Introduction

Six months into 2025 and Americans are on a bit of an upswing concerning their money. Worries about money are going down, and Americans are saying it’s less difficult to afford the basics of life. However, Americans also seem to be approaching this relief with a heaping helping of caution, as many are still struggling. And mistrust of the federal government’s management of the American economy continues to rise.

In this edition of The State of Personal Finance, we’ll look at how Americans’ feelings about their money often clash with the reality of their money situations, leading to some questionable choices.

Executive Summary

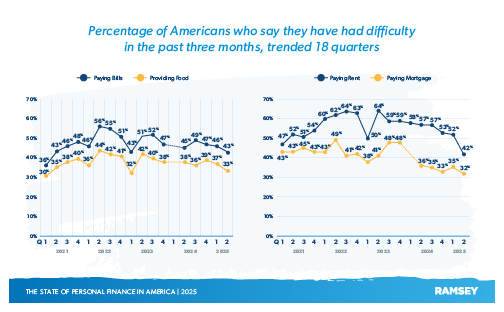

- The number of Americans having difficulty paying bills is at a two-year low (43%).

- Housing difficulty is continuing a downward trend from a peak set two years ago.

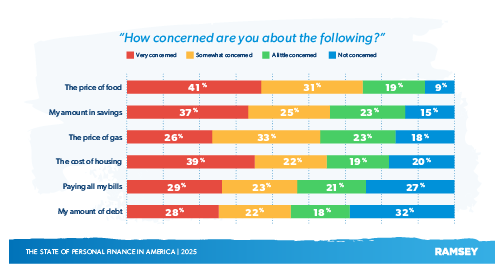

- The price of food is the top money issue for U.S. adults, far above the price of gas and the cost of housing.

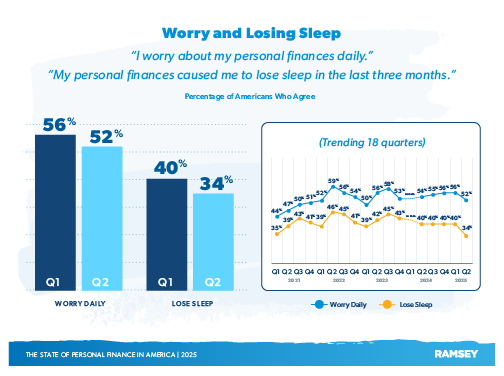

- 52% of U.S. adults say that they worry daily about their finances, which is a drop of 4 percentage points from the previous quarter and a two-year low.

- The percentage of Americans who say they are losing sleep because of money dropped from 40% to 34%, which is a four-year low.

- Almost 60% of Americans are optimistic that they will achieve their money goals.

- Only 25% of U.S. adults say they are better off financially compared to a year ago.

- A third of Americans (33%) say they’re struggling or in crisis with money, and 52% are living paycheck to paycheck—figures that have been relatively flat over the last year.

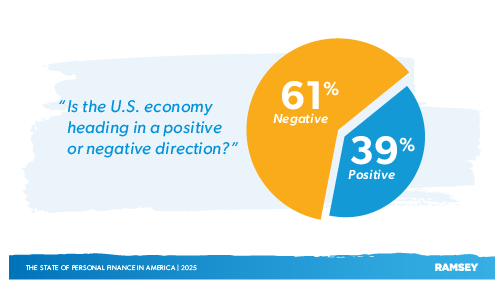

- A majority of Americans (61%) believe the U.S. economy is heading in the wrong direction, and almost half (46%) say the economy is unhealthy.

- Less than half of Americans (45%) believe that President Donald Trump and his administration will improve the economy—down 7 percentage points from last quarter.

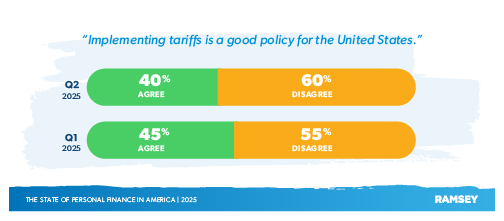

- Support for the implementation of tariffs among U.S. adults is now at 40%, and two-thirds of Americans (66%) say that tariffs are having a negative effect on their money.

- 1 in 3 Americans do not believe Social Security will be around when they turn 65.

- For 45% of Americans, a high credit score is more desirable than a paid-off car

- Almost half of Americans (42%) say they admire people who own expensive homes, cars and clothes.

- 54% of U.S. adults say they’ve made a money mistake they still regret to this day.

Download a PDF version of the report.

