Last Will and Testament: Married Couples

$249

Two Last Wills and Testaments

Two Medical Powers of Attorney

Two Financial Powers of Attorney

Take the worries out of creating your legal powers of attorney and will—in just 20 minutes or less.

Two Last Wills and Testaments

Two Medical Powers of Attorney

Two Financial Powers of Attorney

Last Will and Testament

Medical Power of Attorney

Financial Power of Attorney

Choose a couples package to get a complete set of documents for both you and your spouse, or an individual package if you’re planning just for yourself.

Learn More About Your Will and Powers of Attorney in Our Frequently Asked Questions

Learn More About Your Will and Powers of Attorney in Our Frequently Asked Questions

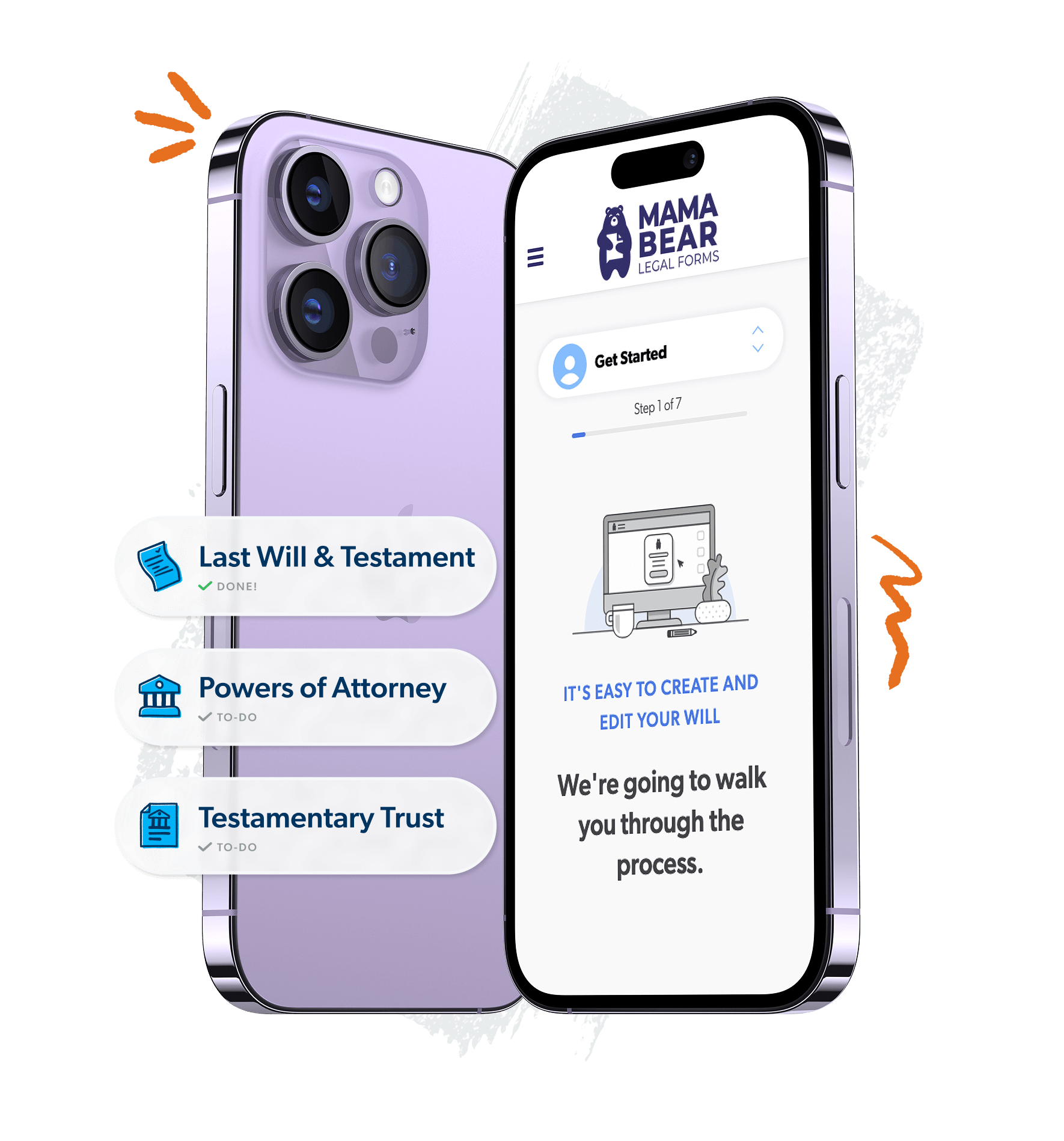

Make an account and fill out the form in minutes.

Save your progress, download and print your legal documents.

Sign in front of witnesses and a notary and file in a safe place.

Two Last Wills and Testaments

Two Medical Powers of Attorney

Two Financial Powers of Attorney

Last Will and Testament

Medical Power of Attorney

Financial Power of Attorney

A durable power of attorney is a legal document that authorizes a person you have chosen (known as your “attorney in fact” or “agent”) to handle your health care decisions or financial decisions for you if something were to happen to you and you were unable to make decisions for yourself.

Every adult should have a durable power of attorney for their medical and financial powers of attorney so they can designate someone to handle medical and financial decisions in an emergency. If a person becomes incapacitated and has not signed powers of attorney, their family may be required to ask a court to appoint a guardian or conservator to handle decisions. This can be a complex and expensive process overseen by a court.

A medical power of attorney usually takes effect when your attending physician determines you are incapable of making your own health care decisions.

Typically, a financial power of attorney takes effect immediately upon signing. Your agent can act whenever they are needed without a doctor determining that you’re incapacitated. However, if you’re reluctant to grant your agent broad powers to act on your behalf when you’re able to act for yourself, you can prepare a “springing power” that allows your agent’s authority to spring into effect only when your physician determines that you are incapacitated.

You can amend or revoke a power of attorney at any time by notifying your agent of the amendment or revocation, or in the case of a medical power of attorney, notifying your attending physician, or other health care provider. Otherwise a power of attorney ends when your agent receives notice of your death.

A living will is not your last will and testament. A living will is often referred to as an advance health directive, and includes written instructions regarding the withholding or withdrawal of certain life support equipment or medical procedures in an end of life situation. The difference between a living will and a medical power of attorney is essentially a piece of paper vs. a person.

A medical power of attorney is a lot more flexible than a living will, which is why this bundle doesn't include a living will.

Your agent should be a competent adult, who fully understands your desires and beliefs related to your health care or finances, is completely trustworthy, and is willing to accept responsibility for making decisions.

A family member is usually designated to serve because they are familiar with your wishes regarding your health care and can be trusted to handle your assets carefully. Your agent does not need to live in the same city as you do, but in the event of incapacity, it is important that your agent be available to help. A power of attorney should name a co-agent or a successor agent to act if your primary agent cannot serve.