What Is an Amortization Schedule and How Does It Work?

7 Min Read | Oct 23, 2025

Key Takeaways

- An amortization schedule outlines each loan payment until the end of your mortgage, showing how much goes toward interest and how much chips away at the principal.

- To calculate amortization, first multiply your principal balance by your interest rate. Next, divide that by 12 months to know your interest fee for your current month.

- Shorter amortization periods—like a 15-year mortgage—result in higher monthly payments but significantly lower total interest paid compared to longer terms.

- An amortization schedule helps you make a game plan for how extra payments can shorten the loan term and save you money.

Amortization—what a crazy word! This hard-to-say financial term pops up whenever you borrow money to buy big-ticket items like a house.

When your lender mentions an amortization schedule, your eyes might glaze over. We get it. Amortization isn’t exactly the most exciting subject. But it’s an important one! In simple terms, amortization is how you gradually pay off your house loan (mortgage) over time.

We’ll help you dive a little deeper into what it means and walk you through a typical amortization schedule using our Mortgage Calculator so you’ll know how to pay off your house as fast as possible!

Let’s get started.

What Is Amortization?

In the mortgage world, amortization refers to paying off a loan over time through monthly payments. Your monthly mortgage payment will go toward a number of different categories. But amortization is only concerned with two of those categories:

- Principal. This is the original chunk of money you borrow from your lender to buy a house. As you pay it back, your principal balance goes down and your equity (how much of the house you own) goes up.

- Interest. This is a fee a lender collects for letting you borrow money. It’s based on a percentage of your mortgage balance (the principal). As you pay down your mortgage, you'll pay less in interest.

When you take out a mortgage to buy a house, you’ll agree to a specific amortization plan, or repayment plan, with your lender—usually a 15-year or 30-year term. Keep in mind, the longer your term, the more you’ll pay in total cost.

What’s an Amortization Schedule?

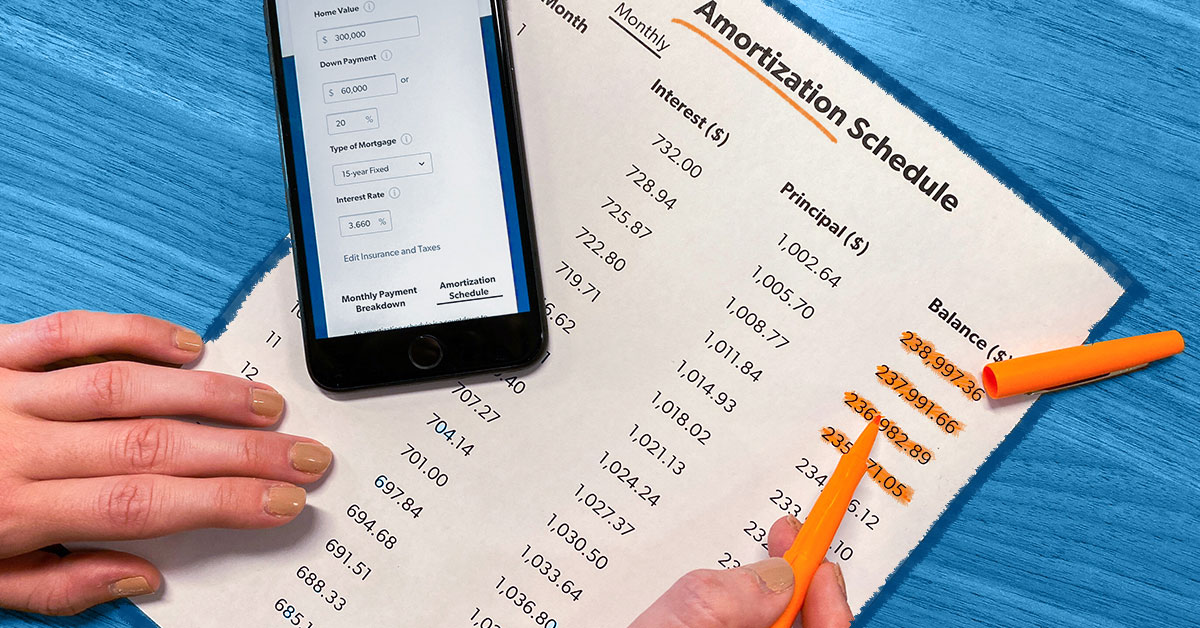

An amortization schedule or table gives you a visual countdown to the end of your mortgage. It’s a chart that shows you how much of each payment will go toward interest and principal—until you pay off the house!

Amortization Period vs. Mortgage Term

An amortization period tells you how long it’ll take to pay off your mortgage, while a mortgage term tells you how long you’re locked into a specific mortgage contract with your lender.

For example, you could do a mortgage refinance to change your mortgage term. This would change things like your interest rate, monthly payment amount and amortization period. (Hint: Only do a refi if you’re able to score a lower interest rate and a shorter amortization period.)

How Do I Calculate Amortization?

To calculate amortization, first multiply your principal balance by your interest rate. Next, divide that by 12 months to know your interest fee for your current month.

Finally, subtract that interest fee from your total monthly payment. What remains is how much will go toward principal for that month. This same process repeats every month until your loan is completely paid off.

We know calculating amortization can make you want to throw a desk out the window. But stay with us. We’ll walk you through an example.

What’s an Example of Amortization?

Let’s say you work with a top agent to buy a $300,000 house with a 20% down payment (that’s $60,000 in cash). To cover the rest, you take out a 15-year fixed-rate mortgage at a 5.5% interest rate—that’s a total home loan of $240,000.