Money Issues May Be Looking Up

This quarter saw a decrease in the number of Americans struggling to afford the basics of life—with some categories even seeing record lows. Compared to last quarter, Americans are having less difficulty paying their bills, providing food, and covering their housing.

Specifically, the number of Americans having difficulty paying bills (43%) is now the lowest it’s been in two years. Housing difficulty is continuing a downward trend from a peak set two years ago, and those reporting having trouble paying rent (42%) is at a four-year low.

Breaking things down demographically, Gen Z is having the most trouble, with just over half experiencing trouble with rent (53%) and paying bills (55%). And more women than men struggle on both counts (46% vs. 38% for rent and 49% vs. 37% for bills).

What’s even more telling of the current downtrend in money worries is that paying bills isn’t a top concern for Americans overall. The price of food is actually the number one money concern for U.S. adults. And the percentage of Americans who say the price of eggs is going down almost doubled from 15% to 28% this quarter.

With many Americans less concerned about paying bills or the price of gas, a majority of them are sticking to their summer travel plans, with 57% saying they’re either traveling more or about the same as last year. The younger generations and households with kids are more likely to travel more.

Americans Aren’t Feeling the Upswing

It seems that Americans are experiencing relief from financial hardship, but are they really feeling that relief? In some ways, yes, but in others . . . it’s complicated.

Just over half of U.S. adults (52%) say that they worry daily about their finances, which is a drop of 4 percentage points from the previous quarter and a two-year low. The percentage of Americans who report losing sleep because of money also dropped, from 40% to 34%, which is a four-year low. And almost 60% of Americans are optimistic that they will actually achieve their money goals.

This might sound promising, but there’s more going on under the hood (or the roof). Although the number of Americans worried about their finances has gone down, only 25% say they are better off financially compared to a year ago—bringing that percentage back down to 2024 levels. The majority (52%) report they are about the same. What’s also interesting is that the number of Americans who worry about their finances is very similar to the percentage who are happy with their finances overall (52% and 50%, respectively).

Also telling are certain figures that have remained steady over the course of several quarters. A third of Americans (33%) say they are struggling or in crisis with money, a number that has been relatively flat over the last year. The percentage of Americans living paycheck to paycheck is at 52% and has seen similar numbers over the last five quarters.

This all may be pointing to the conclusion that even though Americans might be getting relief from some money issues, their ears and eyes are clouded by other money problems. They still don’t feel like they’re getting ahead or even treading water.

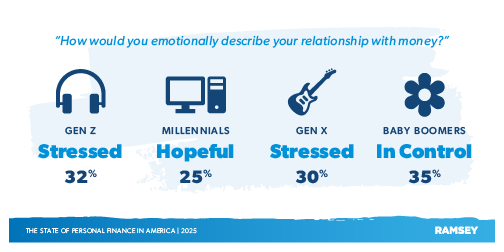

Going a little deeper, we asked Americans how they would emotionally describe their relationship with money. When given a group of emotions to choose from, a plurality of millennials (25%) say they are hopeful about their finances. Both Gen Z and Gen X are most likely to feel stressed about money. And baby boomers feel the most in control of their money.

Americans Losing Faith in the Federal Government

Despite the lowering of prices and some relief from money stress, it’s clear that Americans are still feeling anxious about their money. What’s also certain is that most Americans aren’t jumping to give credit for any gains to the new administration in Washington, D.C. Almost half (46%) say the economy is unhealthy. In fact, a majority of Americans (61%) believe the U.S. economy is heading in the wrong direction while only 39% say it’s headed in a positive direction.

Women are more likely to say that the U.S. economy is heading in the wrong direction, as are households making less than $50,000 a year (69%). Generationally, baby boomers are the most pessimistic about the economy (67%), which is ironic given that baby boomers say they’re the most stable financially. And it seems that a person’s political persuasion has a sizable impact on their view of the economy. A majority of liberals believe the economy is both unhealthy and headed in the wrong direction (54% and 81%, respectively) compared to a minority of conservatives (33% and 31%, respectively).

Americans aren’t just pessimistic about the economy. Less than half of Americans (45%) believe that President Donald Trump and his administration will improve the economy—down 7 percentage points from last quarter. Until now, Trump had been steadily gaining the confidence of the American people since his election last November. Even so, the younger generations are still more likely to support this administration, as are men and households making over $100,000 a year.

Something to note is that this research study was conducted before President Trump signed the One Big Beautiful Bill Act (OBBBA) into law, so that did not influence any of our findings.

