Introduction

It’s the fourth year of The State of Personal Finance—giving insights into how Americans feel about and are dealing with the important money topics of the day—and the new year is starting off as a mixed bag.

There’s optimism for the future, but the present holds many Americans in dire straits. Around half of the country is struggling to pay bills or save for the future, which weighs heavily on minds and hearts. And a similar number are turning to Washington, D.C., and a new president for hope that things will get better.

In this edition of The State of Personal Finance, we’re looking at several key findings in the world of money, analyzing both current numbers as well as trends over the last four years.

Executive Summary

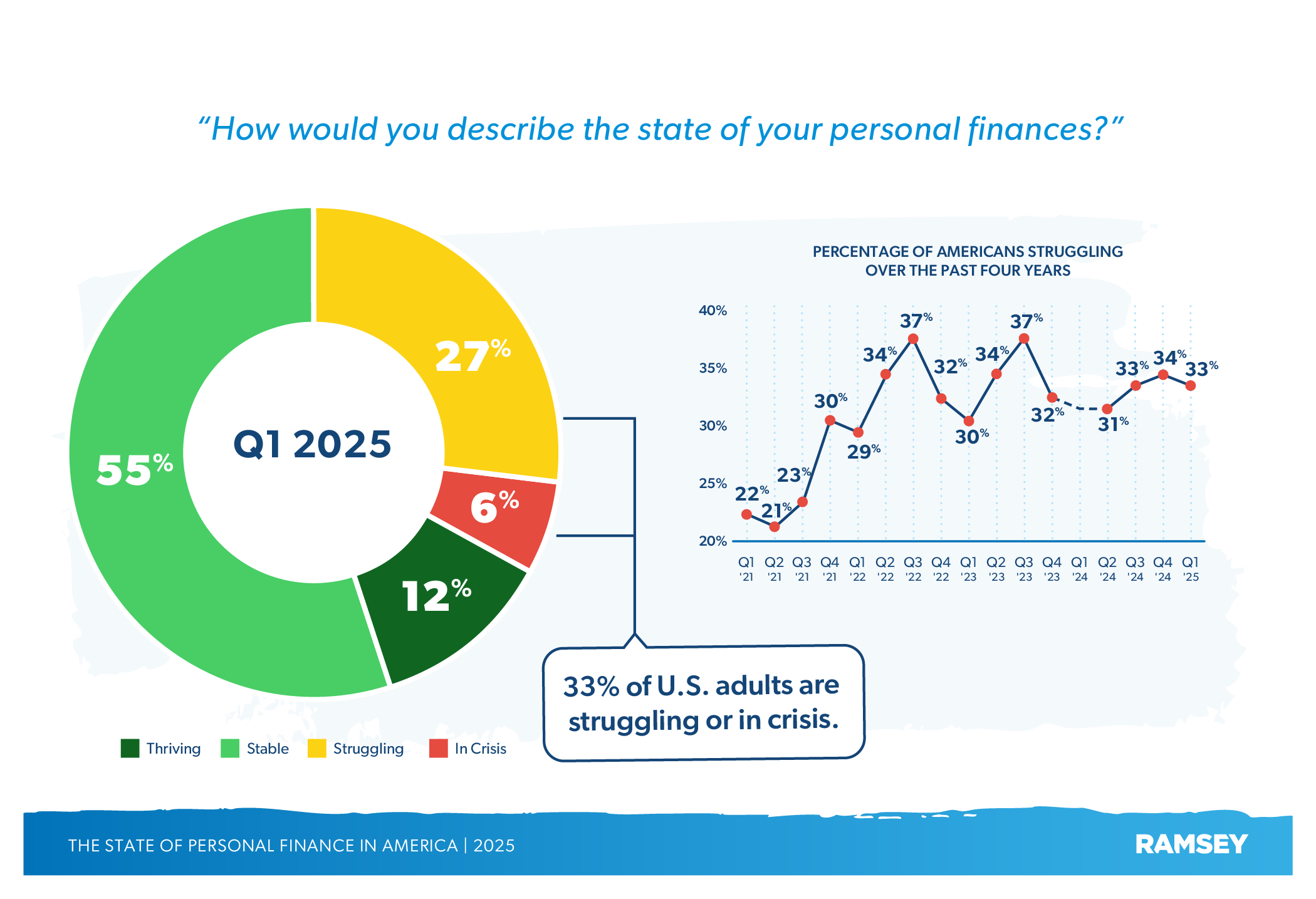

- One-third of Americans (33%) report that they’re struggling or in crisis with their money.

- 53% of Americans say they are living paycheck to paycheck.

