Key Takeaways

- Financial literacy means having the skills to consistently do the right money things.

- Financially literate people budget, save for emergencies, understand debt, and can distinguish key savings and investment tools.

- Financial literacy translates into concrete habits—like building an emergency fund, paying off debt, investing, and planning for college and retirement.

If you’ve spent any time reading up on education or financial news lately, you’ve probably come across the term financial literacy. The goal behind teaching financial literacy is to help people develop a stronger understanding of basic financial concepts—that way, they can handle their money better.

Are you a teacher? Help your students win with money today!

That’s a worthy goal, especially when you consider a few stats about how the typical American handles money:

-

Nearly four out of every five U.S. workers live paycheck to paycheck.

-

Over a quarter never save any money from month to month.

-

Almost 75% are in some form of debt, and most assume they always will be.(1)

Ouch! With those numbers, it’s no surprise that leaders in business, education and government want to help spread the benefits of greater financial literacy to as many people as possible.

In fact, it mattered so much to lawmakers, in 2004 the Senate passed a resolution officially recognizing April as Financial Literacy Month to “raise public awareness about the importance of financial education in the United States and the serious consequences that may be associated with a lack of understanding about personal finances.”(2)

As more people become aware of the importance of financial literacy, we should be asking: What skills, traits and best practices do people show who are “financially literate”? And, How does this skill set really affect personal finance?

What Is Financial Literacy?

Financial literacy is the possession of skills that allows people to make smart decisions with their money.

And don’t be misled by the word literacy. Although understanding stats and facts about money is great, no one has truly grasped financial literacy until they can regularly do the right things with money that lead to the right financial outcomes.

When you have this skill set, you’re able to understand the major financial issues most people face: emergencies, debts, investments and beyond. Financially literate people know their way around a budget, know how to use sinking funds, and know the difference between a 401(k) and a 529 plan. Here are the concepts financially literate consumers have mastered:

Budgeting

It’s one thing to learn how to add and subtract in elementary school, but it’s something else entirely to actually apply those principles to your own finances! Most Americans live paycheck to paycheck, and it’s largely because of a gap between what the math says they can afford and what they actually spend. Financial literacy can make people habitual budgeters who are willing to save for their goals and delay gratification in order to have peace of mind, both today and in the future.

Emergencies

Only 39% of Americans would be able to cover a $1,000 emergency if one happened to them today.(3) And actually, about 40% of Americans wouldn’t even be able to cover a $400 emergency.(4) But people who become financially literate learn how to build a $1,000 emergency fund—and from there, learn how to grow their emergency fund to include three to six months of expenses for those times when life throws a bigger curveball.

Debt

In addition to mortgages, which amount to nearly $9 trillion in debt nationwide, Americans are weighed down with auto loans, credit cards and student loans. The Federal Reserve Bank of New York reported in 2018 that the total consumer debt in America had reached $3.95 trillion.(5) To see how that debt load impacts daily living, consider the fact Northwestern Mutual reported that 40% of Americans spend up to half of their monthly income in debt payments.(6) A big part of financial literacy focuses on understanding how the time and money people spend on paying off debt hurts their ability to invest in their future.

Teaching financial literacy skills in schools is becoming more popular all the time. After all, what better place to communicate these life lessons around money than in the classroom? And you can probably guess that we believe financial literacy is as fundamental to learn as reading and writing!

How Many People Are Financially Literate?

Based on the stats that we’ve already considered, it’s fair to guess that the majority of people don’t know how to handle their money. And while there’s no one sure way to measure how many people are financially literate, the lack of certain skills would confirm that guess.

For example, if you used the number of people who don’t live paycheck to paycheck as an estimate of financial literacy, only about 20% of people would qualify!

Budgeting could be another skill for measuring financial literacy. And how do Americans stack up in that department? Sadly, not even a third of people earning a paycheck (32%) stick to a budget.(7)

Let’s look at the findings of the National Financial Capability Test given to over 17,000 people from all 50 states. The National Financial Educators Council (NFEC) reports that less than half (48%) of participants were able to pass the 30-question test that covered things like budgeting, paying bills, setting financial goals, and other personal-finance related topics.(8)

Fewer than half are passing a basic exam on financial literacy—and the average test taker only answered 63% of the questions correctly!

On the bright side, there’s a trend in the other direction: Many young people are boosting their financial literacy through personal finance courses in high school. And research shows it’s having a positive impact! Ramsey Solutions Research surveyed over 76,000 American students who had taken a personal finance class, and many of the results are in stark contrast to the NFEC report. We found that students who had taken a course in personal finance highly understood key financial topics such as:

-

The difference between credit cards and debit cards (86%)

-

How to pay income taxes (87%)

-

How home, auto and life insurance work (90%)

-

How student loans work (94%)

-

What a 401(k) is and how it works (79%)(9)

Are You Financially Literate?

To help you decide whether you should include yourself among the financially literate, think through the following questions and give yourself some honest answers.

-

Do you know how to create a monthly budget that includes all of your basic expenses, your bills, any debts, and your sinking funds for future purchases?

-

Are you currently debt-free? Or are you taking active steps to reduce your debts?

-

Do you know about how much money you spend to cover living expenses over a period of three to six months?

-

Do you have an emergency fund in place that would allow you to get through a sudden large life event like a layoff or a totaled vehicle without having to borrow money?

