Listen to this article

What Is No Medical Exam Life Insurance?

Types of No Medical Exam Life Insurance

How Does No Medical Exam Life Insurance Work?

Do I Qualify for No Medical Exam Life Insurance?

How to Choose the Right No Medical Exam Life Insurance Provider

Compare No Medical Exam Life Insurance Providers

Pros and Cons of No Medical Exam Life Insurance

How Much Life Insurance Can I Get With No Medical Exam?

Whole vs. Term: Which No Medical Exam Life Insurance?

Whole vs. Term Life Insurance

Life insurance—it’s been on your to-do list for years, right? You’ve been meaning to knock it out but . . . life happens. Well, here’s some good news: These days there’s one less hurdle between you and getting covered.

Compare Term Life Insurance Quotes

Over the past few years, some insurance companies have started offering an exam-free life insurance option—and it doesn’t come with sky-high premiums. So, if you’ve ever thought, Medical exam? I’d rather walk barefoot across a sea of LEGO bricks! then this new flexible option should make the process a whole lot happier for you.

Here’s what you need to know about getting life insurance without a medical exam.

What Is No Medical Exam Life Insurance?

This type of life insurance is an option that doesn’t require you to go through a medical exam to get covered. In certain age groups, customers can sometimes skip the exam completely and still get the most competitive term life rate available.

But there are some conditions.

- You can only get a policy worth up to $2 million.

- You must be under 60 years old.

- You must be healthy.

Are you guaranteed a no medical exam policy (no-med) if you fit those criteria? Not necessarily. You’ll still need to answer questions about your medical history and disclose any conditions you have on your term life policy application.

Based on your answers, the insurance company will decide if you need lab work anyway or medical records to get a policy. I know you guys wouldn’t ever think of lying, but just a reminder: Honest and complete answers are a must because if they find you’ve hidden something on your application and you end up dying, your death benefit will most likely be withheld from your beneficiaries. And . . . that’s the whole reason you're getting the insurance in the first place, right? Honesty is the best policy, and it’ll help you get the right policy for you and your family.

Pros and Cons of No Medical-Exam Life Insurance

No medical exam seems like a great option—why wouldn’t everyone just go that route? Who would choose to put on a backless shirt and let someone get all up in their personal space?

Well, turns out there are a couple reasons why someone might have to.

- You might not qualify so it’s just not an option for you. This is probably you if you’ve got a lot of health problems. I’ll go into this in more detail later.

- No med policies cap at $2 million.

If you qualify for no medical exam life insurance, you can get coverage up to $2 million. That sounds like a lot—and it is. But you’ll need 10–12 times your annual salary in term life insurance to make sure your family can replace your income if something happens to you. So, if your income is over $200,000 a year, you’ll need more coverage than a no med policy can provide.

|

Pros |

Cons |

|

Getting coverage without going anywhere |

Not always an option for those with lots of health problems |

|

Avoiding home visits from a nurse |

Coverage limit of $2 million |

How Does No Medical Exam Life Insurance Work?

So, how do these companies decide whether to cover people for life insurance without giving them the normal exam for height, weight and other basic health measures? Good ol’ new-fashioned technology!

Yep! Insurance companies use statistics and algorithms (plus your Medical Information Bureau and prescription history reports) to analyze your questionnaire answers. Those results allow companies to offer the same competitive rates that used to require an exam with one less hurdle to leap.

Do I Qualify for No Medical Exam Life Insurance?

If you fall into one of the categories below, you could be a great fit for a no medical exam life insurance policy:

- People who are pretty healthy and don’t have a long medical history

- Busy people who just want coverage fast but don’t want to fool around with appointments and needles (relatable!)

- Young smokers who don’t have any other medical conditions

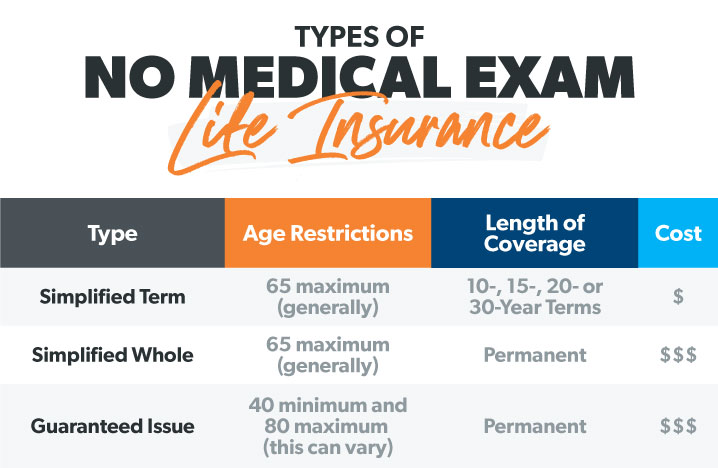

Types of No Medical Exam Life Insurance

Is life insurance with no medical exam sounding so sigma right now? (If you don’t have TikTok or a middle schooler, that’s code for “awesome,” I’m told.) If it is, great! But which one’s for you?