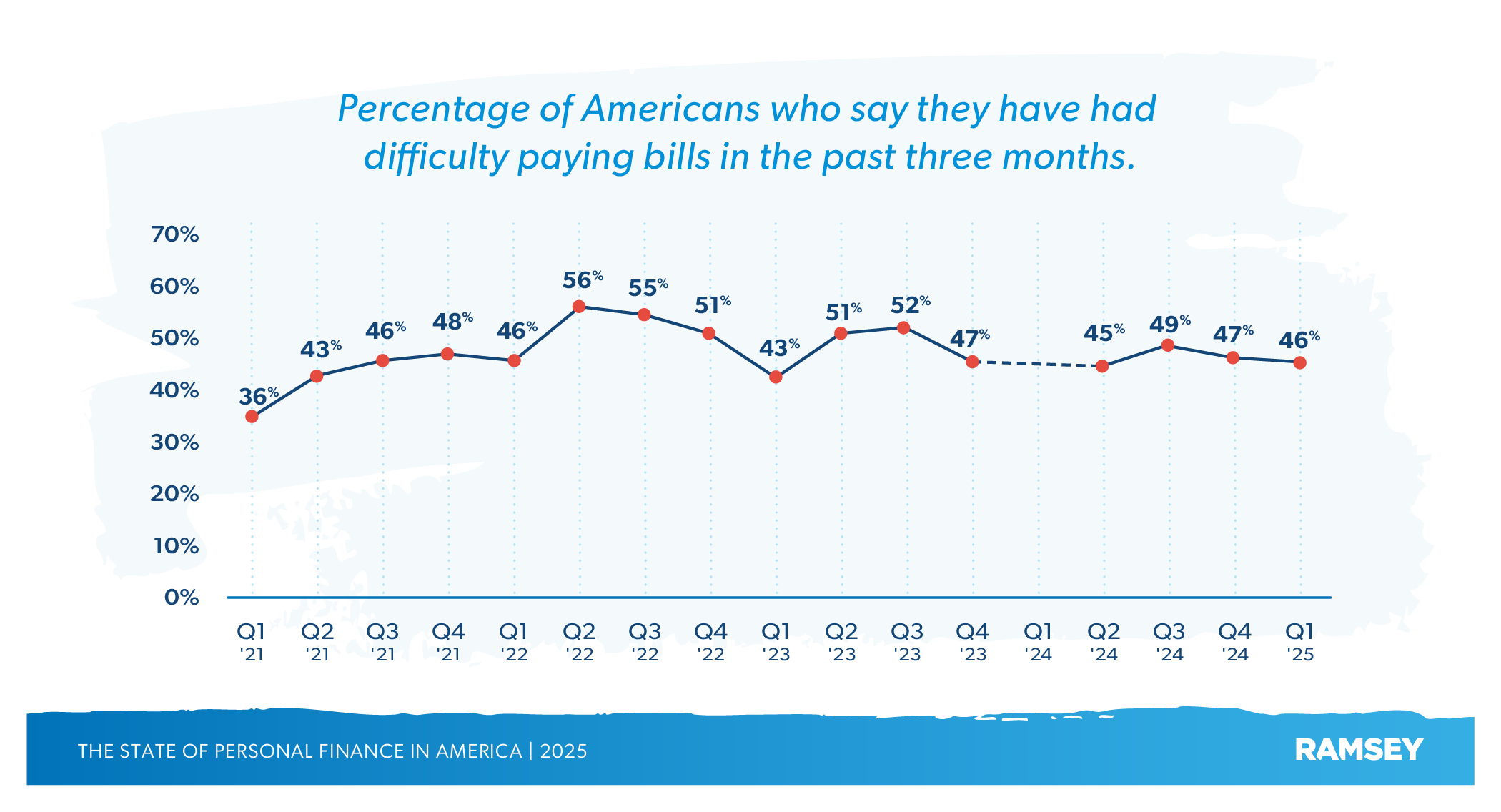

- Almost half of Americans (46%) report some difficulty paying bills, and about a third (32%) have paid a bill late in the last three months.

- 52% of renters report some difficulty paying rent in the last three months.

- 50% of Americans say they were either happy or very happy with their overall personal finance situation, and almost as many (42%) say they are optimistic about their financial future.

