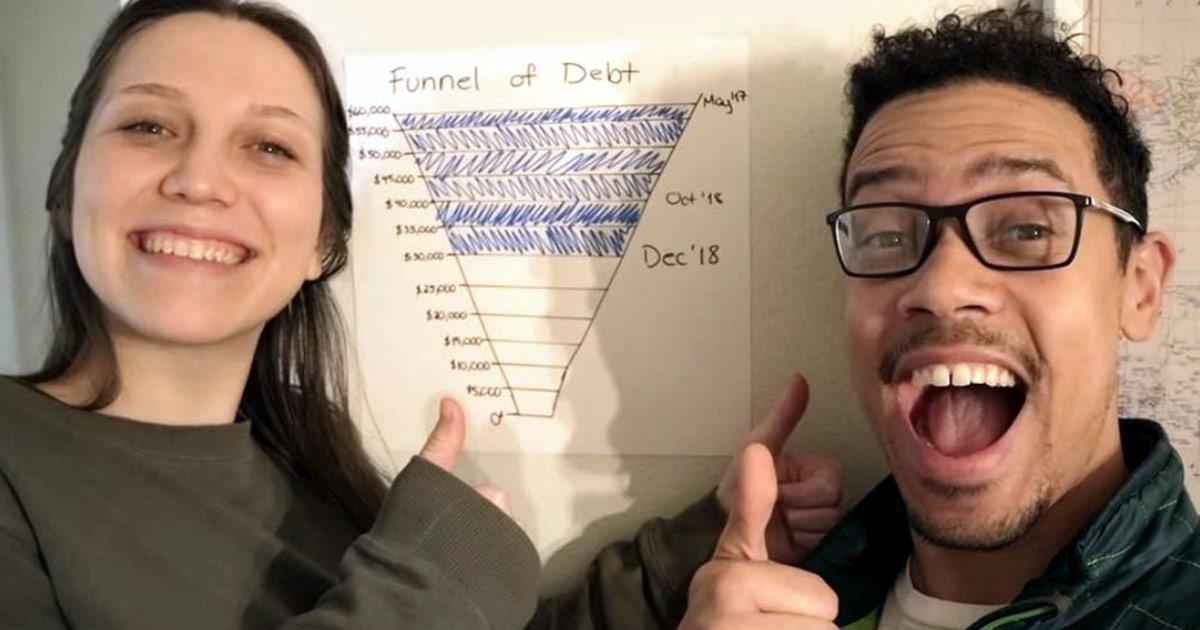

Get Out of Debt

You don’t need a finance degree to transform your money—it’s 80% behavior and 20% head knowledge. Get the tools you need to help you take control once and for all.

Get EveryDollar: the app that makes creating—and keeping—a budget simple. (Yes, please.)

In the first month, most EveryDollar budgeters . . .

Uncover up to $395 to use toward money goals

Cut monthly expenses by 9%

Build better budgeting habits

From budgeting to saving to tax tips and more, see how simple steps will lead to big money wins.

Tune in to real-time stories and practical advice for life’s tough money questions.

The Ramsey Show

Filter what episodes and topics you want to hear using the Ramsey Network app.

Get in-depth articles full of practical steps to help you budget, pay off debt for good, and build lasting wealth.

Financial security isn’t just a dream that only certain people achieve. It’s for everyone—that includes you! Here are five ways to achieve financial security (and become financially stable).

These easy-to-follow Baby Steps will help you pay off debt, save for the future, and be a generous giver. You need a plan to win with money, and this is it!

How many of these things have you done on your debt-free journey?

Lend us an ear, and we’ll tell you the tale of the Gazelle.

Should you stay gazelle intense in Baby Steps 4, 5 and 6?

Every week, receive expert guidance and practical steps to help you stay on track with your goals and create a strong financial future.