The Basics of Investing: Planning for Retirement

Benjamin Franklin once said, “By failing to prepare, you are preparing to fail.” Unfortunately, many Americans are preparing to fail when it comes to having enough money saved for retirement.

According to The State of Personal Finance, 6 out of 10 Americans (60%) feel behind on their retirement savings goals and more than half of Americans aren’t currently investing for the future. That’s a problem!

Ready or not, retirement is coming. You have to prepare for it! So, without further ado, here are the basics of investing for your retirement future.

1. Invest 15% of your gross income for retirement.

More than anything else (including the investments you choose), studies have shown that your savings rate is the top factor that will determine retirement success.2 It’s really simple: You can’t build wealth if you’re not saving enough for retirement.

That’s why we recommend you invest 15% of your gross income for retirement. The 15% rule will help you build a nest egg over time while still giving you room to work toward other important financial goals—like your kids’ college funds and paying off your home early.

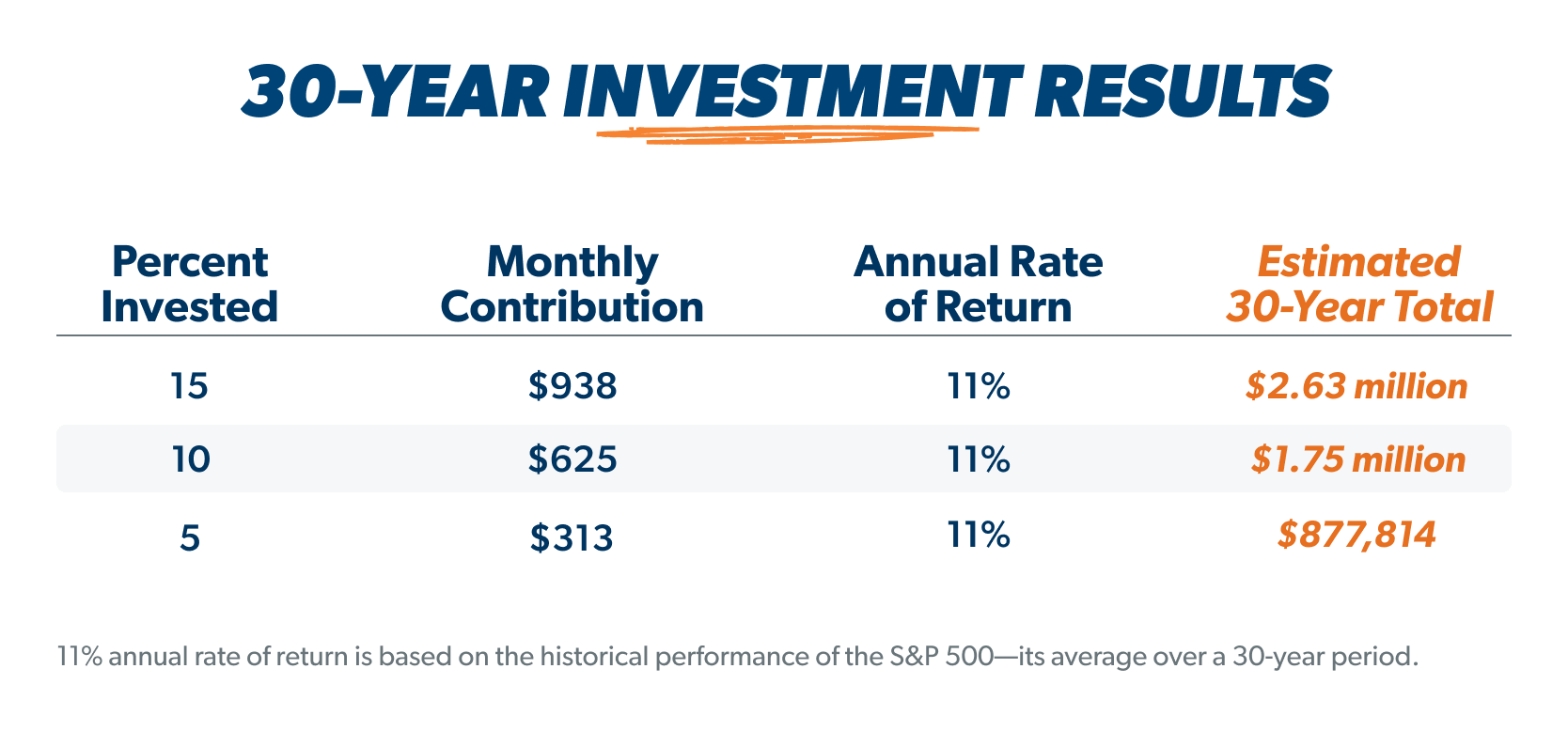

If you invest 15% of a $75,000 household income from age 35 to age 65, you could have a $2.6 million nest egg by the time you retire (assuming an 11% average annual rate of return). And that’s if you never get a raise in 30 years!

2. Take advantage of tax-advantaged retirement accounts.

Save for retirement and get a nice tax break? Sign us up! Workplace retirement plans and individual retirement accounts (IRAs) both offer tax advantages that will fire you up to save for retirement, and they both have a place in your retirement investing plan. Here’s how they work.

Workplace Retirement Accounts

Workplace retirement accounts like a 401(k), 403(b), or Thrift Savings Plan are the backbone of your investing strategy. They let you invest thousands of dollars every year for retirement and many employers offer a match on your investment, which is basically free money.

They also make it very easy to automatically save for retirement since your contributions are deducted directly from your paycheck. Plus, they come with some pretty sweet tax advantages (either tax-deferred growth or tax-free growth and withdrawals—more on that in a minute).

