Take The Quiz

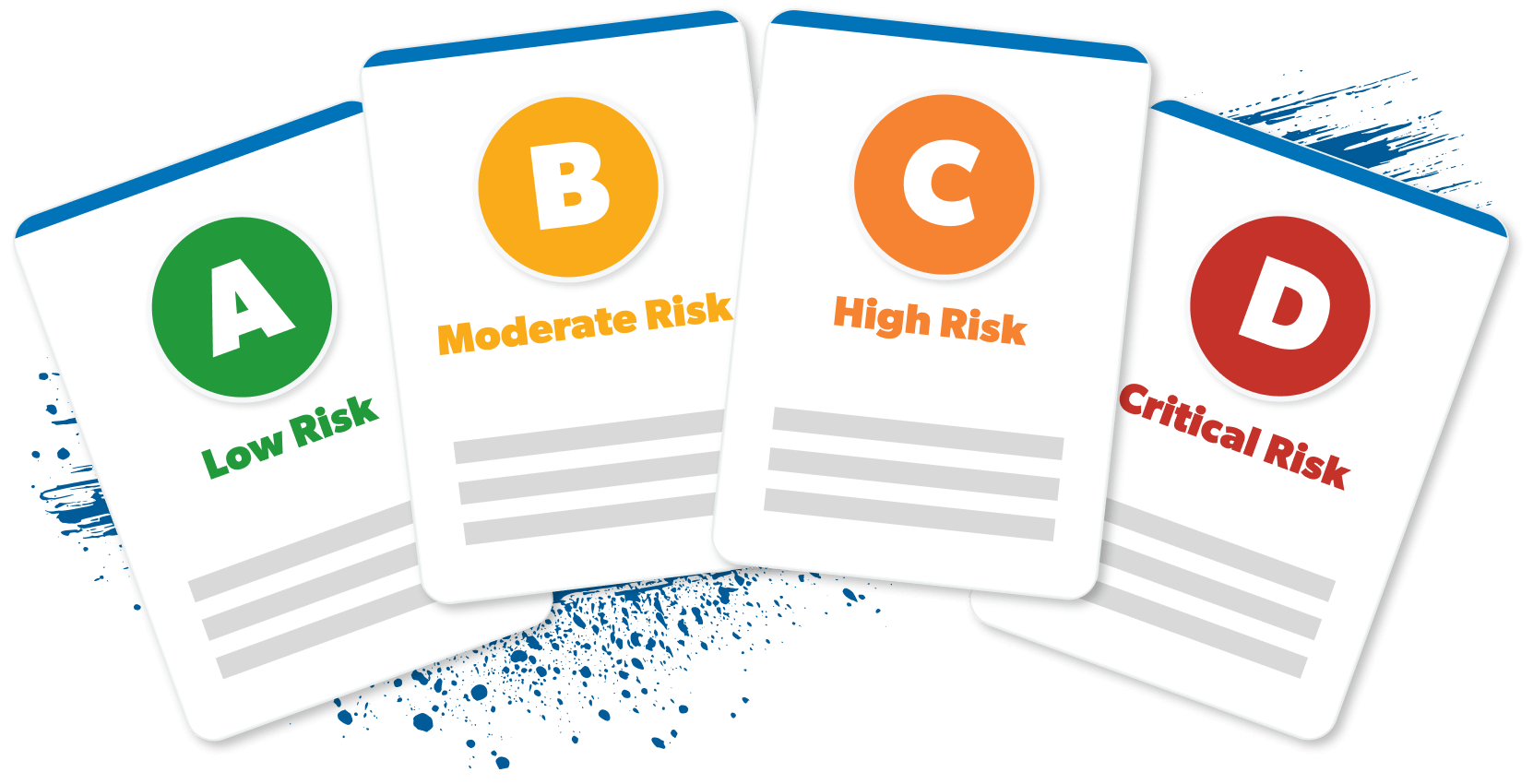

What's your risk of identity theft?

Take this quiz to assess your risk.

Next Steps

Okay, you know your risk level. Now what?

- Based on your risk assessment grade, check the list at the bottom of your results (look for the drop-down button).

- Keep an eye on your inbox for more identity protection tips and a copy of your results.

