Ever wonder if our society is going completely cashless? Maybe you’ve noticed more and more businesses are only accepting digital payments.

So, what’s the deal with all this cashless society hype? Are cash and coins going away for good? And does a cashless society really look all that different than the world we live in right now?

Whew! That’s a lot of questions. Let’s break down everything you need to know (and debunk some serious junk too).

What Is a Cashless Society?

A cashless society is one where all physical money (cash and coins) is totally replaced by a digital currency. What do you do with cash? In a cashless society, you can’t spend or save paper dollars, because they aren’t accepted as payment. And the money in your bank account only exists in digital form—no driving through an ATM to withdraw a fresh stack of Andrew Jacksons.

Get expert money advice to reach your money goals faster!

The only way to pay for stuff in a cashless society is through digital transfers. These transfers can be done with debit or credit cards or through digital wallets (think Cash App, Zelle, PayPal, Google Pay, Venmo and Apple Pay).

You might be thinking, Wait . . . don’t we already have a cashless society now? Well, you’re not completely wrong. Cash is still king, but because of the convenience factor, a lot of people choose to make their everyday purchases with cards or apps. Think about it: Unless you’re a hardcore stickler for using the tried and true envelope system, when was the last time you actually pulled out a wad of cash to pay for anything?

Pew Research shows that in a typical week, 41% of Americans make absolutely zero purchases using cash.1 That’s not all that surprising though. It makes sense, right? A lot of us swipe our debit cards to pay for everything and have wallets stuffed to the brim with receipts, gift cards and gum wrappers—anything but cash.

But a true cashless society is way different than that. It’s a world where cash doesn’t exist at all in physical form, no one is paid “under the table,” and every transaction you make is traceable (insert Twilight Zone theme song here). A cashless society runs totally on a government-backed digital currency. And while no societies are 100% cashless at the moment, some countries, like Sweden and China, appear to be headed that way.

What Is Digital Currency?

Digital currency is created in a computer network, and it only exists electronically.

Be careful not to confuse electronic currency with digital currency. If you look at your bank account balance, you’ll see a number that represents electronic currency that can be withdrawn at any time for actual dollar bills. You probably even get your paycheck through an electronic transfer that shows up in your bank account. The difference between electronic currency and digital currency is that digital currency can’t be withdrawn for physical cash.

If you’re thinking this sounds like cryptocurrency, you’re right. Cryptocurrency is a type of digital currency. But crypto isn’t overseen by a government’s central bank, and it’s not legal tender. This means businesses aren’t legally required to accept cryptocurrency as payment. And unless you’re dealing with a business that accepts crypto, you have to convert your crypto into dollars to spend it.

