Everything You Need

to Do Real Estate the Ramsey Way

Find the pros, tools and resources you read about in Dave’s real estate book.

Tools and Resources

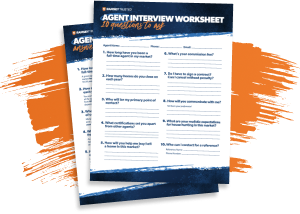

Work With a RamseyTrusted Agent

When you work with a top real estate agent who’s earned the RamseyTrusted shield, you’ll have a pro in your corner to help you crush your goals. And connecting with them is free—our favorite price tag.

Frequently Asked Questions

-

What type of mortgage makes the most sense for my situation?

-

A 15-year fixed-rate conventional mortgage is the only kind of loan we ever recommend at Ramsey. It keeps you on track to pay off your house fast and has the lowest total cost. Other types of mortgages, like FHA, VA and 30-year loans, keep you in debt for decades and cost you tens or even hundreds of thousands of dollars more in the long run. No, thanks!

-

What is title insurance—and do I really need it?

-

Title insurance is like a financial shield that protects you when buying a house—and yes, you need it. Here’s why: Some bozo who can prove legal claim to the house might pop up out of nowhere to sue you even after you buy. To avoid the financial loss and frustration of dealing with title issues, a title insurance policy could cover those costs and keep you in the clear.

-

What is PMI, and do I have to pay for that?

-

PMI, or private mortgage insurance, is a type of insurance that protects your lender—not you—if you stop making your mortgage payments. It makes your monthly mortgage payment more expensive, and it doesn’t benefit you at all. Your mortgage lender will require you to pay PMI unless you save up a down payment of 20% or more.

-

How do I pay off my house sooner?

-

Start by setting a goal of how much money you’d like to put toward your house every month. Then see where you can trim your budget to make those extra house payments. You can also dedicate work bonuses and raises to those extra payments. And if those ideas don’t have you moving as fast as you’d like, see if refinancing or downsizing would help you knock out that mortgage once and for all.

-

What does it mean to have equity?

-

Having home equity is a great thing! The term refers to your home’s current value minus what you owe on your mortgage. In other words, equity is the part of your home you own. You build more home equity as you pay down your mortgage principal and as your home’s value goes up (aka home appreciation). Never be fooled into borrowing against your home equity on stupid debt products like a home equity loan or HELOC.

-

What are property taxes?

-

Local governments collect a “lovely” fee from homeowners to raise money for public services in the community. A good chunk of the money collected from property taxes goes to your local police and fire departments, schools, and road maintenance. Homeowners are required to pay property taxes, which are based on the assessed value of their house.

-

What is escrow—and do I need it?

-

Escrow refers to a neutral third party that’s put in charge of holding money until a transaction between a buyer and seller is complete. The money is kept safe in an escrow bank account managed only by that third party. Think of escrow as a referee in a football game. They take no sides and make sure everyone is playing by the rules until the game is over. Most mortgage lenders will request you have an ongoing escrow account for taxes and insurance. It can be a convenient way to handle payments throughout your real estate journey.

Real Estate Advice

Directly to Your Inbox

Whether you’re trying to buy your first home, getting ready to sell, or just want to be a smarter homeowner, it’s always good to have your finger on the pulse of real estate trends so you can make informed decisions. Simply enter your email to get monthly content that’ll help you navigate the market with confidence.

Other Real Estate Help

If you’re unsure, take your best guess.