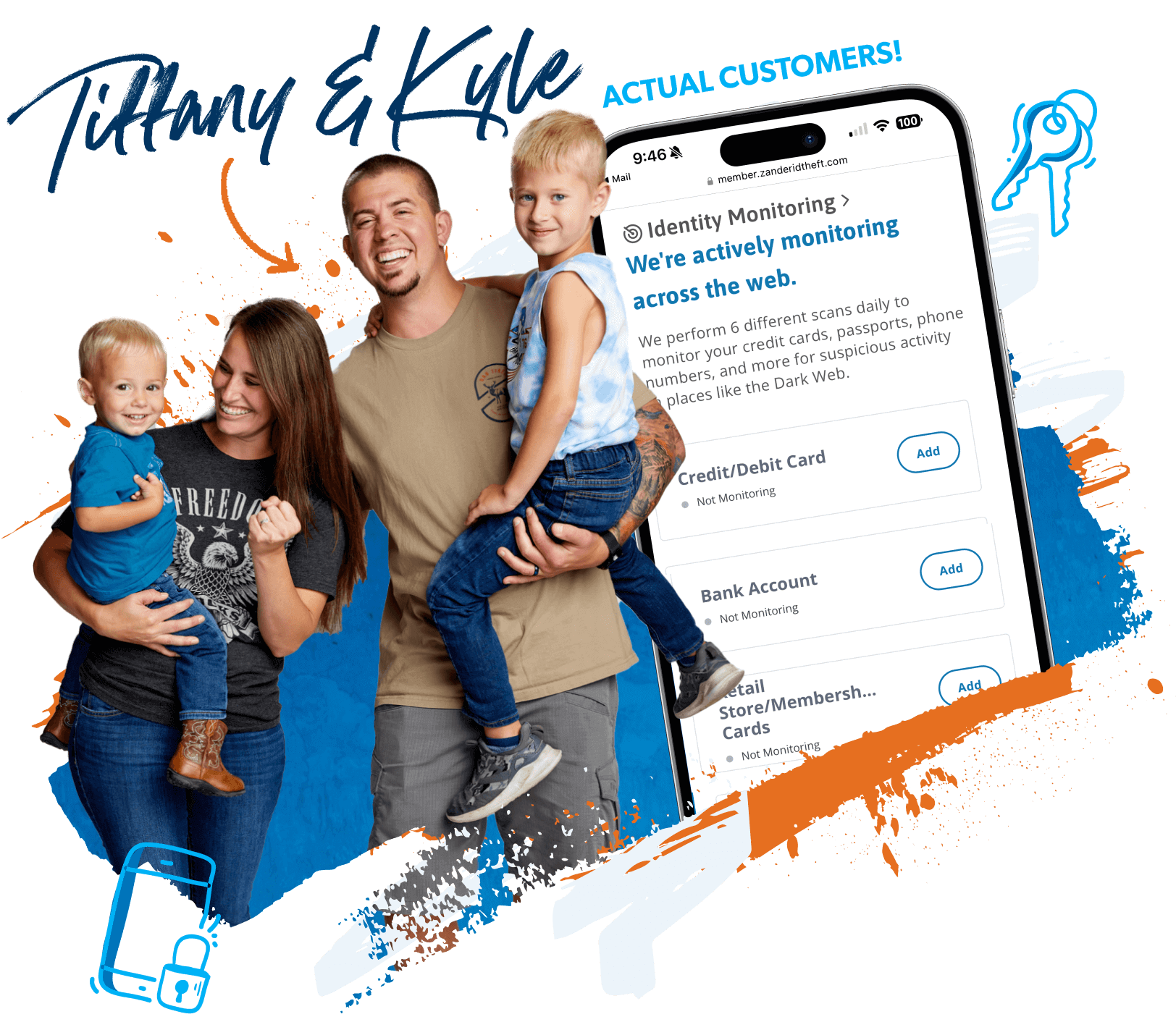

- Get your identity theft protection in place with Zander Insurance, our RamseyTrusted® provider.

Choose Your Plan

Check out Zander's Summary of Benefits, Reimbursement Benefits and Terms and Conditions for the full story of what they can do for you.

ID Theft Protection is not an insurance product. It is an administrative service that provides identity recovery, reimbursement, monitoring and alert services.

Our RamseyTrusted® Provider Has Your Back!

With Zander, even if the worst does happen, they won’t leave you hanging. They’ll stay with you every step of the way—and that’s why identity theft protection is worth having.

If your identity gets stolen, they’ll clean up the mess—so you can get back to normal.

If your personal info starts popping up where it shouldn’t, they’ll let you know immediately.

They’ll reimburse money lost from identity theft, including legal fees, lost wages and more.

DATA BREACH NEWS

What’s Going On?

According to Cybernews, cybersecurity experts just uncovered a massive data dump of up to 16 billion stolen credentials—we’re talking usernames, passwords and even session cookies. This wasn’t from one big company getting hacked. Instead, it came from computers infected by sneaky malware called “infostealers.” These little monsters quietly collect your logins while you go about your day, and now cybercriminals have bundled all that stolen info into massive files that were briefly exposed online. This isn’t some recycled leak from years ago—it’s fresh, dangerous and ready for bad guys to use.

What Should You Do?

If you’ve ever reused passwords or skipped two-factor authentication, now’s the time to get serious. Change your passwords (especially on your bank, email and social accounts), set up multi-factor authentication, and consider using a password manager. Better yet, lock arms with a solid identity theft protection plan that includes monitoring, alerts and expert recovery if something ever goes sideways. Because in a world full of digital threats, protection isn’t optional—it’s essential.