Workplace retirement plans also have higher contribution limits that allow you to save more for retirement each year. But the one drawback is that these plans usually come with a limited menu of investment choices that could lead to slim pickings of solid mutual funds to invest in.

Roth vs. Traditional: Which One Is Better?

With IRAs and most 401(k)s, you have a choice between a traditional account or a Roth account. It’s true, they both come with sweet tax advantages—but we have to give the edge to the Roth. Here’s why.

Traditional IRAs and traditional 401(k)s allow you to fund your retirement with pretax dollars, which means you don’t pay income taxes on the money you put into your account. That lowers your taxable income, giving you a break on your taxes now. That’s great and all, but it means you will have to pay taxes on your withdrawals in retirement (and that includes whatever investment growth you earn). When you hear someone talk about “tax-deferred growth,” that’s what they mean.

Roth IRAs and Roth 401(k)s, on the other hand, let you save for retirement with after-tax dollars. You pay income taxes on the money that goes into your account today, but that means you get to enjoy tax-free withdrawals in retirement. That’s a win-win! Side note: If you have a Roth 401(k), your employer contributions are not treated as after-tax. So, you will have to pay taxes on that money and its growth when you use it in retirement.

Whenever you get a chance to invest in a Roth account, take it! Not having to pay taxes on your withdrawals in retirement or on the growth of your investments pays off in the long run.

Workplace Retirement Accounts

Outside of your workplace retirement plans, you can also invest in an IRA, which allows you to save for retirement on your own.

The great thing about IRAs is that you get to choose from more mutual funds than you could from your workplace retirement plan. The account is also yours, which means you won’t have to worry about moving any money around whenever you change jobs.

If you’re a stay-at-home parent without a working income, don’t worry! You and your spouse can still have two separate IRAs between the two of you with a spousal IRA, which allows the nonworking spouse to set up a retirement account in his or her own name.

The contribution limits for an IRA are much lower than for workplace retirement accounts, so you won’t be able to invest as much money in your IRA as you can in your 401(k), but they still come with the same tax advantages: tax-deferred growth or tax-free growth and withdrawals in retirement. Which leads us to . . .

