Find one near you for free, and navigate the ups and downs of the market with the help of an investing pro.

Ramsey Solutions is a paid, non-client promoter of SmartVestor Pros. Learn more.

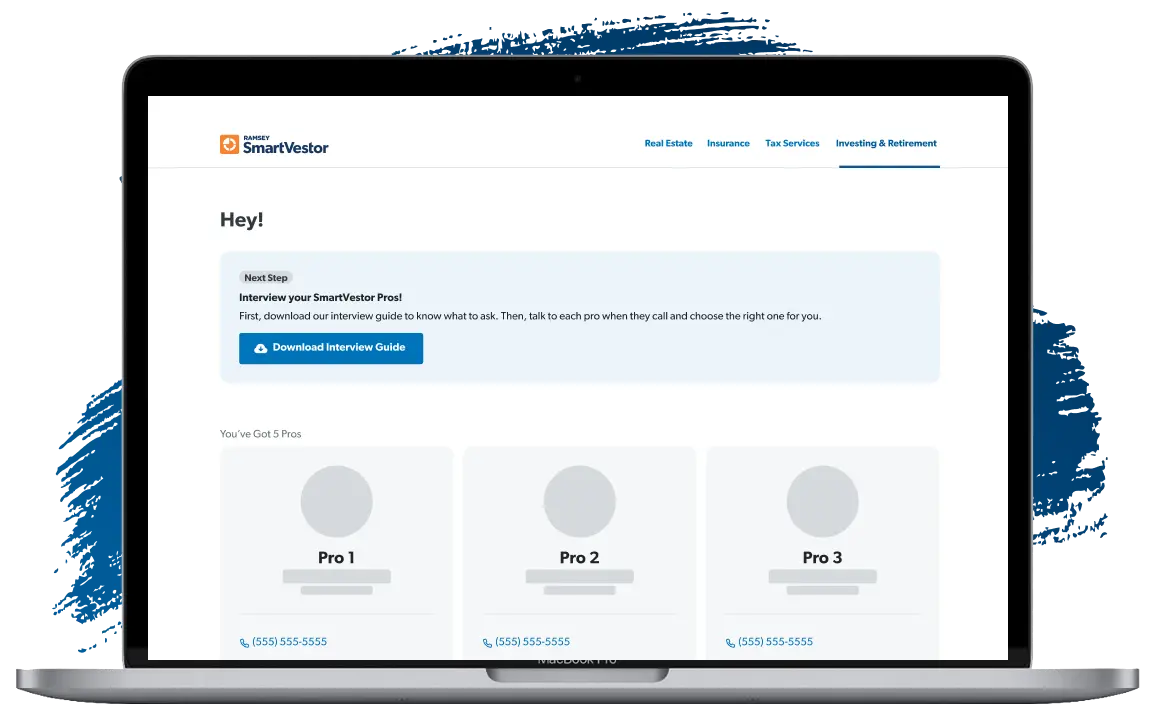

Get Ready to Talk With Your Pros

Once you share your info on the SmartVestor Pro request form, you can expect up to five pros to reach out to you pretty quickly. Responsiveness is just one of their awesome qualities!

And to help you start the conversation, we’ve put together an interview guide. It has some questions to ask and space to rank the pros. And when you’re done, you choose the one you want to work with and get started.

What is the SmartVestor Program?

SmartVestor is a referral program that connects you with investment professionals who value serving over selling. The program was created over 20 years ago by financial expert Dave Ramsey and his team. Since then, SmartVestor has helped millions of people find pros who are committed to extraordinary customer service.

What Sets SmartVestor Pros Apart?

They lead with the heart of a teacher. You deserve to leave every meeting with your advisor feeling smarter and more empowered than when you went in.

They guide instead of intimidate. While a SmartVestor Pro can offer you custom advice based on your goals, they keep you in the driver’s seat.

They know Ramsey values. These investment professionals believe in the Ramsey mission of helping people work toward financial peace.

What Needs Do You Have?

These are some of the ways a SmartVestor Pro can help:

-

Get a whole-picture perspective of your financial goals and support for each step of the journey.

-

Get clear on your options, ways to diversify your portfolio, and complex investing concepts.

-

Learn how to use a Roth IRA, 401(k), traditional IRA or other accounts to your advantage.

-

Have a large nest egg? Get help to invest and protect it––and leave a legacy for those you care about.

-

Learn the ins and outs of college savings plans, like timing, eligible costs, investment options and taxes.

