Ah, Missouri. The home of the Gateway Arch, ragtime music, and lots of confusion about which state Kansas City is part of. (Spoiler: Its metropolitan area spreads over both Missouri and Kansas.)

If you’re considering a move to the Show-Me State, you probably have an important question on your mind: Can I afford to live there? To help you answer that question—and make a confident decision about whether you should stay put or start loading a moving truck—we’re going to break down the cost of living in Missouri.

We’ll do it by looking at how much you can expect to pay for housing, groceries, transportation, health care and other common expenses. Let’s dive in!

What’s the Average Cost of Living in Missouri?

The cost of living in Missouri is 10% lower than the national average, which makes it a more affordable place to live than many other states.

Find expert agents to help you buy or sell a home.

Where’d we get that number? We looked at the 2023 Cost of Living Index from The Council for Community and Economic Research, which compared the cost of living in Missouri to the rest of the U.S.1 All the numbers in this article come from the fall 2023 edition index unless otherwise noted.

Cost of Living in Missouri by Major City

Wondering about the specific cost of living in St. Louis or any of Missouri’s other big cities? We’ve got you covered. Here’s a breakdown, with cities organized by population:

|

Major City |

Cost of Living vs. National Average |

|

Kansas City |

6% lower |

|

St. Louis |

11% lower |

|

Springfield |

14% lower |

|

Columbia |

8% lower |

|

Joplin |

16% lower |

|

Cape Girardeau |

5% lower |

Cost of Living in Missouri by Expense Category

The costs of specific, individual expenses like housing, utilities, transportation and health care also play into a state’s affordability. So, let’s break down the cost of living in Missouri by some of the most common expense categories you’ll want to include in your budget.

|

Expense Category |

Cost vs. National Average |

|

Groceries |

3% lower |

|

Housing |

21% lower |

|

Utilities |

3% lower |

|

Transportation |

5% lower |

|

Health Care |

11% lower |

|

Miscellaneous Goods and Services |

7% lower |

Don’t buy or sell without an agent you can trust.

There are RamseyTrusted real estate agents all over the country who are ready to help you win.

Cost of Housing in Missouri

Missouri’s median home listing price toward the end of 2023 was $289,900, and the median rent for a two-bedroom apartment was $1,015. For comparison, the median home listing price across the U.S. in that timeframe was $420,000, and the national median rent for a two-bedroom apartment was $1,317.2,3

Here’s the deal, though: Housing in some Missouri cities is cheaper than that, and getting into a house or apartment is much pricier in other cities. So the price you’ll pay for housing in Missouri will depend on which city you choose to live in.

To give you a good idea of the range, here’s a look at how much it costs to buy a home or rent an apartment in some of the biggest cities and best places to live in Missouri.

|

City |

Median Home Listing Price |

Median Rent |

|

Kansas City |

$399,9254 |

$1,3105 |

|

St. Louis |

$275,0006 |

$1,2007 |

|

Springfield |

$314,9998 |

$1,2259 |

|

Columbia |

$384,72510 |

$1,05011 |

|

Joplin |

$256,38212 |

$95013 |

|

Cape Girardeau |

$262,47514 |

$96515 |

Other Costs to Keep in Mind

Housing isn’t the only thing you’ll have to pay for if you move to Missouri! Let’s dive into some of the other expenses you’ll need to keep in mind, including groceries, transportation, health care, taxes and other miscellaneous expenses.

