Get Out of Debt

You don’t need a finance degree to transform your money—it’s 80% behavior and 20% head knowledge. Get the tools you need to help you take control once and for all.

Get EveryDollar: the app that makes creating—and keeping—a budget simple. (Yes, please.)

In the first month, most EveryDollar budgeters . . .

Uncover up to $395 to use toward money goals

Cut monthly expenses by 9%

Build better budgeting habits

From budgeting to saving to tax tips and more, see how simple steps will lead to big money wins.

Tune in to real-time stories and practical advice for life’s tough money questions.

The Ramsey Show

Filter what episodes and topics you want to hear using the Ramsey Network app.

Get in-depth articles full of practical steps to help you budget, pay off debt for good, and build lasting wealth.

Financial coach David Volzer shares about his journey from a passionless job to a job full of purpose. Plus, get his three tips to starting a coaching business.

Getting out of debt can be scary, especially if you don’t have any support. But getting out of debt is a family affair, and we’ve got tips on how you can start gathering your cheer squad.

So you’ve heard about the debt snowball method—you know, where you pay your debts from the smallest to largest balance regardless of interest rate—and now you’re ready to dive right in.

Discover how one man coached his clients to pay off $10 million in debt. Use these 6 tips to help your friends and family and power up your own coaching practice.

Want to know how to sell a timeshare, but you’re not sure where to start? We’ve boiled it down for you to four practical steps, plus a couple of “gotchas” to watch out for.

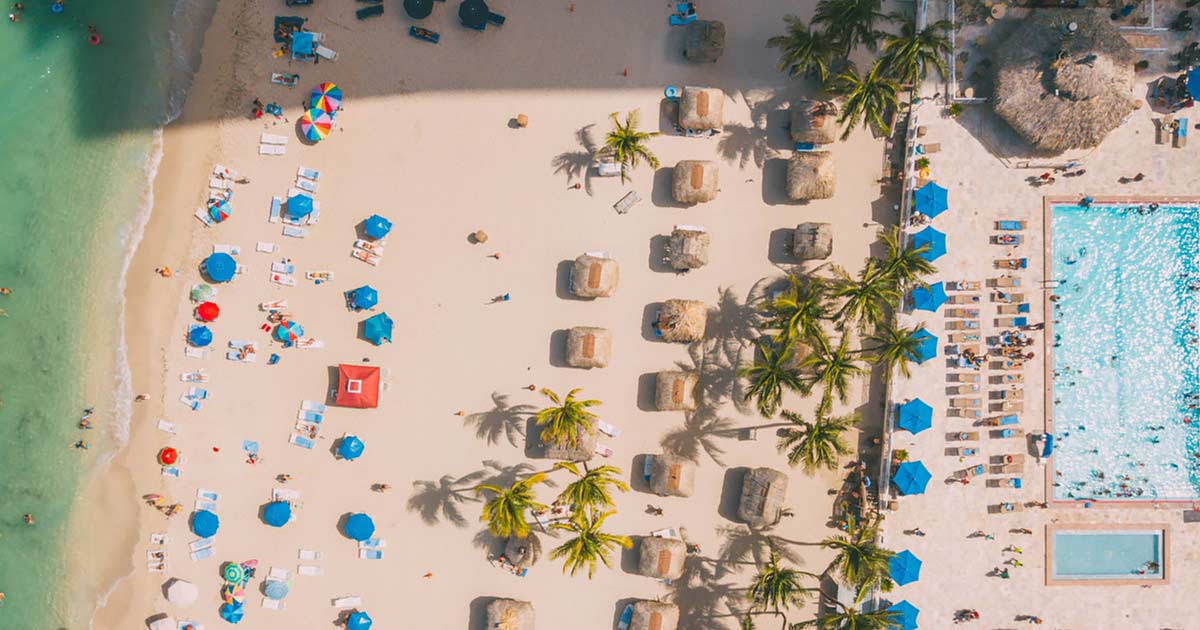

A timeshare is a guaranteed vacation spot, but it’s also a guarantee you’ll be slapped with hefty maintenance fees every year. Here’s what you need to know.

Every week, receive expert guidance and practical steps to help you stay on track with your goals and create a strong financial future.