Get Out of Debt

Imagine a future where money decisions bring freedom, not frustration. We call that financial peace. And we’ll help you get there one step at a time.

Imagine a future where money decisions bring freedom, not frustration. With the right plan, budget and tools, you can get there—one step at a time.

Over three decades ago, Dave Ramsey turned around his money struggles and sparked a movement that’s helped millions improve their finances—and their future.

Over three decades ago, Dave Ramsey turned around his money struggles and sparked a movement that’s helped millions transform their money and future.

You work too hard to live paycheck to paycheck. Whether you’re struggling with debt or building your savings, the 7 Baby Steps will help you take control of your money for good.

Baby Step 1

Baby Step 2

Baby Step 3

Baby Step 4

Baby Step 5

Baby Step 6

Baby Step 7

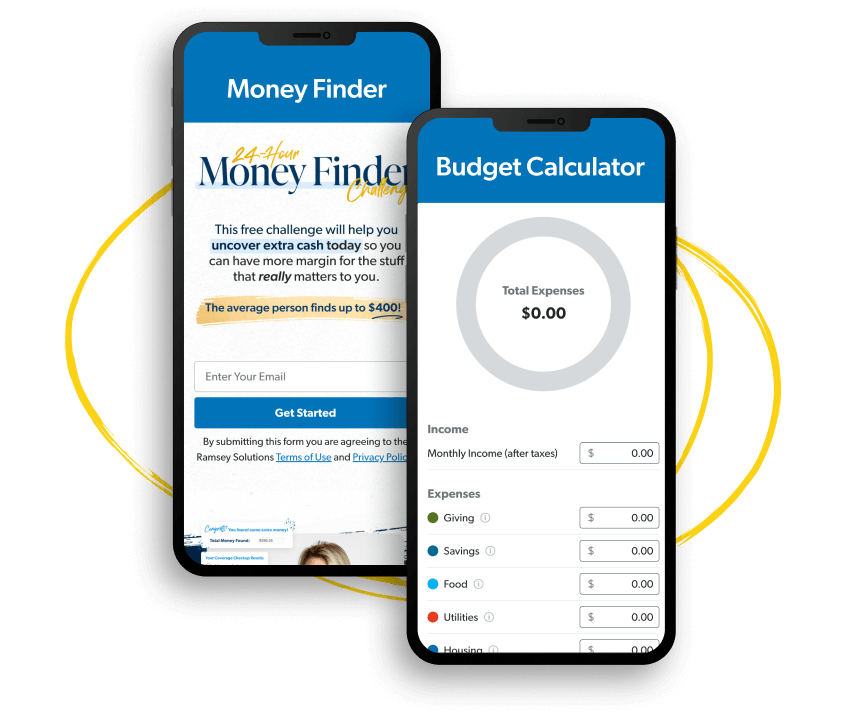

You don’t have to walk the Baby Steps alone. From expert advice to life-changing tools, we’ll show you how to live like no one else—so later you can live and give like no one else.

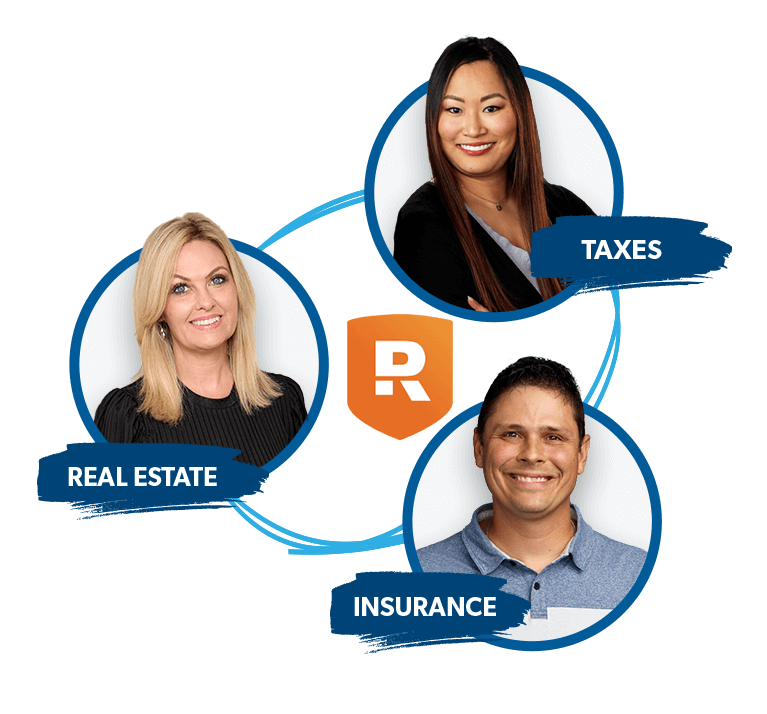

Trust isn’t something that’s gained just once. It’s maintained day in and day out. That’s why each provider in our RamseyTrusted® pros network is vetted by our team of experts. You deserve a service you can count on and someone to walk alongside you during your most important financial decisions.

Trust isn’t something that’s gained just once. It’s maintained day in and day out. That’s why each provider in our RamseyTrusted® network is vetted by our team of experts. You deserve a service you can count on and someone to walk alongside you during your most important financial decisions.

“Budgeting gives you a true picture of your finances—of your life—so you can pick what you can do and plan all the good stuff.”

“Now, we talk more about our money, we make decisions together, and it’s not stressful anymore.”

“I cried the first time we finished a month and actually had money left over. That had never happened before.”

"I paid off $121,000 in 28

months. I feel strong! The

burden is gone!"

“We're not stressed anymore. Our journey's in our hands now. We get to choose what we want to do."

"There’s freedom on the other side of debt. You don’t have to live like everyone else. I wanted something different for my family."

Stay in the know with weekly money tips, exclusive content and the latest from Ramsey Solutions—right in your inbox.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.