the fund manager or the team of investing professionals who make sure the fund achieves its investing objective and performs well. Typically, this fee falls between 0.5% and 2% of the assets being managed.

- 12b-1 fees: These fees pay for the marketing and selling of the fund. They’re capped at 1% of the fund’s assets and are paid directly out of the fund.

- Miscellaneous: These include accounting fees, audit fees, as well as recordkeeping and legal fees.

- Transaction fees: These include redemption fees, sales charges and trading fees.

We know that’s a lot to remember, and it can get confusing. That’s one of the reasons we recommend you work with an investment professional. These pros can explain the details and your options in easy-to-understand language.

-

My 401(k) fees feel pretty high. Should I Still Invest in my Employer-sponsored Retirement Plan?

-

If you’re looking at all the fees on your 401(k) statement and wondering if it’s worth it to invest in your workplace retirement plan, the answer is . . . yes!

A 401(k)—with an employer match and the tax savings involved—is still the best way to kick off your retirement savings strategy. If your employer offers a match on your 401(k) contributions, that means you’re getting free money. Don’t miss out on that just because of a few investment fees.

This article provides general guidelines about investing topics. Your situation may be unique. To discuss a plan for your situation, connect with a SmartVestor Pro. Ramsey Solutions is a paid, non-client promoter of participating Pros.