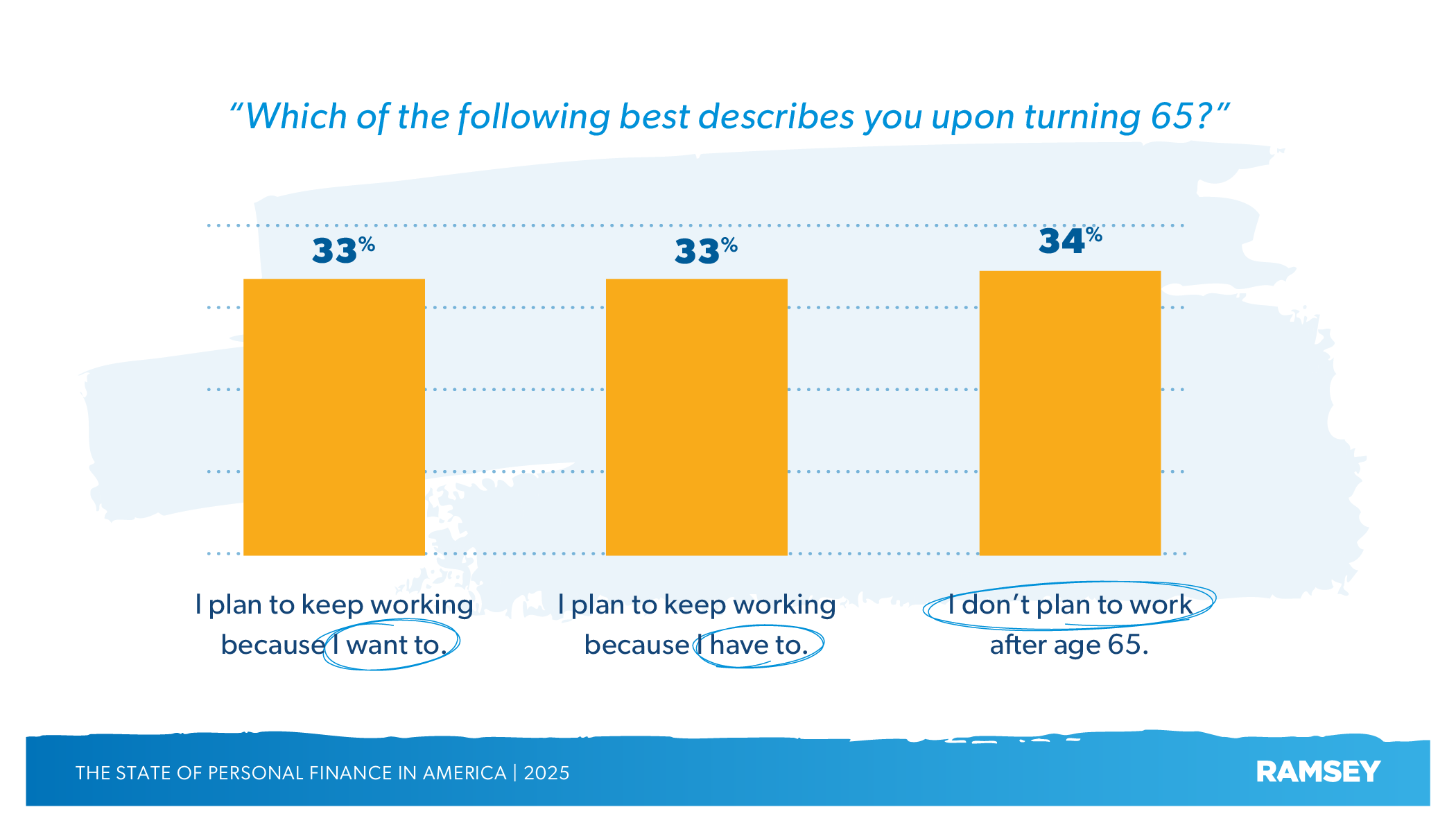

- Two-thirds of Americans (66%) say they plan on working past age 65, and one-third (33%) say they plan on working because they have to.