-

Make a plan for your family’s future and the wishes you want carried out after you pass away.

Be sure to discuss your needs and goals with a SmartVestor Pro—and ask questions—before you hire one. The services that one pro offers can be different from another. You should also know that the SmartVestor program itself doesn’t provide investing services or monitor the services that pros provide.

Find the Right SmartVestor Pro for You

When you interview pros, it’s good to have a few questions ready to help you choose between them. Here are four to get the conversation started:

What’s your investment philosophy?

How will you measure and evaluate my investment performance?

What services do you provide?

How will we communicate about my investments?

Once you complete the connection form, you’ll get a full list of questions you can ask.

What Does It Cost to Work With a Pro?

If you work with a SmartVestor Pro, there will be some type of payment for serving you as there would be with any other investing professional. This payment arrangement is directly between you and the SmartVestor Pro. They’re happy to answer any questions you may have.

There are typically three ways that SmartVestor Pros can charge for their services:

-

This is when you pay a portion of the money you invest—typically up front.

-

Charges can be an hourly fee, an asset-based fee, a flat fee or a retainer fee.

-

Some charge a combination of commission and fees.

Need More Resources and Info?

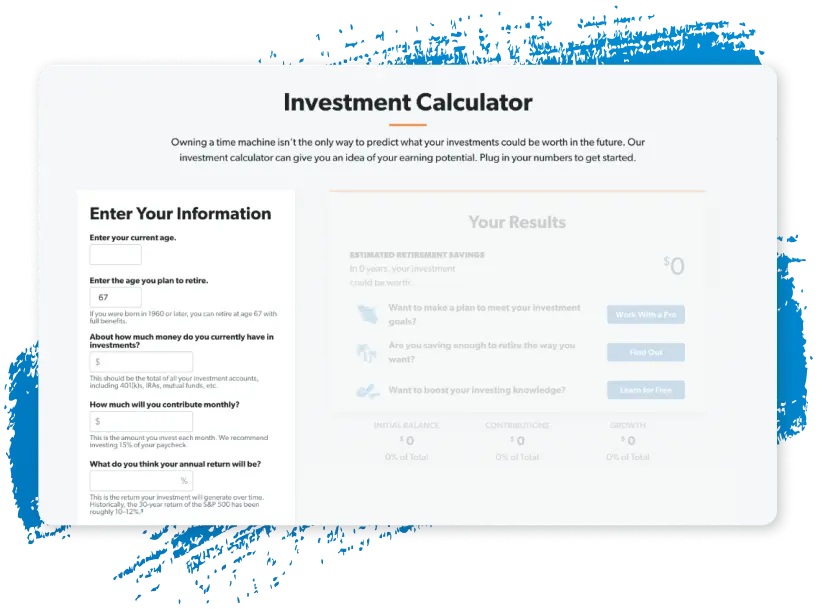

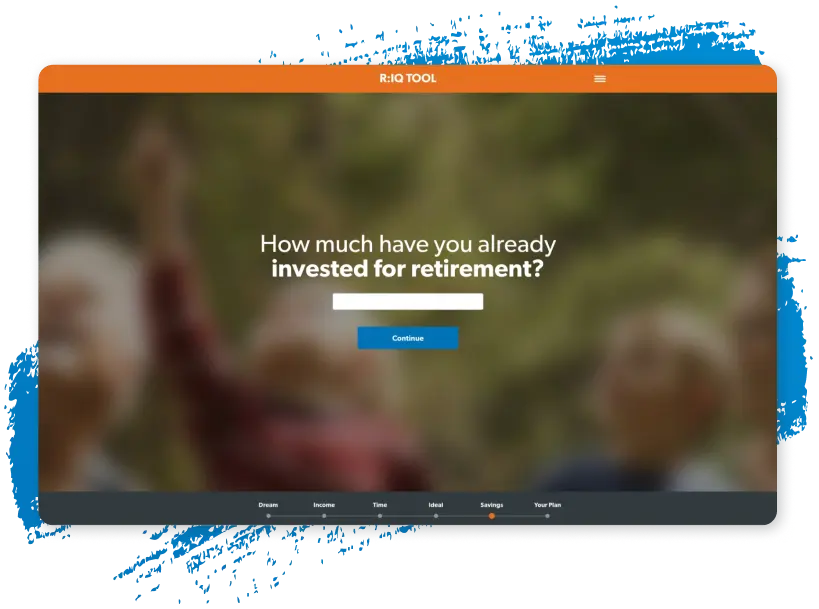

Not ready to reach out to an investing pro yet? Here are some educational resources that can help you too.