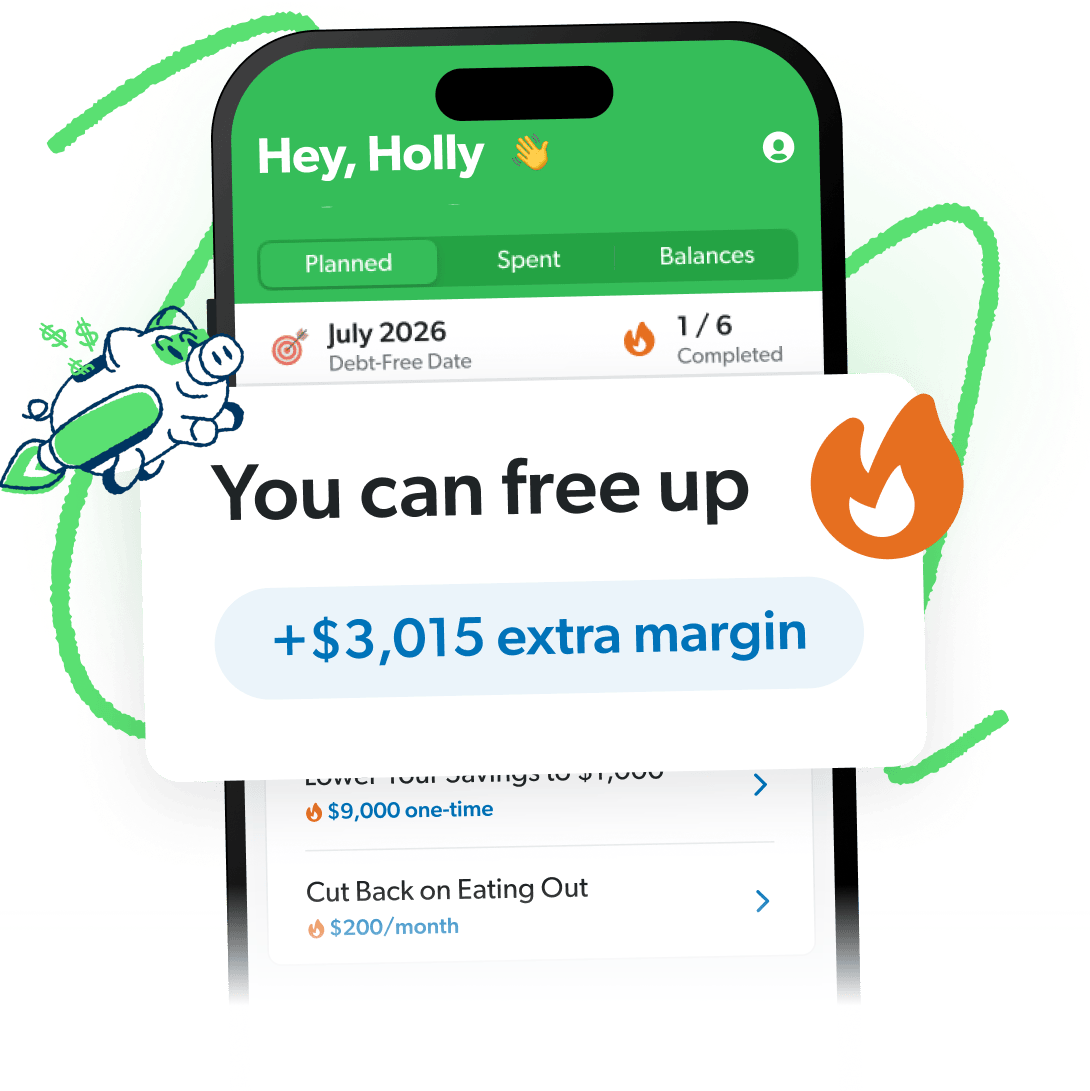

Find Margin You Didn’t Know You Had With EveryDollar

The EveryDollar budgeting app helps you find extra money every month so you can beat debt, build wealth, and make progress. Every. Day.

What Is a Central Bank Digital Currency (CBDC)?

For a cashless society to be cashless, it needs a government-backed digital currency that’s legal tender—otherwise known as a central bank digital currency (CBDC).

Have you ever looked at the fine print on a dollar bill? It says: “This note is legal tender for all debts, public and private.” CBDCs are legal tender that can be spent pretty much like cash. (But you can’t stuff them under your mattress or mail them to your grandkids in a birthday card.)

Several countries have created their own CBDCs, and the Federal Reserve (the U.S. central bank) is currently investigating its own CBDC that some people refer to as Fedcoin.

What Is Fedcoin?

The Federal Reserve is in the beginning stages of exploring the pros and cons of a CBDC. In March 2022, President Biden signed an executive order announcing that the government would look into the potential of a U.S. CBDC.2

So, what’s the backstory to all of this? Well, the government has been scrambling to come up with a good response to the mining and investing boom of cryptocurrencies like Bitcoin, Ethereum and Dogecoin (yep, that’s the one named after a dog meme).

And since the internet loves to combine words, some people are referring to the Fed’s CBDC as Fedcoin (aka a federal kind of Bitcoin). If a U.S. CBDC ever becomes a real thing, we’ll probably still call them dollars though. But let’s be clear, Fedcoin doesn’t exist—yet.

The Fed’s most recent report on a potential CBDC said it would “complement, rather than replace, current forms of money and methods for providing financial services.”3 This means a CBDC would exist with paper dollars—at least at first.

The Fed also thinks a CBDC would be safer for Americans because it would be held directly by the Fed instead of a commercial bank.4 Banks lend out most of the money their customers deposit, which causes some (minimal) risk for bank customers. If everyone decides to withdraw their money at the same time (aka a bank run), the bank will fail. But with digital dollars, your money would be held by the Fed.

What Are the Problems With a CBDC?

As you might imagine, a CBDC would have a huge effect on the banking industry and how it serves its customers. It could drastically reduce the amount of money banks have available to lend. And if the Fed creates a CBDC, it would expect private companies and banks to offer accounts and digital wallets to make spending and saving digital currency possible.5

Privacy also is a big concern for a CBDC because the government would know how you spend your digital dollars. Yep, Uncle Sam would know if you bought bed bug spray or a Nickelback CD. (Both are pretty embarrassing.)