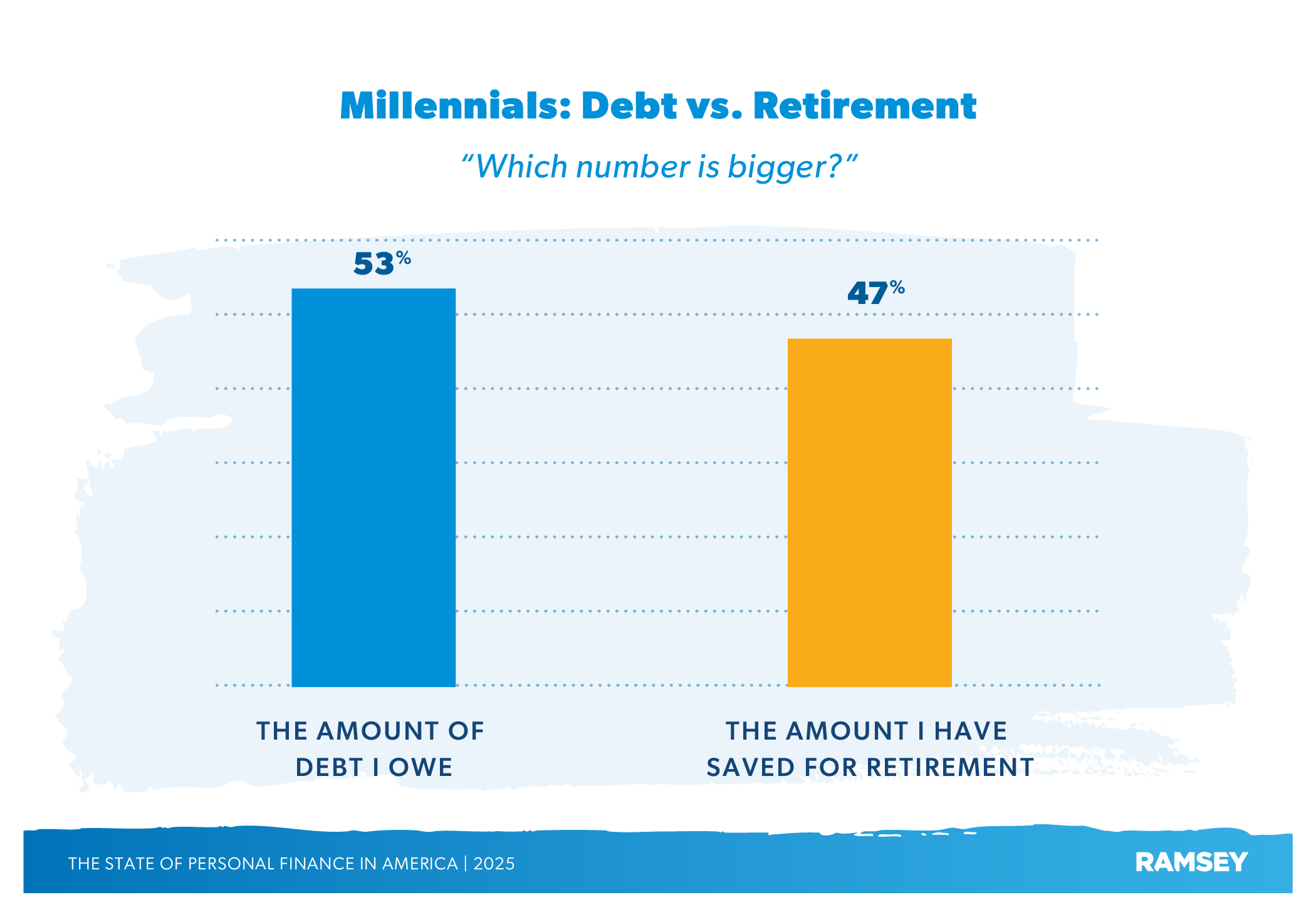

- Over half of millennials (53%) say the amount of debt they have is greater than what they have in retirement savings.

- 6 in 10 U.S. adults report that they worry about their finances daily.

- One-third of American workers (36%) say they are often distracted at work by their personal money stress—a percentage evenly split by both blue- and white-collar workers (38% vs. 35%).

