Average 15-Year Fixed

Mortgage Rate

5.43%

-0.01 month over month

Stay on top of U.S. real estate trends so you can feel confident in your decisions—and make your home a blessing, not a burden.

These figures represent a month-over-month comparison from February 2026 to March 2026. Last update: March 8, 2026. Next scheduled update: March 16, 2026.

Sources: FRED® API, Realtor.com®, Freddie Mac and Fannie Mae.

Powered by AI—built on Ramsey principles.

-0.01 month over month

How Mortgage Rates Work (and How They Impact Your Payment)

Mortgage rates play a big role in your monthly house payment and the total amount you’ll pay over the life of the loan. A mortgage is a loan used to buy a home, and the interest is the cost of borrowing that money.

Here’s the math on that: Say you purchase a $423,000 home with a 5% down payment. If you take advantage of a 15-year fixed mortgage rate of 5.5%, instead of 6.5%, you could save:

Ramsey Guideline: Keep your mortgage payment at 25% or less of your take-home pay, using a 15-year fixed-rate conventional loan with a solid down payment. That’s how you own your home, without it owning you.

When you’re ready to buy, Churchill Mortgage can help you find a loan that fits your budget. Because the right mortgage shouldn’t just help you buy a house. It should give you peace of mind.

Expected rate by 2027

This is where mortgage rates could be by the end of the year. It’s smart to keep an eye on what experts are forecasting. But remember, rates can be as unpredictable as the weather.

If you’re financially ready, don’t let a small change (or the chance of a change) hold you back. Rates will always rise and fall, but what matters most is finding a home you can actually afford. You can always refinance later.

Where did we get this rate prediction?

This forecast comes from Fannie Mae, one of the largest players in the U.S. mortgage market. Their experts analyze housing, economic and mortgage trends, and they survey both lenders and consumers to predict where rates might be headed.

The key word here is might—because even with all that research, these are still educated guesses. Mortgage rate forecasts can be helpful, but they shouldn’t be the main reason you decide to buy or wait. Your own financial readiness should be the deciding factor.

Methodology: Fannie Mae publishes forecasts for 30-year mortgage rates, but we only recommend 15-year fixed-rate loans. To estimate a predicted 15-year rate, we start with Fannie Mae’s projected 30-year rate and subtract the average difference between 30-year and 15-year mortgage rates over the last 12 months using Freddie Mac data.

Example: 6.3% (Fannie Mae 30-year forecast) − 0.82% (12-month average spread) = 5.48% estimated 15-year rate.

+0.9% month over month

How Does the Housing Market Affect Listing Prices?

Home prices are driven by supply and demand:

Buying or selling a home is one of the biggest financial decisions you’ll ever make, so getting the price right matters. When you understand what’s happening in your local market, you’re far more likely to avoid overpaying or selling for too little and walk away with a great deal.

That’s where a RamseyTrusted® real estate agent comes in. They’ll help you price your home competitively, negotiate with confidence, and make smart decisions every step of the way.

-8 days month over month

What Do “Median Days on Market” Mean?

Median days on the market show how quickly homes are selling, and who has the advantage.

We pulled this data from Realtor.com by first grouping states into the four U.S. Census regions (West, South, Midwest and Northeast). For each region, we multiplied each state’s median listing price by its number of active listings, then added everything up and divided by the total active listings in that region. This way, states with more homes on the market have a larger impact on the regional price.

This product uses the FRED® API but is not endorsed or certified by the Federal Reserve Bank of St. Louis.