-

Calculate your investment growth over time.

-

See how much you could save for retirement.

-

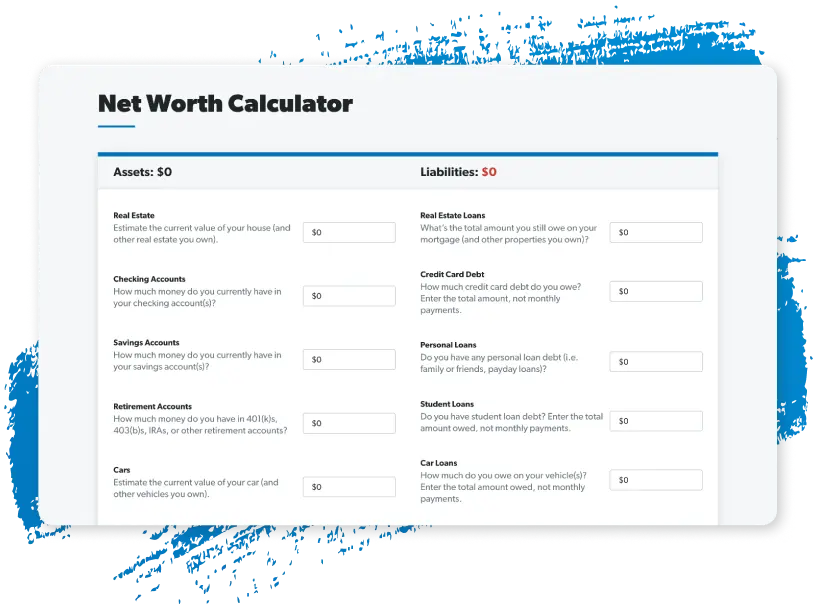

Calculate your net worth to see where you stand.

Have a Question?

We’re here to help! If you have a question about the SmartVestor program that’s not answered below, call 866.523.8473 or send us an email.

Become a SmartVestor Pro

Are you a registered investing professional interested in joining our SmartVestor program?

Share the SmartVestor Program

Common Questions (and Answers)

-

How much does SmartVestor cost?

-

Nothing, zilch, nada. SmartVestor connects you to SmartVestor Pros for free.

Each SmartVestor Pro pays a fee to participate in the SmartVestor program. These fees are paid regardless of whether you decide to hire a SmartVestor Pro and are not passed along to you. Also, pros can’t just get into our program by paying a fee. You can learn more about what we look for in SmartVestor Pros in the “requirements” question below.

-

What should I expect after I fill out the form?

-

If you choose to share your info, up to five SmartVestor Pros will contact you shortly. Wait . . . your phone is probably ringing right now—that’s how SmartVestor Pros work! When you talk to the pros, be sure to set up an appointment so you can interview them. Then, simply choose the SmartVestor Pro you want to work with.

If you decide to hire a SmartVestor Pro, you’ll enter into an agreement directly with that SmartVestor Pro (or their firm) to provide you with investment advice. SmartVestor does not monitor or control the investing services the SmartVestor Pros provide.

-

What can a SmartVestor Pro help me with?

-

A SmartVestor Pro can show you how to make the most of your investments and create a plan to help you reach your retirement or other financial goals. And when the going gets rough—think stock market swings—they’ll be the voice of reason that calms your nerves.

-

When should I start investing?

-

As a general guideline, we suggest you start investing after you’re out of debt (other than your mortgage) and after you’ve saved 3–6 months of expenses in an emergency fund. You should discuss your own financial circumstances and investment goals with the SmartVestor Pro you choose.

-

What are the requirements to become a SmartVestor Pro?

-

To join the SmartVestor program, the pros must:

• Work for investment advisors or broker-dealer firms that are not affiliated with Ramsey

• Have at least two years of experience as a registered investing professional

• Understand Dave Ramsey’s 7 Baby Steps and agree to our Code of Conduct

• Participate in ongoing coaching with us to help maintain our high standards of customer serviceThe SmartVestor program does not provide investment advice or try to match you with a pro based on your individual needs. And it does not evaluate pros’ investing skills or performance or provide training on investing matters.

It’s up to you to make sure you’re on the same page as your SmartVestor Pro about investing and to understand the performance of your investments.

-

Are SmartVestor Pros financial advisors?