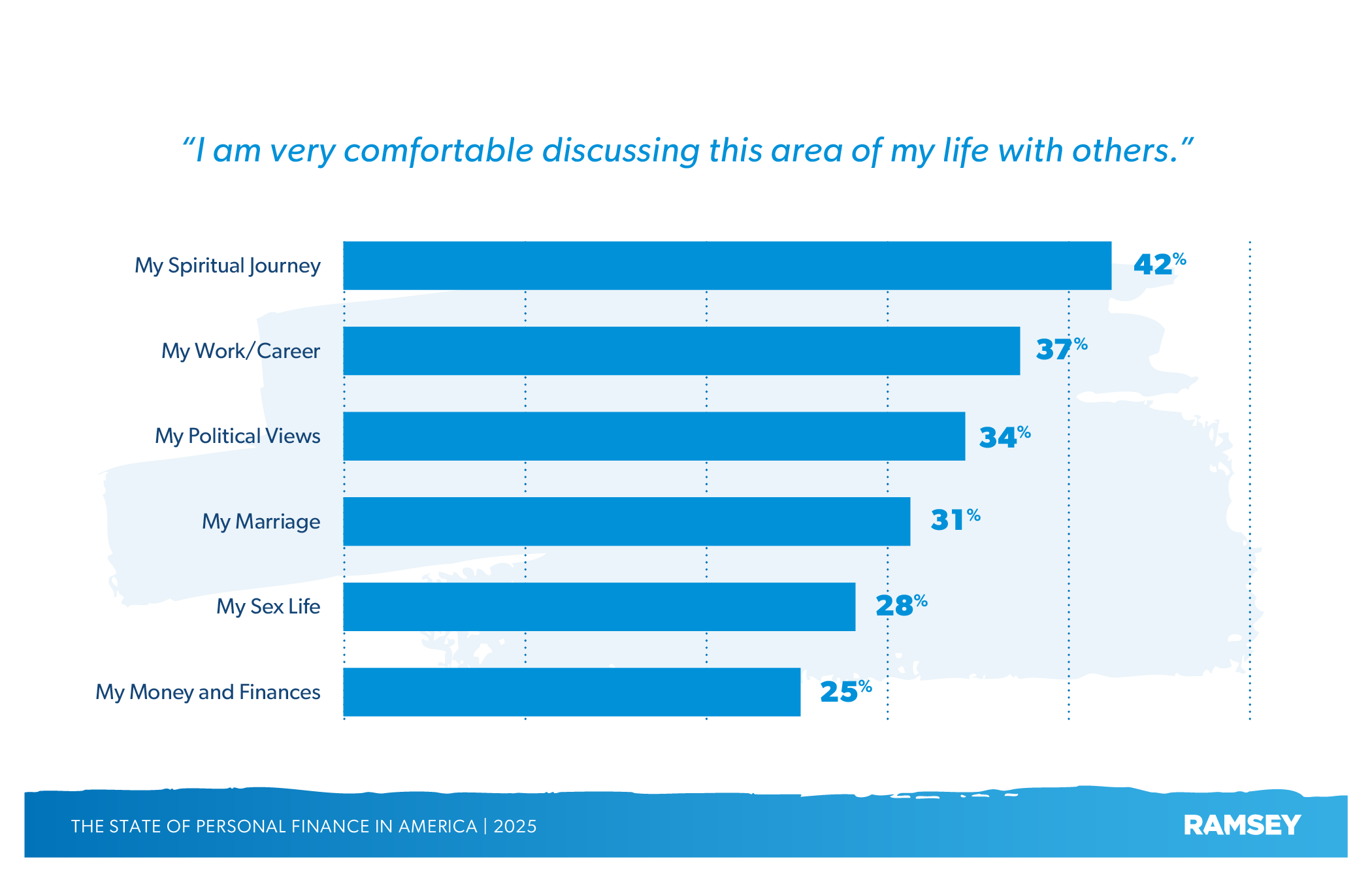

- Americans say they are more likely to discuss politics, religion and their sex lives before talking about their personal finances.

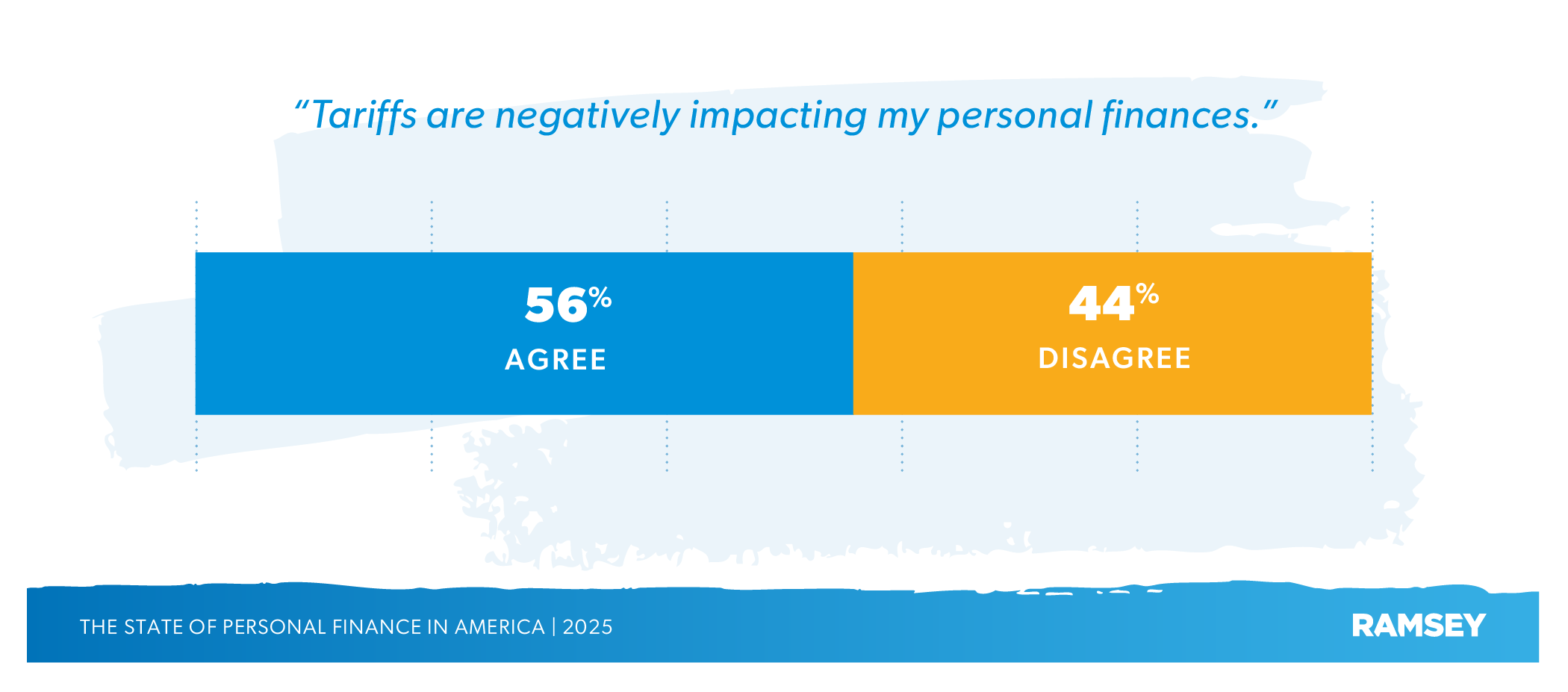

- 56% of Americans say that President Trump’s tariff policy is negatively impacting their personal finances.

- 52% of U.S. adults believe the economy will improve under the second Trump administration—a jump of 15 percentage points from the previous quarter.

