“I used it this year, it was also my first time filing my taxes without having someone to do it for me. The process was painless and everything was step by step.”

Tommy P.

Get the major forms you need for different tax situations, deductions, investment income and more—no hidden fees or paywalls.

Our calculations are up-to-date so you can trust them. We’d make things right if they were wrong (but we’ve never had to).

We’ll get you every penny you’re owed and stick around to help you figure out what to do with it.

No hidden fees or surprises along the way. Get all the major federal forms for the price you sign up for.

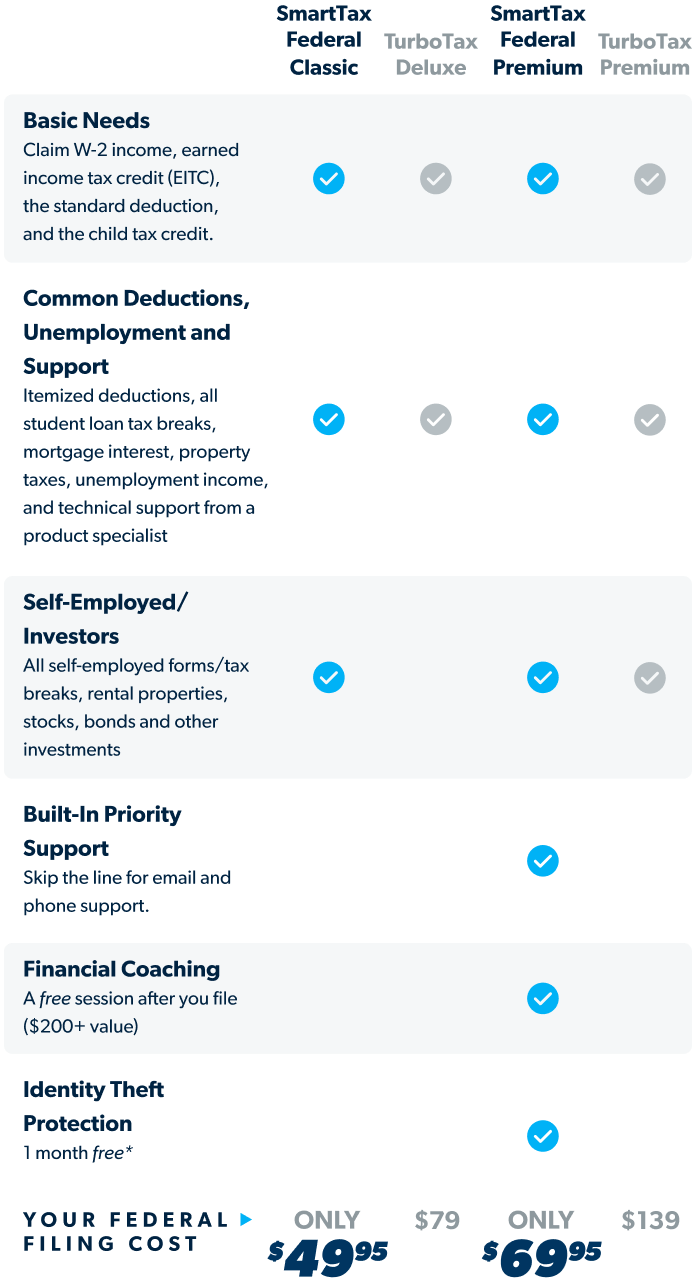

Ramsey SmartTax gives you two easy ways to file your taxes online. With Federal Classic, you get all major federal forms and deductions. And at only $20 more, Federal Premium gives you priority-level support for your questions and more perks.

Need a state return? Ramsey SmartTax can do that too. The cost to file a state return is $44.95 whether you choose Federal Classic or Federal Premium.

1Information on TurboTax® products comes from the TurboTax website on December 21, 2023, and is subject to change.

See the TurboTax website for their full details, including any other exclusions and additional costs.

2Free trial is available to new customers only. Learn more about this offer.

