Let’s be honest. Balancing a checking account—aka balancing a checkbook—probably isn’t on your list of fun activities. But keeping up with your spending and income is a must, and that’s exactly what balancing a checkbook does! So, let’s break down the what, why and how.

What Does It Mean to Balance a Checkbook?

Back in the day, before there were things like online banking, most people had these things called checkbooks that contained pieces of paper called checks. You could use checks just like cash to buy stuff. These checkbooks also had small worksheets called registers where you could write down all your transactions going in and out.

Crazy, right? The younger folks out there might be surprised to hear this. Just ask your parents or grandparents all about checkbooks. They might still use them!

Checkbooks are where we get the phrase “balancing a checkbook.” It’s also called reconciling an account. Basically, it just means you’re making sure the records you’ve kept for all your spending and income match what the bank says on your physical or online statement.

Get expert money advice to reach your money goals faster!

And when we say “all your spending,” we mean all your spending—even the bag of Sour Patch Kids you bought at the gas station when you filled up your car yesterday.

Most people don’t use actual checkbooks for regular transactions these days, but the name still sticks—like “filming” or “taping” a video on your iPhone (even though you’re not using actual film or tape).

Why Should You Balance a Checkbook?

Balancing a checkbook is a way to keep up with your transactions. And if you aren’t tracking all your spending and income right now, you’re putting yourself at risk of getting hit with dangerous overdraft fees.

You can also catch any mistakes early when you stay on top of your account—like if the bank made an error or a business charged you the wrong amount. Or you might catch an error you made when writing down a payment or deposit. (It happens. We’re human.)

And here’s a big one: Balancing a checkbook is a way to catch identity theft because you’ll see any odd charges as you’re balancing.

Think of balancing a checkbook as just another layer of security for you and your money. It doesn’t take that much effort, but it can save you lots of headaches down the road.