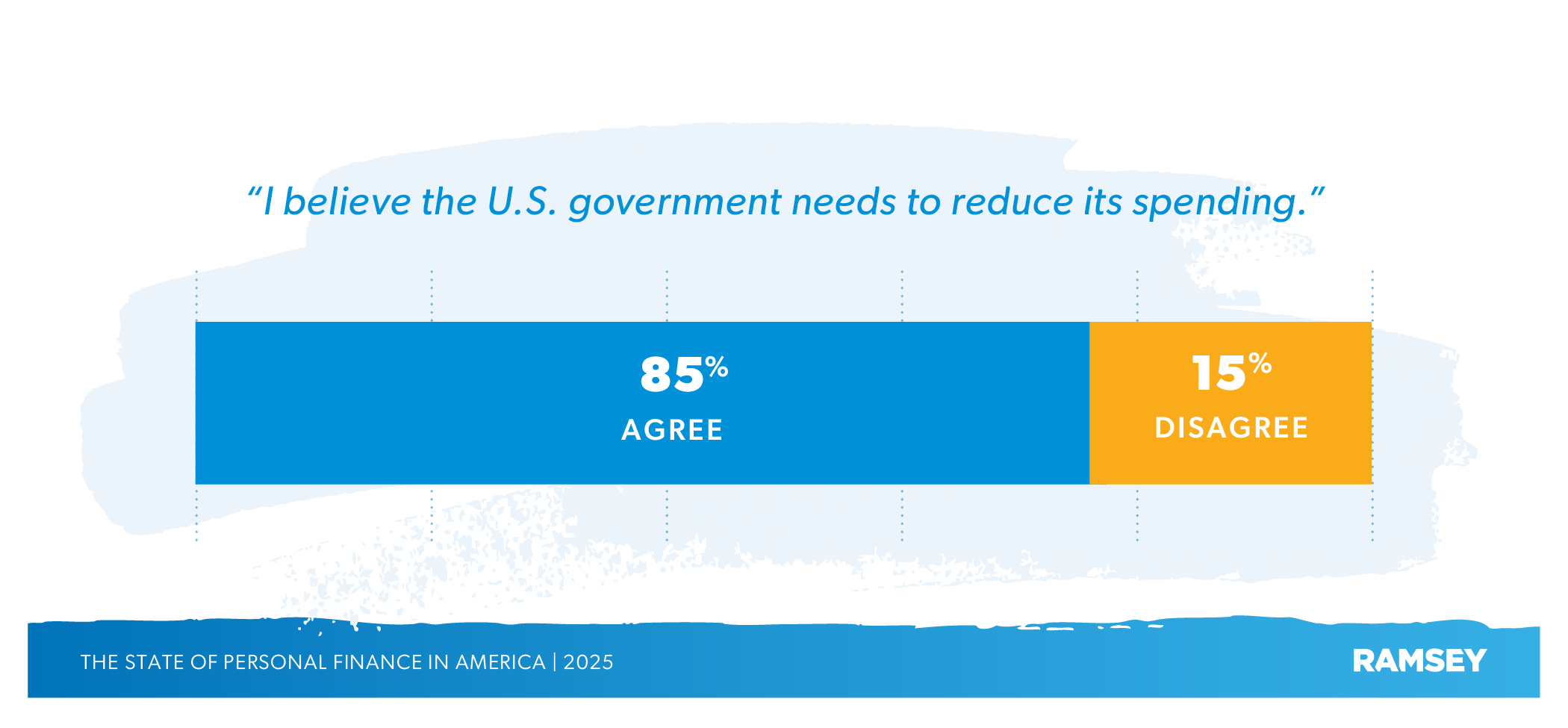

- 85% of Americans say the U.S. government needs to reduce its spending—a figure that cuts across all demographics we measured: sex, age, political affiliation, etc.

- When asked if the Department of Government Efficiency (DOGE) was doing good work, just under half of Americans (46%) agree.

Download a PDF version of the report.

More Americans Are Struggling With Their Personal Finances

2025 is beginning with an increase of Americans in financial trouble. One-third of Americans (33%, or about 86 million adults) report that they are struggling or in crisis with their money. Women are more likely to say they are struggling than men (41% vs. 25%). And generationally, Gen Xers report struggling the most (40%).

While 33% is less than the peak of 2022 and 2023 (37%), the trend over the last four years shows an overall gradual climb in Americans struggling or in crisis with their finances, compared to the first quarter of 2021 (22%).

Living paycheck to paycheck no doubt adds to feelings of financial instability, but 53% of Americans say they’re doing just that—and that figure hasn’t changed much in about a year. In fact, the percentage of those who are living paycheck to paycheck hasn’t gone below 43% for almost four years.

While this situation is more common for Americans with lower household incomes (72% of those who make less than $50,000), 36% of Americans making over $100,000 a year still live paycheck to paycheck. And Americans with kids at home are also more likely to report living paycheck to paycheck (62%).

Because half of Americans are living paycheck to paycheck, it’s no surprise that almost half of Americans (46%) report some difficulty paying bills, and about a third of Americans (32%) have paid a bill late in the last three months. Gen Z is the generation with the most trouble paying bills (64%), which is understandable since, on average, Gen Zers are just entering the workforce and are likely dealing with burdens like student loans.

One of the bills Americans struggled with in the first quarter was housing. Following the overall trend on bills, over half of renters (52%) report some difficulty paying rent each month, and Gen Z is again the generation with the most difficulty (66%). Homeowners, however, fared a little better, with 35% saying they had difficulty making their monthly payments—continuing a downward trend since 2023.