Let’s go over the major types of life insurance coverage you can get without doing a medical exam.

Simplified Issue

Who doesn’t love simple? A simple solution. Simple math. Simple pleasures. Maybe all three if you’re an accountant. Simplified issue means you can get a policy by answering just a few health questions. And you can get both whole life and term life simplified issue policies, so let’s go over each kind.

Simplified Term Life With No Medical Exam

The name says it all. These simplified term life policies let you get term life insurance (the kind of coverage I always recommend for both price and simplicity), and they don’t require a medical exam. But they do require applicants to answer a health questionnaire.

Simplified Whole Life With No Medical Exam

Again, the name helps here: You can apply for this policy without a medical exam by answering a health questionnaire. But I don’t recommend whole life coverage at all. Why not? Because whole life insurance (sometimes called permanent life insurance) is one of the worst financial products on the market. It mixes two important jobs—life insurance and investing—and gives you a horrible payoff in both departments. No-med term life is way cheaper than no-med whole life too so it’s a no-brainer on all counts. Don’t just skip the medical exam—skip whole life insurance completely.

Guaranteed Issue

Guaranteed issue is another no medical exam option, but the catch is that it’s also one of the most expensive ways to get life insurance. To get a guaranteed issue policy, you get to skip the medical exam and the health questionnaire!

But the market for this kind of policy is pretty limited. It’s designed to help people who would otherwise be uninsurable. In addition to the high price, many companies also impose a few basic limits for this type of coverage:

- Age minimum: usually 40 years old

- Age maximum: usually 80 years old

- Coverage limits: typically from $5,000–100,000

Those aren’t hard-and-fast rules, but if you’re in that age range, you could qualify for guaranteed issue.

Now, there’s another wrinkle with this policy type you should know about. Guaranteed issue has what’s called a graded death benefit. What’s it all about? It means if you’re the policyholder and you die shortly after getting the policy—say within three years—your beneficiaries would only get a portion of the full death benefit.

But it’s life insurance coverage, and it has the fewest strings attached of any type. So, if you’ve been declined for other kinds of life insurance because of health problems, a guaranteed issue policy could get you enough coverage to take care of your final expenses.

Group Life Insurance

Group life insurance can get you a decent price on modest coverage through your employer (hence the word group in the name). Coverage amounts are capped pretty low, but it usually won’t require a medical exam.

If no exam and discounted premiums sound good to you, you can opt in at open enrollment time. You can also add supplemental life insurance to your group coverage to make sure you have enough life insurance. (Like I mentioned earlier, you really want coverage worth 10–12 times your annual income.) Just be aware that adding more coverage often requires filling out a medical questionnaire.

Accelerated Underwriting

Accelerated underwriting is no-med-exam coverage with a slightly different underwriting process than you’d see in other coverage types. Instead of requiring a new medical exam, some companies will accept your prior lab results—if the tests were done within the past six months.

This process could be a great fit for you if your motto is “Health is wealth” and you’d never miss an annual physical. However, if you’re in the “I’ll go to the doctor if my arm is falling off” camp and that hasn’t happened recently, this option probably isn’t going to work for you. Some recent medical records are necessary.

But for those of you who know all of your doctor’s children by name, accelerated underwriting could get you fast life insurance coverage without having to do a new exam!

Here's A Tip

To take advantage of this option, I highly recommend you get on the phone with our RamseyTrusted® partners over at Zander Insurance. There’s nothing they love more than helping you and your family get great life insurance coverage as soon as possible. And while you’ve got them on the line, tell them you’re interested in accelerated underwriting. They’ll help you figure out if you qualify.

How to Choose the Right No Medical Exam Life Insurance Provider

One way to compare providers is to look at their AM Best rating—AM Best is an agency that rates a company’s ability to pay claims over the long haul. (Just like in school, A-plus is excellent work.) You’ll obviously want to compare prices as you shop too.

Compare No Medical Exam Life Insurance Providers

I know finding life insurance can feel pretty overwhelming. With all the options out there, picking the right one can feel like finding an honest man in Congress. So, here’s a handy tool and some of the top options for no med life insurance to help you get started.

|

Insurance Company |

AM Best Rating* |

Medical Exam |

|

American General Life Insurance Company |

A |

Yes |

|

Banner Life Insurance Company |

A+ |

No** |

|

Lincoln National Life Insurance Company |

A |

No** |

|

Pacific Life Insurance Company |

A+ |

No** |

|

Protective Life Insurance Company |

A+ |

No** |

|

Pruco Life Insurance Company |

A+ |

Yes |

|

Savings Bank Mutual Life Co of MA |

A- |

No** |

|

United of Omaha Life Insurance Company |

A- |

Yes |

*AM Best is an agency that rates insurance companies on their ability to pay claims over the long haul. An A+ rating means this company has a “Superior” ability to pay out claims.1

**All you have to do is answer a few health questions instead of setting up medical exams and blood tests. Depending on responses, you may still need a medical exam to obtain a policy.