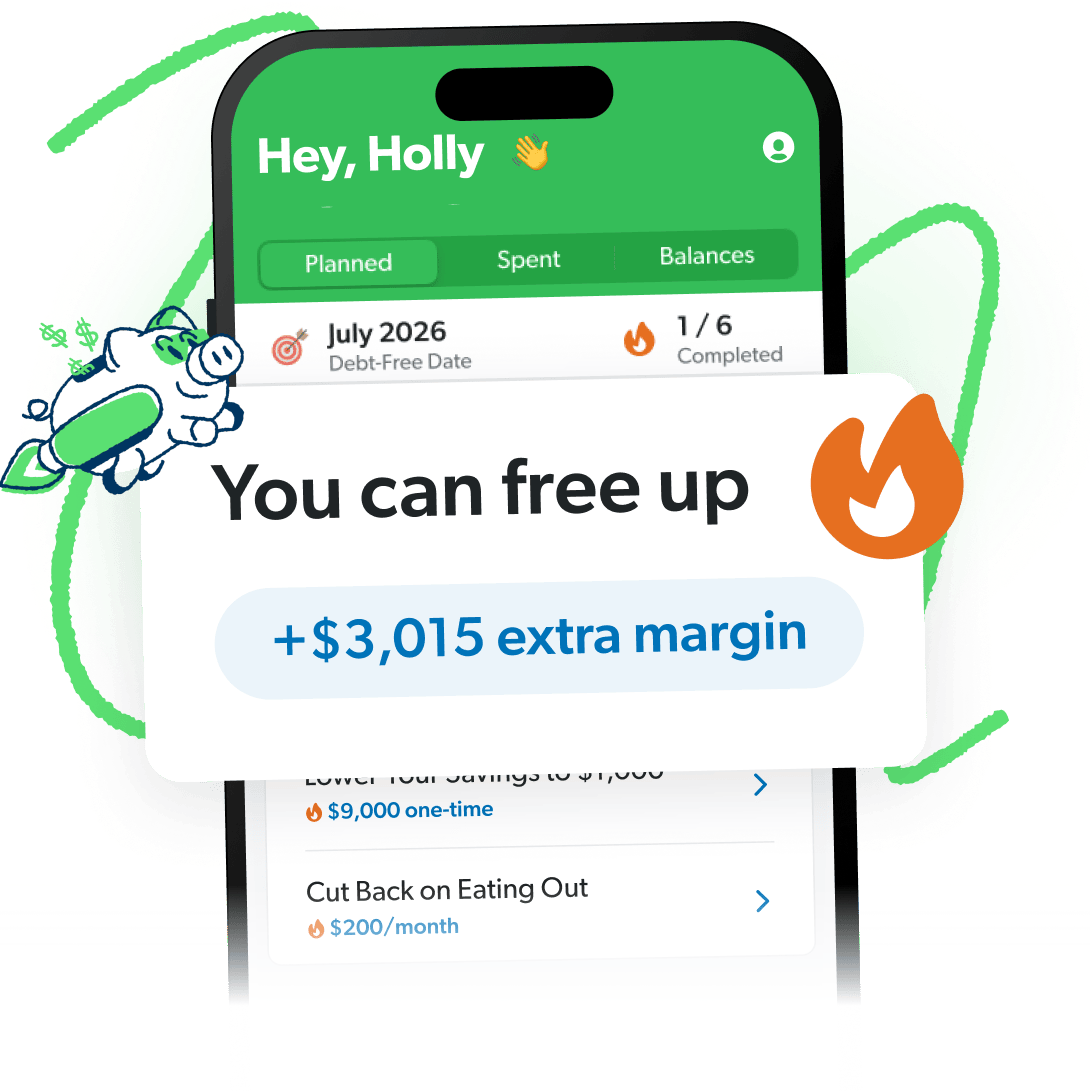

More Margin Means More Money in the Bank

In just minutes, the EveryDollar budgeting app helps you find margin you didn’t know you had—you’ll feel like you got an instant raise!

How to Balance a Checkbook in 5 Steps

Listen, this process isn’t glamorous, and neither is cleaning your bathroom—but they both need to be done to keep your house in order. And hey, at least balancing a checkbook isn’t a disgusting chore. It’s actually pretty easy! Here’s how to do it in five basic steps:

Step 1: Write Down Your Transactions Often

Start by getting out your check register (if you use an actual checkbook) or making a spreadsheet (check out the register example above). Write down your current checking account balance in the “Cash Balance” column on the far-right side. This is the amount that’s in your account before you begin to make transactions.

If money comes in or out of your checking account, write it down in the register or spreadsheet. Do this with any payment (like writing a check, using your debit card, sending money with a mobile payment service—you get the idea) and with any income (like regular paychecks or any side hustle money).

Some people write down transactions the second they happen. Others collect receipts and log them later. Just make sure you don’t let too many days go by before you check in on your account. Why? Because keeping an up-to-date balance is one of the ways you can stop your money from getting away from you.

Step 2: Open Your Checking Account Statement

Next, you need to open your checking account statement—either the paper copy you got in the mail, the digital version that was emailed to you, or the online view you can access when you log in to your bank account.

Step 3: Check All Transactions

Make sure every transaction on the statement is also in your register or spreadsheet—even pending payments.

Step 4: Update Your Balance

If you realized in Step 3 that you missed some transactions, you need to add them now.

Then you’ve got to do some basic math to make sure your balance is up to date. This means subtracting each withdrawal (money you spent) and adding every deposit (money you put in) to your existing bank balance and writing the new balance in the far-right column. Pretty simple stuff.

Even better: If you’re using a program like Microsoft Excel to create a spreadsheet, you can punch in fancy formulas to make the computer update your balance automatically. Nifty, right?

And if you aren’t very computer savvy, go ahead and use the ol’ pencil and paper method. Or just ask your kids or grandkids about it.

Step 5: Repeat

Some people wait until the monthly statement comes from the bank before they balance their checkbook. But if you log in to your bank at least once a week, you’ll give yourself way less chance of letting any transactions slip past you (which helps you avoid those overdraft fees we mentioned earlier!).

Beyond Balancing a Checking Account

Okay, here’s the deal: Balancing a checkbook is great—but it’s not enough if you want to really take control of your money. Why? Because when you balance your checking account, you’re just keeping track of what already happened to your money. You aren’t actually planning what should happen with your money. You’re making sure you don’t overspend, which is good—but you’ll never get ahead if you don’t plan ahead.

In other words, you need a budget.

Listen—budgeting gets a bad rap, but it’s just a plan for your money. It’s giving every single dollar a purpose and a job. It’s creating habits for your spending so you’re intentional with your income.

Every. Single. Month.

That’s why we made the EveryDollar budgeting app!

EveryDollar helps you find extra margin every month so you can start making real money progress, really fast. Just download the app, answer a few questions, and we’ll build you a personalized plan, based on your situation, to free up margin and make the most of every dollar. Every day. (See where we got the name?)