But Americans are still hopeful despite the financial difficulties. Asked whether they are happy with their overall personal finance situation, 50% of Americans say they are either happy or very happy. Almost as many (42%) say they are optimistic about their financial future. And 77% say they are financially better or about the same compared to last year.

Americans Are Unprepared for Retirement

Americans may be optimistic about their financial outlook, but their saving habits and retirement plans tell another story.

When asked whether they would continue to work past age 65, two-thirds of Americans say they plan to do so. And one-third (33%) say they are planning on working because they have to—meaning they need a steady income to supplement their retirement savings (if they have any).

Breaking things down a little more, all three of the pre-retirement generations are pretty even: 33% of Gen Z, 31% of millennials and 36% of Gen X all say they will have to work post-65. More women than men (37% vs. 28%) and singles than marrieds (40% vs. 24%) say they will have to work. And Americans with consumer debt are twice as likely to say they have to work compared to those with no debt (39% vs. 20%).

Millennials’ issues with retirement go beyond just working past 65. Over half of millennials (53%) say the amount of debt they have is greater than what they have in retirement savings. These young workers will need to eliminate their debt if they ever hope to retire with any kind of substantial nest egg.

The baby boomers, who are currently retiring, aren’t doing much better. Almost half of baby boomers (46%) are living on less than $100,000 in retirement savings. By itself, $100,000 may seem like a large amount, but it’s not large enough to create enough growth each year for someone to live off without touching the principal amount. And if they also have a mortgage, saving is going to be even more challenging.

The Invisible Effects of Personal Finance Issues

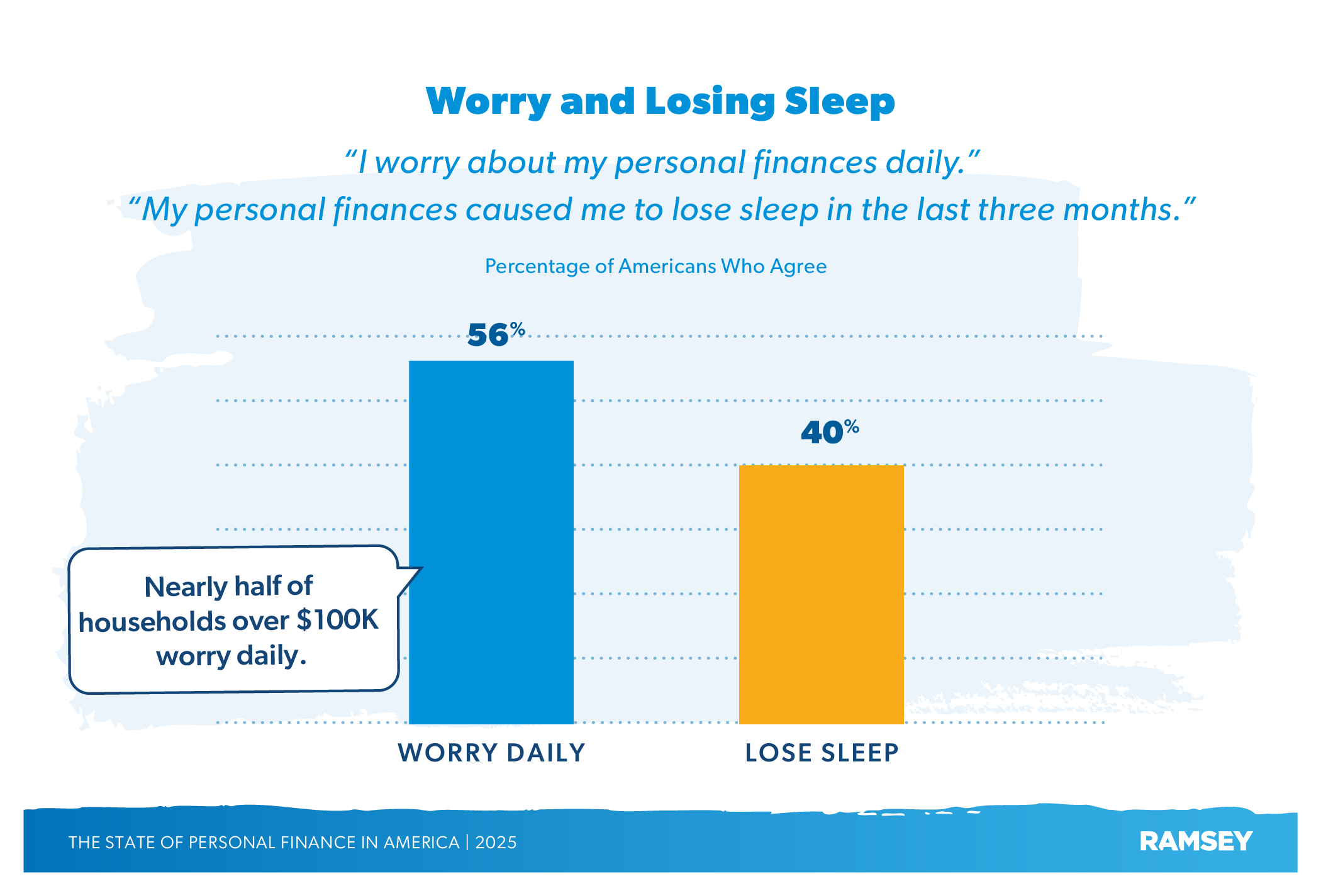

Financial uncertainty doesn’t only affect money. The anxiety and stress of trying to figure out how to pay for everything is very real. In fact, 6 in 10 U.S. adults report that they worry about their finances daily, and 4 in 10 say they lose sleep over the state of their money.