A major source of concern for many Americans is Trump’s ongoing tariff policy on foreign goods. Support for the implementation of tariffs among U.S. adults is now at 40%, down from 45% the previous quarter. As the administration continues to negotiate new trade deals with foreign countries, the effects of the tariffs are just now coming into play, with some consumer goods being hit more than others— likely adding to Americans’ feelings of uncertainty about the economy.

Americans are also worried about the effect tariffs will have on their personal finances, with most of the concern coming from companies passing tariff costs on to consumers in the form of higher prices. Two-thirds of Americans (66%) say that tariffs are having a negative effect on their money.

Adding to the worries about tariffs is a continuing concern about inflation and its effects on prices. A majority of Americans (61%) are either extremely or very concerned that inflation is still making things more expensive.

The federal government’s own spending has also been under public scrutiny lately, which led to the formation of the Department of Government Efficiency (DOGE). But even public support for DOGE is waning, as only 42% of Americans agree that DOGE is doing good work—down from 46% the previous quarter. Yet, the younger generations are still more inclined to believe in what DOGE is doing (48% of Gen Z), as are political conservatives (73%).

Low confidence in the government also extends to retirement benefits. One in 3 Americans (31%) do not believe that Social Security will be around to pull from when they turn 65. When broken down demographically, this number rises to almost half of millennials and Gen Xers (45% and 44%, respectively). And income appears to have very little effect on the concern, which hovers around 30% across all three annual income brackets.

Americans’ Money Attitudes Reveal a Disconnect Between Expectations and Reality

Based on the findings above, there seems to be a gap between how Americans feel about their money and what their money situation actually is—a gap that may be fueled by misplaced perceptions, priorities and behaviors.

Most Americans appear to have received at least a few essential truths about money growing up. Seven in 10 Americans say their parents taught them about the importance of saving, which shows that Americans do, on a fundamental level, understand the value and importance of money. In fact, Americans seem to value money so much that when asked if they would stop on the sidewalk to pick up a dime (a relatively insignificant amount of money), 76% of Americans said yes.

Contrasting this fundamental knowledge about money are the popular perceptions of what makes a person win with money (no matter how misguided some of these perceptions might be). For 45% of Americans, for example, a high credit score is more desirable than a paid-off car—even though a credit score is just an assessment of your relationship with debt. A paid-off car, on the other hand, means you get to keep more of your money every month instead of making car payments.

A high credit score isn’t the only status symbol some Americans are pining after. Almost half (42%) say they admire people who own expensive homes, cars and clothes. Younger generations are more likely to agree, including 63% of Gen Z. And it’s no surprise that those who carry consumer debt admire people with expensive stuff more than those without debt (46% vs. 36%).

But that admiration may be contributing to Americans’ misconceptions of what it means to be wealthy. It’s no wonder why so many buy things they can’t afford and get into debt that weighs them down.

Perception can also hold someone back from seeking help with money. Only 39% of Americans say financial advice today is designed for them. Perhaps they don’t think they make enough money, or perhaps they’ve made too many mistakes with their money to ever even hope for something better. Over half of Americans (54%) say they’ve made a money mistake they still regret to this day.

Conclusion

The state of personal finance in America is looking better, but the foundation is still somewhat shaky. Americans are experiencing relief and hope in some areas, yet they don’t feel like they’re getting ahead.

It’s true that our feelings about our money in the moment can often lead to questionable choices. We might know what we should do with money, but the key to personal finance is 80% behavior and 20% head knowledge. Success with money depends much more on what you do than what you know.

Changing behaviors and perceptions takes time and discipline, and you have to be willing to put in the work to win. If real change is to be made, you must align your money expectations with reality. This means being diligent about spending less than you make, saving an emergency fund (because emergencies happen!), and staying away from debt. Concern yourself with what you can do for you and your household every day, not what you think a bunch of politicians in D.C. or the White House might do for you.

Don’t depend on someone else to rescue you, especially politicians. You can do something about it today. You can change your money situation by adjusting the expectations and behavior of the one person we find the most difficult to deal with—the person in the mirror.

About the Study

The State of Personal Finance is a quarterly research study conducted by Ramsey Solutions with 1,017 U.S. adults to gain an understanding of the personal finance behaviors and attitudes of Americans. The nationally representative sample was fielded from June 5–12, 2025, using a third-party research panel. Margin of error was ±3.08%.

Since January of 2021, The State of Personal Finance has surveyed over 17,000 U.S. adults. Research from the study has been shared on hundreds of media outlets, like Forbes, Fox News Channel, The New York Times and Good Morning America.