Protective Life

Protective Life was founded in 1907. Today, they provide life insurance coverage for millions of customers. A medical exam isn’t required for some Preferred Plus applicants.

Lincoln National

Since its founding in 1905, Lincoln Financial has covered more than 17 million Americans. A medical exam isn’t required for most Preferred Plus applicants.

Banner Life

Part of parent company Legal & General, Banner Life Insurance Company has seen a few name changes as well as industry changes and new technologies since their founding in 1949. Their Horizon digital platform allows qualified applicants to complete an application in about 15 minutes and offers the opportunity to get coverage with no medical exam and accelerated underwriting.

Use a Provider You Can Trust

Getting life insurance just got easier. You now have one less excuse to go ahead and get your family set for life in case something ever happens to you. For a small amount of money per month, you can get coverage that’ll give you peace of mind knowing your family’s protected.

Like I said before, I always recommend RamseyTrusted provider Zander Insurance. The absolute best way to get the right kind of no medical exam life insurance for you and your family is to give Zander a call and talk things over with one of their agents.

Next Steps

- Find out if you would qualify for a no medical exam life insurance policy. Folks who are pretty healthy and don’t have a long medical history are usually the best candidates.

- Weigh the pros and cons of getting a no medical exam life insurance policy. While it'd be nice to skip the appointments and needles, you might have to settle for higher premiums for coverage.

- Talk with an agent from RamseyTrusted provider Zander Insurance. They can walk you through all your life insurance options and get you the custom quotes from the top insurance companies.

Monthly Estimate

0 - 0

Learn the Smarter Way to Do Life Insurance

Life insurance can feel freakin’ confusing. Sign up to get Ramsey’s no-nonsense advice, including free access to Dave’s video from Financial Peace University (normally $80), plus guides and resources sent right to your inbox.

Frequently Asked Questions

-

Can you get life insurance without a medical exam?

-

Yes! Although you might assume this kind of coverage would for sure require some prodding and poking, technology has made those methods optional in some cases. Many carriers can now use algorithms and personal data to see if you’re a good fit for coverage. Check out our no medical exam assessment tool above.

-

Should I get no medical exam life insurance?

-

The short answer? Yes—as long as you don’t need more than $2 million in coverage. If you meet the right criteria, no medical exam policies are great. They can save you the time and hassle of a medical exam. Plus, they’re affordable. It’s a win-win-win.

-

Is there a waiting period for no exam life insurance?

-

No. You can apply as quickly and easily for no exam coverage as you would for a medically underwritten policy.

-

Can seniors qualify for no exam life insurance?

-

For simplified issue, the maximum age for coverage is generally 60.

-

Does no exam life insurance have term and whole options?

-

Yes. But that doesn’t mean getting whole life is a good idea. With or without an exam, always go for level term life coverage that’s worth 10–12 times your annual income.

-

Can you borrow money from a no medical exam life insurance policy?

-

You might be able to do this with some whole life no exam policies. But why would you ever want to borrow money? Especially your own money? And you’d never want to get a whole life policy unless it was the only type of insurance you can get approved for!

-

Is no medical exam life insurance worth it?

-

We think it is! Life insurance is one of the best and most affordable ways to protect your family’s future. And skipping the medical exam makes the whole process more convenient.

-

How long does a no exam life insurance policy last?

-

If it’s a term policy (and it should be), it’ll last for 10, 15, 20, 25 or 30 years. If you make the mistake of buying whole life, it’ll last your whole life (unless you let the policy lapse by not paying for it).

-

Who is the beneficiary?

-

The beneficiary is the person who you choose to receive the death benefit from your life insurance policy after you die.

-

Who is the policyholder?

-

The policyholder is the person covered by the life insurance policy (so, probably you).

-

What is a death benefit?

-

This is the life insurance payout the company sends to the beneficiary after the policyholder has died.

-

How long do you have to claim life insurance?

-

There’s usually no time limit on this. After all, survivors who lose a loved one need as few things as possible to worry about as they grieve.

-

Does life insurance pay for death by suicide?

-

Often it does. There are exceptions, though. Many policies have a clause stating that if the policyholder commits suicide within two years of the policy being written, the insurer can deny the claim.

-

Can you get life insurance if you have cancer?

-

If you actively have cancer, you won’t be eligible for any term policy. However, you could be eligible as soon as six months after you’re in remission, depending on the type of cancer. More often the eligibility won’t come into play until five years after remission.