More women than men worry daily about money, though the gap is narrow (59% vs. 53%). Gen Z is the most worried generation (69%), with baby boomers the least worried (32%). And while 60% of households earning below $50,000 a year are stressed about their finances, nearly half of $100,000 households (45%) are also feeling the mental burden.

If people are stressing about money at home, chances are, they aren’t doing very well at work—and our data found just that. One-third of American workers (36%) say they are often distracted at work by their personal money stress. And this figure is nearly even between blue- and white-collar workers (38% vs. 35%). So domestic money issues not only affect a household but a business’ bottom line.

It’s obvious that Americans need to get serious about their money. But the topic is still a cultural taboo. In fact, Americans say they are more comfortable discussing other taboo topics like politics, religion and their sex lives before talking about their personal finances.

Americans Are Uneasy About Trump Tariff Policy but Remain Hopeful for the New Administration

The first quarter of 2025 saw the inauguration of a new president, which means a new vision for American economic policy. And in his first three months, President Donald Trump has wasted no time following through on that vision—including the implementation of new and higher tariffs on imports from foreign countries.

Since the announcement of his official tariff plan on April 2 (and the 90-day pause on that plan a week later), Trump’s tariff policy has sent the markets into a series of record-breaking ups and downs, leaving many Americans feeling like passengers on a roller coaster—nervous about what these new tariffs will do to already inflated prices and retirement accounts. Fifty-six percent of Americans say that tariffs were negatively impacting their personal finances before the tariff policies even took effect.

The negative perception of the impact from tariffs is consistent across generations, with all age groups hovering around 60% in agreement. More women than men are concerned about the influence of tariffs on prices (64% vs. 56%), as are city dwellers (68%) more than suburban and rural Americans (57% and 54%). And political liberals focus on the negative effect more than conservatives (76% vs. 46%), but moderates aren’t too far behind liberals (63%).

Despite the nervous feelings about tariffs, President Trump seems to be gaining the confidence of the American people on the economy generally, as 52% of U.S. adults say they believe the economy will improve under the second Trump administration. This figure is up 15 percentage points from last quarter’s State of Personal Finance, which was surveyed just after Trump’s win in the election.

Breaking things down further, more men than women believe Trump and his policies will improve the economy (58% vs. 46%), and millennials have the most confidence in the new administration (61%). Political persuasion can factor into confidence levels as well, as conservatives were naturally the most confident (79%), with moderates at 41% and liberals at 32%.

Aside from tariffs, the new Trump administration has made curbing government spending one of its primary goals—and a supermajority of Americans are behind it. These days, you can’t get a significant majority of Americans to agree on anything, but 85% of Americans say the U.S. government needs to reduce its spending. This figure is consistent across all demographics—sex, age, political affiliation, etc. Even 80% of Americans on public assistance agree.

Though a huge majority believes the government has a spending problem, Americans are less confident in the way the Trump administration is going about cutting that spending. When asked if the Department of Government Efficiency (DOGE) was doing good work, just under half of Americans (46%) agree. The demographic breakdown is similar to that of the confidence in Trump’s general economic policy—with men, millennials, conservatives and higher income earners expressing more confidence in DOGE.

Conclusion

2025 holds a lot of uncertainty for the state of personal finance in America—from the average Americans’ house to the White House. With financial struggles still very real and present, Americans seem to be waiting for the next shoe to drop in Washington before making any moves with their money.

But lasting change can only happen if you start making moves in the right direction—today. The best way to curb the shock of any economic issues that may come (be they from your own life or from the government) is to follow a budget, get and stay out of debt, build an emergency fund, and start saving for your future—in that order. That way, you’ll be prepared for whatever life throws at you, no matter who’s in the White House.

It may require a little pain and delayed gratification today, but your financial future will thank you.

About the Study

The State of Personal Finance is a quarterly research study conducted by Ramsey Solutions with 1,014 U.S. adults to gain an understanding of the personal finance behaviors and attitudes of Americans. The nationally representative sample was fielded from March 1–11, 2025, using a third-party research panel. Margin of error was ±3.08%.

Since January of 2021, The State of Personal Finance has surveyed over 15,000 U.S. adults. Research from the study has been shared on hundreds of media outlets, ranging from Forbes to Fox News Channel, The New York Times and Good Morning America, and ad campaigns during the NBC coverage of the 2024 Summer Olympics in Paris.