-

Do you have an understanding of how compound interest allows invested money to grow over time?

-

Do you know the various kinds of insurance that are needed to protect your finances and investments?

-

Do you understand the difference between an investment and insurance?

What Action Steps Can You Take?

Hopefully you were able to answer “yes” to all—or at least some!—of the assessment questions. If so, congratulations! You’re probably among the fortunate few who have achieved real financial literacy!

But in case you found yourself answering “no” to some of the questions, don’t be discouraged! There are steps you can take to get a better understanding of how money works. In fact, the same Ramsey Solutions research we cited above shows that many who take personal finance courses experience awesome results with their money when following these steps:

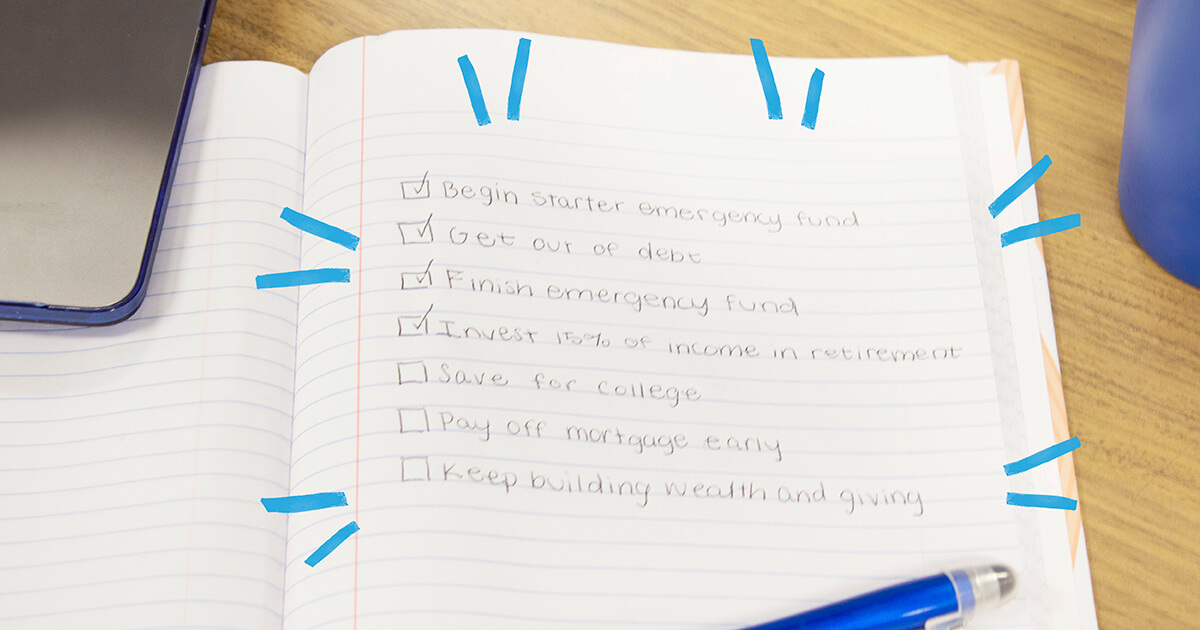

1. Start a baby emergency fund.

Begin by saving up $1,000. This is to keep you from being thrown off track when those inevitable, tough financial events hit you. (You’ll be making this emergency fund even bigger later on.)

2. If you’re still in debt, get out of it.

You’ve seen for yourself how much debt slows down financial progress. To rid yourself of pesky debts, just list them from smallest to largest. Then use the debt snowball method to pay them off. As you pay off the smallest debt, roll what you used to pay toward it onto the next largest debt. Repeat this process until all your debts are cleared!

3. Finish your emergency fund.

This is another area where taking a class on good money habits helps, and many of those who do so save an average of $3,000 per year in personal earnings.(10) To complete this step, move all the momentum you gained while paying off debt toward saving up three to six months’ worth of living expenses.

4. Invest 15% of your income in retirement.

It’s never too late (or early) to plan for retirement, as our research shows. Eighty-seven percent of students who take a finance class agree they feel confident about investing.(11) You can face the future with hope when you have a plan that includes smart retirement investment. Use good growth stock mutual funds in a tax-advantaged retirement savings plan like a 401(k) or Roth IRA. Investing 15% can help ensure you beat inflation over the long haul—while still having enough income to put toward paying off your home.

5. Save for college.

Over half (51%) of students who learn about finance in high school plan to pay for college themselves.(12) The best methods are Education Savings Accounts (ESAs) and 529 plans.

6. Pay off your mortgage early.

This monthly housing payment is one of the biggest expenses for most people. Imagine never sending out this payment again—and owning your home free and clear!

7. Keep building wealth and giving generously.

The purpose of financial literacy isn’t just head knowledge. The real goal is to be able to use your money to do the things you truly want to do, like retire with dignity, spend free time with family, and give to other people and worthy causes.

Financial Literacy Is Changing Communities for the Better

By now, you’ve got a pretty good sense of where you stand in terms of your own financial literacy. Maybe you have a lot to learn, but it’s encouraging to know that increasing financial literacy could transform whole families, communities and even the nation!

Many educators are already working hard to bring this kind of understanding to millions of students nationwide. Every year, thousands of graduates go through our middle school and high school personal finance curriculum, Foundations in Personal Finance, and gain financial literacy skills that empower them for a lifetime of winning with money.