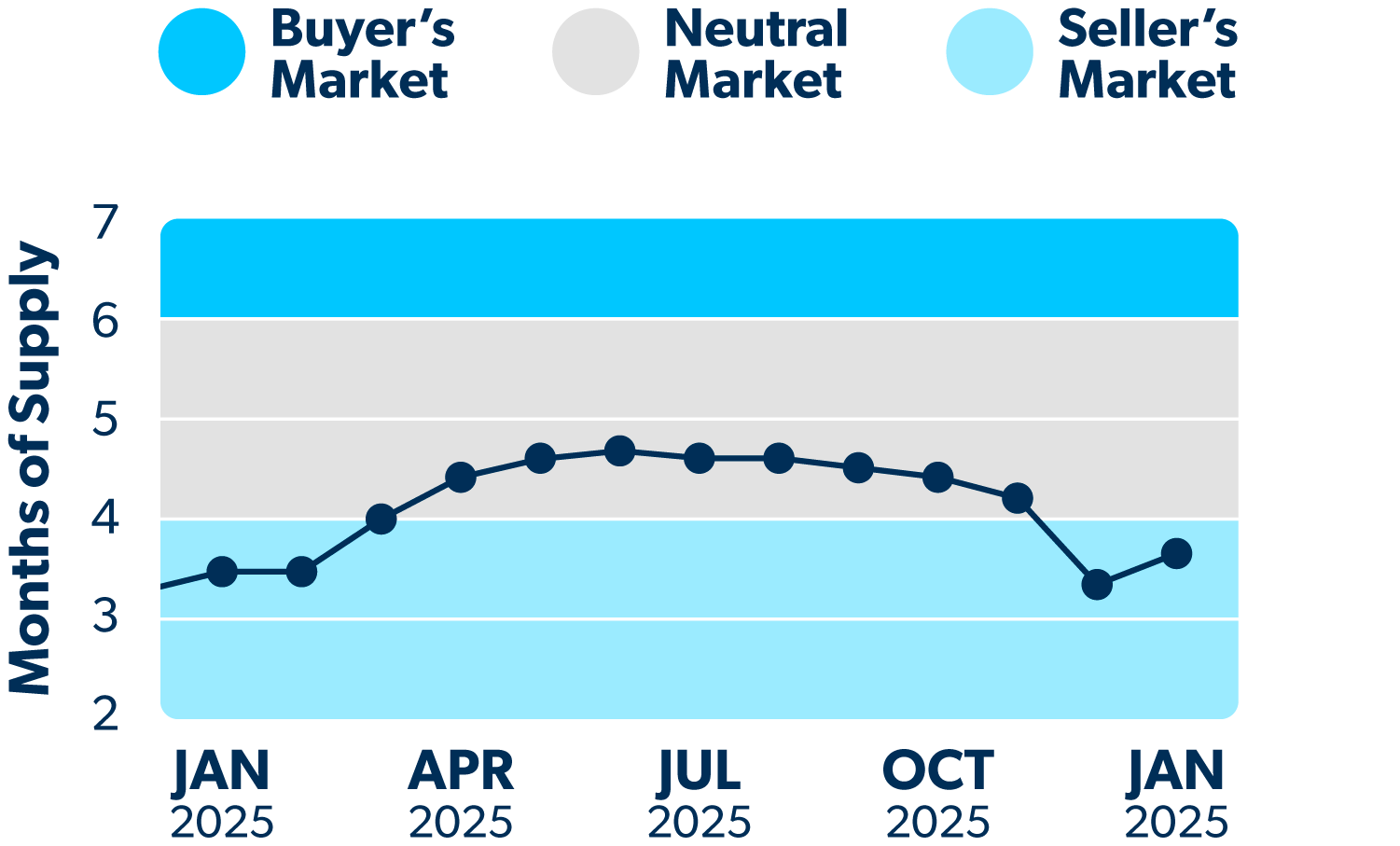

One easy way to tell if the market favors buyers or sellers is to check the months of supply. That’s how long it would take for all the listings on the market to get snatched up at the current sales pace. Learn more about buyer’s and seller’s markets here.

Last update: February 16, 2026. Next scheduled update: March 17, 2026. Source: National Association of REALTORS®, 2025.

You can buy or sell successfully in any kind of market. But the best time to make a move is when you’re financially ready. Whether it’s a buyer’s or a seller’s market shouldn’t drive your decision—but it can give you a good idea of what to expect. Let’s take a look.

Keep in mind, this chart is based on national data for existing homes. Conditions may be different in your local market depending on what you’re looking for. Want a clearer picture of your area? Connect with a local real estate agent you can trust.

Buying or selling a home doesn’t have to be complicated. Follow Ramsey Real Estate to hear from real people learning to buy or sell the Ramsey way. And get practical tips to take your next step with confidence.

Real estate is hard enough. Work with an experienced agent to navigate changing markets. Try RamseyTrusted.