-

The SmartVestor Pros you’re matched with can include financial advisors and other types of financial professionals like investment advisors, financial planners, wealth managers and more. You may even see other terms like CFP (Certified Financial Planner), RR (registered representative), IAR (investment advisor representative) and RIA (registered investment advisor).

Think of “financial advisor” as an umbrella term that can represent many types of pros. Not everyone goes by the same title. But all SmartVestor Pros can help you invest. And many have additional specialties to help you with other financial goals, like wealth management or estate planning.

Ramsey Solutions is not affiliated with any SmartVestor Pros and neither Ramsey Solutions nor any of its representatives are authorized to provide investment advice on behalf of a SmartVestor Pro or to act for or bind a SmartVestor Pro. Each SmartVestor Pro has entered into an agreement with Ramsey Solutions under which the Pro pays Ramsey Solutions a combination of fees. The fees paid by the Pros to Ramsey Solutions are paid irrespective of whether you become a client of a Pro and are not passed along to you. However, the presence of these arrangements may affect a SmartVestor Pro’s willingness to negotiate below their standard investment advisory fees, and therefore may affect the overall fees paid by clients introduced by Ramsey Solutions through the SmartVestor program. Please ask your SmartVestor Pro for more information about their fees.

Neither Ramsey Solutions nor its affiliates are engaged in providing investment advice. Ramsey Solutions does not receive, control, access, or monitor client funds, accounts, or portfolios. Ramsey Solutions does not warrant any services of any SmartVestor Pro and makes no claim or promise of any result or success of retaining a SmartVestor Pro. Your use of the SmartVestor program, including the decision to retain the services of any SmartVestor Pro, is at your sole discretion and risk. Any services rendered by SmartVestor Pros you contact are solely that of the SmartVestor Pro. The contact links provided connect to third-party sites. Ramsey Solutions and its affiliates are not responsible for the accuracy or reliability of any information contained on third-party websites.

SmartVestor™ is an advertising and referral service for investment professionals operated by The Lampo Group, LLC d/b/a Ramsey Solutions (“Ramsey Solutions”). When you provide your contact information through the SmartVestor site, Ramsey Solutions will introduce you to up to five (5) investment professionals (“Pros”) that cover your geographic area. Each Pro has entered into an agreement with Ramsey Solutions under which the Pro pays Ramsey Solutions a combination of fees, including a flat monthly membership fee and a flat monthly territory fee to advertise the Pro’s services through SmartVestor and to receive client referrals from interested consumers who are located in the Pro’s geographic area. Each Pro may also, if applicable, pay Ramsey Solutions a one-time training fee.

The fees paid by the Pros to Ramsey Solutions are paid irrespective of whether you become a client of a Pro and are not passed along to you. However, you should understand that all of the Pros that are available through SmartVestor pay Ramsey Solutions fees to participate in the program. Further, the amount of compensation each Pro pays to Ramsey Solutions will vary based on certain factors, including whether the Pros choose to advertise in local or national markets. Ramsey Solutions has a financial incentive to present certain Pros that offer their services on a national basis (“National Pros”) more often than other National Pros that pay lower fees.

It is up to you to interview each Pro and decide whether you want to hire them. If you decide to hire a Pro, you will enter into an agreement directly with that Pro to provide you with investment services. Ramsey Solutions is not affiliated with the Pros and neither Ramsey Solutions nor any of its representatives are authorized to provide investment advice on behalf of a Pro or to act for or bind a Pro. Ramsey Solutions introduces you to Pros that cover your geographic area based on your zip code. Neither Ramsey Solutions nor its affiliates provide investment advice or recommendations as to the selection or retention of any Pro, nor does Ramsey Solutions evaluate whether any particular Pro is appropriate for you based on your investment objectives, financial situation, investment needs or other individual circumstances.

No investment advisory agreement with a Pro will become effective until accepted by that Pro. Ramsey Solutions does not warrant any services of any SmartVestor Pro and makes no claim or promise of any result or success by retaining a Pro. Your use of SmartVestor, including the decision to retain the services of a Pro, is at your sole discretion and risk. Any services rendered by a Pro are solely that of the Pro. The contact links provided connect to third-party websites. Ramsey Solutions and its affiliates are not responsible for the accuracy or reliability of any information contained on third-party websites. Each Pro has signed a Code of Conduct under which they have agreed to certain general investment principles, such as eliminating debt and investing for the longer-term, and, if applicable, have completed Ramsey Pro Training. However, Ramsey Solutions does not monitor or control the investment services the Pros provide.