3. Remember, match beats Roth beats traditional.

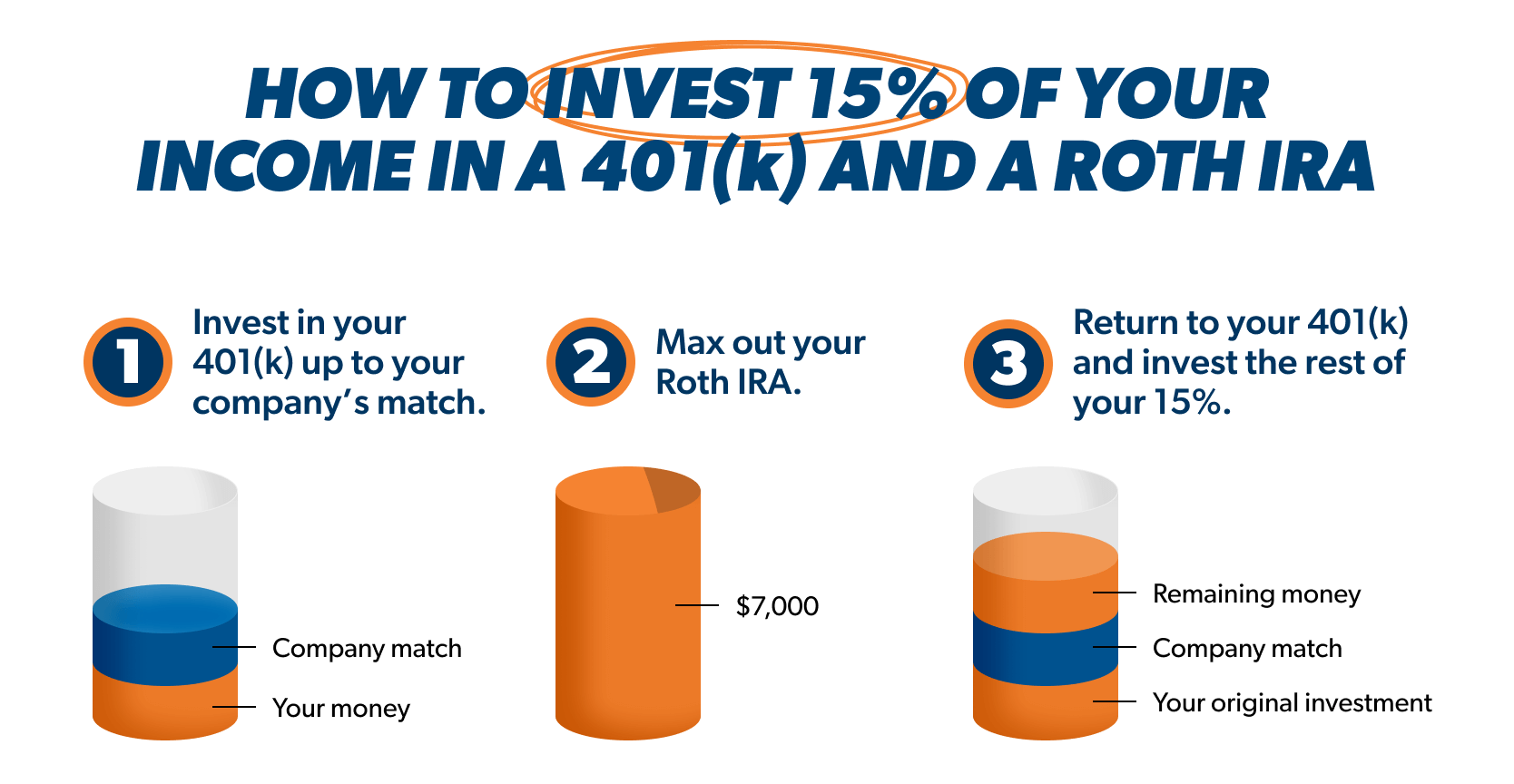

If you get an employer match at work, even if it’s a traditional account, that’s the first place to invest for retirement—it’s free money!

After the match, fund your Roth accounts. If you have a Roth 401(k) at work, great! You can invest your entire 15% there if you like your investment options. If not, then you can open up and max out your Roth IRA.

If you’ve contributed up to the match, maxed out your Roth IRA, and still haven’t hit 15%, go back to your workplace retirement account and up your contributions until you hit that mark. Voila! You’re now officially building wealth for your retirement!