Here's how Ramsey SmartTax can be less than half the price of the other guys: Let’s say you have investments or self-employed income/expenses to claim and you want to file your federal tax return online. These types of filings are included with Ramsey SmartTax Federal Classic—while you’d need the Premium version of TurboTax® for those filings. If you crunch the numbers using the current list prices for those two products as of April 1, 2025, you’ll get the estimated savings. We do our best to stay on top of the current list prices, features and savings, but there’s always a chance details may not be exact as of today’s date. We recommend you do your own research to choose the best product for your situation. Ramsey isn’t affiliated with TurboTax.

*Free trial is available to new customers only. Learn more about this offer.

Active duty military can file with Federal Classic for $0 (yeah, you read that right). No matter your tax situation, it’s on us.

“I have used [another tax software] for years, and I was almost finished with filing and I saw that they had an additional $40 in a hidden fee at the end . . . I switched [to Ramsey SmartTax] and it was so easy . . . I’m grateful for this product and that I didn’t have to click through 10+ advertisements to get through the filing process!”

Make taxes a piece of cake—dig into our easy-to-digest checklists, guides and more.

See what other people like you have to say . . .

“I used it this year, it was also my first time filing my taxes without having someone to do it for me. The process was painless and everything was step by step.”

Tommy P.

“I used it and loved it way better than [leading competitor], which is my usual go-to for taxes! I received my tax return within a week of filing! So glad Dave [Ramsey] came out with this product!”

Lisa F.

“Super simple, and half the price of [leading competitor]. I had a question and support was prompt and helpful. Loved it!

Santi M.

Ninety-eight percent of Ramsey SmartTax users plan on filing with us the next year. That’s just how easy it is! Plus, you can file your taxes for a fraction of the cost of the other guys and not get suckered into loans and credit cards you don’t need. Why’s that a big deal? In a nutshell: The other guys make a profit when you take on debt. That’s not how we do things at Ramsey. #debtfree

You bet! The guided online process walks you right through it—and you can choose how little or how much guidance you want. You can even save time and fast-fill some of your info by starting with last year’s tax return. When you log in to Ramsey SmartTax to start your return, simply import a pdf when prompted. Using the pdf of your return from another tax prep site, Ramsey SmartTax can pull in your name, address, Social Security number, occupation and filing status.

You’ve got support for that! With Ramsey SmartTax Federal Classic, you’ll get help with IRS inquiries for up to one year after your return is accepted. With Ramsey SmartTax Federal Premium, we’ll work with you to prepare for and resolve inquiries for up to three years after your return is accepted.

Ramsey SmartTax is powered by TaxSlayer, who’s been trusted in the tax industry for over 50 years. That means the software is always up-to-date and accurate. Your info is kept safe. And if you’ve paid Uncle Sam too much, Ramsey SmartTax can help you get your refund.

Ramsey says two things about taxes: You need to do them (duh), and you need to adjust your paycheck withholding so you end up as close to $0 for a tax return as possible. That way, you keep the money you need in your monthly budget—and stop giving Uncle Sam an interest-free loan. To learn more, browse our tax articles.

If you’d feel better handing your taxes over to a seasoned pro, connect with a RamseyTrusted tax pro in your area. They’ve earned our stamp of approval because of their top-notch service and know-how to help you win with taxes.

Active-duty military personnel get simple and secure federal e-filing including all major IRS forms, deductions, and credits. It even includes unlimited phone and email support for $0.

Here’s how it works:

If you need a little extra support with your return, upgrading to Federal Premium is only $20. Need to file a state return, too? Ramsey SmartTax’s state returns are only $44.95.

Now, get out there, champ. Go file your taxes with confidence and the best discount ever. Also, thank you for your service . . . maybe we should’ve led with that.

If you get a big tax refund, it means you gave the government an interest-free loan—that means your money’s in Uncle Sam’s pocket, doing nothing when it could be working for you and your future instead. Ramsey SmartTax will help you get back every penny you overpaid. Then, you can learn how to keep that extra money in your monthly budget from now on.