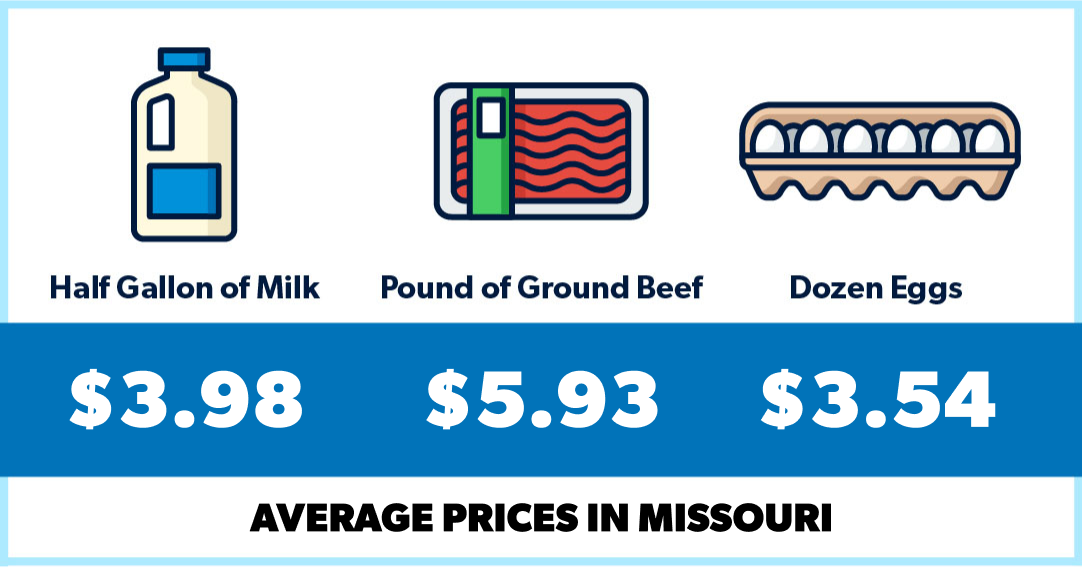

Groceries

Buying groceries in Missouri costs 3% less than the national average. Curious about how much you’d pay in Missouri for the items that always wind up on your grocery list? The typical half gallon of milk in Missouri will cost you $3.98, a pound of ground beef runs about $5.93, and the average price of a dozen eggs is $3.54.

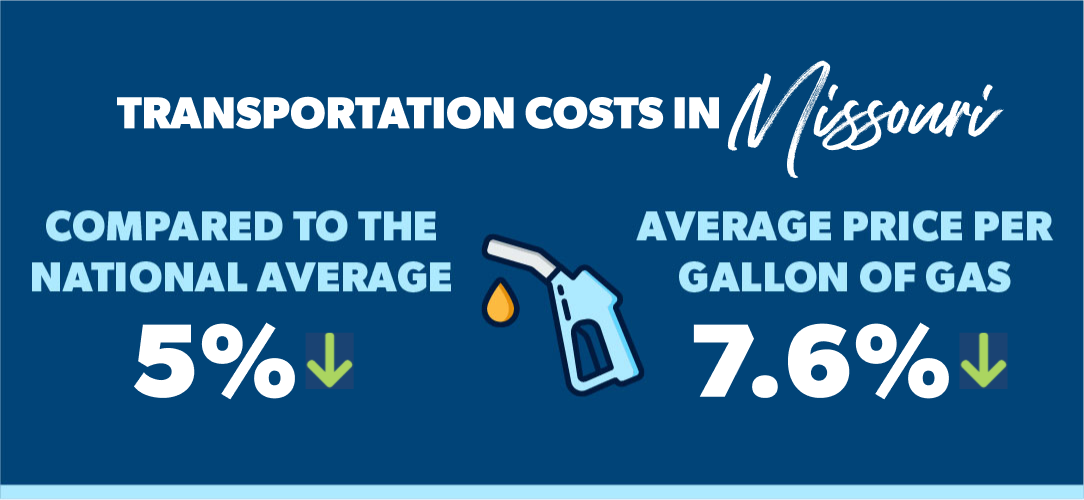

Transportation

Getting from place to place in Missouri is pretty affordable. That’s because the state’s typical transportation costs are 5% lower than the national average, and the average price for a gallon of gas is $3.40—more than a quarter less than the national average of $3.68.

Health Care

Everyone loves paying medical bills! Okay, maybe not. But health care expenses are unavoidable—unless you’re planning to try the whole “an apple a day” thing as a loophole. Here’s how much you can expect to pay in Missouri for a visit to your primary care doctor, dentist or eye doctor, as well as general medicine costs.

