How to Buy a Home the Way Ramsey Teaches

If you feel overwhelmed by all the resources on this page, use the Ramsey plan to make things simpler. This plan is based on advice that’s helped millions of Ramsey followers for over 30 years. You’ll be on your way to owning a home too if you follow these steps:

-

1. Pay off all debt and build an emergency fund.

-

Adding a mortgage to other debts puts you one emergency away from bankruptcy. Don’t do it! Being debt-free and having an emergency fund saved is the best way to prepare to buy a home with confidence. It takes time to get there, but it’s worth it. These tips will help:

- Take control of your money with our free EveryDollar budgeting app.

- Pay off debt fast with the debt snowball method.

- Save 3–6 months of expenses in a fully funded emergency fund.

-

2. Use the 25% guideline to figure out how much house you can afford.

-

Never get a mortgage that costs more than 25% of your monthly take-home pay. Otherwise, you’ll be house poor and have no margin for other financial goals. Always stay away from FHA, VA, USDA, ARM and even 30-year loans. While they might entice you with zero down payment requirements or a lower monthly payment, they cost you thousands of dollars more in the end and keep you in debt for decades. Instead, get a 15-year fixed-rate conventional loan.

- Use the Home Affordability Calculator on this page for a fast way to set your home-buying budget.

-

3. Aim for a 20% down payment.

-

A down payment that’s 20% or more of the home price means you can skip paying for PMI (that stands for private mortgage insurance, and it only benefits the lender). If you’re a first-time home buyer, putting down at least 5–10% is okay—but then you’ll have to pay for that PMI.

- Use the Mortgage Calculator on this page to get an idea of what your monthly mortgage payment could look like as you adjust the home price, down payment amount, loan type, interest rate and more.

-

4. Save 3–4% for closing costs.

-

On top of your down payment savings goal, you’ll want to save another 3–4% of the home price to cover closing costs (which could include fees related to inspection, appraisal, loan processing, taxes and insurance). Keep in mind, that amount doesn’t include the cost of a real estate agent. Some sellers might agree to pay part or all of the buyer’s closing costs to sweeten the deal, but every situation is different. So make sure you plan ahead.

- Use our free Saving for a Down Payment Guide on this page to stay motivated and on track with your savings goal.

For more ideas on how to prepare to buy, keep exploring our Real Estate Home Base for helpful tools, podcast episodes, videos and articles. Once you’ve hit your home savings goal (or even while you’re still saving), grab our free Home Buyers Guide for a step-by-step plan to buy a house you love.

Your Free Step-by-Step Guide to Saving for a Down Payment

Believe it or not, saving for a home is possible—and you can do it too. Use our free guide to break your goal into simple steps so you can buy your home faster and with confidence.

Your Free Guide to Buying an Affordable Home You Love

Whether you’ve hit your down payment goal or you’re still saving, you need a plan to buy with confidence. Grab our free Home Buyers Guide for clear steps to find a house you love—and can actually afford.

Ramsey Advice on Home Buying

Housing Market Predictions for 2025

12 States With the Lowest Cost of Living

How to Buy a House in 2025

When Is the Best Time to Buy a House?

Best Places to Live in Michigan

First-Time Home-Buyer Mistakes

Tips for First-Time Home Buyers

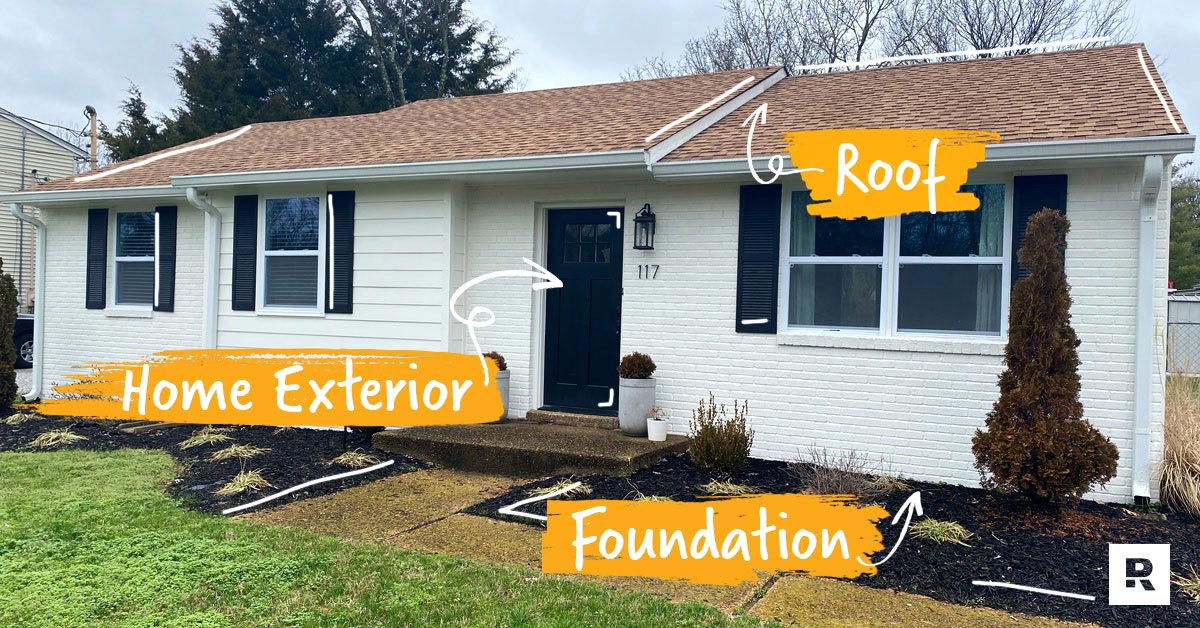

What to Look for When Buying a House

Are Tiny Homes Worth It?

How to Save for a House

Am I Ready to Buy a House?

Need Renting Help?

Renting makes good training wheels for future homeowners. But it’s a bad long-term plan for your money. To help you make smart decisions while renting and preparing to buy, we gathered our best renter resources into one place. Here’s some of the advice you’ll find:

- When to rent vs. buy

- How much rent you can afford

- Renting mistakes to avoid

Find Trusted Buyer’s Agents Near You

Confidently buy a home you can actually afford with a vetted referral who has your best interests in mind.