So, the Fed is looking for ways to protect consumer privacy.6 The worry is that if the government holds your money and knows how you spend it, the government could also restrict your spending—or decide to take your money. You can see why a totalitarian regime (cough, cough, China) would like the idea of a CBDC.

On the other hand, the Fed doesn’t want the digital dollar to be 100% anonymous like cryptocurrency because it wants to keep people from spending digital dollars on illegal stuff normally purchased with cash.7 (Drug dealers don’t accept debit cards.)

Another concern is that a digital dollar would exclude people who are unbanked and primarily use cash. This includes children, the poor, the elderly and undocumented immigrants.

Finally—and this a big concern—tech problems could prevent you from accessing your money. Or your account could get hacked. Those problems kind of already exist, but can you imagine if the Fed’s CBDC got hacked somehow? The American economy would crash.

As you can see, the Fed still has a lot of problems to solve. It also doesn’t plan to issue a CBDC without backing from the president and Congress, and we all know how long it takes for Congress to agree on anything.8 So don’t expect a CBDC anytime soon. China launched its pilot CBDC in 2016, and it still hasn’t gone fully digital.9

Is FedNow Related to a CBDC?

In July 2023, the Fed plans to launch its FedNow Service. This new platform will allow banks and individuals to send and receive payments instantly between bank accounts.10

Though conspiracy theories abound, the Fed has said FedNow isn’t a form of digital currency and that it doesn’t plan to replace cash or other forms of payments with FedNow. FedNow is similar to existing Fed transfer services—it’s just much faster. Transfers that used to take days to clear will be done in seconds with FedNow.11

Did the COVID-19 Pandemic Lead to a Cashless Society?

Nope. We might use less cash, but our society still has a long way to go before it’s totally and completely cashless. And just because some stores didn’t want to accept dollar bills for a while (and maybe still don’t), that doesn’t mean a cashless society is here to stay. We hate to break it to you, but dollar bills were always gross and germ-infested—even before the pandemic ever came along. But that didn’t seem to bother anyone back then. Strange . . .

Think about how much of your money is virtual already. Does your boss hand you a pile of cash on payday? We’re guessing not. You probably wake up on Friday morning to a nice little direct deposit from your employer in your bank account.

You never saw the money physically. It never changed hands in person. And the only reason you even know you did get paid is because some ones and zeroes tell you that you did. Plus, you probably pay your family and friends through apps like Zelle, PayPal or Venmo—especially if you don’t have cash on hand or didn’t see your friends in person.

But remember: This doesn’t mean we live in a cashless society. You can still pull out cash from the bank and stuff your grocery envelopes with it or even slip a few dollars under your kid’s pillow for their lost tooth. Cash is still alive and well, and no pandemic can take it down. Like it or not, there are plenty of people who like and rely on using dollar bills. And as long as those people are around, no, we won’t be moving to a cashless society anytime soon.

Cash Is Still King

Yeah, you read that right. Dave Ramsey has always stood by using cash, and that will never change. When you buy something with cash, you really feel it. You have to give up something (like that $20 bill) to get the thing you want to buy (like that brand-spanking-new T-shirt). There’s internal friction as you watch the money leave your hands and disappear into the cashier’s drawer.

Think about how much big businesses would love for us all to go cashless though. It’s easier to spend more when we can just swipe a card or scan our phones, isn’t it? So, of course these big companies would jump at the chance to get us all to stop using cash for good! It’s more kickback in their pocket—a lot more if you use a credit card. Still, nothing beats cold hard cash. In fact, 85% of business owners say they’ll always accept cash.12 Take that, cashless society.

And look, don’t feel like you’re causing the “downfall of America” by not using cash. Seriously. As long as you have money in the bank, using your debit card is okay.

At the end of the day, whatever kind of payment you want to use (debit, mobile wallet, cash), just make sure you’ve budgeted for it first. You need to plan for every expense whether you’re laying down a few George Washingtons for a gas station hot dog or paying back your friend for spotting you at lunch.

Ready to start telling your money where to go (instead of always wondering where it went)? Make it easier on yourself and download our EveryDollar budgeting app.

EveryDollar does more than just help you track your spending and manage your money—it actually helps you find more margin every month! Just download the app, answer a few questions, and we’ll build you a plan to free up thousands in margin to put toward your goals.

Start EveryDollar for free right now!

And remember: Staying on top of the money in your own life is the best way to stick it to this cashless society business.