Using our Mortgage Calculator, your monthly mortgage payment would be $1,961 (principal and interest only). Later, we’ll show you how to calculate this monthly payment manually—if you’re interested (and brave).

To calculate the amortization on this example, let’s plug these numbers into the formula we mentioned above:

- $240,000 (principal balance) x 5.5% (interest rate) = $13,200 (current annual interest fee)

- $13,200 (current annual interest fee) / 12 (months) = $1,100 (current month’s interest fee)

- $1,961 (monthly payment) − $1,100 (current month’s interest fee) = $861 (current month’s principal payment)

So, for your first month of making payments, that $1,961 monthly payment will be split into $1,100 for interest and $861 for principal—which will drop your $240,000 loan balance to just over $239,000.

15-Year Mortgage Amortization Schedule by Month

To see how our 15-year mortgage example plays out, here’s what the first five months would look like on your amortization schedule (we rounded the numbers to make it easier on the ol’ eyes):

|

Month |

Interest ($) |

Principal ($) |

Balance ($) |

|

1 |

1,100 |

861 |

239,100 |

|

2 |

1,096 |

865 |

238,300 |

|

3 |

1,092 |

869 |

237,400 |

|

4 |

1,088 |

873 |

236,500 |

|

5 |

1,084 |

877 |

235,700 |

30-Year Mortgage Amortization Schedule by Month

Now, if we took the same example from above, but stretched out your repayment plan to a 30-year mortgage, your interest rate would probably bump up to 6.5% and your monthly payment would drop to $1,517.

Here’s what that 30-year mortgage amortization schedule would look like in the first five months:

|

Month |

Interest ($) |

Principal ($) |

Balance ($) |

|

1 |

1,300 |

217 |

239,800 |

|

2 |

1,299 |

218 |

239,600 |

|

3 |

1,298 |

219 |

239,300 |

|

4 |

1,296 |

221 |

239,100 |

|

5 |

1,295 |

222 |

238,900 |

Did you catch that? Sure, the 30-year plan gives you a smaller monthly payment. But this longer, drawn-out repayment plan has more of your money going toward the interest each month—which also makes the principal balance go down much slower.

That’s why we only ever recommend a 15-year fixed-rate mortgage—it helps you pay off your house decades faster and saves you tens of thousands of dollars in interest!

Why Is Amortization Important?

Remember, an amortization schedule shows you how much of your monthly payment goes toward principal and interest. It helps you see a full view of what it’ll take to pay off your mortgage.

As with any type of goal setting, an amortization table gives you a game plan and the confidence to take on the mammoth task of paying off your house.

How to Pay Off Your House Faster

Understanding amortization can help you get creative with paying off your mortgage early. For example, you could throw extra payments at your mortgage that go toward the principal instead of the interest—which would also save you thousands of dollars!

To see how this plays out, try our Mortgage Payoff Calculator. Let’s use the same example from earlier of the $240,000 mortgage at a 15-year term with a 5.5% interest rate.

After 15 years paying the minimum monthly payment of $1,961, you’ll have paid nearly $113,000 in total interest. But if you squeeze another $100 out of your monthly budget to make your monthly payment $2,061, you’ll save more than $9,000 in interest and be debt-free a whole year sooner!

Want More Expert Real Estate Advice?

Sign up for our newsletter! It’s packed with practical tips to help you tackle the housing market and buy or sell your home with confidence—delivered straight to your inbox twice a month!

How Do I Calculate a Monthly Mortgage Payment?

As promised, we’ll now show you how to calculate a monthly mortgage payment manually—in case you want to know the magic behind our Mortgage Calculator.

This is useful to know when it comes to amortization since your monthly payment is what actually pays down your mortgage.

To calculate a monthly mortgage payment, here’s a scary-looking formula your lender might use:

M = P x ir (1 + ir)^n / (1 + ir)^n − 1

- M = monthly payment

- P = principal loan amount

- ir = interest rate per month

- n = number of months

- ^ = This is the exponent symbol. You’ll need a special calculator for exponents, which you can find online.

If we use the formula on our example from earlier, your mortgage details would look like this:

- M = (Hint: We’ll find out soon!)

- P = $240,000

- ir = 0.0045833 (5.5% per year / 12 months)

- n = 180 (15 years x 12 months)

Let’s start with the first part of the formula, P x ir (1+ir)^n. Here’s how that breaks down:

- 240,000 x 0.0045833 (1+0.0045833)^180

- 1,100 (1.0045833)^180

- 1,100 (2.2775702) = 2,505.33

Okay, now let’s figure out the second part of the formula, (1+ir)^n − 1:

- (1+0.0045833)^180 − 1

- (1.0045833)^180 − 1

- 2.2775702 − 1 = 1.2775702

And now let’s divide the two parts to get our answer:

- 2,505.33 / 1.2775702 = 1,961.01

That $1,961 is your fixed monthly mortgage payment—this is what you’ll pay every month in order to pay off or amortize your mortgage.

Work With a Mortgage Lender We Trust

Amortization isn’t the easiest topic to wrap your brain around. So if you want to learn more, talk to our home loan specialist friends at Churchill Mortgage. They actually care about helping you get a mortgage you can afford and pay off fast.

Next Steps

- Congratulate yourself for learning about the nerdy underbelly of amortization.

- Realize that choosing a 15-year amortization plan offers the lowest total cost.

- Work with a home loan specialist we trust to get a mortgage you can pay off fast.

Did you find this article helpful? Share it!

We Hear You!

We’re considering adding the ability to save articles to your Ramsey account.