|

Health Care Expense |

Average Missouri Cost |

National Average |

Difference |

|

General Doctor |

$114.96 |

$133.50 |

14% less |

|

Dentist |

$99.29 |

$113.26 |

12% less |

|

Eye Doctor |

$115.71 |

$124.85 |

7% less |

|

Prescription Drug |

$421.01 |

$467.33 |

10% less |

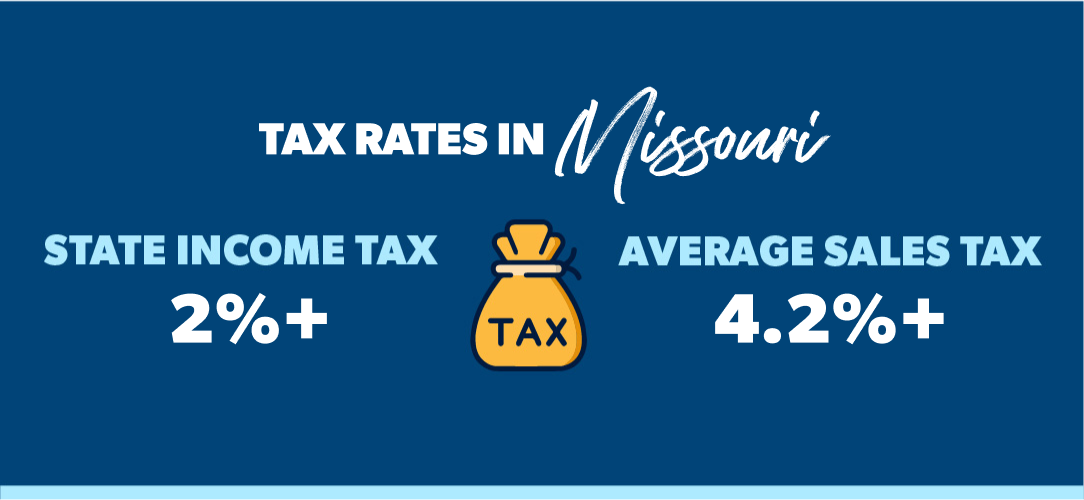

Taxes

Taxes in Missouri are a little tricky, so don’t feel bad if you have to read this section more than once to get it. Here’s a breakdown:

- State income tax: Missouri uses a graduated system for its state income tax, which means the amount you pay increases as your income goes up. The rates range from 2% to 4.95%. Some cities also collect local income taxes.

- Sales tax: Missouri’s state sales tax rate is 4.225%, and the max local rate is 5.763%. The average combined sales tax rate across the state is 8.33%.16

Miscellaneous Goods and Services

A lot of expenses don’t fit into a bigger category, so we’ll take a quick look at some of those here. In Missouri, eating at a pizza restaurant costs $10.83 (compared to the U.S. average of $12.02), getting a haircut runs $21.58 ($23.93 U.S. average), and buying a new dress shirt sets you back $34.46 on average ($36.42 U.S. average).

Can You Afford to Live in Missouri?

Chances are, you have one big question on your mind at this point: Can I afford to live in Missouri? Unfortunately, we can’t give you a hard and fast answer because it depends on your individual situation—your income, the size of your family, and which city you choose to live in will all have an impact.

So you’ll need to crunch the numbers yourself to see whether you can afford the cost of living in Missouri. One of the best ways to do that is by using our free Cost of Living Calculator. It’ll let you plug in your current city (or a nearby metro area) and compare it with major cities in Missouri.

When you’re looking at whether Missouri’s housing costs would fit in your budget, remember the 25% rule: Your monthly housing payment as a renter or homeowner should be no more than 25% of your take-home pay. Anything more than that, and you run the risk of paying too much for housing and not having enough money left over for other important items in your budget.

You can use our free mortgage calculator to get a good idea of which home prices would fit within your budget.

Ready to Move to Missouri?

If the numbers work out and you’ve decided that moving to Missouri is the best decision for you and your family, that’s awesome!

Before you hit the road, you’ll need to start working with a trustworthy, experienced real estate agent in Missouri if you’re planning to buy a home.

A pro who knows the local housing market like the back of their hand can make the buying process much smoother by teaching and leading you from beginning to end. And that’s a big deal, because let’s face it—moving to a new state isn’t easy!

Our network of RamseyTrusted real estate agents includes a ton of great pros in Missouri. They’ve all been vetted by our team to make sure they’ll serve you with excellence and prioritize your needs.

Next Steps

1. Use our free cost of living calculator to get a good idea of whether you can afford to live in Missouri.

2. Figure out how much it’ll cost to move and make a plan to save up that amount.

3. Work with a RamseyTrusted real estate pro if you’re planning to buy a house.

Frequently Asked Questions

-

Is Missouri an affordable state to live in?

-

Yes! At 10% lower than the national average, Missouri’s cost of living makes it one of the cheaper states to live in.

-

Is it cheaper to live in Missouri or Kansas?

-

The costs of living in Missouri and Kansas are pretty much the same. Overall, Missouri’s cost of living is 10% below the national average, while Kansas’s is 13% lower than the national average. However, some individual expenses (like housing) are more affordable in Kansas, and others (like health care) cost less in Missouri.

-

Does St. Louis have a low cost of living?

-

Yes! The cost of living in St. Louis is 11% lower than the national average, with housing costs that are a whopping 24% lower than the typical costs across the U.S.

Did you find this article helpful? Share it!

We Hear You!

We’re considering adding the ability to save articles to your Ramsey account.